Printed on October thirtieth, 2025 by Felix Martinez

Excessive-yield shares pay out dividends which are considerably increased than the market common. For instance, the S&P 500’s present yield is just ~1.2%.

Excessive-yield shares may be significantly useful in supplementing earnings after retirement. A $120,000 funding in shares with a median dividend yield of 5% creates a median of $500 a month in dividends.

Bridgemarq Actual Property Companies Inc. (BREUF) is a part of our ‘Excessive Dividend 50’ collection, which covers the 50 highest-yielding shares within the Certain Evaluation Analysis Database.

We have now created a spreadsheet of shares (and intently associated REITs, MLPs, and many others.) with dividend yields of 5% or extra.

You’ll be able to obtain your free full listing of all securities with 5%+ yields (together with vital monetary metrics equivalent to dividend yield and payout ratio) by clicking on the hyperlink beneath:

Subsequent on our listing of high-dividend shares to assessment is Bridgemarq Actual Property Companies Inc. (BREUF).

Enterprise Overview

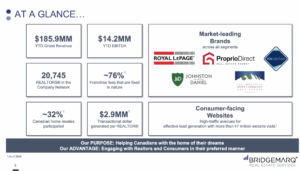

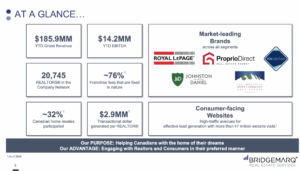

Bridgemarq Actual Property Companies helps residential actual property brokers and REALTORS throughout Canada by offering info, instruments, and providers that improve their operations. Working beneath the Royal LePage, Through Capitale, Johnston, and Daniel manufacturers, the corporate, previously often called Brookfield Actual Property Companies, rebranded as Bridgemarq in 2019. Based in 2010, Bridgemarq is headquartered in Toronto.

The corporate generates income via fastened and variable franchise charges from a community of practically 21,000 REALTORS. Roughly 81% of those charges are fastened, offering secure, predictable money flows which are additional secured by long-term contracts. Bridgemarq maintains sturdy accomplice relationships, as mirrored in its traditionally excessive renewal price of 96%. Royal LePage franchise agreements, representing 96% of the corporate’s REALTORS, span 10 to twenty years, guaranteeing important money circulation visibility.

Bridgemarq holds a number one place within the Canadian market, collaborating in over 70% of nationwide residence resales. Its model repute and technological benefits entice franchisees and reinforce its market dominance. Nevertheless, the corporate was considerably impacted by the 2020 pandemic-induced recession, with earnings per share falling 47%, from $0.34 in 2019 to $0.18 in 2020.

Supply: Investor Relations

The corporate reported Q2 2025 income of $108.0 million, barely beneath final 12 months’s, whereas year-to-date income rose to $186.0 million, pushed by acquisitions and better franchise charges. Adjusted Web Earnings had been $2.2 million, with Free Money Move of $3.6 million. The corporate declared a month-to-month dividend of $0.1125 per share, sustaining its $1.35 annual goal.

The corporate posted a web lack of $5.4 million ($0.57 per share), pushed by a $4.9 million loss on Exchangeable Items, partially offset by decrease curiosity and depreciation. Working money circulation fell to $5.9 million as a consequence of increased curiosity prices and dealing capital modifications, whereas Adjusted Web Earnings and Free Money Move edged down from 2024.

Bridgemarq added about 600 gross sales representatives to its Royal LePage community, strengthening its presence in key markets. Regardless of a 4% year-over-year decline within the Canadian housing market, exercise improved in Quebec and a few metro areas, supported by secure rates of interest and managed inflation.

Progress Prospects

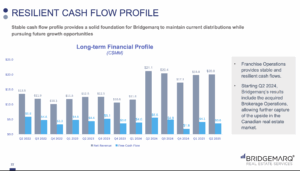

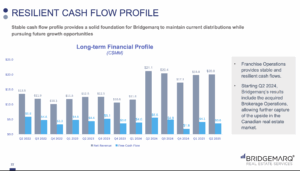

Over the previous decade, Bridgemarq has advanced from a pure franchise operator to a extra built-in actual property platform. Traditionally, its income got here from secure fastened and variable franchise charges, offering regular money circulation even throughout downturns just like the COVID-19 pandemic. Current strikes, together with the 2024 acquisition of brokerage operations and the internalization of administration, have expanded the corporate into direct actual property gross sales and eradicated third-party charges, strengthening its operational management and cash-generating capabilities. Regardless of volatility in EPS, largely pushed by non-cash gadgets equivalent to exchangeable unit revaluations, the underlying enterprise has constantly supported its dividend.

Trying forward, development prospects are restricted. Elevated working prices, dangers from integrating current acquisitions, and uncertainty within the Canadian housing market make EPS and dividend development unlikely. Bridgemarq has maintained a secure month-to-month dividend of CAD $0.1125 since 2017, reflecting consistency relatively than development. Whereas the corporate stays cash-generative, buyers ought to count on stability relatively than important near-term earnings or dividend development.

Supply: Investor Relations

Aggressive Benefits & Recession Efficiency

Bridgemarq’s aggressive edge comes from its giant community of over 21,000 REALTORS, supported by sturdy manufacturers like Royal LePage and Through Capitale. Its mixture of franchise and corporately owned brokerages, long-term franchise agreements, and superior know-how instruments ensures predictable money circulation, excessive agent loyalty, and market dominance.

The corporate has confirmed resilient throughout recessions, together with the COVID-19 downturn. Its reliance on fastened franchise charges and cash-generative operations has allowed it to maintain dividends and preserve stability, even when earnings fluctuate as a consequence of non-cash accounting gadgets.

Dividend Evaluation

Bridgemarq presents a excessive dividend yield of 9.9%, far above the 1.2% S&P 500 yield, making it engaging for income-focused buyers. U.S. buyers ought to observe that dividends are affected by the CAD/USD trade price.

Nevertheless, the corporate’s payout ratio is excessive at 98%, and its web debt of $182 million exceeds its market cap, signaling a weak steadiness sheet. The dividend has been primarily flat over the previous 9 years, so significant development is unlikely.

Supply: Investor Relations

Ultimate Ideas

Bridgemarq offers secure earnings via a resilient, fee-based actual property platform, however its restricted development potential and sensitivity to the housing market place it extra as a yield-focused funding than a development alternative. We mission annualized returns of 6.6%, pushed largely by the present dividend yield however partially offset by potential valuation pressures.

Given the speculative nature of current acquisitions and the internalization of administration, mixed with the absence of current dividend will increase, we preserve a promote ranking on the inventory.

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].