Pictures By Tang Ming Tung/DigitalVision through Getty Pictures

Synopsis

Graphic Packaging Holding (NYSE:GPK) is among the market leaders in sustainable shopper packaging, providing distinctive and revolutionary packaging merchandise for meals service, meals & drinks, family and different shopper merchandise. The agency has been reporting sturdy year-over-year progress up till FY23 as quantity stabilizes. It has additionally demonstrated vital progress in its profitability margins all through the years. Because the EU’s regulation on packaging progresses, it’s important for GPK to enhance compliance capabilities, innovate, and adapt packaging options to remain forward within the EU market. Given its beneficial outlook, I’m reiterating my purchase ranking for this inventory.

Enterprise Overview

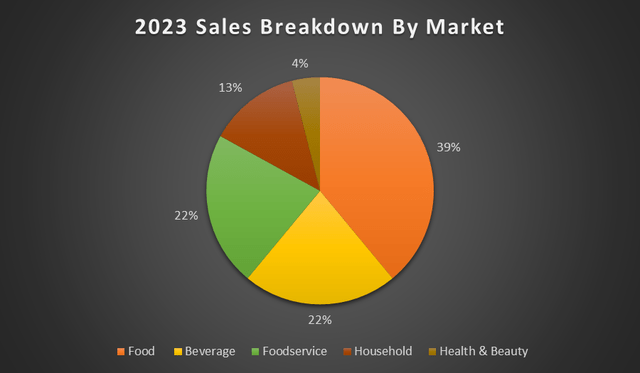

GPK is a significant participant in shopper packaging, one of many largest producers of cartons, containers, and paperboard-based foodservice packaging within the U.S. and Europe. Its enterprise could be damaged down into 3 reportable segments: Paperboard Manufacturing, Paperboard Packaging, and Europe Packaging. It has a various gross sales distribution as proven beneath, with 61% beneath Meals & Drinks, 22% beneath Foodservice, 13% beneath Family and 4% beneath Well being & Magnificence.

Writer’s Chart

Historic Monetary Evaluation

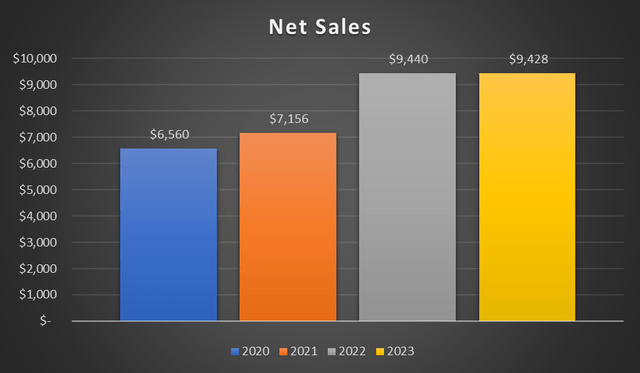

Over time, GPK has proven constant top-line progress till it turned flat in FY23. In FY22, internet gross sales have grown by greater than 30% year-over-year, from $7.15 billion to $9.440 billion. In FY23, it fell by -0.13% from $9.44 billion to $9.42 billion. FY23 internet gross sales turned flattish because of weaker natural gross sales and open market gross sales. Innovation gross sales, Bell’s acquisition, larger pricing, and favorable overseas trade have partially offset this decline. FY22’s internet gross sales have been sturdy because of $1.088 billion in gross sales from Americraft acquisition in 3Q21 and AR packaging in 1Q21. As well as, larger quantity arises from extra conversion to fibre-based packaging options.

