Sproetniek/iStock via Getty Images

Concentrating solar-thermal power holds a lot of promise and has been a relative success in Spain which currently leads the world in installed CSP capacity at 2.3 GW. The US closely follows at 1.7 GW with China and South Africa also being notable. But compared to solar photovoltaics, CSP has seen very little hype and traction. Heliogen, (NYSE:HLGN) whose stock is down around 92% year-to-date, is likely one of the more prominent US-based CSP companies.

Is this a case of a misunderstood technology’s potential being undervalued? Kind of. This year has seen a pertinent risk-off trade push the valuation of stocks in high-growth sectors to record lows. There are a ton of high-quality companies operating in secular growth industries that can now be picked up at cheap multiples but I would struggle to place Heliogen in this bracket. Indeed, despite the benefits offered by CSP, Heliogen’s technology stack is quite novel.

Concentrated Solar-Thermal Faces Barriers To Adoption

CSP is likely to remain more expensive than conventional solar PV whose cost has been on a near-constant decline since the turn of the millennium. Heliogen bulls would be right to say that a direct comparison between both technologies is not entirely prudent.

BloombergNEF

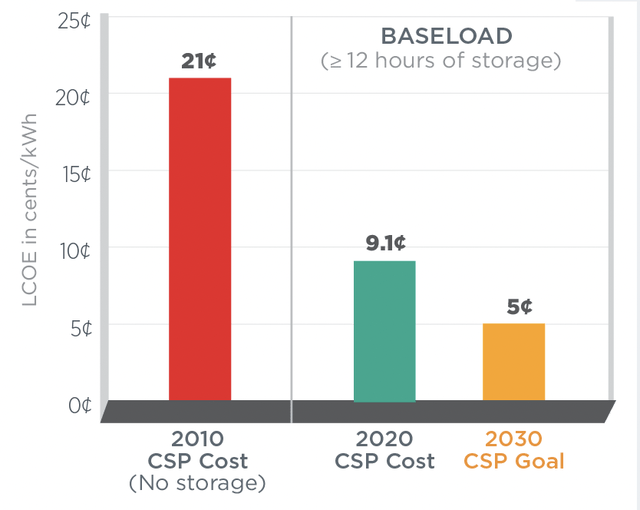

Whilst fixed-axis and tracking PV both have the lowest levelized cost of electricity, this does not include short-duration energy storage. Utility-scale storage is absolutely critical to address the intermittency of renewables and correct the duck curve. The curve illustrates the dichotomy between peak electricity demand and solar energy production seen during the day. Whilst the LCOE of CSP is currently more expensive at around $0.091 per kWh versus $0.045 for fixed-axis PV, it comes with thermal storage.

