gilaxia/E+ via Getty Images

Grab Holdings Limited (NASDAQ:GRAB) continues to reign in Southeast Asia. From being an online ride-booking app, it has expanded into food and item delivery, grocery purchasing, and even hotel booking. It has gone a long way and doesn’t indicate a weakening performance. Instead, it continues to improve, as shown by its impressive revenue growth. Its income is still negative, but improvements are evident. Even better, it has a solid financial positioning that allows it to cover its expansion and borrowings. Indeed, it is an exciting company that exudes growth and sustainability despite tight competition and economic volatility. Likewise, the stock price is promising, and even if valuations are not as towering as they were in its SPAC, growth prospects are enticing.

Company Performance

Since its foundation, Grab Holdings Limited has proven its capacity to grow and expand. Initially a ride-booking app, it was able to penetrate more niches over the years. In the last two years, it has flourished as growth avenues broadened. The company has been and will always be a staple for billions of households in Southeast Asia. And even if restrictions ease, customers still turn to Grab as a convenient and efficient way to travel and receive food and other items.

In 3Q 2022, its operating revenue amounted to $382 million, more than thrice as much as it was in 4Q 2021. Indeed, it continues to show its capacity to sustain growth despite reopening businesses and lifting health protocols. The pandemic fears continue to subside, but Grab remains a vital app for many customers. In fact, its average monthly transacting users (MTUs) reached 33 million, a 26% year-over-year growth. It shows increased demand for its services in a changing market landscape. Indeed, Grab has successfully normalized its demand despite its fierce competition across different niches. It is most evident in food delivery and online ride booking. These further highlight the solid customer base of Grab. Its core strengths are its popularity, massive expansion, and partnerships with numerous restaurants, QSRs, hotels, cars, and taxis. Also, its importance amidst shaky commuting and dining protocols has become more apparent. Lastly, its acquisition of Uber in the region became pivotal to its humongous growth. It captured more customers, monopolizing the car and taxi booking niche.

Operating Revenue (MarketWatch)

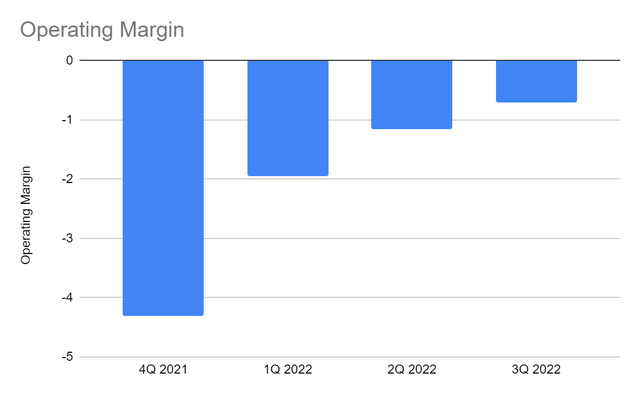

Even more, Grab continues to show its ability to balance growth and viability. As we can see, operating losses dramatically decreased in only a year. Operating margin dropped from -430% to -70%, thanks to its practical focus on cost structure and incentives. It is even more impressive since inflation-adjusted foreign currency translation remains unfavorable. In addition, it continues to innovate its services, improving its efficiency further, raising user engagement, and synergizing services. Its focus on cost optimization may allow it to reach its revenue and margin expansion expectations.

Operating Margin (MarketWatch)

Market Risks And Opportunities

In the face of economic volatility, Grab is also susceptible to risks. Prices are higher, raising its operating costs and expenses. It is most evident in its marketing and research expenses. Impairments are also higher as interest rate hikes affect the valuation of its financial assets. Another risk it must consider is the fierce competition among digital apps in Southeast Asia. Although Grab remains a giant, smaller apps are entering the market. The company must widen its gap and highlight service differentiation. Despite this, more opportunities are evident in the market. Restrictions are easing, but booking a taxi or a car has become more convenient. Commuters remain unfazed despite the rising fares due to oil and fuel price increases. Food deliveries have become more convenient and cheaper than commuting to restaurants and supermarkets. It is most evident in Singapore, with 58% showing a preference for food delivery.

