There’s little question, Wall Avenue didn’t like Fed Chair Jerome Powell’s Jackson Gap speech. The markets tumbled after Powell harassed the central financial institution is dedicated to taming inflation and can implement one other 75bp hike if that’s what is required to get the job completed.

The markets may need thrown the toys out of the pram, however whereas cognizant of a bearish situation, Goldman Sachs’ chief economist Jan Hatzius isn’t overly involved, preferring to deal with Powell’s much less hawkish commentary.

“We proceed to anticipate the FOMC to gradual the tempo from right here, delivering a 50bp hike in September and 25bp hikes in November and December, for a terminal charge of three.25-3.5%. Nonetheless, extra CPI and employment reviews will likely be accessible by the September assembly, and Powell harassed that the choice will ‘rely upon the totality of the incoming information and the evolving outlook,’” the economist defined. “We see the dangers to each the near-term tempo and our terminal charge forecast as tilted to the upside.”

Upside is actually on the menu for a pair of shares Goldman Sachs is bullish on proper now – the agency’s analyst Kash Rangan has pinpointed two names which he thinks have a minimum of 100% progress on the menu for the approaching months. We’ve used the TipRanks platform to learn how different Wall Avenue specialists assume the subsequent 12 months will pan out for these shares.

Splunk (SPLK)

The primary Goldman choose we’ll have a look at is Splunk, a giant information analytics firm. Splunk supplies companies with the instruments to get insights from enormous troves of information. The info can be utilized to tell enterprise selections and assist operations run easily. The corporate is a identified chief in IT operations and safety, has an put in base of greater than 20,000 prospects, and boasts differentiated tech and a powerful monitor file of innovation.

All that could be true, however Splunk has not been resistant to the financial downturn, as was evident when the corporate delivered FQ2 earnings (July quarter) not too long ago.

That’s to not say the report itself was a dud. The corporate’s income elevated by 32% year-over-year to succeed in $798.75 million, whereas beating the analysts’ expectation for $747.7 million. EPS of $0.09 additionally fared much better than the lack of $0.35 per share Wall Avenue predicted.

Nonetheless, shares took a battering within the post-earnings session on account of the corporate’s disappointing outlook. Annual recurring income (ARR) – a key metric within the software program house – is now anticipated to succeed in $3.65 billion this 12 months, down from the prior forecast of $3.9 billion. Additional souring sentiment, the corporate now sees this 12 months’s cloud annual recurring income hitting $1.8 billion, additionally beneath the earlier outlook of $2 billion.

Traders had been fast to point out their disappointment, which Goldman’s Kash Rangan believes is “legitimate.” Nonetheless, the lowered outlook doesn’t alter the long-term thesis in any method.

“We’re bullish on Splunk’s quickly scaling cloud enterprise, vital perpetual license and Non-Cloud ARR renewal alternative, long-term fundamentals and enhanced worth proposition exiting COVID. Furthermore, Splunk is a gorgeous asset with a novel and strategic worth proposition,” Rangan opined

“We stay optimistic on the long-term upside as the corporate efficiently navigates the cloud transition underneath the route of the brand new CEO. Moreover, approaching the Rule of 40 (income progress + free money move margin) in FY23 might drive the inventory into the next valuation territory,” Rangan added.

