Revealed on October twenty first, 2025 by Felix Martinez

Excessive-yield shares pay out dividends which can be considerably increased than the market common. For instance, the S&P 500’s present yield is simply ~1.2%.

Excessive-yield shares could be notably useful in supplementing revenue after retirement. A $120,000 funding in shares with a mean dividend yield of 5% creates a mean of $500 a month in dividends.

Barings BDC (BBDC) is a part of our ‘Excessive Dividend 50’ sequence, which covers the 50 highest-yielding shares within the Positive Evaluation Analysis Database.

We have now created a spreadsheet of shares (and carefully associated REITs, MLPs, and many others.) with dividend yields of 5% or extra.

You’ll be able to obtain your free full record of all securities with 5%+ yields (together with necessary monetary metrics comparable to dividend yield and payout ratio) by clicking on the hyperlink beneath:

Subsequent on our record of high-dividend shares to evaluate is Barings BDC (BBDC).

Enterprise Overview

Supply: Investor Relations

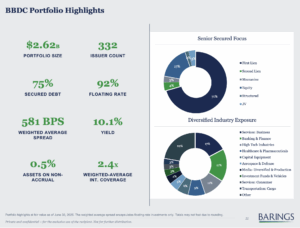

The corporate reported robust monetary outcomes for the second quarter of 2025, with internet funding revenue (NII) of $29.8 million, or $0.28 per share, exceeding analyst expectations by $0.02 per share. Whole funding revenue reached $74.4 million, reflecting a slight year-over-year decline of 0.65% however surpassing projections by $7.98 million. The corporate declared a quarterly money dividend of $0.26 per share, totally lined by NII, and continues to take care of disciplined credit score administration, with non-accruals representing simply 0.5% of the portfolio. Throughout the quarter, Barings BDC deployed roughly $199 million into new and present investments, whereas sustaining over $322 million of obtainable capital to pursue extra income-generating alternatives.

The corporate’s internet asset worth (NAV) per share decreased barely to $11.18 from $11.29 on the finish of Q1 2025, primarily as a consequence of internet realized losses, overseas forex fluctuations, and a $0.05 particular dividend, partially offset by internet unrealized appreciation and NII exceeding dividend payouts. Portfolio exercise included 19 new investments totaling $137.3 million, $61.7 million in follow-on investments, and $59.1 million in mortgage repayments, leading to internet realized features and losses from gross sales and restructurings of $(9.3) million. Web unrealized appreciation totaled $5.9 million, pushed by portfolio efficiency, forex results, and reclassification changes.

Barings BDC ended Q2 2025 with whole belongings of $2.79 billion, debt of $1.57 billion, and whole internet belongings of $1.18 billion, leading to a internet debt-to-equity ratio of 1.29x. The corporate repurchased 100,000 shares at a mean value of $8.88 in the course of the quarter as a part of its ongoing share repurchase program. Subsequent to quarter-end, BBDC dedicated $59.3 million to new investments and totally repaid $38.6 million of maturing Collection A notes. With a sturdy stability sheet, disciplined funding technique, and ongoing capital deployment, Barings BDC stays well-positioned to generate enticing, risk-adjusted returns for shareholders.

Development Prospects

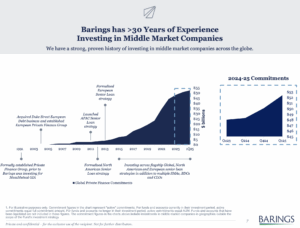

Barings BDC’s internet funding revenue (NII) per share from 2015 to 2024 displays each market circumstances and a strategic shift in its funding method. In 2015, underneath its former identify Triangle Capital, NII reached $2.16, pushed by a give attention to decrease middle-market investments and robust capital deployment, regardless of challenges like yield compression and rising nonaccruals. NII declined to $1.62 in 2016 and $1.55 in 2017 as a consequence of elevated competitors, portfolio rotation for improved asset high quality, and continued strain on returns.

The corporate underwent a significant transition in 2018, promoting its legacy portfolio for practically $1 billion and externalizing administration to Barings LLC, successfully resetting its operations. In 2019, NII declined to $0.61 as Barings BDC shifted its focus towards first-lien senior secured loans to prioritize threat discount and capital preservation. NII steadily recovered to $0.64 in 2020 and $0.90 in 2021, supported by elevated mortgage originations and improved financial circumstances. Development continued in 2022 and 2023, reaching $1.12 and $1.19, pushed by rising rates of interest and robust credit score efficiency, earlier than stabilizing in 2024 amid declining yields.

Trying forward, NII per share is predicted to develop at a modest 1% CAGR, reflecting normalization after a good market setting. Barings BDC has additionally elevated its dividend for 5 consecutive years, and payouts are projected to develop at an analogous 1% CAGR by 2030, reflecting regular revenue technology and disciplined capital administration.

Supply: Investor Relations

Aggressive Benefits & Recession Efficiency

- 2008 earnings-per-share: $1.54

- 2009 earnings-per-share: $1.63

- 2010 earnings-per-share: $1.58

Supply: Investor Relations

Dividend Evaluation

Barings BDC’s annual dividend is $1.04 per share. At its current share value, the inventory has a excessive yield of 12.1%.

Given the corporate’s earnings outlook for 2025, NII is predicted to be $1.10 per share. Because of this, the corporate is predicted to pay out roughly 95% of its NII to shareholders in dividends.

The dividend seems sustainable, and we estimate that the corporate will proceed to expertise dividend progress going ahead. General, the 12.1% dividend yield is enticing for buyers who prioritize revenue.

Ultimate Ideas

Barings BDC has skilled risky NII and dividends traditionally, however its efficiency has stabilized lately. Its give attention to senior secured middle-market loans and disciplined funding method makes it interesting for income-oriented buyers in search of increased yields.

We mission annualized returns of greater than 10% by 2030, supported by the 12.1% yield and reasonable portfolio progress, although valuation pressures might restrict upside. General, the inventory is rated a maintain, with warning suggested concerning the reliability of the dividend.

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].