Printed on March thirty first, 2022, by Quinn Mohammed

3M Firm (MMM) is an enormous producer, which is closely diversified throughout product segments, and has a robust international presence. The corporate is a Dividend King, because it has elevated its dividend for 64 consecutive years.

The corporate has a excessive yield of three.9%, effectively above its trailing decade common. This might be one indicator that the corporate is at the moment buying and selling at a reduction. Nevertheless, this is only one element in a sea of data.

We have now created a spreadsheet of excessive dividend shares with dividend yields of 5% or extra…

You may obtain your free full checklist of all securities with 5%+ yields (together with necessary monetary metrics resembling dividend yield and payout ratio) by clicking on the hyperlink beneath:

On this article, we are going to analyze manufacturing behemoth 3M Firm.

Enterprise Overview

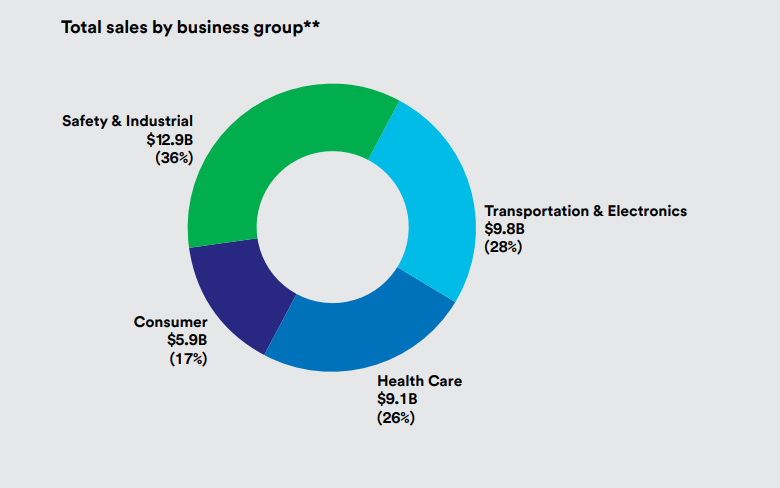

3M is a number one international producer, with operations in additional than 70 nations. The corporate has a product portfolio comprised of over 60,000 objects, that are offered to prospects in additional than 200 nations. These merchandise are used on daily basis in properties, workplace buildings, faculties, hospitals, and others.

The corporate’s historical past will be traced again to 1902, when it was often called Minnesota Mining and Manufacturing. Immediately, 3M dominates in 4 vital enterprise segments.

The Security & Industrial section produce private security gear, industrial adhesives & tapes, abrasives, and provide chain administration software program.

The Transportation & Electronics section serves automotive and digital EOM prospects, by producing objects resembling fibres and circuits.

The Healthcare section develops medical and surgical merchandise, well being data techniques, and oral care know-how.

The Client division sells stationary & workplace provides, house enchancment and residential care merchandise, and protecting supplies.

Supply: 2021 Annual Report

3M reported This autumn and FY 2021 outcomes on January twenty fourth. For 2021, income grew 9.9% to $35.4 billion. Earnings-per-share of $10.12 was an 8% enhance from the prior 12 months. Adjusted EPS rose 14% although, from $8.85 in 2020 to $10.12 in 2021.

The corporate generated adjusted free money movement of $6 billion in 2021. 3M decreased web debt by greater than $1 billion in comparison with 2020. Web debt decreased from $13.7 billion to $12.6 billion by finish of 12 months 2021.

3M additionally returned $5.6 billion to shareholders by means of dividends and share repurchases.

Management supplied 2022 steerage and sees whole gross sales progress of 1% to 4%, natural gross sales progress of two% to five%, and earnings-per-share of $10.15 to $10.65. Our 2022 EPS estimate is at the moment $10.24.

Progress Prospects

With so many merchandise in so many alternative sectors, 3M has the power to concentrate on the fitting progress channels when it’s advantageous. The corporate should allocate their capital and assets to what’s most engaging on the time.

