metamorworks

The US’ economic system is in a droop, and persistently excessive inflation makes it tough for earnings buyers to guard their buying energy.

Golub Capital BDC Inc. (NASDAQ:GBDC) can, in my view, help buyers in mitigating financial dangers due to the BDC’s first lien-focused funding technique.

Golub Capital coated its dividend with internet funding earnings in 3Q-22, whereas internet asset worth fell barely QoQ. The inventory trades at a 7% low cost to NAV, offering buyers with a small margin of security.

Portfolio Actions

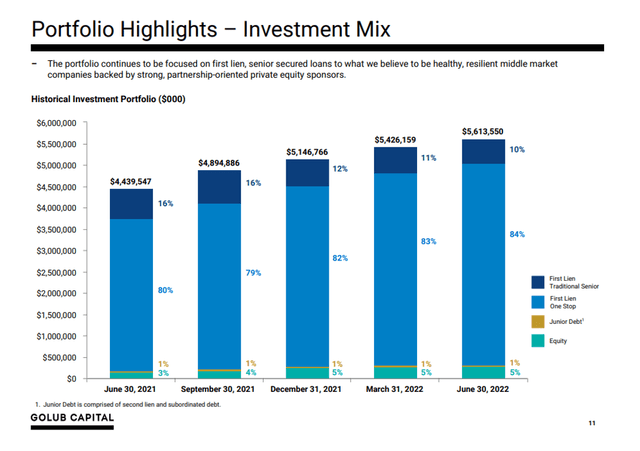

Golub Capital invests with a safety-first mindset, focusing virtually fully on the best types of out there debt: First Liens.

First Liens accounted for 84% of the enterprise growth firm’s investments on the finish of the quarter, a 4% improve from the earlier quarter.

On the finish of 2Q-22, the whole weighting in direction of First Liens (each one cease and conventional senior) was 94%. The whole allocation to investments aside from First Liens elevated by 2 proportion factors YoY and remained steady at 6% QoQ. Except for First Liens, Golub Capital primarily invests in fairness and junior debt.

Portfolio Highlights (Golub Capital BDC)

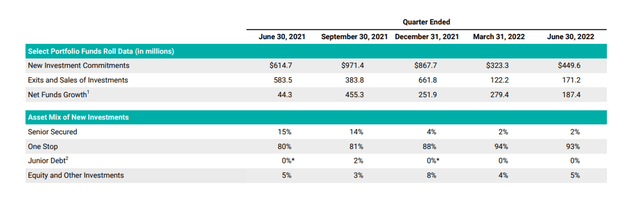

Golub Capital’s portfolio worth elevated by $187.4 million QoQ to $5.6 billion, with new funding commitments totaling $449.6 million. Within the second quarter, roughly 95% of recent investments have been made within the First Lien class, which is already Golub Capital’s core funding product. Fairness investments accounted for about 5% of recent investments in 2Q-22.

Funding Exercise (Golub Capital BDC)

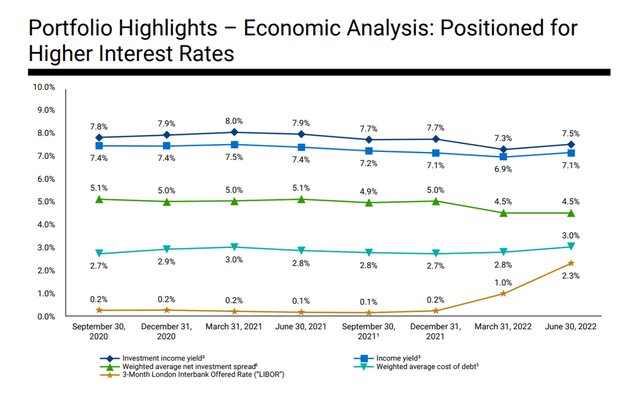

Yields Could Come Underneath Strain

Golub Capital’s portfolio yields remained steady in 2Q-22, however charges are rising, and the BDC’s rising rate of interest prices could restrict its means to generate engaging yields sooner or later. Golub Capital’s funding earnings yield was 7.5% in 2Q-22, up 0.2 proportion factors QoQ.

