Revealed on October twenty second, 2025 by Felix Martinez

Excessive-yield shares pay out dividends which might be considerably larger than the market common. For instance, the S&P 500’s present yield is barely ~1.2%.

Excessive-yield shares will be notably useful in supplementing retirement revenue. A $120,000 funding in shares with a median dividend yield of 5% creates a median of $500 a month in dividends.

Ellington Monetary Inc. (EFC) is a part of our ‘Excessive Dividend 50’ collection, which covers the 50 highest-yielding shares within the Certain Evaluation Analysis Database.

We’ve created a spreadsheet of shares (and carefully associated REITs, MLPs, and many others.) with dividend yields of 5% or extra.

You possibly can obtain your free full record of all securities with 5%+ yields (together with vital monetary metrics corresponding to dividend yield and payout ratio) by clicking on the hyperlink beneath:

Subsequent on our record of high-dividend shares to assessment is Ellington Monetary Inc. (EFC).

Enterprise Overview

Ellington Monetary solely transitioned right into a REIT at first of 2019. Earlier than this, the belief was taxed as a partnership. It’s now categorised as a mortgage REIT.

Ellington Monetary is a hybrid REIT, that means that the belief combines the traits of an fairness REIT, which owns properties, and a mortgage REIT, which invests in mortgage loans and mortgage-backed securities.

The corporate manages mortgage-backed securities backed by prime jumbo loans, Alt-A loans, manufactured housing loans, and subprime residential mortgage loans.

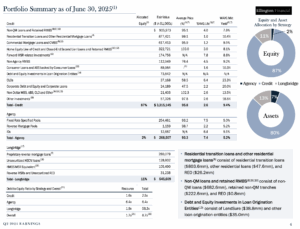

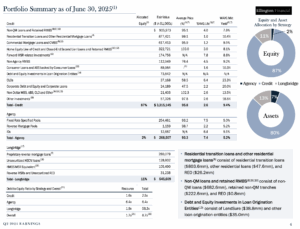

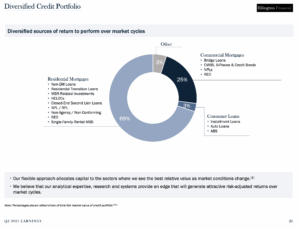

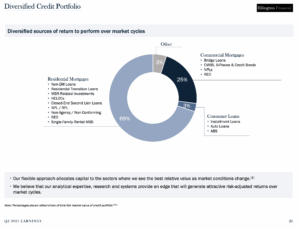

Ellington Monetary has a market capitalization of about $1.4 billion. You possibly can see a snapshot of Ellington’s funding portfolio within the picture beneath:

Supply: Investor Relations

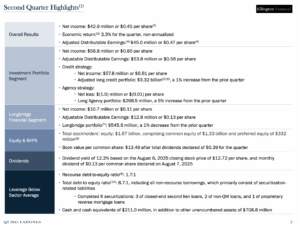

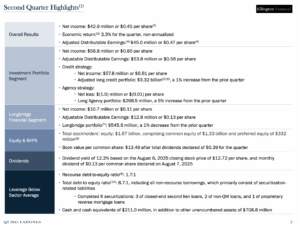

Ellington Monetary Inc. (EFC) posted robust Q2 2025 outcomes, with web revenue of $42.9 million, or $0.45 per share, and adjusted distributable earnings of $45.0 million, or $0.47 per share, above its $0.39 quarterly dividend. Income rose 14.9% year-over-year to $115.47 million, pushed by broad contributions from its funding portfolio, credit score technique, and Longbridge phase. Guide worth per share elevated to $13.49, and the dividend yield was 12.3%.

The corporate accomplished six securitizations and maintained a steady portfolio, with the credit score portfolio rising barely to $3.32 billion. Web curiosity margins improved to three.11% attributable to decrease funding prices. Company RMBS outcomes have been impacted by hedge losses, whereas Longbridge’s portfolio declined 1% sequentially however benefited from larger reverse mortgage originations and servicing features.

Trying ahead, Ellington plans to develop its portfolio, speed up securitizations, and leverage Longbridge’s new HELOC for Seniors program. Complete belongings reached $17.1 billion, with $211 million in money, and debt-to-equity ratios of 1.7:1 (recourse) and eight.7:1 total, reflecting disciplined leverage and monetary flexibility.

Supply: Investor Relations

Development Prospects

Ellington Monetary’s earnings per share have been uneven over the previous decade, largely attributable to a declining rate of interest atmosphere. Consequently, its per-share dividend has principally decreased since 2015.

To mitigate volatility, the corporate has centered on diversifying its portfolio throughout a number of funding methods and sectors. This strategy helps cut back efficiency swings and smooths total returns.

Its residential mortgage investments are unfold throughout varied safety sorts, together with Non-QM loans, reverse mortgages, and REOs. By avoiding concentrated threat, Ellington improves the steadiness of its financial returns and enhances portfolio resilience.

Supply: Investor Presentation

Ellington has structured its portfolio to reduce the affect of rate of interest fluctuations on total efficiency. This defensive positioning helps stabilize returns, even in altering market circumstances.

The Federal Reserve has indicated potential future fee cuts if inflation reaches its goal, which might seemingly profit Ellington. Below the present portfolio, a 50-basis-point decline within the fee might generate $2.2 million in fairness features, whereas a 50-basis-point enhance might end in $9.7 million in losses.

Trying forward, the corporate is anticipated to realize modest development, with projected annual EPS will increase of roughly 1% over the subsequent 5 years. Its portfolio design and threat administration help regular, resilient efficiency.

Aggressive Benefits & Recession Efficiency

Ellington Monetary doesn’t have a serious aggressive benefit, although it maintains a high-quality stability sheet. Its recourse debt-to-equity ratio was 1.8x in This autumn, down from 2x on the finish of 2023, reflecting decrease borrowings within the Company RMBS and proprietary reverse mortgage portfolios.

Though the corporate was not publicly traded throughout the Nice Recession, its inventory value fell sharply on the onset of the COVID-19 pandemic. This highlights some sensitivity to market stress regardless of conservative leverage.

For the reason that pandemic, EFC’s earnings and dividends have recovered, but each stay beneath 2014 ranges. The corporate stays dedicated to sustaining monetary stability amid financial uncertainty.

Dividend Evaluation

Ellington Monetary has a risky dividend historical past, with cuts and subsequent will increase. The corporate decreased its month-to-month dividend from $0.15 to $0.08 in Q1 2020 as a result of pandemic, later elevating it a number of occasions. In This autumn 2023, the month-to-month dividend was lowered from $0.15 to $0.13 to help fairness development and has remained at that degree.

The annual dividend is at present $1.56 per share, translating to a yield of 11.5%. Whereas that is enticing for revenue buyers, dividend security is unsure given previous cuts and excessive anticipated payout ratios, that are projected at 96% for 2025. The five-year common payout ratio has been 85%, although it has exceeded 100% in earlier durations.

Regardless of volatility, Ellington has delivered robust cumulative dividends since its IPO, totaling over $34 per share—almost thrice the present inventory value—demonstrating a traditionally strong revenue stream for shareholders.

Closing Ideas

Excessive-yield dividend shares warrant warning, as elevated yields usually sign underlying dangers. Ellington Monetary exemplifies this, exhibiting important volatility in its dividend funds over time.

The corporate maintains a diversified mortgage portfolio and has improved profitability, supporting the present dividend. Nonetheless, a slowdown in enterprise might set off one other lower, highlighting potential threat.

EFC provides a pretty yield of 11.5%, however buyers ought to concentrate on the elevated threat related to its inventory.

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].