jiefeng jiang

GLOBALFOUNDRIES (NASDAQ:GFS) makes up 6% of the global foundry market as of 2Q22. We are sell-rated on the foundry player as we expect the company will underperform in the advanced foundry peer group in 2023. GFS is a multinational semiconductor chip-making company. While GFS revenue grew 23% Y/Y, we don’t expect the company will be able to maintain that revenue growth.

Our bearish sentiment is based on our belief that ASP increases primarily drove GFS revenue increase. The company’s unit shipments only increased 6% Y/Y, and we don’t believe this 6% could account for the revenue growth. Instead, we believe the 16% Y/Y ASP per wafer increase justifies the growth. We don’t expect GFS will be able to continue to increase ASP to boost revenues. Hence, we don’t expect to see significant revenue growth for the company going forward. We also believe the company’s unit growth will slow down in the post-pandemic environment. While GFS remains a global foundry player, we believe the revenue growth will not be consistent. The company is also not spared from macroeconomic headwinds, as it is highly exposed to the smartphone industry. We recommend investors exit the stock.

Black sheep of the foundries

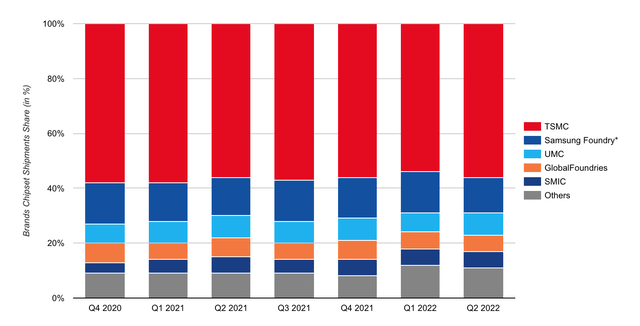

TSMC (TSM) and Samsung (OTCPK:SSNLF) are leading the global foundry market, and GFS is trailing behind in 4th place. While we recognize GFS’ position within the foundry industry, we believe capital spending and time stand between GFS and a higher rank in the foundry industry. A single fab costs around $10B, and TSMC has already invested $100B in building fabs. The following graph outlines the foundry industry market share:

Counterpoint

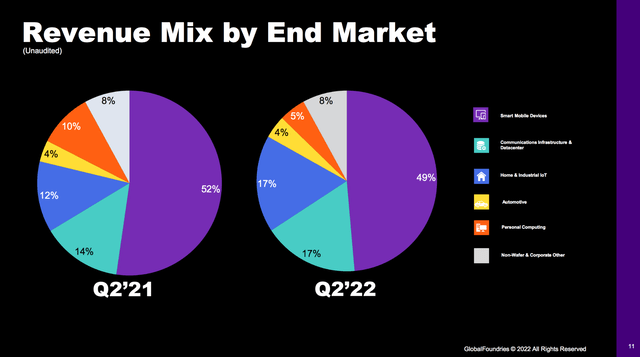

Aside from being behind the group, GFS is highly exposed to weakening smartphone demand. Diverse markets drove the company’s 2Q22, but the GFS remains highly exposed to its smartphone markets, making up 49% of the revenue mix by end market, as shown in the following graph.

Company Earnings

IDC forecasts smartphone demand to decline by 6.5% in 2022. We expect this weakening demand, alongside macroeconomic pressures to cause unit growth to normalize in the post-pandemic environment. We believe GFS will face increased churn as the smartphone market hits saturation point.

As for GFS’ other markets, we expect growth in the automotive and data center segments to outpace the industry growth, but we think it won’t be enough to offset the mobile headwinds. We also expect GFS’s fastest-growing consumer home and industrial IoT segment to see lumpy growth due to the macroeconomic environment.

Revenue growth on the back of ASP increases

ASP increase was a word thrown around a lot in GFS 2Q22 earnings call, and we believe the increased ASP per wafer is indeed a significant factor of GFS revenue growth. GFS reported an increase of around 16% in ASP per wafer while only reporting a 6% increase in unit shipments. We believe the company’s revenue growth relies on ASP increases resulting from the inflationary environment and supply shortage. Our bearish thesis is based on our disbelief that GFS can sustain revenue growth on the back of ASP increases.

