skynesher

Rising interest rates and a risk of further economic growth deceleration are prompting Goldman Sachs to shift its equity portfolio allocation to a more defensive position.

“The performance of short duration equities vs. long duration equities suggests that the equity market has not priced rate moves that have already occurred,” strategist David Kostin wrote in a note.

“Our overweight recommendations are defensive and reflect the significant risks to earnings and valuation in an environment of elevated inflation and interest rates,” Kostin said.

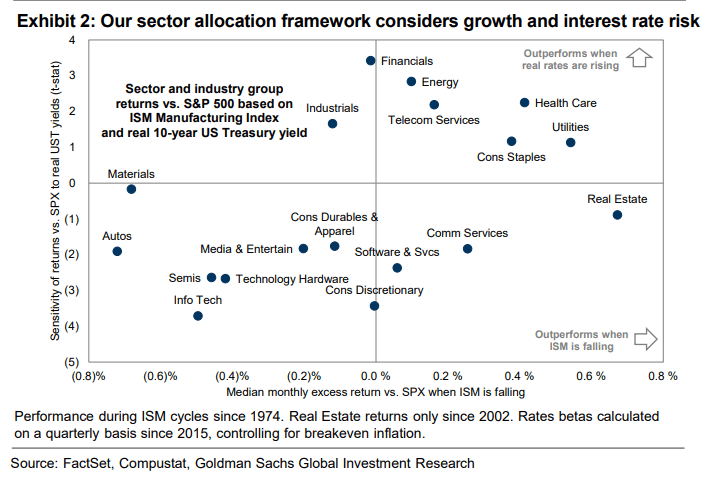

“We analyze each sector’s median monthly excess return vs. the S&P 500 (SP500) (NYSEARCA:SPY) in periods since 1974 when the ISM Manufacturing Index was falling,” he said. “We isolate each sector’s quarterly excess return vs. the S&P 500 and find its sensitivity to changes in the real 10-year US Treasury yield (US10Y) (NYSEARCA:TBT) (NASDAQ:TLT), controlling for breakeven inflation.”

With that analysis, Goldman recommends Overweight in Healthcare (NYSEARCA:XLV), Consumer Staples (NYSEARCA:XLP) and Telecom Services within Communication Services (NYSEARCA:XLC). Consumer Durables and Apparel within Consumer Discretionary (NYSEARCA:XLY) is also Overweight “to gain a counter-balance of exposure to a slice of a cyclical sector” with the group trading “low valuations vs. the S&P 500 and 10-year yields relative to history.”

In the Neutral camp Goldman has Financials (NYSEARCA:XLF), Real Estate (NYSEARCA:XLRE), Consumer Discretionary (XLY) ex-Autos and Durables and Utilities (NYSEARCA:XLU), a defensive play but one with “elevated valuation.” Software and Services is also Neutral, with the longstanding Overweight in Tech (NYSEARCA:XLK) revised.

Also within XLK, Semiconductors (STOXX) (NASDAQ:SMH) and Tech Hardware are cut to Underweight.

“The macro environment appears challenging for these groups,” Kostin said. “Each has typically lagged the index when growth was slowing, and both are vulnerable to rising real rates.”

“Tech Hardware screens as relatively expensive vs. history. While Semiconductor valuations do not appear as elevated, depressed demand and export restrictions represent near-term headwinds.”

Also in the Underweight group are Industrials (NYSEARCA:XLI), which Kostin said looks overvalued if earnings fall as much as expected, and Materials (NYSEARCA:XLB). Media and Entertainment in XLC and Autos and Components in XLY are also at the bottom.

“Autos and Media also carry elevated concentration risk. The largest stock in each group comprises 81% (TSLA) and 53% (GOOGL) (GOOG) of market cap, respectively.”

Could 10-year yields at 4.5% usher in a stock bottom?