ansonmiao

This past weekend marked the start of the year of the Water Rabbit, based on the Chinese lunar calendar. The combination of the rabbit and yin water “bodes well for a calmer 2023 compared to last year’s tumultuous experience,” writes CLSA in its annual Feng Shui Index.

Deutsche Bank, meanwhile, believes 2023 “will be a year of transition toward more normalcy after the bust and boom pattern of the last few years.”

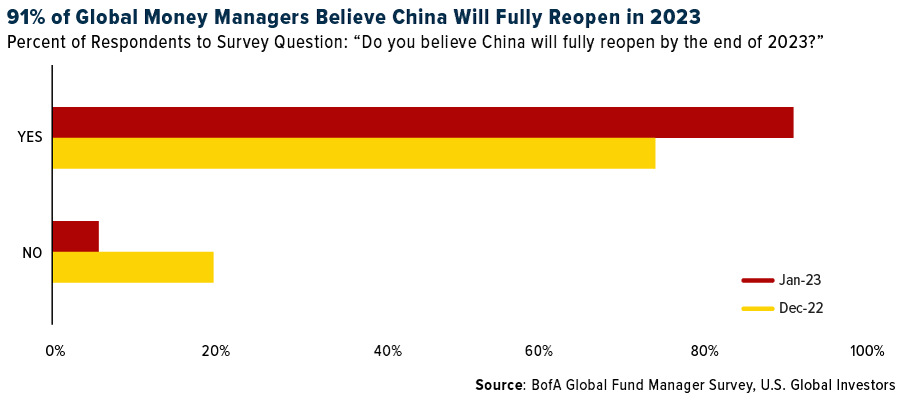

Whether true or not, global fund managers are betting that China region stocks and commodities will have a strong year as the world’s second-largest economy gradually reopens after three long years in lockdown.

A January survey conducted by Bank of America shows that 91% of money managers believe China will “fully reopen” in 2023. That’s a significant increase from December 2022. Growth expectations for the country are also at a 17-year high.

U.S. Global Investors

Shares of Chinese companies are forecast to beat their emerging market peers in 2023, with Morgan Stanley calling for returns of 10% and Citi Global Wealth Investments seeing 20%.

This is expected to lift equities in surrounding Asian markets, including big exporters such as South Korea and Taiwan as well as popular Chinese tourist destinations such as Thailand and Indonesia.

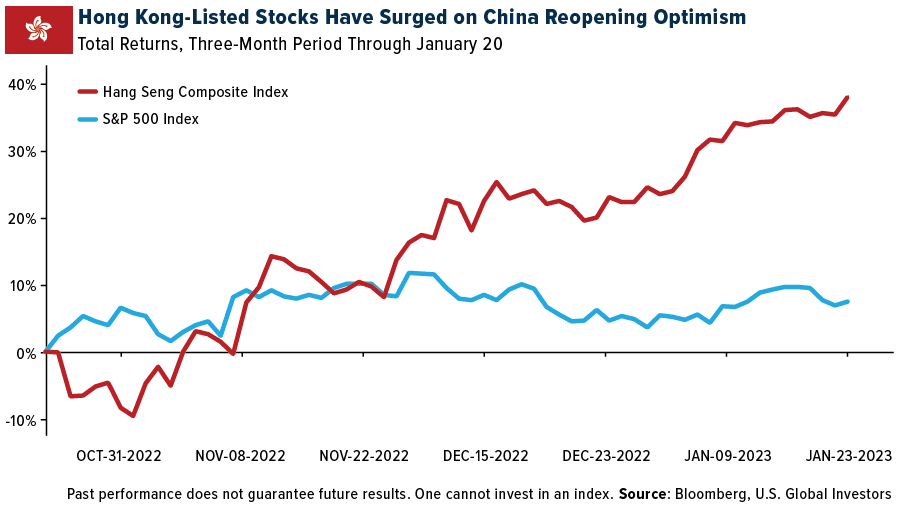

Take a look below. Hong Kong-listed stocks have surged 37.5% over the past three months, compared to the S&P 500, up 7.7%, in response to reopening optimism. Among the best performers in the Hang Seng Composite Index are Macau-based travel and casino stocks, including MGM China, up 196% over the same period, and Wynn Macau, up 170%.