GFS revenue growth was achieved through price pressures, but nothing has changed regarding the bread and butter of the foundry industry: advanced process technology. We believe GFS will fall behind while the leading foundry, TSMC, capitalizes on advanced process technology. We believe GFS grew through unit volume and price increases. Now, we expect the unit volume to moderate and don’t expect ASP to increase meaningfully. We believe GFS will underperform the advanced foundry peer group and recommend exiting the stock at current levels.

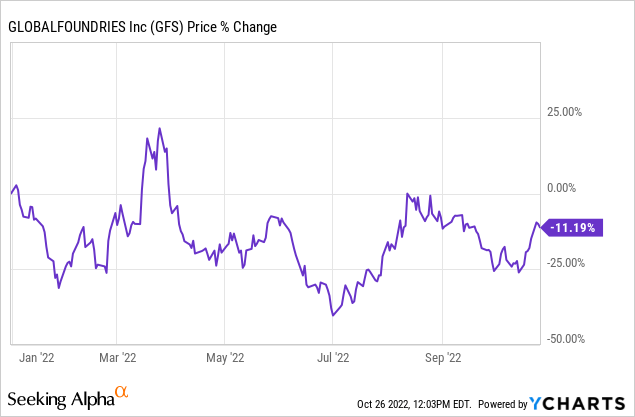

Stock performance

GFS stock grew 19% over the past five years, underperforming TSMC, up 57%. YTD, GFS is down around 11%. We believe the company has been able to boost back revenues and investor optimism through ASP increases, but we don’t believe this growth is sustainable. We expect it to underperform the index and peer group in 2023.

The following graph outlines GFS stock performance YTD.

TechStockPros

Valuation

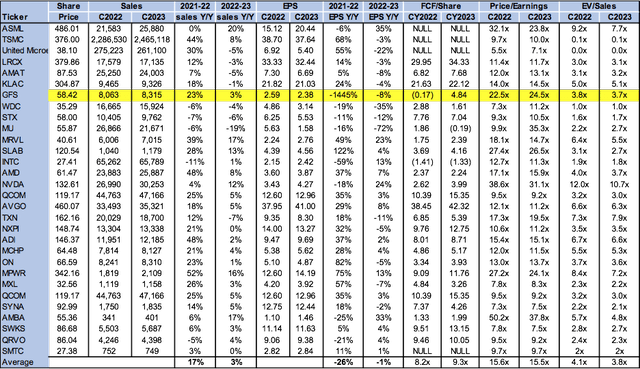

GFS is not cheap, trading at 24.5x C2023 EPS $2.38 on a P/E basis compared to the peer group average at 15.5x. On EV/Sales, GFS is trading at 3.7 C2023 versus the peer group average at 3.8x.

The following chart illustrates the semiconductor peer group valuation.

TechStockPros

Word on Wall Street

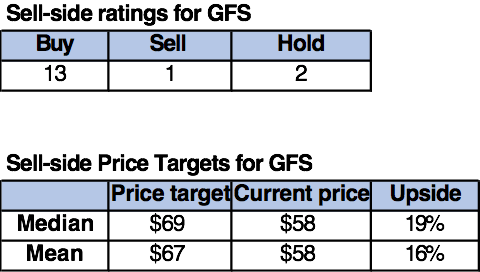

Wall Street is overwhelmingly bullish on the stock. Of the 16 analysts covering the stock, 13 are buy-rated, two are hold-rated, and the remainder is sell-rated. We believe Wall Street’s bullish sentiment is driven by GFS’s revenue growth in 2Q22. The company beat EPS estimates by 28.27%, reporting $0.58 compared to the $0.45 estimate. We disagree with Wall Street analysts’ buy-rating on GFS as we believe GFS revenue growth has relied on high ASP. We don’t expect the company will be able to continue increasing ASP to see revenue growth. Hence, we are bearish on the stock.

GFS is trading at around $58. The median and mean price targets are set at $69 and $67, respectively, with a potential upside of 16-19%.

The following chart indicates GFS stock’s sell-side ratings and price targets:

TechStockPros

What to do with the stock

GFS is a major foundry player, but we expect macroeconomic tailwinds and moderating unit shipment to hurt the company’s top line. We believe GFS is overvalued as we believe the company’s revenue grew unsustainably through unit volume and ASP increase. We don’t expect the company will grow meaningfully towards 2023 and believe it will underperform the peer group. We recommend investors sell the stock at current levels.