Revealed on October twenty second, 2025 by Felix Martinez

Excessive-yield shares pay out dividends which might be considerably increased than the market common. For instance, the S&P 500’s present yield is simply ~1.2%.

Excessive-yield shares will be significantly helpful in supplementing retirement revenue. A $120,000 funding in shares with a mean dividend yield of 5% creates a mean of $500 a month in dividends.

Chimera Funding Company (CIM) is a part of our ‘Excessive Dividend 50’ sequence, which covers the 50 highest-yielding shares within the Certain Evaluation Analysis Database.

We’ve created a spreadsheet of shares (and intently associated REITs, MLPs, and so on.) with dividend yields of 5% or extra.

You possibly can obtain your free full record of all securities with 5%+ yields (together with essential monetary metrics akin to dividend yield and payout ratio) by clicking on the hyperlink beneath:

Subsequent on our record of high-dividend shares to assessment is Chimera Funding Company (CIM).

Enterprise Overview

Chimera Funding Company is an actual property funding belief (REIT) specializing in mortgage finance. The corporate primarily invests, by its subsidiaries, in a diversified portfolio of mortgage-related property, together with residential mortgage loans, non-agency RMBS, company CMBS, and different actual property securities. Chimera generates revenue primarily from the unfold between returns on its property and its financing and hedging prices.

To fund these investments, the corporate makes use of a mixture of asset securitization, repurchase agreements, warehouse strains of credit score, and fairness capital. At present, Chimera has a market capitalization of roughly $1.0 billion and is positioned as a distinguished participant within the specialty finance sector of the mortgage market.

Supply: Investor Relations

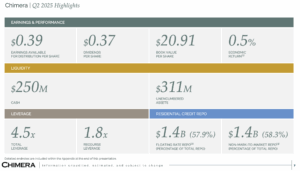

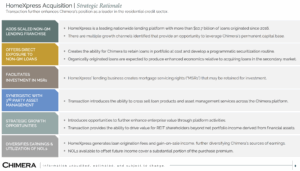

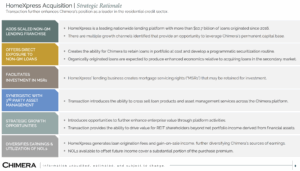

Chimera Funding Company reported Q2 2025 GAAP internet revenue of $0.17 per diluted share and earnings accessible for distribution of $0.39 per adjusted share. GAAP guide worth was $20.91 per share, with an financial return of 0.5% for the quarter and 9.8% year-to-date. The corporate additionally introduced a definitive settlement to amass HomeXpress Mortgage, increasing its position from mortgage asset supervisor to originator.

The corporate’s diversified portfolio consists of residential mortgage loans, Non-Company and Company RMBS, Company CMBS, and MSRs. Web curiosity revenue totaled $66.0 million, with different revenue of $1.4 million, whereas bills—together with compensation and transaction prices—had been $27.1 million. Non-GAAP measures, akin to earnings accessible for distribution, exclude non-recurring gadgets to higher mirror distributable revenue.

As of June 30, 2025, Chimera held $14.86 billion in property, funded by secured financing, securitized debt, and fairness. GAAP leverage was 4.5:1, with a balanced mixture of fixed- and adjustable-rate property. These outcomes underscore Chimera’s technique of portfolio diversification, disciplined financing, and continued progress within the residential mortgage market.

Supply: Investor Relations

Development Prospects

Chimera Funding Company has exhibited risky efficiency over the previous decade, characterised by stagnant earnings and a 10-year low in EPS in 2023. Excessive debt and rising rates of interest have uncovered the corporate’s vulnerabilities, and its advanced enterprise mannequin provides uncertainty. We mission modest EPS progress of about 9% yearly over the following 5 years from this low base.

The REIT has traditionally supplied excessive dividends, starting from 9.2% in 2021 to 17.5% in 2009 and 2011, however earnings volatility and leverage make the payout unsure. Whereas Chimera continues to diversify and pursue strategic acquisitions, buyers ought to view its excessive yield as enticing but additionally take into account it as a threat.

Supply: Investor Relations

Aggressive Benefits & Recession Efficiency

Chimera’s aggressive edge stems from its experience in mortgage credit score and a diversified portfolio that spans residential loans, Non-Company and Company RMBS, CMBS, and MSRs. Strategic acquisitions, akin to HomeXpress and Palisades, improve its capacity to originate, handle, and finance mortgage property.

Regardless of this, the REIT’s excessive leverage and rate of interest sensitivity have brought on uneven efficiency throughout downturns, together with a 10-year low EPS in 2023. Whereas diversification mitigates some threat, earnings stay susceptible in recessionary environments.

- 2008 earnings-per-share: $7.28

- 2009 earnings-per-share: $4.99

- 2010 earnings-per-share: $5.87

Dividend Evaluation

Chimera’s annual dividend is $1.48 per share. At its current share value, the inventory has a excessive yield of 11.6%.

Given the corporate’s earnings outlook for 2025, EPS is predicted to be $1.55 per share. Consequently, the corporate is predicted to pay out roughly 95% of its EPS to shareholders in dividends.

Last Ideas

Chimera has been considerably impacted by rising rates of interest, which have pushed it to close 23-year highs, leading to a 48% decline over the previous 5 years. If inflation eases, the inventory may generate a 12.8% common annual return over the following 5 years, supported by a 11.6% dividend and 9% earnings progress, partially offset by a 3.4% valuation headwind.

The corporate could rebound if the Fed cuts charges extra, however its risky efficiency, opaque enterprise mannequin, and vulnerability to extended downturns pose substantial dangers. Mixed with the historic underperformance of shares present process reverse splits, Chimera is finest thought of a maintain for buyers who perceive and settle for its excessive threat.

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].