Writer’s Chart

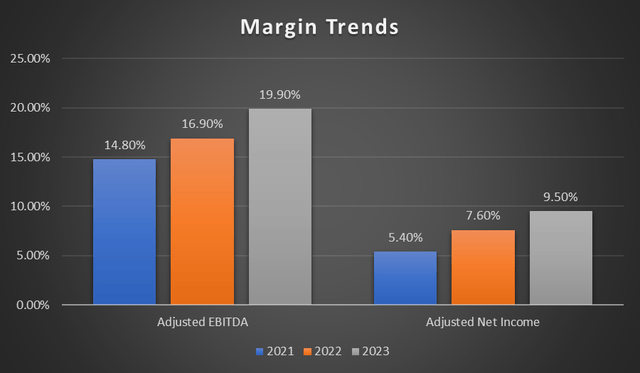

GPK’s profitability margins have proven constant enlargement over time. The corporate’s adjusted EBITDA margin elevated from 16.90% to 19.90%, and its adjusted internet earnings margin improved from 7.6% to 9.5%. Its EBITDA for FY23 was at $1.795 billion, larger than FY22 by $326 million. With the impact of changes from enterprise combos and different particular expenses, adjusted EBITDA for FY23 has elevated from $1.6 billion to $1.876 billion. It was positively impacted by $556 million in pricing and $75 million in beneficial internet efficiency. They’ve been capable of preserve sturdy margins in addition to regular and constant EBITDA and EPS progress.

Writer’s Chart

Second Quarter Earnings Evaluation

2Q24 internet gross sales are down by ~6% year-over-year from $2.39 billion to $2.23 billion. Adjusted EBITDA has fallen by ~11% year-over-year from $453 million to $402 million, with its adjusted EBITDA margin falling barely from 18.9% to 18.0%. This quarter has proven continued stronger leads to Foodservice and Drinks, in addition to blended outcomes in well being & magnificence and family segments. The decline in internet gross sales was largely because of the sale of the Augusta bleached paperboard facility, together with decrease paperboard quantity and costs. A portion of the gross sales proceeds has been used to repurchase ~2.4% of excellent shares. GPK continues to return worth to shareholders by means of dividends and share buybacks as gross sales and money stream are anticipated to develop within the subsequent few years.

PPWR Packaging Regulation in EU

The Packaging and Packaging Waste Regulation [PPWR] has made progress with new guidelines for packaging producers, retailers, and waste administration corporations. The regulation units to cut back plastic packaging waste by 5% by 2030, 10% in 2035, and 15% by 2040. It additionally contains sure standards for recycled content material in packaging supplies. Such rules might pose a few challenges for the patron packaging business, resulting in larger prices when suppliers want to stick to strict disclosures and practices. Corporations should pay larger charges for sure decorations, components, coatings, and different components which are tougher to recycle.

The intention of the regulation is to incentivise using easier and extra recyclable packaging supplies. Vital funding could be required to develop the infrastructure vital for gathering recyclable supplies, enhance sorting amenities, and guarantee sufficient capability to deal with the elevated quantity of recycled supplies. As well as, there could be a possible elimination of secondary packaging that’s deemed pointless and environmentally burdensome. Future rules may introduce further restrictions, additional complicating compliance efforts.

Positively, stricter rules on plastic utilization will result in a desire for paperboard because of its perceived environmental friendliness and ease of recycling, boosting demand for paperboard packaging because of this. Such rules would encourage transitions to extra sustainable supplies, resembling paperboard. Its PaperSeal™ Form innovation can cut back plastic content material by over 80-90% as in comparison with conventional plastic tray, changing them and different merchandise which are troublesome to recycle, simply aligning with the rules.

UK’s Sainsbury is the primary buyer to be use this revolutionary paperboard tray. Except for their PaperSeal™ Form, Boardio®, and KeelClip™ merchandise, that are options to plastic packaging, GPK would wish to repeatedly develop new sustainable packaging options to adjust to these new necessities.

Augusta Divestiture

In Might 2024, GPK bought the Augusta bleached paperboard facility to Clearwater Paper Company (CLW). As a result of most bleached paperboard gross sales have been eradicated, this divestiture resulted in a $155 million lower in reported gross sales in comparison with the earlier yr. This divestiture, together with decrease paperboard quantity and costs, resulted in a $51 million lower in adjusted EBITDA.