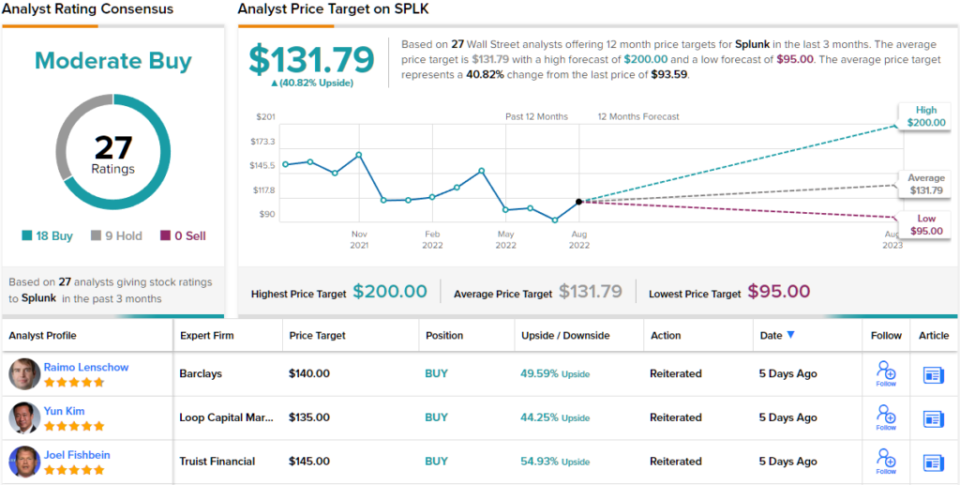

These feedback underpin Rangan’s Purchase ranking whereas his $200 value goal makes room for one-year features of a hefty 114%. (To look at Rangan’s monitor file, click on right here)

Splunk will get quite a lot of protection on Wall Avenue; over the previous 3 months there have been 27 analyst critiques, tilting 18 to 9 in favor of Buys over Holds, all leading to a Average Purchase consensus ranking. Going by the $131.79 value goal, the shares are anticipated to see ~41% progress over the next months. (See Splunk inventory forecast on TipRanks)

Salesforce (CRM)

Within the sector of cloud-based buyer relationship administration software program, Salesforce is a market chief, constructing and creating its merchandise for enterprises. Its product portfolio spans throughout gross sales, advertising, analytics, synthetic intelligence, e-commerce, buyer functions, integration and collaboration. In actual fact, it virtually covers all aspects of the continued pattern of digital transformation. In line with the corporate, the TAM (whole addressable market) for its mixed companies by FY26 ought to attain $284 billion.

As has turn into de rigueur, Salesforce delivered one other sturdy set of ends in its not too long ago launched second quarter fiscal 2023 report (July quarter).

Income clocked in at $7.72 billion, amounting to a 22% enchancment vs. the identical interval final 12 months, whereas additionally trumping the consensus estimate of $7.69 billion. The corporate beat expectations on the bottom-line too, as adj. EPS of $1.19 got here in forward of the Avenue’s name for $1.02 per share.

Nonetheless, regardless of the sturdy headline metrics, the report did not please traders; like many others within the present surroundings, Salesforce has needed to tame expectations for the remainder of the 12 months. The corporate lowered its full-year income forecast to the vary between $30.9 billion and $31 billion. Beforehand, the corporate has guided for income between $31.7 billion to $31.8 billion.

Whereas shares trended south within the post-earnings session, Goldman’s Rangan thinks the response was unmerited and he sees loads of causes to remain bullish.

“Salesforce stays positioned to capitalize on quite a few secular tendencies driving progress throughout the firm’s massive and increasing TAM,” the analyst wrote. “In our view, the corporate stays broadly positioned to capitalize on digital transformation as corporations look to type extra holistic views of their prospects. We see continued room for enchancment in unit economics, as the corporate’s massive put in base and expansive portfolio throughout a number of product classes place the corporate to develop share of pockets inside prospects’ general IT budgets.”

To this finish, Rangan charges CRM a Purchase together with a $320 value goal. What’s in it for traders? Upside of a sturdy 100%.

Tech shares have a tendency to draw quite a lot of consideration, and Salesforce isn’t any exception – the inventory has 35 analyst critiques on file, they usually embody 30 Buys towards simply 4 Holds and 1 Promote to present the corporate its Robust Purchase consensus advice. Whereas the common goal isn’t fairly as upbeat as Rangan’s, at $227.67, traders may very well be sitting on returns of 42% in a 12 months’s time. (See Salesforce inventory forecast on TipRanks)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Greatest Shares to Purchase, a newly launched instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analyst. The content material is meant for use for informational functions solely. It is vitally vital to do your individual evaluation earlier than making any funding.