Printed on March twenty seventh, 2025 by Bob Ciura

The S&P 500 Index is off to a challenged start to the 12 months. Thus far in 2025, the S&P 500 Index has declined 3%.

Many dividend shares are off to quite a bit worse begins year-to-date, which could present value and income consumers with some compelling purchasing for alternate options.

To begin the search for prime quality dividend growth shares, we recommend the Dividend Champions, a gaggle of shares which have elevated their dividends for not lower than 25 consecutive years.

It’s possible you’ll get hold of your free copy of the Dividend Champions document, along with associated financial metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the hyperlink beneath:

Merchants are seemingly conscious of the Dividend Aristocrats, a gaggle of 69 shares throughout the S&P 500 Index with 25+ consecutive years of dividend will improve.

Within the meantime, consumers additionally must familiarize themselves with the Dividend Champions, which have moreover raised their dividends for not lower than 25 years in a row.

This article is going to give attention to the three worst-performing Dividend Champions so far in 2025, along with their anticipated returns over the following 5 years.

Desk of Contents

It’s possible you’ll instantly bounce to any explicit a part of the article by clicking on the hyperlinks beneath:

The three Dividend Champions have been ranked by anticipated entire annual return over the following 5 years, from lowest to highest.

Overwhelmed Down Dividend Champion #3: Matthews Worldwide Corp. (MATW)

- 12 months-to-Date Effectivity: -15.6%

- 5-year anticipated returns: 12.2%

Matthews Worldwide Firm presents mannequin choices, memorialization merchandise and industrial utilized sciences on a world scale. The company’s three enterprise segments are diversified.

The SGK Mannequin Choices presents mannequin enchancment suppliers, printing gear, ingenious design suppliers, and embossing devices to the consumer-packaged objects and packaging industries.

The Memorialization part sells memorialization merchandise, caskets, and cremation gear to funeral home industries.

The Industrial utilized sciences part is smaller than the alternative two corporations and designs, manufactures and distributes marking, coding and industrial automation utilized sciences and choices.

Matthews Worldwide reported first quarter FY 2025 outcomes on February sixth, 2025. The company reported product sales of $402 million, an 11% decline compared with the equivalent prior 12 months interval. The decrease was the outcomes of a 28% product sales decline in its Industrial Utilized sciences part.

Adjusted earnings had been $0.14 per share, a 62% decrease from $0.37 a 12 months previously. The company’s internet debt leverage ratio rose from 3.6 one 12 months previously to 3.9.

Matthews continues to depend on $205 million to $215 million of adjusted EBITDA for fiscal 2025.

The dividend payout ratio for Matthews Worldwide has been very conservative and solely these days eclipsed one third of earnings. This conservative payout ratio permits Matthews to proceed elevating the dividend as a result of it has for the ultimate 31 years.

The company has a small aggressive profit in that it’s uniquely diversified all through its corporations, which allows it to local weather utterly totally different storms on a consolidated basis.

Click on on proper right here to acquire our most modern Sure Analysis report on MATW (preview of internet web page 1 of three confirmed beneath):

Overwhelmed Down Dividend Champion #2: T. Rowe Worth Group (TROW)

