Bartosz Hadyniak/E+ by way of Getty Pictures

Fundamentals

The struggle in Ukraine continues to place stress on world meals and commodity provide chains. The mainstream media doesn’t look like giving this challenge sufficient consideration. ZeroHedge printed a report highlighting that Europe will depend on Russia, Belarus, and Ukraine for vitality, palladium, nickel, grains, pig iron, sure forms of metal, and plenty of different commodities. Vitality, particularly, is a vulnerability as Russia now could be demanding fee in rubles. Europe can’t shift to different suppliers or vitality within the brief time period. Pig iron and different iron and metal merchandise are additionally being impacted closely. The EU can also be going through import points with items from third nations that depend on imports of uncooked supplies from the struggle zone.

Simply as provide chain points attributable to the pandemic have been starting to ease, now the struggle in Ukraine is inflicting extra provide chain points. Commerce with Russia, Ukraine and Belarus has come to virtually a whole halt with the West. Though they aren’t a serious proportion of world commerce, they’re essential in sure sectors. The EU is shedding exports to the struggle zone, in addition to going through import shortages. The struggle in Ukraine reveals no finish in sight, so these shortages are usually not going to be brief time period. If Russia blockades Ukraine’s entry to the Black Sea, it might additional impression any Ukrainian exports of grains, metals and different commodities.

China’s COVID coverage of locking down Shanghai is additional impacting the worldwide financial system. Shanghai has a inhabitants that ranks it between Florida and Texas. It’s the world’s busiest port. Locking it down, means a small, however important chunk of the worldwide financial system is locked down. The lockdown might make the logistics problems with 2020 and 2021 look small as compared. China’s lockdown additionally doesn’t look like shrinking; if something, the lockdown seems to be spreading.

Recession on the Horizon

In a chat not too long ago, funding advisor Steven Van Metre warned of a coming recession. With inflation operating increased and rates of interest rising, shoppers are beginning to pull cash from banks. The Wall Road Journal warned that for the primary time since World Warfare II, financial institution deposits might decline. Rising rates of interest might ripple by the financial system in surprising methods, akin to financial institution deposits declining.

With rising rates of interest, shoppers seek for a greater return on their financial savings. When banks maintain financial savings return charges low, cash strikes out of banks. Some banks had been reaching regulatory limits on their capital, so the withdrawals mustn’t harm the banks. Banks had deposits available, which they may not mortgage out. Revenue margins for banks ought to enhance as deposits lower.

One place the financial savings might go are cash market funds, however we have already got $1.7 trillion in cash market funds. Cash market funds might elevate their return charges to make them extra engaging than financial institution financial savings accounts.

Normally shoppers are gradual to maneuver cash out of financial savings accounts at banks, however that might happen a lot quicker with inflation and the Fed elevating charges extra quickly.

This summer time the Fed is meant to start out unwinding its stability sheet. Banks shall be joyful, since it’ll launch a few of their capital and permit banks to steer shoppers to shift funds from financial savings accounts into cash market accounts. Lots of the cash market accounts are backed by short-term treasury payments. If a flood of cash enters the short-term a part of the bond/invoice market, then short-term charges ought to fall, which is able to then drag down long-term charges–the alternative of what many consider will occur. Cash markets must spend money on T-bills of lower than a yr, since they’ve to remain liquid as a result of nobody is aware of when the holders of the cash market funds will need their cash.

Inflation For The Nation?

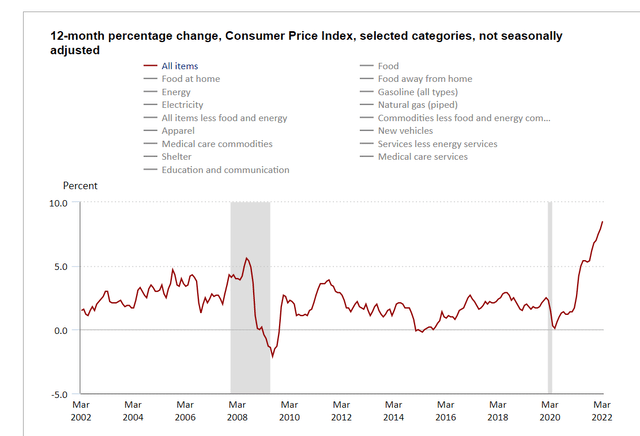

The Client Worth Index hit 8.5%, the very best because the Nineteen Seventies and Nineteen Eighties. Excessive costs and excessive inflation normally results in shoppers spending much less, which brings each charges down. We anticipate the CPI to chill off. Meals and vitality costs are driving the CPI, with vitality up 11% over the prior month, however crude oil is already coming down.

CPI (US BUREAU OF LABOR STATISTICS)

Wages are usually not maintaining with inflation. Common hourly earnings adjusted for inflation are down -2.7% yr over yr. Customers are usually not maintaining with inflation, which implies much less spending, which implies much less inflation. If banks are going to flood cash market funds with cash from financial savings accounts as traders search increased returns, then the cash market funds have to purchase extra T-bills, which is able to drive short-term charges down, in flip driving inflation down and setting the stage of a recession.

The Markets

The secret is to know the way to commerce this basic scenario. We have now a variety of volatility this morning, Monday, April 18, 2022. Silver made a excessive of $26.49. It has then come all the way down to $26.16 after which again as much as $26.30. So we’ve got an excessive amount of volatility in metals. Gold is at $1996, however we crossed the $2000 vary.

For silver we’re beneath the weekly Variable Altering Worth Momentum Indicator (VC PMI) Promote degree of $26.28. The sign is brief, until there’s a shut above $26.28. The goal for the weekly is $25.59. Silver is warning you to watch out up right here; it’s a place the place the market is prone to transfer down within the brief time period.

For gold, we made a excessive of $2003 early this morning, April 18, 2022. We’re above the every day resistance degree of $1996. We’re additionally above the weekly Promote 1 degree of $1994. The subsequent goal is $2012. The value is coming into an space of distribution of provide and assist ranges. When resistance is damaged, it turns into assist with the goal of $2012. If we shut beneath $1994, we are going to activate weekly and every day brief triggers–a robust brief sign.

Bitcoin made a low of 38,535. It didn’t fairly attain the weekly Purchase 1 degree 38,468, however discovered consumers at the next degree. Now we’re in a bullish sign with targets of 40,330 and 40,637, in line with the VC PMI.

Opinion and technique

The ten-Yr Treasury is at 2.83, which is a big enhance over the previous couple of years.

“The three p.c yield is within the playing cards,” Fairness Administration Academy CEO, Patrick MontesDeOca mentioned.

The inflation fee within the US of about 8.5 p.c and the 10-Yr Be aware at even 3 p.c, leaves no less than a 5 p.c unfavorable yield. That can’t proceed. On the identical time, we’ve got a $30 trillion debt. Rates of interest, in line with the IMF, needs to be a few proportion level above the inflation fee, so rates of interest needs to be at about 9 or 10 p.c.

“If that occurred,” MontesDeOca mentioned, “the worldwide financial system would collapse. There isn’t any doubt in my thoughts.”

If the Fed raises charges too quick or too aggressively, they are going to kill the fairness markets. By printing cash, the Fed has been defending the fairness markets. On the identical time, the US greenback has considerably declined. Despite the fact that property, akin to actual property have elevated in worth, the greenback is down about 30 p.c in worth. The rise in asset worth is simply reflecting the devaluation of the greenback. Gold and Silver shall be checked out as a protected haven asset in instances like this. Proceed to build up long-term positions.