Petmal

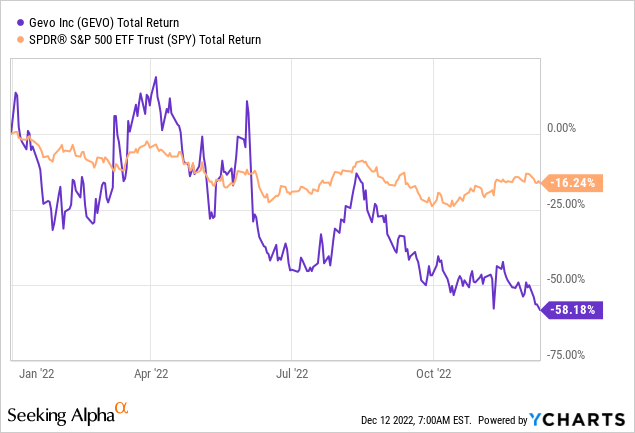

Gevo has been hit quite hard in 2022 with the share price falling more than 58% YtD. On 15 September, the company broke ground on its NZ-1 facility. According to the latest guidance, the project is expected to generate around US$300M of EBITDA annually, while Gevo’s EV is around US$70M. However, anticipated initial capital costs of the NZ-1 facility were raised to US$850M, while the company has only 422.6M of cash and equivalents and marketable securities. Obtaining sufficient loan financing at favorable terms may be a challenge in the current rising interest rates environment, while the risks surrounding the commercial viability of Gevo’s production process remain. Further dilution also seems a likely path. Overall, the stock may be perceived as speculative opportunity, given the very low EV and the high uncertainty.

Company overview

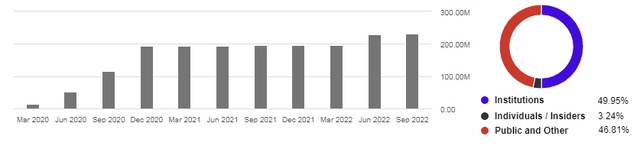

Founded in 2005, Gevo (NASDAQ:GEVO) aims to position itself as a leading producer of Sustainable Aviation Fuel (SAF). The company intends to reach capacity of around 1BGPY (billion gallons per year), through multiple facilities, the first one of which – Net Zero 1 is in pre-construction and is projected with a capacity of 55MGPY (million gallons per year). The company’s ambitious plans have led to significant dilution in the last two years, as the number of shares has increased considerably and are standing at 237.2M as of 30 Sept 2022.

Gevo’s shares outstanding and ownership structure (Seeking Alpha)

The ownership structure is close to evenly split between institutions and retail, while insider ownership is only 3.2%. There are also 33.4M warrants outstanding with the vast majority (33.3M) an exercise price of US$4.37, which is far away from the current price of US$1.80.

Recent developments

On 15 September 2022, Gevo held an official groundbreaking event at the site of the future Net Zero 1 facility in South Dakota. However, until the end of this year pre-construction activities will take place, while the actual construction is expected to begin in 2023 and the plant is expected to be fully operational in 2025.

The groundbreaking event at the NZ-1 site (Gevo)

Subsequently in October, management provided an update for the NZ-1 project. The release reiterated full-production scheduled for 2025, while raising expected annual EBITDA from the plant to more than US$300M. On the other hand, anticipated initial construction costs were raised 33% to US$850M citing increases in costs of materials and transportation.

Meanwhile the company signed two additional sales contracts with Qatar Airways for 5MGPY over 5 years and with Iberia Airlines for 6MGPY over 5 years. With that, the total amount sold forward in a take or pay contracts approaches 400MGPY, according to the Q3’22 earnings call.

