seewhatmitchsee

Typically, while you put money into a inventory for pure worth functions, you get caught holding an unattractive asset whose story retains sliding south. Such is my expertise in Groupon (NASDAQ:GRPN), as soon as a well-liked web website for discount offers on native experiences (reminiscent of wine tasting). Evidently, the pandemic has bashed Groupon’s enterprise in various methods – by sapping buyer demand for occasions and providers, and likewise by placing many smaller companies that are the bread and butter of Groupon’s choices out of enterprise.

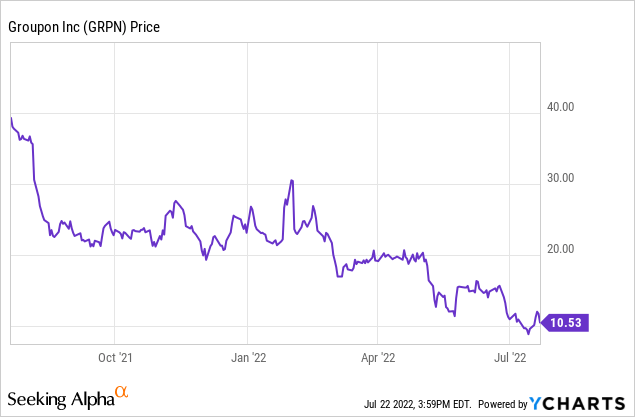

12 months up to now, shares of Groupon have tumbled greater than 60% as traders fled this sinking ship that has reliably posted a worsening story with each quarterly launch.

Beforehand, I had been bullish on Groupon. That ranking was predicated on two elements: first, a really low cost share value that was virtually “free” when contemplating the online money on Groupon’s steadiness sheet, and second, the looks of a steady buyer and income base.

Whereas Groupon’s cheapness is unchanged (in actual fact, the deeper slide that the inventory has seen since April has made Groupon even cheaper than earlier than), its elementary story has gotten significantly worse, particularly as the corporate’s buyer base began tapering in Q1 (extra particulars within the subsequent part). In brief, I’m now bearish on Groupon – and am now of the view that Groupon’s worth component is basically the market’s manner of predicting that Groupon will burn by the money on its books earlier than it could obtain a liquidity occasion (and actually, with prospects and income falling sharply, it is extremely unlikely to discover a prepared acquirer now).

In December, the corporate tapped a brand new CEO to guide the enterprise, Kedar Deshpande. Previous to becoming a member of Groupon, Deshpande had served because the CEO of Zappos. Along with the management group at Groupon, Deshpande unveiled a three-pronged technique to attempt to flip the corporate round:

Groupon turnaround plan (Groupon Q1 investor presentation)

A lot of this technique entails modernizing the know-how base that Groupon sits on and bettering the stock of offers it presents to its prospects. And whereas I believe these are lifelike objectives, I do fear in regards to the sinking worth of the Groupon model and the comparatively shoddy regard which it is given in the present day. With the latest proof that the corporate’s buyer base is beginning to bleed, I doubt there are any important levers the corporate has in its toolkit to reverse that decline.

Groupon is, undoubtedly, low cost. At present share costs close to $10, its market cap is simply $314.7 million. After we internet off the $403.0 million of money and $323.8 million of debt on the corporate’s most up-to-date steadiness sheet, its ensuing enterprise worth is $235.5 million.

For the present fiscal 12 months, Groupon is anticipating $60-$80 million in adjusted EBITDA – roughly half, by the best way, of FY21’s adjusted EBITDA of $143.2 million (which did embody a $30 million one-time profit). It is also decrease than the corporate’s prior outlook of $112 million in adjusted EBITDA for FY22. Towards this new decrease outlook, Groupon’s valuation sits at 3.4x EV/FY22 adjusted EBITDA.

In my opinion, nevertheless, it is not price shopping for Groupon just because it is low cost – the basics have a lot draw back danger particularly after the latest spate of buyer churn and steering cuts that I believe sentiment on Groupon will solely proceed to worsen. Transfer again to the sidelines right here and lower losses sooner fairly than later.

Q1 obtain

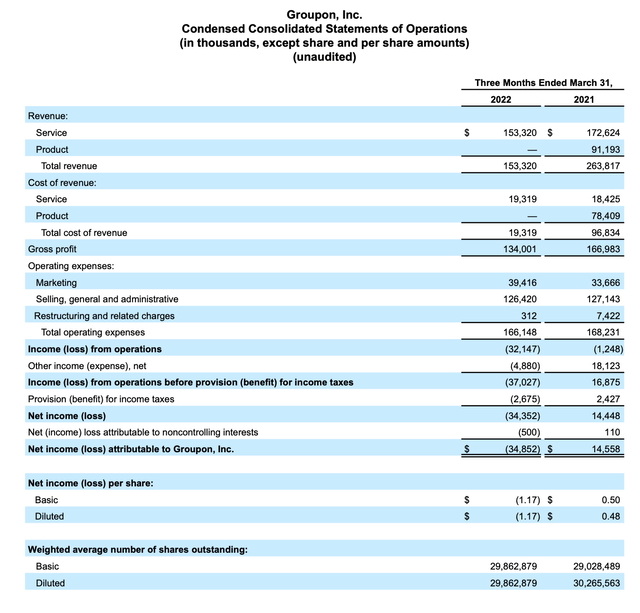

Let’s now undergo the corporate’s newest Q1 ends in larger element. The Q1 earnings abstract is proven beneath:

Groupon Q1 outcomes (Groupon Q1 investor presentation)

Groupon’s income declined -42% y/y to $153.3 million within the quarter, lacking Wall Road’s expectations of $165.3 million (-37% y/y) by a five-point margin. You may discover {that a} massive chunk of this income miss was pushed by the lack of product income, which was Groupon’s determination to exit the first-party market enterprise. Nonetheless, nevertheless, core providers income nonetheless additionally fell -11% y/y.