Positioned For Increased Curiosity Charges (Golub Capital BDC)

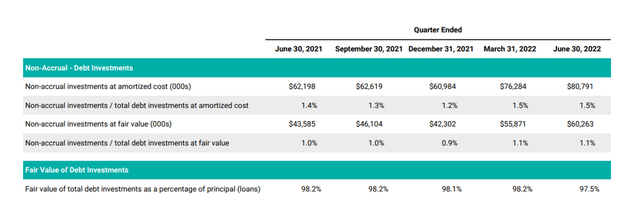

Credit score High quality

BDCs primarily put money into high-quality debt devices, so debtors should have the ability to repay no matter cash they borrow. Golub Capital has no main points on this regard. The enterprise growth agency’s non-accruals didn’t rise within the final quarter, indicating that credit score high quality remained steady. Non-accruals at Golub Capital remained steady in 3Q-22, at 1.1% at honest worth or 1.5% at value.

Non-Accruals (Golub Capital BDC)

Q2’22 Dividend Pay-Out Metrics

Golub Capital’s stronger enterprise leads to 3Q-22 have been pushed by a recovering economic system, which allowed for strong internet funding earnings progress in comparison with the 2021 interval. Golub Capital’s internet funding earnings in 3Q-22 was $53.9 million, a 28% improve over the earlier 12 months’s NII of $42.1 million.

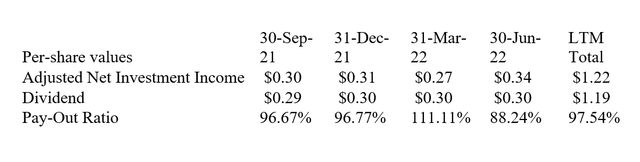

I exploit Golub Capital’s adjusted internet funding earnings, which incorporates the capital acquire incentive charge paid to the exterior supervisor, to calculate dividend pay-out ratios. The BDC’s adjusted NII in 3Q-22 was $0.34 per share, up from $0.30 in 3Q-21.

Consequently, Golub Capital’s dividend payout was simply coated by adjusted NII (pay-out ratio of 88%). Golub Capital distributed 98% of its adjusted internet funding earnings during the last twelve months.

NII, Dividend And Pay-Out Ratio (Creator Created Desk Utilizing BDC Info)

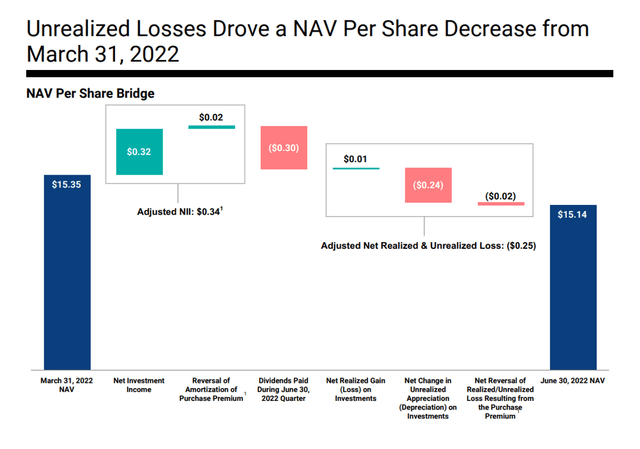

Web Asset Worth Dropped Solely Marginally

Golub Capital’s internet asset worth fell $0.21 per share within the third quarter because of unrealized depreciation on the BDC’s investments of $0.24 per share. The drop in internet asset worth was comparatively minor (1.4% QoQ), and the BDC’s credit score high quality remained robust.