- 12 months-to-Date Effectivity: -16.0%

- 5-year anticipated returns: 13.6%

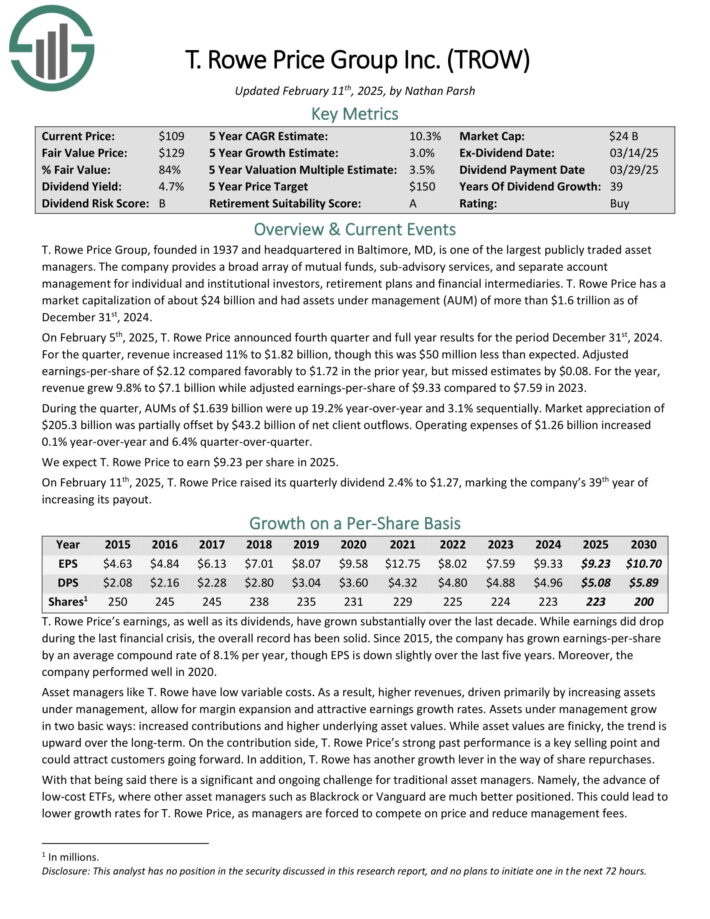

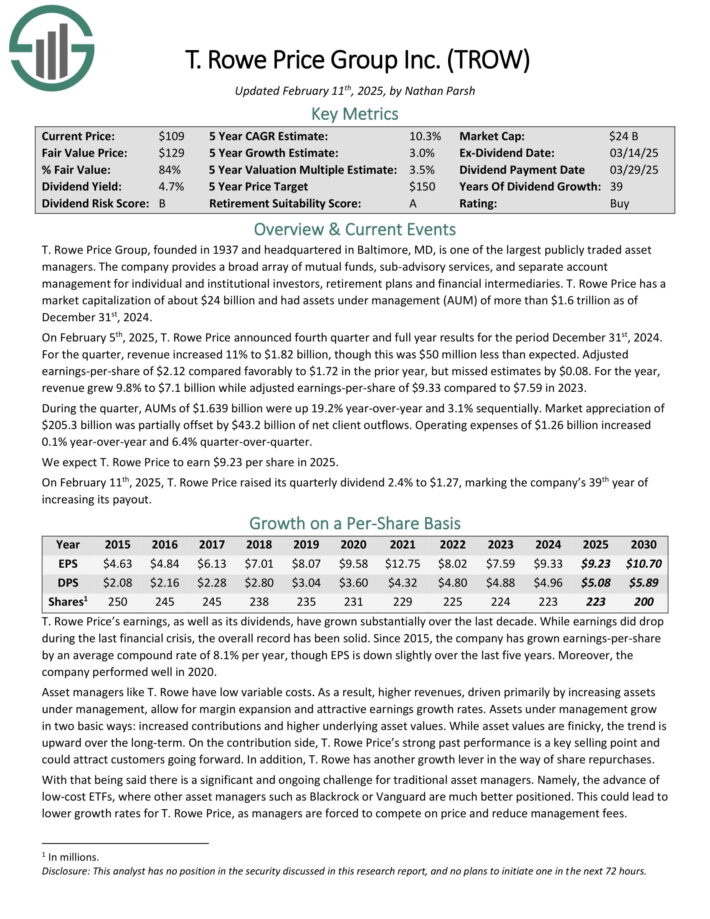

T. Rowe Worth Group, primarily based in 1937 and headquartered in Baltimore, MD, is probably going one of many largest publicly traded asset managers.

The company presents a broad array of mutual funds, sub-advisory suppliers, and separate account administration for explicit particular person and institutional consumers, retirement plans and financial intermediaries.

Provide: Investor Presentation

Property beneath administration develop in two main strategies: elevated contributions and higher underlying asset values. Whereas asset values are finicky, the event is upward over the long term.