The corporate is at the moment prioritizing their investments in massive, fast-growing sectors which have favorable components all throughout the globe. Some examples are automotive know-how, house enchancment, private security, healthcare, and electronics.

The corporate is firing on all cylinders, with vital progress in its automotive electrification platform, biopharma enterprise, and residential enchancment enterprise. All 4 enterprise segments noticed excessive single-digit natural gross sales progress in 2021. These segments ought to all proceed to develop meaningfully.

Moreover, 3M is more likely to make strategic acquisitions, resembling with the practically $7-billion acquisition of Acelity, a number one international medical know-how firm that manufactures wound care and specialty surgical merchandise. 3M additionally determined to divest and mix their meals security enterprise with Neogen in 2021.

Aggressive Benefits & Recession Efficiency

3M’s know-how and mental property are its most vital aggressive benefits. These distinctive benefits have paved the best way for 3M to boost its annual dividend for greater than 60 years with out fail.

3M has greater than 50 know-how platforms and a group of scientists devoted to producing innovation. Innovation has afforded 3M the power to acquire over 100,000 patents all through its historical past, which retains many would-be-competitors at bay.

3M continues to take a position closely in analysis and improvement. The corporate goals to spend round 6% of annual gross sales on R&D. In 2021, the corporate spent $2.0 billion on R&D.

The corporate has performed so effectively in creating new merchandise that roughly 30% of annual gross sales got here from merchandise which didn’t exist 5 years in the past. 3M has established itself as an business chief throughout its product segments. The corporate has remained worthwhile, even all through recessions, which may, partly, be credited to their aggressive benefits.

Listed beneath are 3M’s adjusted earnings-per-share outcomes earlier than, throughout and after the Nice Recession:

- 2006 adjusted earnings-per-share: $5.06

- 2007 adjusted earnings-per-share: $5.60 (10.7% enhance)

- 2008 adjusted earnings-per-share: $4.89 (12.7% lower)

- 2009 adjusted earnings-per-share: $4.52 (7.6% lower)

- 2010 adjusted earnings-per-share: $5.75 (27.2% enhance)

- 2011 adjusted earnings-per-share: $5.96 (3.7% enhance)

Simply because the corporate remained worthwhile, doesn’t imply it’s immune from recessions, and its earnings-per-share fell in 2008 and 2009. Nevertheless, the constant profitability afforded the corporate the power to proceed rising the dividend. And EPS bounced again as early as 2010 and continued rising.

Dividend Evaluation

3M is a Dividend King and has raised its dividend for 64 years straight. The newest enhance was a penny 1 / 4 enhance, which represents a 0.7% increase. Nevertheless, 3M has raised its dividend at a compound annual progress fee of practically 10% within the final ten years, which is robust for such a mature firm. However this has slowed because the 5-year CAGR for the dividend is 4.9%.

3M pays an annual dividend of $5.96, and on the present share value, has a excessive yield of three.9%. The corporate has a ten-year trailing common payout ratio of 53%, which isn’t too regarding. Nevertheless, the payout ratio has been creeping up slowly.

For 2022, we anticipate a payout ratio of about 58%. Contemplating the corporate’s dividend progress has slowed, however the chance for mid-single digit earnings progress remains to be intact, the payout ratio ought to lower within the medium time period.

The corporate’s 3.9% dividend yield is sort of a bit increased than its trailing decade common of two.8%, which can point out shares are buying and selling at a reduction.

Closing Ideas

3M is an enormous firm with a worldwide presence, and because of this, it’s pretty reliant on the general economic system. Whereas the corporate can really feel the impacts of recessions and financial weak point, its sturdy aggressive benefits afford it the power to stay extremely worthwhile.

This profitability and power of the corporate have allowed it to boost its dividend yearly for the final 64 years. We anticipate a discount within the payout ratio going ahead as earnings outpace the slowing dividend progress. This prudence on the firm causes us to consider the corporate may have little drawback persevering with on this unimaginable dividend enhance streak.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].