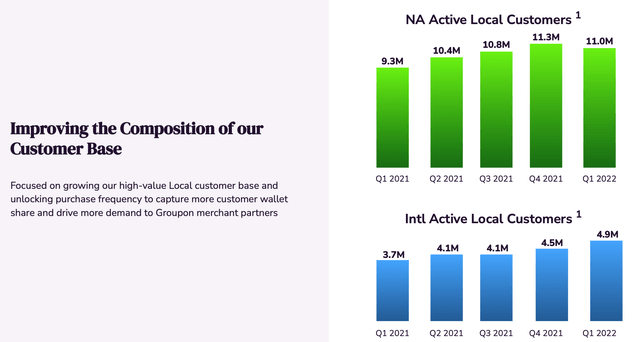

The corporate’s base of energetic prospects in North America, which makes up roughly three-quarters of the corporate’s Native section income, slipped to 11.0 million within the quarter. The corporate defines an “energetic” buyer as somebody who has made a purchase order over the trailing twelve months. You may discover that there was numerous buyer progress throughout 2021, but when these actions have been one-time, we may very properly see a continued peeling-off of Groupon’s prospects. Energetic prospects did nonetheless develop internationally, however income per buyer right here is barely decrease than in North America.

Groupon buyer traits (Groupon Q1 investor presentation)

Groupon had been hoping for purchases to rebound as soon as the Omicron wave handed, however this has not materialized. Per new CEO Kedar Deshpande’s remarks on the Q1 earnings name:

Within the first quarter, we did not see native demand come again as Omicron circumstances started to subside. We had anticipated to see a sample much like what we noticed final 12 months within the wake of Delta. So we executed on the initiatives that mirrored our expectation for growing demand publish Omicron however this demand didn’t materialize. As you realize, Groupon is a market that gives discounted experiences and providers. And retailers merely didn’t must leverage the Groupon market as a lot as we thought they might, popping out of the pandemic. And this has been worsened by inflationary headwinds. With demand excessive and capability low, retailers didn’t must promote discounted stock in our market. As well as, we noticed service provider availability contribute to driving refund charges increased, which put additional strain on our stock ranges in addition to adjusted EBITDA. Whereas we expect that is transient, you’ll hear us speak about our plans to make Groupon extra useful to retailers all through the financial cycle.”

The corporate’s technique to reverse this detrimental buyer pattern is to deal with curated, packaged experiences. The corporate desires to maneuver away from being a “deep {discount}” experiences model to at least one that curates somewhat-discounted packages (an instance right here that Deshpande gave is a date night time combo that features dinner at an Italian restaurant plus bowling). The corporate desires to roll out a brand new market providing by the tip of the 12 months that can separate this new method from Groupon’s current deep-discount model.

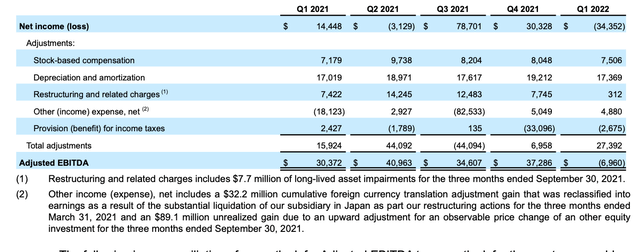

In the meantime, nevertheless, Groupon’s profitability is struggling. Adjusted EBITDA fell to a -$7.0 million loss within the quarter, down from a $30.3 million acquire within the first quarter of final 12 months.

Groupon adjusted EBITDA (Groupon Q1 investor presentation)

For subsequent 12 months (FY23), the corporate nonetheless targets to ship 15-20% adjusted EBITDA margins and $100+ million in annual free money movement. Groupon, nevertheless, doesn’t have an ideal observe document for executing on its commitments (look no additional than the huge steering lower that the corporate gave for this 12 months, from $112 million in adjusted EBITDA to $70 million on the midpoint). In my opinion, Groupon might be hard-pressed to satisfy these lofty targets (and given the place the inventory is presently buying and selling, Wall Road would not have a lot religion both).

Key takeaways

Groupon is affordable, but it surely’s low cost for a purpose. The corporate is struggling to keep up relevance for its model, and sweeping adjustments to rebuild its know-how platform and roll out a brand new market providing could backfire. In a market period the place many higher-quality shares are additionally buying and selling at a deep {discount} within the tech sector, I’d dump Groupon and make investments elsewhere in preparation for a year-end market rebound.