In addition to, T. Rowe has one different growth lever inside the kind of share repurchases. The company has shrunk its share rely by an annual charge of 1.3% over the past decade.

On February fifth, 2025, T. Rowe Worth launched fourth quarter and full 12 months outcomes for the interval December thirty first, 2024.

For the quarter, revenue elevated 11% to $1.82 billion, though this was $50 million decrease than anticipated. Adjusted earnings-per-share of $2.12 in distinction favorably to $1.72 throughout the prior 12 months, nonetheless missed estimates by $0.08.

For the 12 months, revenue grew 9.8% to $7.1 billion whereas adjusted earnings-per-share of $9.33 compared with $7.59 in 2023.

Via the quarter, AUMs of $1.639 billion had been up 19.2% year-over-year and three.1% sequentially. Market appreciation of $205.3 billion was partially offset by $43.2 billion of internet shopper outflows.

Working payments of $1.26 billion elevated 0.1% year-over-year and 6.4% quarter-over-quarter.

Click on on proper right here to acquire our most modern Sure Analysis report on TROW (preview of internet web page 1 of three confirmed beneath):

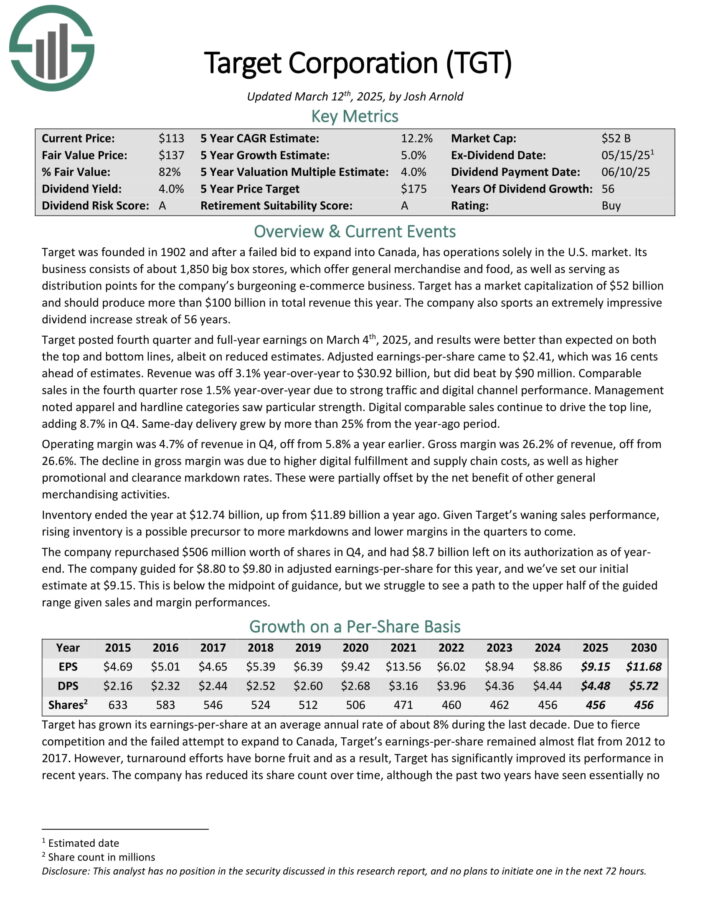

Overwhelmed Down Dividend Champion #1: Aim Firm (TGT)

