Olemedia/E+ by the use of Getty Photos

The GitLab Funding Thesis

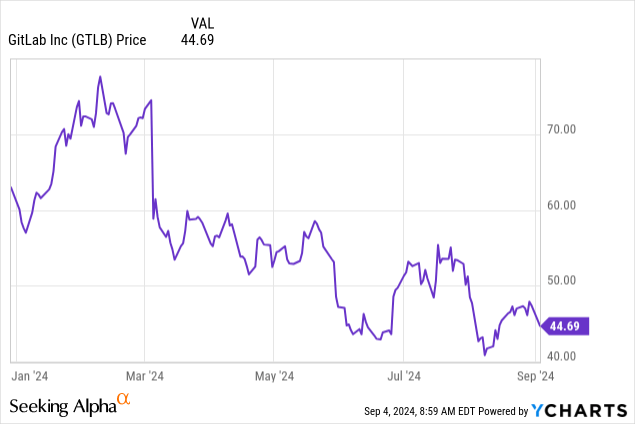

GitLab Inc (NASDAQ:GTLB) is a company with important growth potential because of its market place and a doable TAM of better than $40 billion. On the time of my closing article, however, the stock had taken an infinite hit after guidance obtained right here in worse than anticipated. Fortunately, the stock was able to bounce once more from the weaker-than-expected guidance and even raised guidance above what was anticipated on the time.

The first half of the fiscal 12 months was moreover very sturdy from a enterprise perspective, nevertheless that’s nonetheless not adequate for me to spice up my rating, regardless that the company is extraordinarily sturdy.

Short-term Overview Of The Enterprise And Aggressive Situation

GitLab Investor Presentation

GitLab and GitHub, which is owned by Microsoft (MSFT), are the two dominant players throughout the Git market. Git principally signifies that various people can work on the equivalent issue with out interfering with each other.

Atlassian (TEAM), with its Bitbucket software program, may also be obtainable in the marketplace, nevertheless for my part, performs a fairly minor operate compared with GitLab and GitHub. GitLab’s differentiator is its take care of a single platform that goes previous typical code web internet hosting and collaboration decisions. On account of it’s a single platform, licensing costs are lower for purchasers because of they solely need GitLab and by no means various completely different capabilities. Plus, this moreover retains the mixture costs low.

The problems that GitLab does, or that you’ll be able to do with GitLab, are planning and collaboration, publishing and monitoring, and bug monitoring and fixing. Then there’s regular enchancment and regular provide, and closing nevertheless not least, security. Significantly, security is a strong differentiator correct now, and I really feel GitLab is a step ahead of the opponents on this area.

One different profit over GitHub is that you simply’ve obtained additional administration over your information and repositories because of they’re usually hosted domestically. GitLab has quite a lot of choices that GitHub requires you to utilize third-party devices for. Nonetheless on the entire, like Visa (V) and Mastercard (MA) in a single different home, they’re every very sturdy players that dominate the market. GitHub moreover has its advantages in some areas. As an illustration, it’s normally talked about that GitHub is supposed to be faster.

GitLab’s Q2 Outcomes

GitLab Investor Presentation

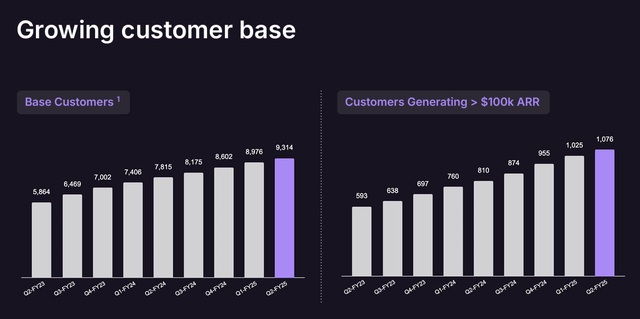

Purchasers with better than $5,000 ARR elevated by 19% 12 months over 12 months, and purchasers with better than $100,000 ARR observed a implausible 33% year-over-year growth to 1,076 purchasers. This, combined with revenue growth of 30.8% 12 months over 12 months, is a implausible consequence that many wouldn’t have anticipated given the downwardly revised guidance firstly of the 12 months.