The corporate used the proceeds from the sale to cut back debt and repurchase $200 million price of shares within the quarter. Ending the quarter with 2.9x internet leverage, they anticipate to realize 2.7x by the tip of the yr.

The agency has expressed that they’re snug with the present debt ranges and maturity schedule, with plans to cut back it over time by means of the subsequent couple of years. Administration has claimed that this sale was a strategic transfer to focus extra on sustainable packaging options, and it permits GPK to reoptimise their Texarkana bleached paperboard facility. Their Texarkana facility will proceed to serve the rising foodservice and packaging demand.

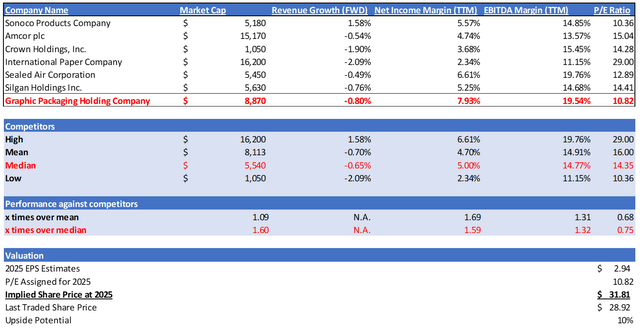

Relative Valuation Mannequin

Writer’s Relative Valuation Mannequin

In my relative valuation mannequin, I’ll consider GPK in relation to an inventory of its friends within the aggressive packaging market, as proven above, when it comes to its progress outlook and profitability margins. At a look, the packaging business’s outlook is weak, with most of its friends displaying a unfavourable ahead income progress charge. GPK’s ahead income progress charge of -0.80% falls barely beneath the median of its friends, which is -0.65%.

GPK’s profitability margins prime its friends’ median when it comes to internet earnings margin TTM and EBITDA margin TTM, reflecting its stronger profitability and operational effectivity. GPK reported internet earnings TTM of seven.93% and EBITDA margin TTM of 19.54%, that are 1.59x and 1.32x of the friends’ median, respectively.

GPK’s ahead non-GAAP P/E ratio is at the moment buying and selling at 10.82x, which is decrease than the friends’ median of 14.35x. For context, GPK’s present P/E is buying and selling beneath its 5-year common of 12.29x. Regardless of reflecting stronger profitability in opposition to its friends, the EU packaging regulation nonetheless brings uncertainties and potential headwinds for GPK. Increased manufacturing bills, a larger want for funding and improvement for brand spanking new sustainable merchandise, and an absence of definition within the regulation will complicate compliance efforts. Due to this fact, this necessitates a extra conservative valuation.

The 2024 market income estimate for GPK is $9.04 billion, whereas the EPS is $2.72. For 2025, the income estimate is $9.21 billion, with EPS of $2.94. Given the administration steering for FY24 in addition to my forward-looking evaluation as mentioned, they assist the market’s estimate. Thus, if I apply my conservative goal P/E of 10.82x to its 2025 EPS estimate, my 2025 goal share value is $31.81.

Dangers & Conclusion

GPK has demonstrated stronger profitability and operational effectivity in comparison with friends. Because the EU’s PPWR progresses, it’s important for GPK to enhance compliance capabilities, innovate, and adapt packaging options. Ought to GPK fail to develop and introduce new sustainable merchandise that adjust to the EU rules, they might threat dropping market share within the EU because of the extremely aggressive nature of the business and rising demand for sustainable packaging options. Nonetheless, given GPK’s innovation capabilities, I imagine they’re well-positioned to thrive transferring ahead.

:max_bytes(150000):strip_icc()/Health-GettyImages-SummerSquash-aea54fc802684a8fad2efbdc8cbc862e.jpg)