porcorex

Excessive dividend ETFs are a great way to assist battle in opposition to inflation. Nonetheless, I am not a fan of leveraged ETFs that promise greater yields in exchanged for a lot greater danger. That is why it is a greater thought for buyers to stay with bread and butter ETFs that present broad diversification throughout sturdy names in numerous segments.

This brings me to the iShares Core Excessive Dividend ETF (NYSEARCA:HDV), which seems to be one such title. On this article, I spotlight HDV a possible purchase for long-term buyers who prize revenue and progress, so let’s get began.

Why HDV?

Because the title suggests, HDV is an ETF that seeks to trace the funding outcomes of the Morningstar Dividend Yield Focus Index, and is comprised of comparatively excessive dividend paying U.S. equities. The fund typically invests 80% of its property within the part securities of this index and in different securities which have related financial traits of the index.

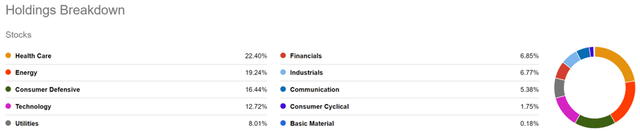

Not like the S&P 500 (SPY), which is closely tilted in the direction of non-dividend paying know-how shares, HDV is tilted in the direction of these sectors which can be comparatively extra mature that do pay a dividend. As proven under, healthcare, vitality, and client defensive comprise HDV’s prime 3 segments, representing 58% of the portfolio worth.

HDV Portfolio Combine (Searching for Alpha)

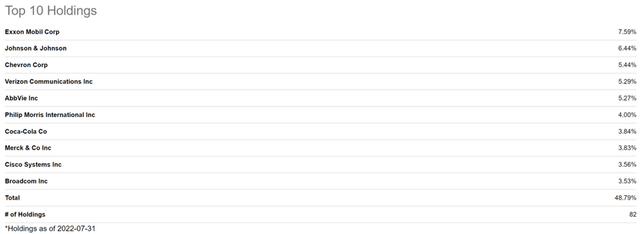

Furthermore, it isn’t as if HDV has little publicity to know-how, as there are some mature and nonetheless rising tech corporations that do pay a stable dividend yield. This contains corporations like Cisco Techniques (CSCO) and Broadcom (AVGO) that make up the #9 and #10 holdings of HDV, respectively.

As proven under, the opposite prime names of HDV embody well-recognized oil majors Exxon Mobil (XOM), Chevron (CVX), telecom large Verizon (VZ), healthcare giants Johnson & Johnson (JNJ), AbbVie (ABBV) and Merck (MRK) and the buyer staples Philip Morris Int’l (PM) and Coca-Cola (KO).

HDV High Holdings (Searching for Alpha)

Dangers to HDV embody its heavy weighting in the direction of vitality, with oil majors presently having fun with a bull run because of greater oil costs. This outsized publicity may very well be a double-edged sword ought to vitality costs come crashing down. Furthermore, drug-pricing reform might negatively affect healthcare corporations. Nonetheless, the specialty medication of the massive pharmaceutical corporations gives a degree of insulation from value controls.

HDV’s heavy concentrate on mature corporations additionally implies that it misses out on outsized features of tech corporations that do not pay a dividend, like Amazon (AMZN) and Google (GOOG). As proven under, HDV’s whole return of 149% over the previous 10 years trails the 264% return of the S&P 500 (SPY).

HDV Complete Return (Searching for Alpha)

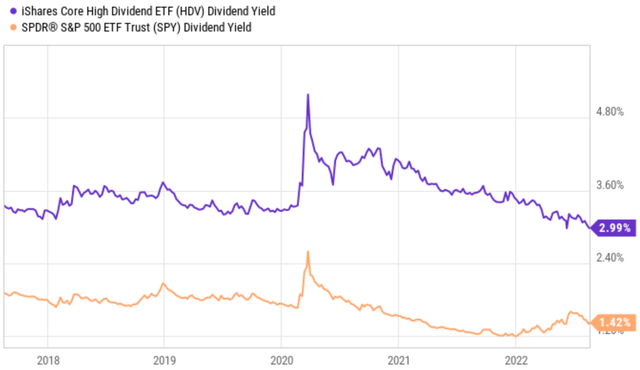

Nonetheless, revenue is the first goal of buyers who purchase HDV, and is dividend yield excels at beating that of the general index. As proven under, HDV’s 3% dividend yield provides it a cushty unfold in comparison with the 1.4% yield of the S&P 500.

HDV & SPY Yields (YCharts)

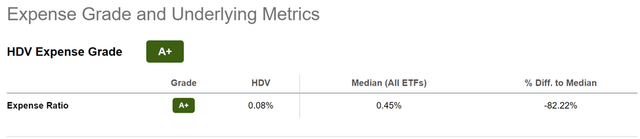

Furthermore, buyers haven’t got to fret about bills consuming into their features. As proven under, iShares costs a low 0.08% expense ratio, which sits nicely under the 0.45% median for all ETFs, serving to HDV to attain an A+ expense grade.

HDV Expense Grade (Searching for Alpha)

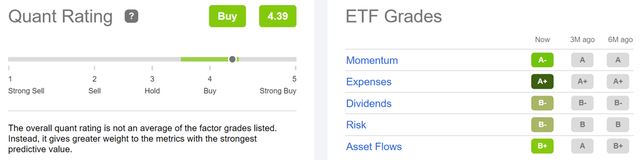

Lastly, HDV scores a Purchase ranking from Searching for Alpha’s Quant system. As proven under, HDV scores A and B grades for momentum, bills, dividends, danger, and asset flows.

HDV Quant Score (Searching for Alpha)

Investor Takeaway

HDV is a excessive dividend ETF that gives a beautiful yield whereas diversifying throughout completely different sectors. This makes it a possible purchase for long-term buyers who’re in search of each revenue and progress. Nonetheless, buyers ought to concentrate on the dangers related to vitality and healthcare shares earlier than making a call.

Nonetheless, I discover HDV’s holdings to be interesting, because it holds a variety of shares that I might advocate for a protected dividend portfolio in any case, and whereas giving buyers the good thing about automated diversification. As such, I discover HDV to be a purchase for long-term revenue buyers.