Nic Antaya

Investment Thesis

General Motors (NYSE:GM) is an iconic automaker with a loyal customer base. It has ready customers for its electric vehicles. The company’s rich expertise, strong brand name, and financial strength can go a long way in its success in the growing EV segment. GM has managed to grow margins despite falling revenue and EVs should help boost margin further.

Business

General Motors Company is an American automotive manufacturing company founded in 1908. The company is involved in the production and selling of automotive vehicles and automobile parts. It also offers software-enabled services all around the world. The firm is geographically diverse. The company operates in four segments – GM North America (GMNA), GM International (GMI), Cruise, and GM Financial. In North America and Internationally, vehicles are developed, manufactured, and marketed under the brand name Buick, Cadillac, Chevrolet, and GMC. In addition, the company has equity participation in other organizations to meet the needs of other nations, primarily China. Through its GM Financial segment, the company also provides financial services. GM purchased a controlling share in Cruise in 2016. Since then, the Cruise segment is accountable for the innovation of new automotive vehicle technology.

Vision

General Motors’ vision for the future is a world with zero crashes, emissions, and congestion. To achieve this target, the company has pledged to invest $35 billion in Electric vehicles and autonomous vehicles between 2020 and 2025. Slowly and steadily the company is transitioning to EVs while strengthening its market position in Internal Combustion Engine vehicles such as trucks and SUVs.

Stock Price

The stock prices of General Motors, Ford Motors Co. (F), and Volkswagen AG (OTCPK:VWAGY) were on an uptrend post-Covid but started falling precipitously since early 2022. GM’s stock price has suffered the least YTD compared to its peers. Its stock price has fallen by 39.96% compared to Ford and Volkswagen which fell by 44.78% and 44.67% over the same period.

The overall market sentiment for 2022 was negative. All the major indexes fell during this period. The S&P 500 and S&P 100 plunged by 23.3% and 19.82% respectively YTD.

Financial Performance

Revenue

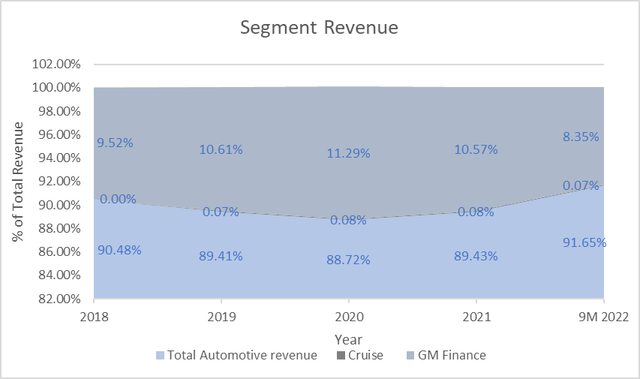

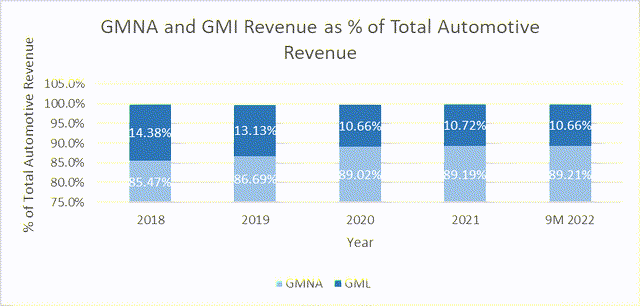

The majority of the company’s revenue comes from its Automotive business. In the automotive business, GMNA meets the demands of customers in North America and GMI sells to customers outside North America. Revenue from the GMNA segment contributes largely to the total Automobile revenue. A small portion of revenue comes from the GM Finance and Cruise segments.

FY21

In 2021, General Motors total revenue stood at $127 billion, out of which Total Automotive revenue was 113.58 billion, Cruise revenue was $106 million, and GM Finance revenue was $13.4 billion. During that year, 90% of revenue for the automotive business came from the GMNA segment.

Third Quarter Revenue

Revenue for Q3 FY22 stood at $41.8 billion compared to $26.7 billion in Q3 FY21. It grew by 56.4 % year-on-year in Q3 FY22.

Segment Revenue

General Motors

Since 2020, the proportion of automotive segment revenue to total revenue has grown. The same cannot be said about GM Finance and Cruise segment. In 2021, GM Finance revenue as a proportion of total revenue declined by 72 basis points.

General Motors

The chart above shows the revenue contribution of GMNA and GMI segments toward total automotive revenue. Since 2018, GMI’s contribution to overall automotive revenue has been decreasing. This suggests that the company is unable to boost its worldwide vehicle sales. On the other hand, the GMNA segment’s contribution to total revenue has been strongly growing.