U.S. Global Investors

100% Increase In Chinese Chunyun Travelers Over Last Year

Travel stocks, including airlines, are indeed soaring right now on reopening hopes and the lifting of Covid-era quarantine and testing policies. That’s particularly true of Asian airlines, as Chunyun swings back into action for the first time since the start of the pandemic.

Chunyun, or Spring Festival, is the 40-day Chinese travel period that’s believed to be the largest annual human migration in history. More than 2 billion passenger trips by air, road and rail are estimated to be taken this season, double the number from last year, but still 70% of the pre-pandemic level in 2019, according to China’s Ministry of Transport.

To prepare for the extra influx of commercial air travelers, the Civil Aviation Administration of China (CAAC) has approved more than 10,000 extra flights, including some 3,500 serving Beijing, Shanghai and Guangzhou.

According to Trip.com Group, China’s largest online travel agency, flight bookings for the Lunar New Year were up 15% compared to last year, while scheduled inbound flights during the first quarter have increased around 150% versus the same quarter a year ago.

Speaking last week in Davos, Switzerland, Trip.com CEO Jane Sun said that leisure travel in China now exceeds 2019 levels and that total commercial aviation capacity would return to normal by the third quarter of this year.

Key Metals And Commodities Responding Positively

For years, China has been the world’s largest consumer of a number of metals and commodities, including steel, iron ore, lead, copper, crude oil and much more. With the country’s reopening, many producers and investors are positioning to catch the next potential wave.

For example, BHP, the world’s largest miner, reported record iron ore output in the six-month period through December 31, as it predicts China’s economic reopening will drive up metals demand. The company produced 132 million tons of iron ore during the period, and it says it will boost its production of copper and nickel.

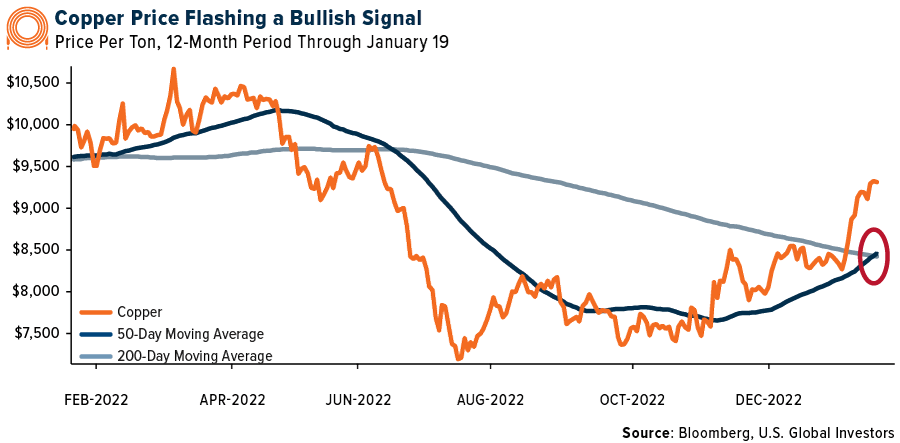

Dr. Copper, so named because the metal’s price action has often reflected the health of the economy, has advanced on expectations of stronger demand from China and tight global supply.

From its 52-week low in July, the metal has risen approximately 30% and is now trading above $9,300 per ton; in addition, its 50-day moving average has crossed above the 200-day moving average for the first time in roughly a year, signaling a bullish “golden cross.”

U.S. Global Investors

Copper, nickel, lithium and other vital metals are primed for growth due to the ongoing clean-energy transition. The latest estimate by Bloomberg New Energy Finance says that the global energy industry will need $6 trillion of metals over the next three decades to meet the zero-carbon mandates governments already have in place.