GitLab Q2 Outcomes

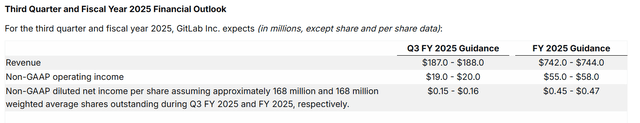

Significantly, the guidance for FY25 has been very encouraging. At first of the 12 months, the guidance was weak, forecasting solely $0.22 per share, whereas analysts had been anticipating $0.37 per share. In Q2, the guidance was raised to $0.34 to $0.37 and is now at $0.45 to $0.47, correctly above the initially anticipated $0.37.

The detrimental for me is that the guidance for shares glorious is 168 million. Since they’re in the mean time at 158 million, we’re capable of anticipate the SBC to proceed to develop.

GitLab Q2 Outcomes

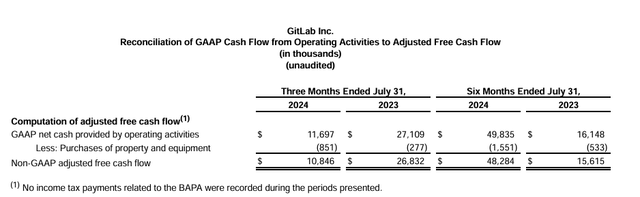

At first look, FCF appears to be good because of it’s significantly bigger than closing 12 months: $48 million this 12 months versus $15 million closing 12 months. Sadly, SBCs are nonetheless so extreme that SBC-adjusted FCF continues to be detrimental.

- FCF $48m – $91m SBC = SBC adjusted = – $43m

- FCF $15m – $78m = SBC adjusted = -$63m

Nonetheless regardless that SBC adjusted FCF continues to be detrimental, there’s a optimistic growth, and it’s doable that FCF is perhaps optimistic throughout the subsequent fiscal 12 months even after the adjustment.

GitLab Q2 Outcomes

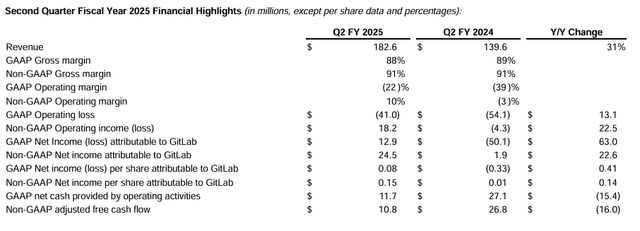

Whole, there are optimistic developments. The GAAP working margin, whereas nonetheless detrimental, improved to -22% and the working loss decreased by $13 million to -$41 million. Although FCF in Q2 was lower than a 12 months previously, it was up sharply in H1, as confirmed above. However, it’s a amount to have a look at in Q3 to see if FCF weakens as soon as extra in Q3.

GitLab Q2 Outcomes

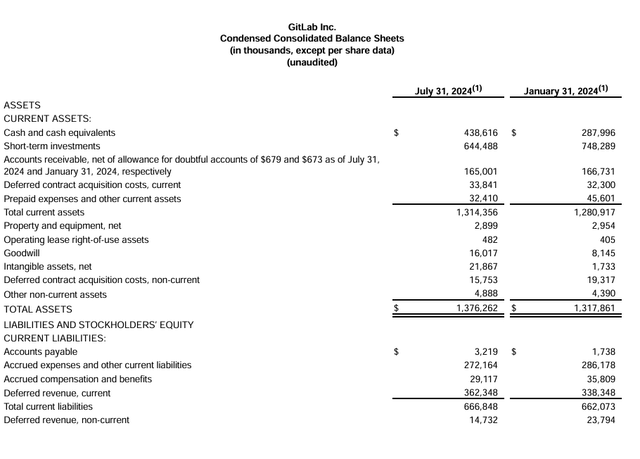

I don’t suppose there are any big surprises throughout the steadiness sheet. Cash and cash equivalents elevated from 1,036,285 to 1,083,104, which is a optimistic enchancment, and debt stays at zero. Receivables are comparatively flat and payables are up, which, I really feel, may also be a sign of improved capital effectivity.