Sales

General Motors vehicle sales have declined over time. GM’s Vehicle sales in North America for 9M FY22 have fallen by 6% year-on-year. GMI Vehicle sales have suffered a lot. Vehicle sales in China were down by 23% year-on-year for 9M FY22. The reason for lower sales is the current Covid-19 lockdown in China. Vehicle sales Outside China grew by 17% year-on-year for 9M FY22.

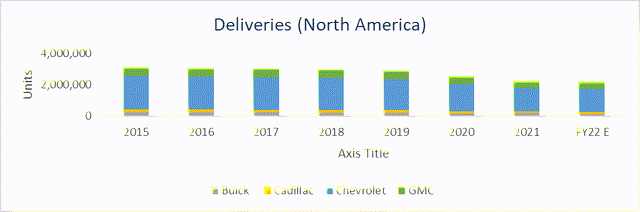

GMNA

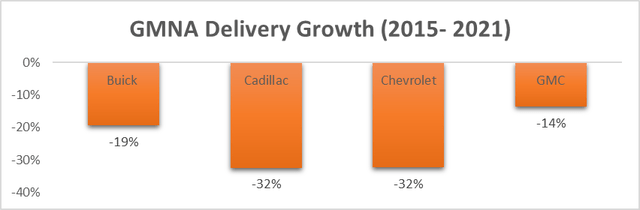

General Motors

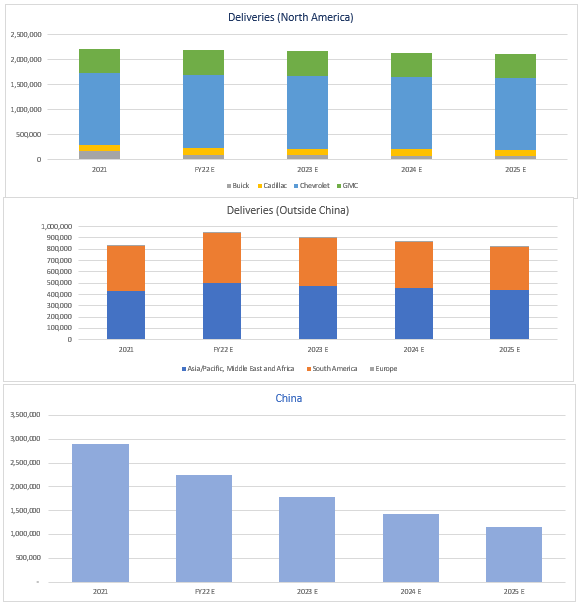

The chart above indicates that all GM major brands have not worked quite well in North America. Although the company holds a strong reputation in the North American markets, its sales have still declined. Chevrolet and Cadillac, two of its biggest brands, have seen a major decline in deliveries since 2015. Deliveries for other brands like Buick and GMC have also declined during the same period.

General Motors

Other Markets

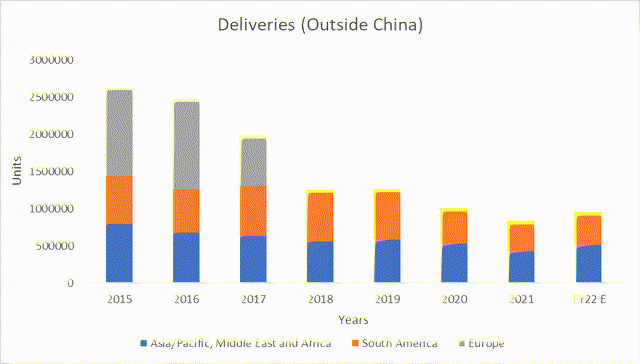

General Motors

Over the past couple of years, GM has exited from major markets. In 2017, GM decided to exit the European market. It made a deal with a France-based automobile company PSA to sell its Opel brand. GM was making continuous losses in Europe due to the failure of its Chevrolet and Opel brands. The chart above indicates the same. Deliveries in Europe fell from 685,000 to 4,000 between 2017-2018. Deliveries in South America and Asia/Pacific, Middle East & Africa have also declined.

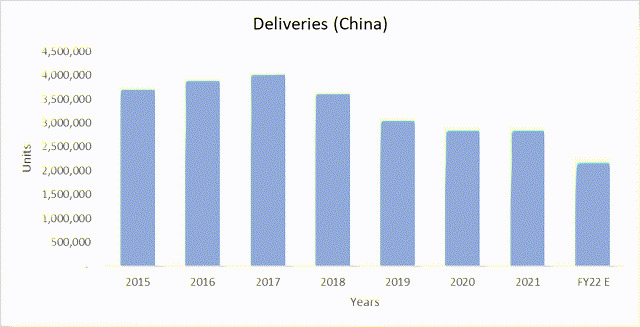

General Motors

Deliveries in China have also fallen over the years. This is because the EV market in China has grown exponentially. Since the majority of GM brands’ product mix consists of ICE vehicles, the company has not been able to make enough sales in China. The delivery data from 2019 indicates that the Chevrolet brand and the Baojun brand have performed quite poorly. On the other hand, the Cadillac brand and the Wuling brand have worked well in the Chinese automotive market during the same period.

