Printed on November eleventh, 2025 by Felix Martinez

Excessive-yield shares pay out dividends which can be considerably larger than the market common. For instance, the S&P 500’s present yield is just ~1.2%.

Excessive-yield shares might be significantly useful in supplementing earnings after retirement. A $120,000 funding in shares with a mean dividend yield of 5% creates a mean of $500 a month in dividends.

Dynex Capital Inc. (DX) is a part of our ‘Excessive Dividend 50’ collection, which covers the 50 highest-yielding shares within the Certain Evaluation Analysis Database.

Now we have created a spreadsheet of shares (and intently associated REITs, MLPs, and many others.) with dividend yields of 5% or extra.

You possibly can obtain your free full listing of all securities with 5%+ yields (together with essential monetary metrics similar to dividend yield and payout ratio) by clicking on the hyperlink beneath:

Subsequent on our listing of high-dividend shares to evaluate is Dynex Capital Inc. (DX).

Enterprise Overview

Dynex Capital, Inc. (NYSE: DX) is an internally managed actual property funding belief (REIT) primarily based in Glen Allen, Virginia. The corporate invests primarily in mortgage-backed securities (MBS), together with company residential and business MBS assured by U.S. government-sponsored entities like Fannie Mae and Freddie Mac.

Dynex makes use of leverage by means of repurchase agreements to reinforce returns, aiming to generate regular earnings from curiosity funds and potential capital positive factors. Its portfolio technique focuses on balancing yield alternatives with interest-rate and credit-spread danger.

Strategically, Dynex emphasizes disciplined danger administration and a long-term method to capital allocation. The corporate positions itself as a secure earnings generator for shareholders whereas supporting the broader U.S. housing market.

Nonetheless, as a mortgage REIT, its efficiency is extremely delicate to interest-rate fluctuations, prepayment speeds, and adjustments in financing situations. Regardless of these challenges, Dynex’s conservative funding philosophy and concentrate on high-quality company belongings have helped it preserve constant dividends and protect ebook worth.

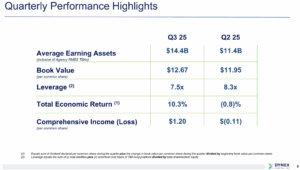

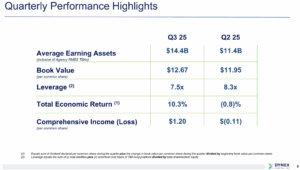

Supply: Investor Relations

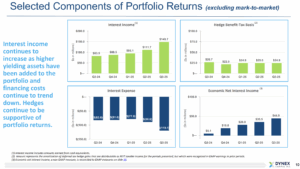

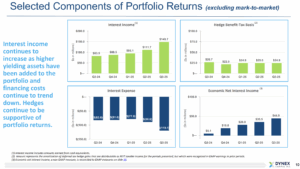

The corporate reported sturdy third-quarter 2025 outcomes, delivering a complete financial return of $1.23 per frequent share, or 10.3% of starting ebook worth. E-book worth rose $0.72 to $12.67 per share, and the corporate declared $0.51 in dividends. Complete earnings reached $1.20 per share, pushed by tighter mortgage spreads and declining Treasury yields. Dynex raised $254 million by means of at-the-market inventory choices, invested $2.8 billion in company MBS and CMBS, and maintained over $1 billion in liquidity with a 7.5x leverage ratio.

Co-CEO Smriti Laxman Popenoe credited the quarter’s success to disciplined capital deployment, higher-yielding belongings, and regular financing prices. With bettering web curiosity spreads and decrease funding charges anticipated within the coming quarter, Dynex stays well-positioned to generate secure earnings and maintain its dividend development technique.

Supply: Investor Relations

Progress Prospects

Dynex’s development potential is anchored in its capability to boost fairness capital, develop its mortgage-backed securities (MBS) portfolio, and seize favorable spreads in agency-backed belongings. The corporate just lately raised over $250 million in at-the-market choices and deployed vital funds into company RMBS and CMBS.

Its reported portfolio enlargement and rising ebook worth counsel that administration is executing on scaling the enterprise. Moreover, the corporate has benefited from falling Treasury yields and tightening mortgage spreads, which have boosted asset valuations and lowered funding value pressures.

Nonetheless, a number of components mood the expansion outlook. The corporate operates with excessive leverage, making it extremely delicate to interest-rate shifts, prepayment speeds, and adjustments within the funding market. Whereas some estimates mission sturdy income development (e.g., ~40% yearly) and bettering earnings potential, others stay cautious, forecasting modest return on fairness (~10–13%).

Analyst consensus worth targets point out restricted upside from the present share worth, suggesting tempered expectations. In brief, whereas Dynex has clear development levers, it stays uncovered to macro dangers that would restrict its capability to persistently ship.

Supply: Investor Relations

Aggressive Benefits & Recession Efficiency

Dynex Capital’s aggressive benefits stem from its concentrate on high-quality, agency-backed mortgage-backed securities (MBS) and disciplined danger administration. By specializing in liquid, clear company RMBS and CMBS, the corporate minimizes credit score danger whereas sustaining entry to environment friendly funding by means of repurchase agreements.

Its skilled administration crew and confirmed capability to boost capital opportunistically allow Dynex to scale its portfolio and capitalize on market dislocations, offering a constant earnings stream for shareholders even in risky markets.

By way of recession efficiency, Dynex has traditionally proven resilience because of its portfolio of government-backed securities, that are much less delicate to defaults than private-label MBS.

Whereas its leverage exposes the corporate to interest-rate and liquidity danger, its conservative capital construction, sturdy liquidity, and concentrate on high-quality belongings assist preserve ebook worth and dividend stability throughout financial downturns. This mixture of asset high quality and prudent danger administration positions Dynex to climate recessions higher than many non-agency mortgage REITs.

Dividend Evaluation

The corporate’s annual dividend is $2.04 per share. At its current share worth, the inventory has a excessive yield of 15%.

Given the corporate’s 2025 earnings outlook, EPS is predicted to be $0.94 per share. Because of this, the corporate is predicted to pay out roughly 217% of its EPS to shareholders in dividends.

Ultimate Ideas

Wanting ahead over the following 5 years, Dynex is predicted to ship whole annualized returns of 8.9%. Nonetheless, contemplating the present challenges within the sector, these returns seem much less compelling on a risk-adjusted foundation. Because of this, we preserve a Maintain score on the inventory regardless of its interesting dividend yield.

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].