NAV Per Share (Golub Capital BDC)

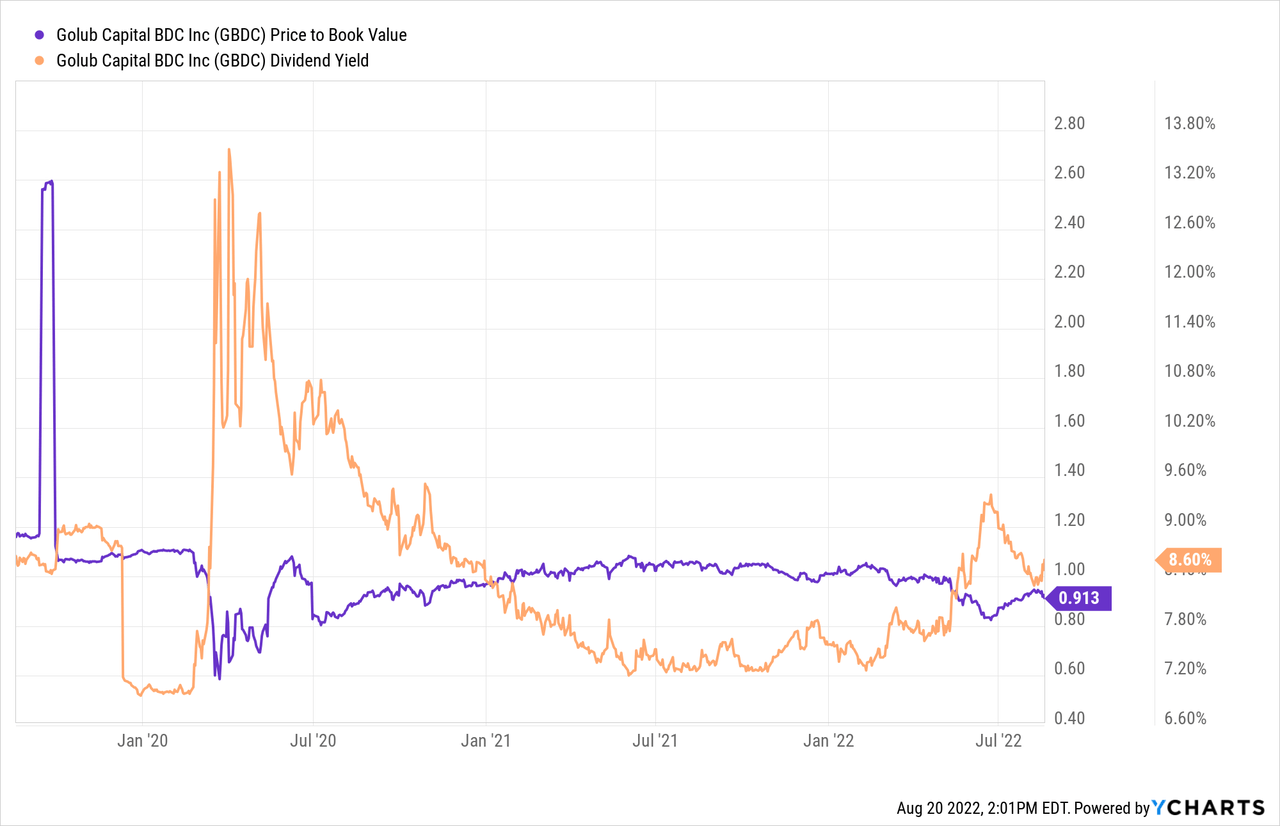

Golub Capital’s inventory is presently yielding 8.6% and buying and selling at a 7% low cost to internet asset worth. Provided that the BDC is invested in a really conservative debt portfolio, the NAV low cost supplies an affordable margin of security.

Why Golub Capital May See A Decrease Valuation

I am not involved about Golub Capital’s First Lien efficiency proper now. Golub Capital’s safety-first funding technique, mixed with robust NII progress and low non-accruals, signifies that the enterprise growth agency is operating a wholesome funding portfolio.

Issues may change for Golub Capital if the BDC noticed a fast improve in non-accruals, however given the corporate’s First Lien focus, I do not see this occurring.

My Conclusion

I am shopping for Golub Capital like loopy as a result of I consider the BDC will do nicely with its conservative strategy to underwriting and investing, particularly in a downturn.

With nearly all of its investments in secured and comparatively secure First Liens, Golub Capital will be comfortable even when the U.S. economic system enters a deeper recession.

As well as, the enterprise growth firm maintained good dividend protection within the third quarter, and the inventory is buying and selling at a 7% low cost to internet asset worth, which is a plus.