U.S. Department of Energy

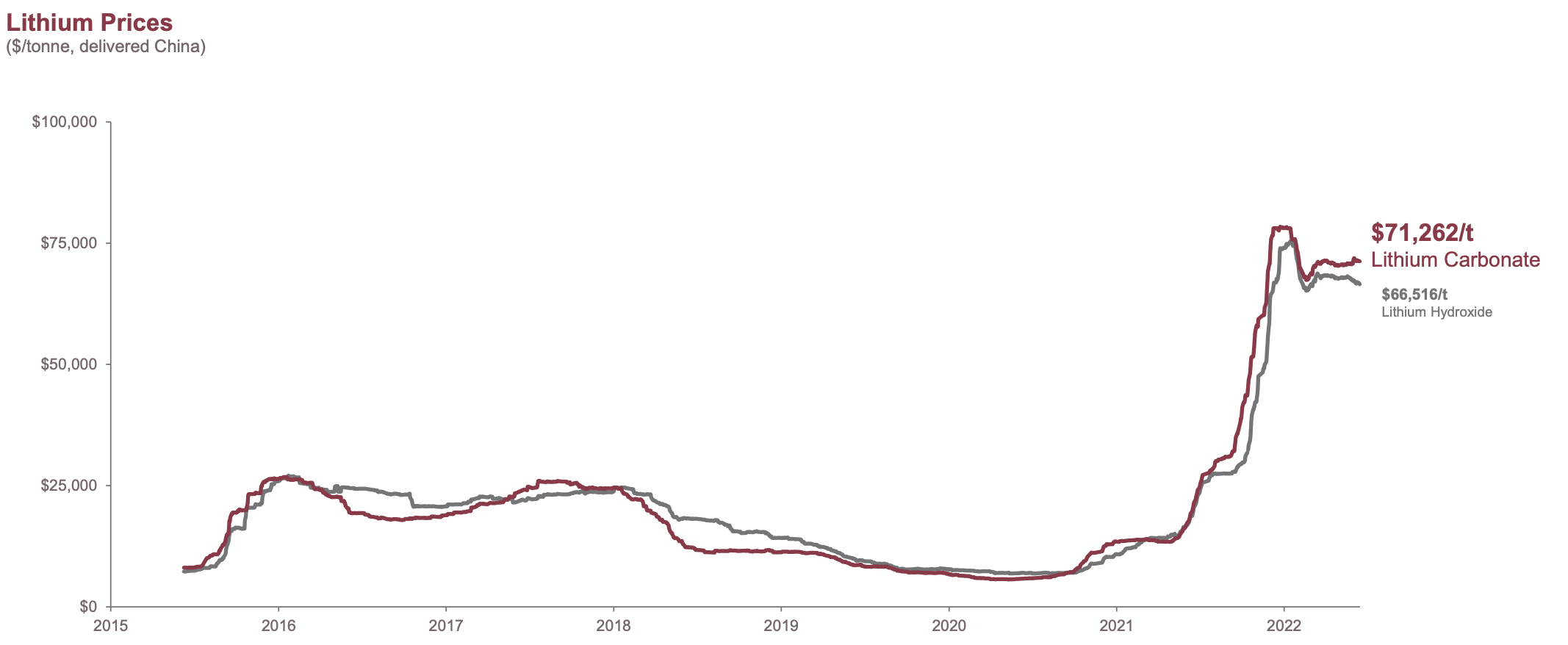

Critically, it embeds energy storage without the need for mining and refining lithium. This accomplishes two important objectives. Firstly, it doesn’t drive mining demand and the subsequent negative environmental impacts. Secondly, it detaches renewable energy growth from what looks set to be material bottlenecks to the supply of lithium in the years ahead.

Lithium Americas

These bottlenecks combined with a demand explosion have already driven lithium carbonate prices to all-time highs this year at over $70,000/t in China. Long-duration thermal energy storage in the form of molten salt will forever be cheaper than conventional lithium-ion batteries and can store energy for up to 10 hours.

Concentrating Sunlight Is Not New But Heliogen Is Pioneering A New Technology Stack

CSP has been around for decades and was actually once ahead in capacity deployments versus utility-scale solar PV. In 2010, the US had 400 MW of CSP capacity installed and only around 100 MW for solar PV. By the time the pandemic hit, CSP capacity had reached 1.7 GW while utility-scale solar PV capacity had increased substantially to 35.4 GW.

Hence, as renewables increase as a per cent of total US electricity produced, CSP might find itself making a comeback as the increasing variability of the grid will demand more storage capacity be installed. However, CSP plants still require direct irradiation and an average daily minimum of sunshine to produce electricity, limiting their optimal sites.

Heliogen

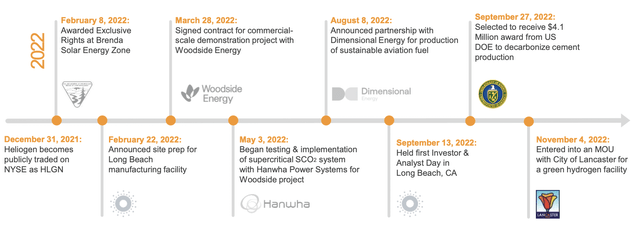

Heliogen’s last reported earnings for its fiscal 2022 third quarter saw revenue come in at $3.1 million, up by 40.9% from the year-ago quarter but a miss by $2.77 million on consensus estimates. Total operating expenses rose to $29.4 million from $13.3 million in the year-ago quarter as net losses rose to $27.8 million. This drove cash burn from operations of $18.2 million. When aggregated with CapEx of $3.8 million during the quarter, free cash outflow came in at $22 million to drive down cash and equivalents to $159.5 million.

Heliogen

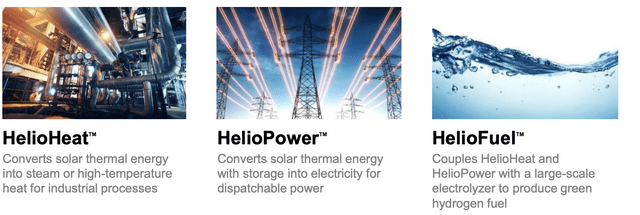

This liquidity position against the current burn rate provides a clear runway into fiscal 2024. This is a stark contrast to peers in the climate economy who like Heliogen have seen their stock prices decline markedly but are operating with less than a year of cash left. The company is of course getting ready to ramp up commercial operations as the Inflation Reduction Act, a large $370 billion initiative to ramp up decarbonization, kicks in to drive demand for HelioHeat, HelioPower, and HelioFuel. Critically, the IRA provides a $3/kg production tax credit for the production of green hydrogen and Heliogen’s management during the earnings call for the third quarter stated the IRA was driving significant customer interest for HelioFuel.

Revenue for the full fiscal year 2022 was revised to not be less than $12 million from prior guidance for revenue to be between $20 million to $25 million. This was driven by a delay to a 5 MW demonstration project with Woodside Energy (WDS).

With the pullback of their shares, Heliogen currently trades at around a $214 million market cap which is a 17.8x multiple to 2022 revenue. Whilst seemingly high, the company is still in the early stages of commercialization and the outlook for revenue growth seems bright. Heliogen isn’t a buy now but could make an interesting play if the IRA drives positive commercial partnership momentum in the year ahead.