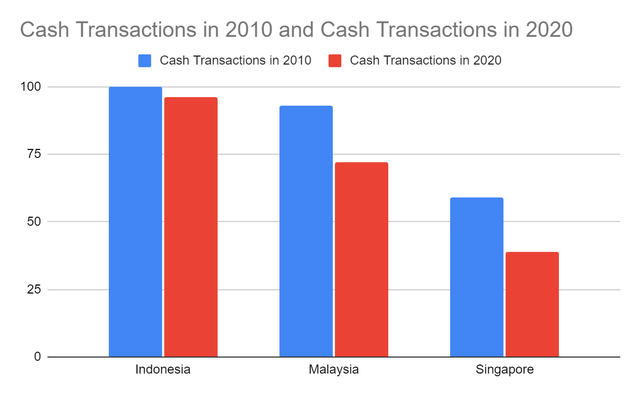

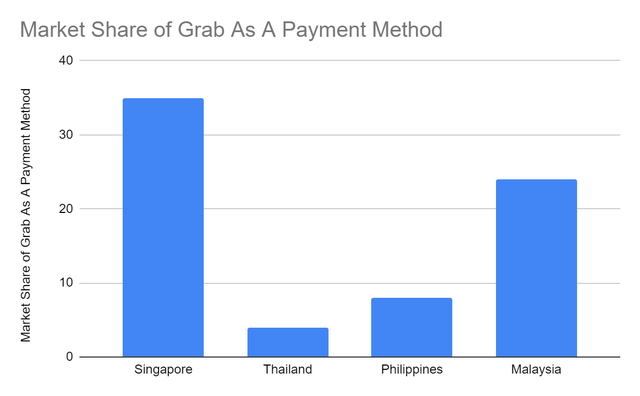

Aside from convenience, cashless transactions remain one of the primary driving forces. Its three markets in Southeast Asia experienced a substantial drop in cash transactions. In Singapore, cash transactions fell from 59% to 39%. Today, it is already higher at 48%, which we can attribute to business reopenings. But the thing is, cash transactions never went back to pre-pandemic levels. Although cash is still king, payment apps continue to revolutionize in the advent of digital transformation. Mobile wallets, credit cards, and debit cards will dominate financial transactions as more businesses go online. Grab remains the primary mobile wallet in the country, with a market share of 35%. It maintains a wide gap from runners-up Favepay with 24%, DBS Paylah! With 19%, and Singtel Dash with 10%. It is also popular in Malaysia, holding 20% of the total market share. In the Philippines and Thailand, percentages are relatively lower. We can attribute it to the increased number of mobile wallets and the higher number of unbanked individuals. Grab may still have to scale up to compete with other payment apps in other countries.

Cash Transactions (The Straits Times)

Market Share Of Grab As A Payment Method (Statista)

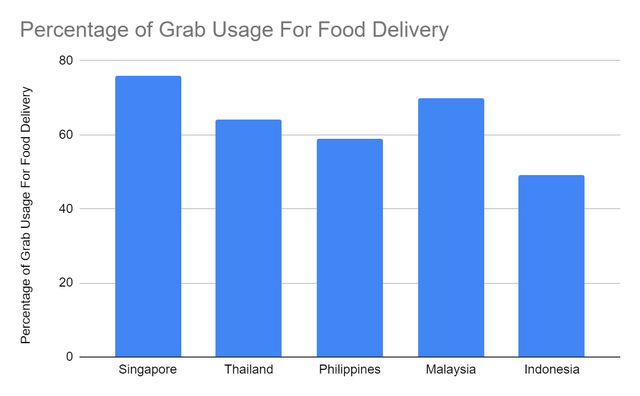

But regarding food deliveries, Grab is the absolute king in Southeast Asia. In Singapore, Grab has an impeccable usage percentage of 76% among the population. Yet, it must be active as it sees tight competition with Food Panda, especially in the Philippines and Malaysia. In Indonesia, it ranks second with a user percentage of 78% versus GoPay with 79%. Although Grabpay is shunned in Indonesia, its food delivery segment is one of its staples. A similar observation is visible in Vietnam, as it holds 64% of the market for food delivery. Grab has the most appeal as a food delivery app, with the vast majority of the market share. Likewise, its online ride-booking niche makes it a formidable champion with a data sensitivity index of 114. It has a vast difference from the second-highest app, with only 81. In all its features, Grab remains the most responsive.

