Printed on October twenty second, 2025 by Felix Martinez

Excessive-yield shares pay out dividends which are considerably increased than the market common. For instance, the S&P 500’s present yield is barely ~1.2%.

Excessive-yield shares may be notably helpful in supplementing retirement earnings. A $120,000 funding in shares with a median dividend yield of 5% creates a median of $500 a month in dividends.

Capital Southwest Company (CSWC) is a part of our ‘Excessive Dividend 50’ sequence, which covers the 50 highest-yielding shares within the Certain Evaluation Analysis Database.

We’ve got created a spreadsheet of shares (and carefully associated REITs, MLPs, and so on.) with dividend yields of 5% or extra.

You’ll be able to obtain your free full record of all securities with 5%+ yields (together with necessary monetary metrics resembling dividend yield and payout ratio) by clicking on the hyperlink beneath:

Subsequent on our record of high-dividend shares to overview is Capital Southwest Company (CSWC).

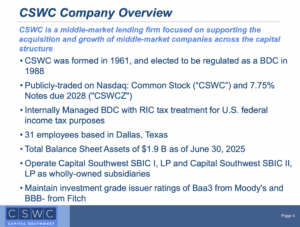

Enterprise Overview

Capital Southwest Company is a Dallas-based, internally managed funding firm structured as a Enterprise Improvement Firm (BDC). It supplies tailor-made debt and fairness financing to decrease middle-market (LMM) corporations and debt capital to higher middle-market (UMM) corporations within the U.S., producing roughly $82 million in annual income.

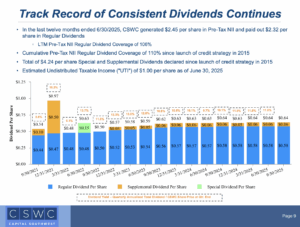

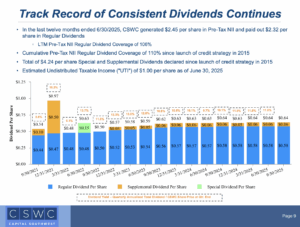

On July 23, 2025, the corporate modified its base dividend to a month-to-month cost of $0.1934 per share, together with a supplemental dividend of $0.06, sustaining an annualized base dividend of $2.32, as mirrored in our estimates.

Supply: Investor Relations

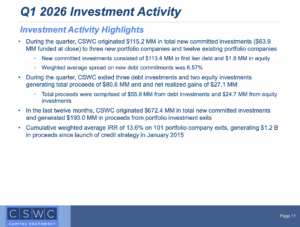

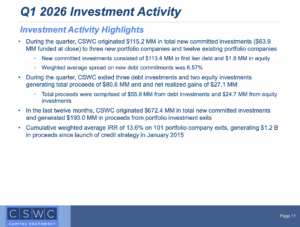

Capital Southwest Company (Nasdaq: CSWC) reported Q1 FY2026 outcomes for the quarter ended June 30, 2025. The corporate’s $1.8 billion funding portfolio consists of $1.6 billion in credit score, largely first-lien senior secured debt, and $166 million in fairness. In the course of the quarter, CSWC dedicated $113.4 million in new credit score and $1.8 million in fairness co-investments. Pre-tax internet funding earnings was $32.7 million ($0.61 per share), supported by $27.2 million in realized fairness positive aspects. Money totaled $46.9 million, internet belongings $916.5 million, NAV $16.59 per share, and dividends had been $0.64 per share.

CSWC originated $115.2 million in new investments and obtained $80.6 million in proceeds from prepayments and exits, producing $27.1 million in internet realized positive aspects. Whole funding earnings rose to $55.9 million from $52.4 million, pushed by increased curiosity earnings and yields. Working bills had been $8.0 million, curiosity expense $15.3 million, and internet funding losses totaled $4.9 million, leading to a $27.0 million improve in internet belongings for the quarter.

Liquidity stays robust, with $46.9 million in money and $397.2 million in unused credit score capability. CSWC raised $41.7 million through its Fairness ATM Program and holds SBA licenses for extra leverage. The corporate will shift common dividends to a month-to-month schedule and expects increased deal stream within the subsequent quarter, sustaining a conservative funding strategy whereas supporting middle-market enterprise progress.

Supply: Investor Relations

Progress Prospects

Capital Southwest Company (CSWC) is positioned for sustained progress by way of strategic funding initiatives and a powerful monetary basis. In 2025, the corporate enhanced its liquidity with a $347.7 million senior unsecured word providing and secured a second SBIC license, offering entry to as much as $350 million in low-cost, SBA-guaranteed funding.

These strikes strengthen CSWC’s capability to pursue new investments, assist portfolio progress, and handle refinancing wants effectively. Analysts at the moment keep a “Purchase” ranking, with a consensus value goal of $23.50, indicating potential upside of practically 15% from present ranges.

Wanting forward, CSWC initiatives $283.9 million in income and $196.4 million in earnings by 2028, reflecting a ten.7% annual income progress price. The corporate’s constant potential to generate robust pre-tax internet funding earnings, coupled with its conservative underwriting and versatile financing mannequin, positions it to capitalize on rising alternatives within the decrease and higher middle-market segments whereas delivering long-term worth to shareholders.

Supply: Investor Relations

Aggressive Benefits & Recession Efficiency

Capital Southwest Company (CSWC) leverages its aggressive benefits as an internally managed BDC by offering versatile debt and fairness options to middle-market corporations. Its give attention to first-lien senior secured debt, conservative underwriting, and entry to SBIC licenses and an Fairness ATM program provides it monetary flexibility and the power to behave rapidly on new funding alternatives.

The corporate has demonstrated resilience throughout financial downturns, with non-accruals accounting for lower than 1% of its portfolio and a conservative debt-to-EBITDA ratio of three.4 occasions. By focusing on steady middle-market companies, CSWC constantly maintains dividends and internet funding earnings, demonstrating a defensive and dependable enterprise mannequin.

The corporate carried out effectively in the course of the earlier main financial downturn, the Nice Recession of 2008-2009:

- 2008 earnings-per-share: $0.24

- 2009 earnings-per-share: $0.68

- 2010 earnings-per-share: $4.91

Dividend Evaluation

The corporate’s annual dividend is $2.32 per share. At its current share value, the inventory has a excessive yield of 10.0%. This excludes some small particular dividends the corporate has declared.

Given the corporate’s earnings outlook for 2025, NII is anticipated to be $2.35 per share. Because of this, the corporate is anticipated to pay out 99% of its NII to shareholders in dividends.

Supply: Investor Relations

Closing Ideas

Capital Southwest is a well-diversified and long-established enterprise growth firm that has efficiently navigated a number of market cycles. Since its 2015 spinoff, the corporate’s financials have grown steadily, supported by low-cost financing and disciplined portfolio enlargement.

We mission medium-term annualized returns of 9.5%, excluding supplemental dividends, pushed by its robust dividend yield and progress. Nevertheless, the inventory is rated a maintain.

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].