Printed on March 21th, 2022, by Felix Martinez

Antero Midstream Corp. (AM) is a high-yield ignored midstream firm. The inventory at present has a formidable 9.2% dividend yield. With the latest dividend lower and the elevated free money move for the foreseeable future, the inventory seems to be acceptable for an income-driven investor.

We’ve created a spreadsheet of shares (and carefully associated REITs and MLPs, and so on.) with dividend yields of 5% or extra…

You’ll be able to obtain your free full checklist of all excessive dividend shares with 5%+ yields (together with essential monetary metrics equivalent to dividend yield and payout ratio) by clicking on the hyperlink beneath:

This text will analyze if Antero Midstream Corp. is an efficient inventory for dividend/earnings traders.

Enterprise Overview

Antero Sources Company fashioned Antero Midstream Company to service its quickly rising pure fuel and NGL manufacturing within the Appalachian Basin. Headquartered in Denver, Colorado, the corporate is concentrated on creating worth by growing midstream infrastructure in two of the premier North American Shale performs, the Marcellus and Utica Shales. Because of its transportation portfolio and midstream possession by Antero Midstream, Antero is considered one of America’s most built-in NGL and pure fuel companies.

The corporate gives gathering and compression providers (65% by EBITDA), processing and fractionation providers, and pipeline providers on a captive foundation to Antero Sources (AR). AR is the fifth largest pure fuel producer and 2nd largest NGL producer within the nation, working fields primarily in West Virginia. The corporate has gone by a number of structural adjustments because it started operation in 2011 and trades right now with a $4.9 billion market capitalization.

On February 16, 2022, the corporate reported fourth-quarter and full-year outcomes for Fiscal Yr (FY)2021. Income for the quarter was up 6.2% from $203 million in 4Q2020 to $216.5 million final quarter. The corporate was capable of hold working bills decrease than in Q42020. Thus, working earnings elevated 11.8% year-over-year.

Web earnings was $79 million, or $0.16 per share, according to the prior-year quarter. Adjusted Web Earnings was $95 million, or $0.20 per share, in comparison with $98 million, or $0.21 per share within the prior-year quarter. Adjusted EBITDA was $213 million, a 5% enhance in comparison with the prior-year quarter.

For the yr, internet earnings was $332 million, or $0.69 per share, in comparison with a $0.26 per share internet loss within the prior yr. Adjusted EBITDA was $876 million. Adjusted EBITDA was above the midpoint of Antero Midstream’s steering vary. Web money offered by working actions for the yr was $710 million. Additionally, Free Money Move (FCF) earlier than dividends was $439 million, and FCF after dividends had been $10 million, each above the midpoint of their respective steering ranges.

Development Prospects

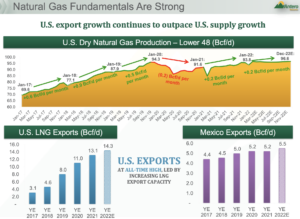

The largest progress driver for the corporate would be the continued progress in U.S. exports. For instance, U.S. dry pure fuel manufacturing ought to proceed to extend and the LNG exports and exports to Mexico. Apart from that, there may be not far more progress driver for the corporate.

Supply: Investor Presentation

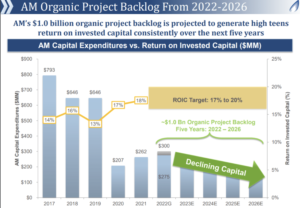

The lower of capital expenditures and the lower of its dividend will assist the corporate within the brief time period to proceed to deleverage. This, in flip, will assist the corporate sooner or later to extend money move and thus begin to enhance or have safer dividend funds.

Supply: Investor Presentation

Aggressive Benefits & Recession Efficiency

Antero Midstream’s most vital aggressive benefit is the corporate’s belongings. The corporate has assembled a set of vitality infrastructure belongings that we imagine can be very troublesome to duplicate. Its pipelines and storage services are important belongings. It makes it a problem for one more firm to assemble a competing pipeline.

As for recession efficiency, the corporate was not round in the course of the 2008-2009 Nice Recession. Thus, we are going to have a look at how nicely the corporate did in the course of the COVID-19 pandemic.

AM’s Discounted Money Move (DCF) per share all through the COVID-19 pandemic:

- 2019 earnings-per-share of $1.30

- 2020 earnings-per-share of $1.39 (6.9% enhance)

- 2021 earnings-per-share of $1.25 (10.1% lower)

As you possibly can see, the corporate did moderately nicely in the course of the COVID-19 pandemic. DCF is predicted to extend to $1.38 per share for 2022. This may characterize a rise of 10.4% in comparison with 2021.

Dividend Evaluation

The corporate pays a really engaging dividend yield of 9.3%. Nevertheless, the corporate needed to lower its dividend by 26.8% on April 14, 2021. Since then, the corporate has been paying a quarterly dividend of $0.225 per share.

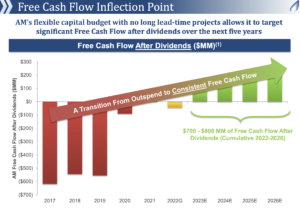

Nevertheless, we don’t suppose a dividend lower will come anytime quickly as the corporate expects the FCF to proceed to develop for the foreseeable future. This may assist traders have peace of thoughts with the excessive dividend.

For instance, for FY2021, the corporate DCF was $1.25 per share. Final yr, Antero paid out $0.98 per share in dividend cost. This represents a dividend payout ratio of 78.4%. For the reason that dividend lower, the corporate is predicted to pay $0.90 per share for 2022. We anticipate the corporate to make $1.38 DCF per share for Fy2022, which might make a dividend payout ratio of 65%. That is an appropriate payout ratio for such a excessive dividend yield.

Supply: Investor Presentation

As well as, the corporate has a passable stability sheet, with an curiosity protection ratio of three.6 and a debt-to-equity ratio of 1.4. Each ratios are at modest ranges. Nevertheless, the corporate doesn’t have an S&P credit standing.

In consequence, we view the dividend of Antero Midstream Company as considerably protected for the foreseeable future. The corporate only recently lower its dividend and free money move is beginning to enhance.

Closing Ideas

AM seems glorious due to the dividend yield and distributable money move foundation. Nevertheless, the primary problem to the funding thesis is assuring traders that reliable money flows cowl its fairness and debt securities and that it is going to be capable of hold leverage ratios down even when its money flows decline considerably. In consequence, regardless of the engaging yield, we see this as a very engaging earnings funding for traders due to the excessive yield, nevertheless it does include dangers.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].