- 12 months-to-Date Effectivity: -20.9%

- 5-year anticipated returns: 13.6%

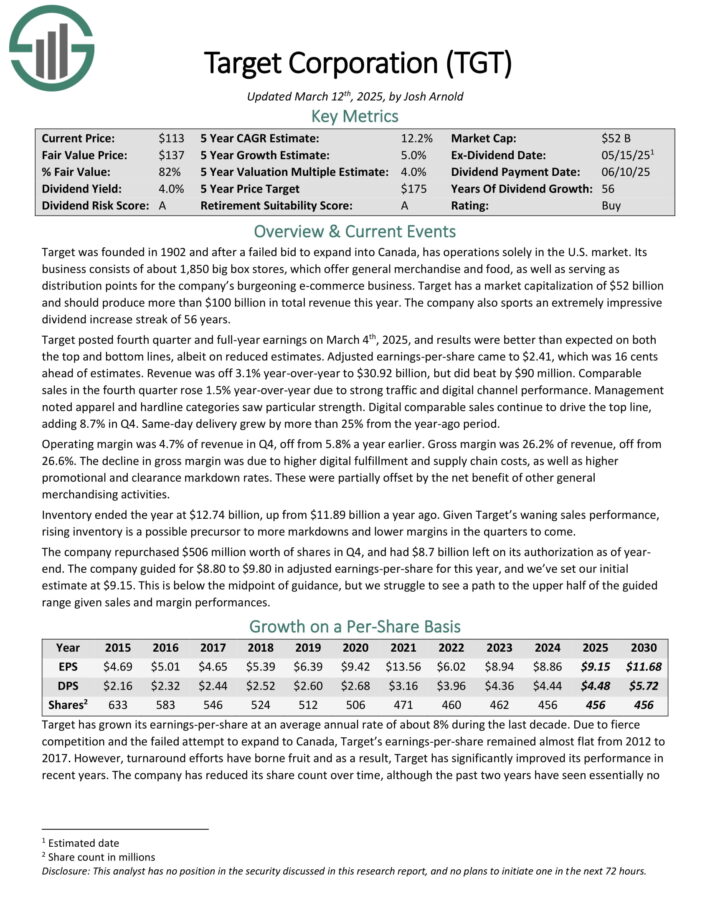

Aim was primarily based in 1902 and now operates about 1,850 big discipline outlets, which provide fundamental merchandise and meals, along with serving as distribution components for the company’s e-commerce enterprise.

Aim posted fourth quarter and full-year earnings on March 4th, 2025, and outcomes had been larger than anticipated on every the best and bottom traces, albeit on lowered estimates. Adjusted earnings-per-share received right here to $2.41, which was 16 cents ahead of estimates.

Revenue was off 3.1% year-over-year to $30.92 billion, nonetheless did beat estimates by $90 million. Comparable product sales throughout the fourth quarter rose 1.5% year-over-year as a consequence of sturdy web site guests and digital channel effectivity.

Administration well-known apparel and hardline lessons observed express vitality.

Provide: Investor Presentation

For 2025, Aim expects spherical 1% product sales growth and a modest enhance in working margins. Nonetheless, parts like tariff uncertainties and shifting shopper confidence would possibly stress short-term earnings.

The company stays centered on digital enlargement, present chain enhancements, and shareholder returns, along with dividend will improve and stock buybacks, with $8.7 billion nonetheless accessible beneath its repurchase program.

Digital comparable product sales proceed to drive the best line, together with 8.7% in This fall. Similar-day provide grew by better than 25% from the year-ago interval.

The company repurchased $506 million worth of shares in This fall, and had $8.7 billion left on its authorization as of 12 months end. The company guided for $8.80 to $9.80 in adjusted earnings-per-share for this 12 months.

Click on on proper right here to acquire our most modern Sure Analysis report on TGT (preview of internet web page 1 of three confirmed beneath):

Desk of Contents

The Dividend Champions document simply isn’t the one technique to quickly show for shares that always pay rising dividends.

Thanks for finding out this textual content. Please ship any options, corrections, or inquiries to [email protected].

rn

rn

Source link ","writer":{"@sort":"Particular person","identify":"Index Investing Information","url":"https://indexinvestingnews.com/writer/projects666/","sameAs":["https://indexinvestingnews.com"]},"articleSection":["Investing"],"picture":{"@sort":"ImageObject","url":"https://www.suredividend.com/wp-content/uploads/2022/11/Dividend-Champions-e1668255689733.png","width":0,"top":0},"writer":{"@sort":"Group","identify":"","url":"https://indexinvestingnews.com","brand":{"@sort":"ImageObject","url":""},"sameAs":["https://www.facebook.com/Index-Investing-News-102075432474739","https://twitter.com/IndexInvesting_"]}}

Source link