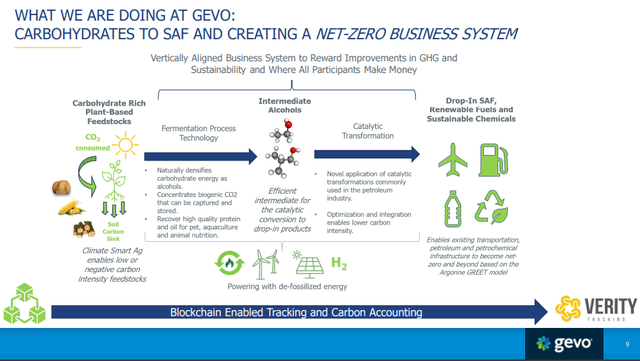

Decarbonization through SAF (Gevo)

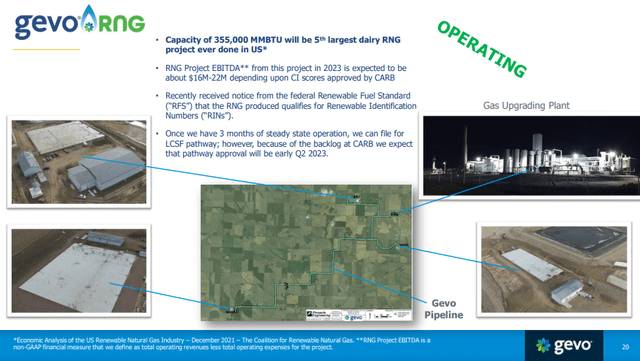

Another important update, provided by management in the earnings call, was that the Northwest Iowa RNG project has begun operations, although not at full scale yet. Previously, Gevo has anticipated EBITDA in the range of US$16M-US$22M from this project in 2023, although the figure may be lower, since management casted doubts about the timeline of achieving full operational capacity.

The Northwest Iowa RNG project (Gevo)

Liquidity and financing challenges

Currently, Gevo has US$422.6M in cash and equivalents and marketable securities. Additionally, there is US$76.9M of restricted cash, the majority of which is related to the Northwest Iowa RNG project. This is well below the recently updated anticipated initial outlay for the NZ-1 project of US$850M. Management is well-aware of this shortcoming so they’re looking for potential solutions as evident from the words of the CFO – Lynn Smull on the earnings call:

We are progressing our net zero build program and are in the process of seeking debt and equity partners for Net-Zero 1 and projects beyond the flagship project. Third-party debt and equity financings for the program are being structured on a nondilutive basis at the asset level rather than at Gevo, Inc. The equity outreach is going well with a substantial market interest, and we expect to secure one more investors as a result of those efforts.

I see two potential problems that could arise in obtaining the needed financing. Firstly, while Gevo claims that the contracts with customers for SAF are financeable, the production process that the company plans to use is yet to be fully employed at economically viable commercial scale as far as I’m aware. In addition, the rising interest rates environment is a recipe for higher financing rates if a loan is given.

The second issue is related to the equity financing. While the CFO claims that it’s going to be non-dilutive, that may be true on a theoretical basis, but not on practical. If an asset level transaction is done and for example the company sells 20% stake in NZ-1 to a third party, then the shareholders of Gevo will own only the rest 80% of profits, so on EPS basis there’s dilution, although not from the number of shares, but from the lower attributable earnings.

Share price and valuation

Looking at YtD performance, Gevo has underperformed the broad market significantly by falling more than 58%. This could be explained by the overall risk-off environment, the additional equity raise in June 2022 and the anticipated raise in initial capital costs of the project.

Turning to the current market value of Gevo, the company has EV of around US$70M, when taking into account the US$67M of bonds and US$424.6M of cash and marketable securities. This would imply F2025 EV/EBITDA of 0.2 if the NZ-1 project plays out as guided by management. However, the market casts serious doubts about whether that could happen. As far as possible bottom for the share price, while a negative EV is possible as it was the case with not one or two companies, approaching the negative territory could provide support to the share price.

Another way to look at valuation would be through the Northwest Iowa RNG project alone. Its EBITDA is anticipated around US$20M, which puts the f EV/EBITDA multiple of 3.5. This seems low, but the risk that the available short-term liquidity would be buried away with the SAF project could not be excluded. Overall, the risks surrounding Gevo are quite substantial, but the low EV compared to expected EBITDA from NZ-1 could justify a speculative opportunity.