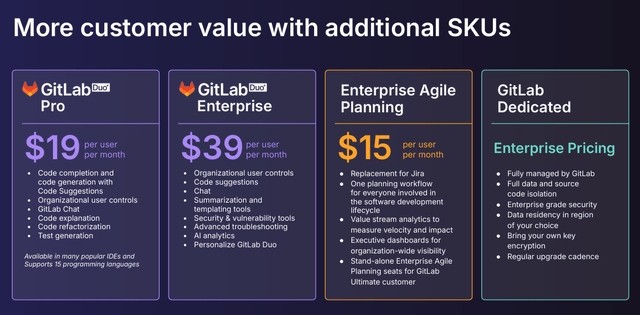

GitLab Investor Presentation

We’re capable of moreover see the pricing for GitLab Duo and what’s included in Duo and Dedicated to have a gift overview. At this stage, it must be well-known that GitLab stands out from the opponents by the use of choices, nevertheless that’s moreover mirrored throughout the prices.

On a optimistic remember, Gardner’s AI efforts normally should not going unrecognized, as GitLab was acknowledged as a pacesetter in Gardner’s new self-discipline of AI code assistants.

GTLB Q2 Earnings Identify

GitLab’s earnings calls are on a regular basis pretty fascinating as you get to hear to plenty regarding the enterprise and, additional not too way back, about AI and the benefits GitLab sees for its shoppers by the use of faster, additional setting pleasant work or determining sources of errors.

GitLab predicts that there is perhaps a shift in how AI is used, from reactive to proactive, and that autonomous brokers will play a much bigger operate in the end. And it appears to be like GitLab can compete very correctly with Copilot. Moreover, SaaS is already at 28% of revenue because of they’ve a 46% growth worth. GitLab may also be doing very correctly throughout the difficult security home with their devoted offering.

The worth will enhance might even proceed to have an effect on revenues throughout the coming months, as not all shoppers had been able to renew their contracts on the equivalent time and revenues will because of this truth vary counting on the timing of the renewal course of.

It was moreover talked about that historically Q1 is the weakest quarter and This autumn is the strongest quarter, so I really feel the guidance for the entire 12 months is conservative and can doubtlessly be exceeded.

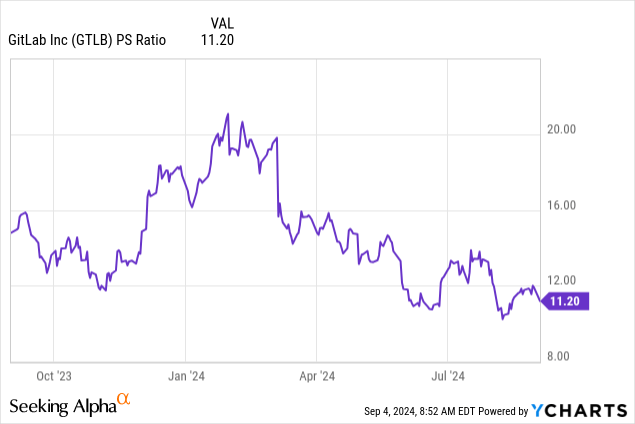

Valuation

GitLab continues to be richly valued, nevertheless in the mean time, the growth costs justify the extreme valuation, and in distinction to sooner than, the valuation has already improved. The occasions of 20x+ PS multiples had been really overdone.

Now, however, with a ~11x PS various for long-term merchants, the valuation must be truthful if you’ve obtained a 5-10 12 months horizon. On account of GitLab is so dominant in what they do that they’ll become the valuation.

Conclusion

The occasion of GitLab and its stock worth illustrates as quickly as as soon as extra the need to separate stock worth from enterprise effectivity. Although the stock’s YTD effectivity has not been good, GitLab’s underlying enterprise has delivered implausible outcomes.

On account of this truth, I bear in mind the shares much more attractive as we converse than firstly of the 12 months. For an enhance to Buy, however, I nonetheless need various additional quarters to have the flexibility to increased assess FCF and the have an effect on of AI.