ekinyalgin

Well, the U.S. Treasury Department used its money well to keep paying U.S. government bills as the debt default date got closer and closer.

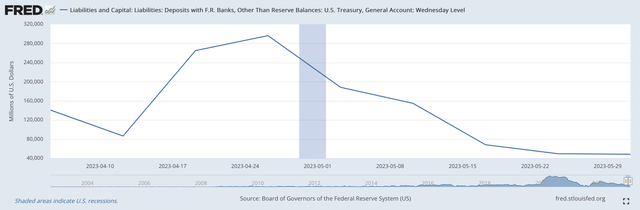

The Treasury’s General Account at the Federal Reserve, the account where the government pays its bills, reached a low of $48.5 billion on May 31, 2023, according to the weekly H.4.1 release of the Federal Reserve.

This was the lowest level this account has reached since 2017.

U.S. Treasury: General Account (Federal Reserve)

As can be seen from the chart, the General Account contained $296.2 billion on April 28 and declined after that date as Janet Yellen and the Treasury Department kept the government’s payments to a minimum giving the government time to reach a debt limit agreement.

Now, the government’s General Account must be restored so that “normal” business can go on.

“JPMorgan has estimated that Washington will need to borrow $1.1 trillion in short-dated Treasury bills by the end of 2023, with $850 billion in net bill issuance over the next four months.”

The immediate concern: the sheer volume of new issuance will cause the yields on government debt to rise and this will result in a lot of cash leaving the banking system.

“Everyone knows the flood is coming,” said Gennadiy Goldberg, a strategist at TD Securities. “Yields will move higher because of this flood.”

This could be one of the biggest increases in Treasury bill issuance in history.

It has been noted that money is moving around the financial system much more rapidly than in earlier cases, analysts point out the deposit loss that took place at Silicon Valley Bank that contributed to its demise, and a rapid movement of money out of banks is not unexpected.

This will be especially hard on smaller banks.

Note too that this rise may exacerbate the problem banks are having holding longer-term securities.

As short-term interest rates remained close to or below zero, many banks sought higher portfolio yields by lengthening the maturity of their holdings of U.S. Treasury issues.

The rise in rates over the past year have created loss situations for many banks as their holdings of longer-term government securities declined in price, placing the securities in an “underwater” situation.

Higher interest rates will just make this situation more precarious for some. And, like Silicon Valley Bank, those hurting from the underwater situation may be found in the larger regional banks.

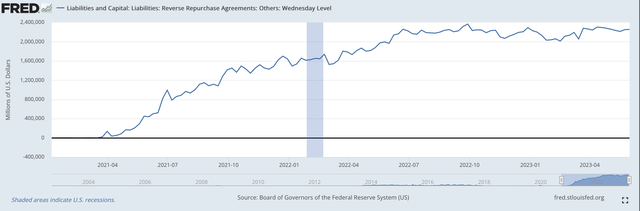

Another pressure may arise in the money market space. Many money market firms invest in overnight funds at Federal Reserve Banks. These funds show up in the H.4.1 Federal Reserve release under the line item Reverse Repurchase Agreements (RRPs).

Consequently, money has already moved into these RRPs as the Fed is now paying a very generous risk-free rate–currently just over 5.00 percent.

A comparable Treasury market yield is just below 5.20 percent, and these securities contain some market risk.

Reverse Repurchase Agreements (Federal Reserve)

Note, at the end of the latest banking week, May 31, 2023, Reverse Repurchase Agreements totaled $2,615.7 billion!

As more and more money moves out of commercial banks and into money market funds, Reverse Repurchase Agreements at the Federal Reserve will continue to rise.

This will be the case unless the Federal Reserve ceases to be so aggressive in competing with these RRPs.

The Rest Of The Year

The financial markets… as well as other markets… are in a real state of disequilibrium.

The fuss over the debt-ceiling limit has cost the U.S. government, according to some estimates, more than $1.0 billion.

Then, there is this forecast of how much money the U.S. Treasury has to raise in order to get back into “working order.”

And, interest rates are now expected to rise further, not only because of the above-described bond issuance but because data keep coming in showing that the economy is not slowing as the Fed would like and, as a consequence, the Fed made have to raise its policy rate of interest even further.

What stresses will these movements put on an already weak banking system?

Then in two years, the debt-limit ceiling issue will have to be dealt with and the country will have to go through the current exercise all over again.

The debt-limit ceiling must go.

It is just another opportunity for politicians to gain headlines before they kick the can down the road again.

Little, if any, good comes from this practice.

The Federal government must begin to take its fiscal affairs seriously and start acting like adults.

For investors: right now, the best prediction for the state of the economy in two years is, “more of the same.”

The one thing that the federal government has shown is that if it continues to act in the way it has acted for the past several decades, the wealthy will get wealthier and the U.S. economy will continue to produce more and more asset price bubbles.

The government’s credit inflation policy of the last forty years or so has proven one thing… as I have discussed in many, many posts on Seeking Alpha… and that is credit inflation produces greater wealth inequality.

And, to those benefitting from credit inflation, the commitment has seemed to be almost riskless.

So, if the government continues to kick the can down the road and continues to engage in credit inflation, the investment practices of the wealthy have shown us where to add to our wealth.

The problem with this is that not everyone can make the same investments.