Percentage Of Food Delivery Usage (Statista)

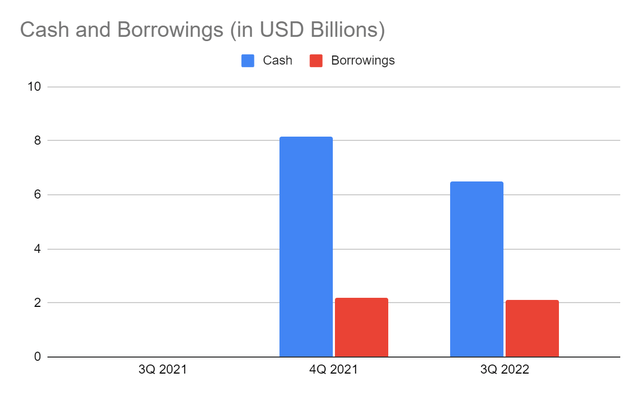

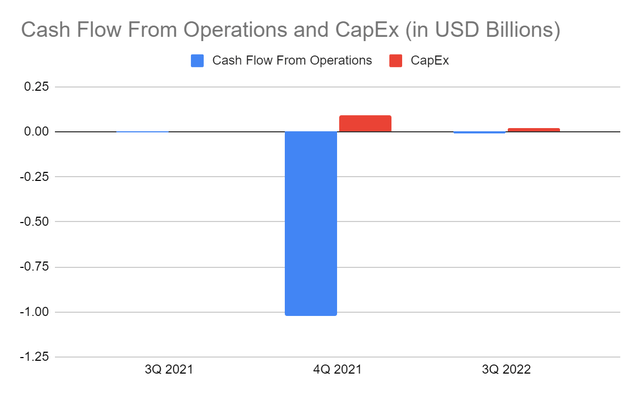

What sets Grab apart from many of its competitors is its massive financials. Aside from its improving performance, it has solid and intact fundamentals. Its financial positioning is one of its cornerstones amidst the tight competition and economic disruptions. It has adequate cash levels of over $2.45 billion, although it is way lower than in 4Q 2021. It comprises 24% of the total assets, making it a very liquid company. It will amount to $6.5 billion or 66% of the total assets if we include its liquid investments. Even more, it can cover all its liabilities even in a single payment. It also shows stable financial leverage, which is favorable for the company amidst interest rate hikes. Meanwhile, its cash inflows from operations remain a negative value, but the improvement is visible. It is also consistent with improving viability.

Cash And Cash Equivalents And Borrowings (MarketWatch)

Cash Flow From Operations And CapEx (MarketWatch)

Grab continues to leverage its popularity and excellent fundamentals to achieve its goals. But other external factors can drive its growth some more. Online food deliveries, cab bookings, and cashless transactions may increase as remote work setups prevail in Southeast Asia. A recent survey shows that over 50% of workers prefer a remote setup. Over 30% prefer hybrid setups, and less than 10% want a complete onsite work setup. Likewise, online cab bookings are essential as traffic congestion continues to intensify. Many studies show an increased preference for riding private cars and taxis than boarding a train or a bus. Also, mobility demand has yet to reach its maximum, as its driver-partners are only 80% of 4Q 2019 numbers. Its potential may materialize in the succeeding years as the environment becomes more stable.

Stock Price Assessment

The stock price has had a slight uptrend in the last month, which is reasonable. It is still insufficient as the bearish trend remains evident. At $3.1, it is less than half its starting price. Even if valuations do not appear as towering as it was in its SPAC, growth prospects are enticing. It has massive room for an uptrend as its expansion and increased viability continue. With its performance and potential opportunities, it may reach or even exceed its guidance. To assess the stock price better, we will use the DCF Model. Right now, it is still quite tricky to find the most precise valuation of the company. As it expands and innovates, it continues to burn cash. Thankfully, it doesn’t have to raise its borrowings. It has well-balanced borrowings and equity, an added security to its shareholders. It is still trading at an EV/Revenue multiple of 7.4x, which is still quite high. But if we plot it to its outlook this year, it will decrease to 5.7-5.8x, which is a better value. I expect it to incur losses still as it adjusts, but it may start to generate more inflows in the following years. Grab Holdings is a good bargain. If we adjust the stock price based on our projected EV/Revenue multiple, it may increase to $4.3-4.5, a 29-30% upside in the next twelve months.

Bottomline

Grab Holdings Limited is a Southeast Asian tiger dominating the market. Its viability goals have yet to materialize, but it is on the right path. Indeed, it has an impressive ability to drive growth while enhancing margins, showing increased efficiency. Even more, it has a stellar balance sheet despite its continued burning of cash. It has excellent liquidity, allowing it to expand while covering its financial leverage. Its move is a logical approach to increased market opportunities as the landscape evolves. It justifies the latest slight uptrend in the stock price, which is an excellent bargain, given its potential. After assessing the risks, opportunities, and core competencies, the recommendation is that Grab Holdings Limited is a strong buy.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!