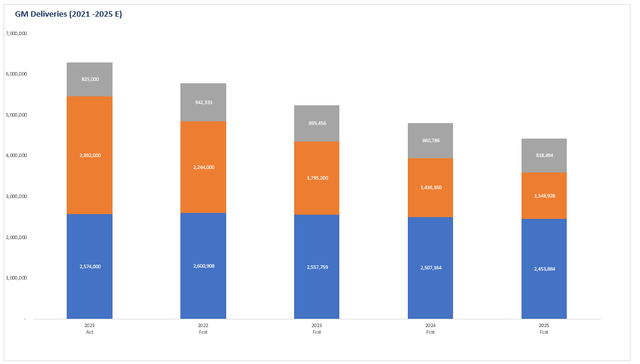

Looking at the past trend, we expect North American sales to range between 2.5 – 2.7 million for FY22. For China, we expect sales to be between 2.1-2.3 million range. GM’s vehicle sales Outside China and North America have grown more significantly compared to 9M FY21. We anticipate Outside China vehicle sales to be below 1 million units in FY22.

Transition to EV

Electric Vehicles are gaining popularity globally due to the rise in carbon emissions. The transition from ICE to EV has been quick in countries like China, Europe, and the USA. In the last 5 years, US consumer interest in EVs has grown by 110%. Moreover, independent forecasters predict EV adoption rising to 17% of industry sales by 2025.

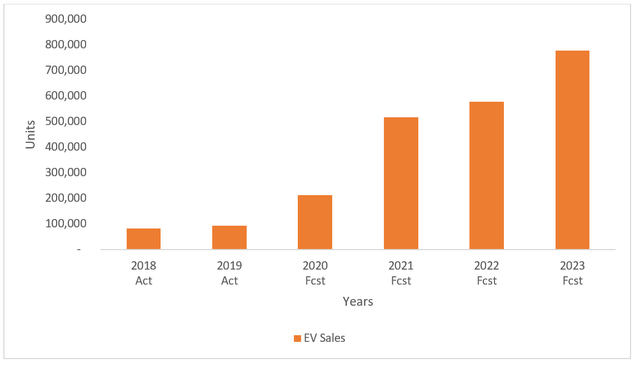

General Motors is planning to take advantage of this by introducing new world-class products in the market. The company plans to leverage the strength of its ICE portfolio to EV. Its EV sales have been growing quite rapidly. Moreover, GMC Hummer EV reservation numbers look quite attractive at 90,000.

GM, author’s forecasts

Investors should pay attention to deliveries of Cadillac LYRIQ, Chevrolet Equinox, Blazer EV, GMC Sierra EV, and Silverado EV going forward. These products are important because they are critical to the company’s EV growth strategy through 2025. Additionally, the company also plans to launch new EV models for Cadillac, Buick, and BrightDrop by 2025.

GM is currently on its path to producing 400,000 EVs by mid-2024. From there the company plans to scale it up to 1 million by 2025.

General Motors

Outlook and Valuation

General Motors forecasts its overall sales and EV revenue to reach $225 billion and $50 billion, respectively, by 2025. In order to reach its revenue targets the company plans to increase its Capex from $9 billion – $10 billion a year to $11 billion – $13 billion a year through 2025.

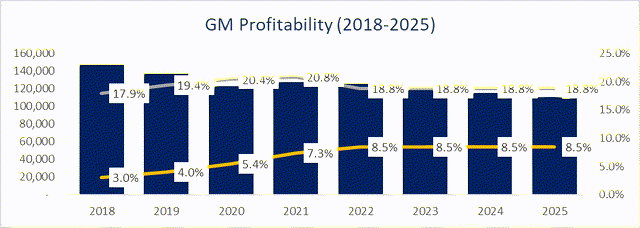

GM’s previous regional ICE car delivery has not been enticing. Although EV sales have increased in recent years, their contribution to revenue is quite small, as EV accounts for barely 10% of the entire product portfolio. Despite this, GM’s gross profit and EBIT margins have been increasing. This is because over the period the company has discounted its operation in non-profitable regions.

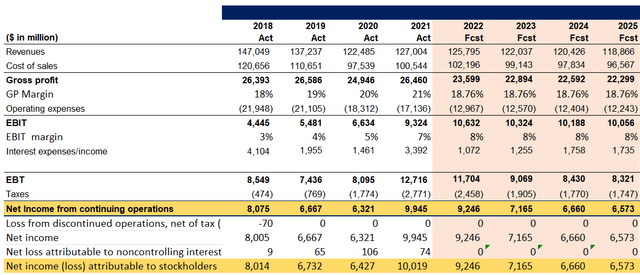

General Motors, author’s forecasts

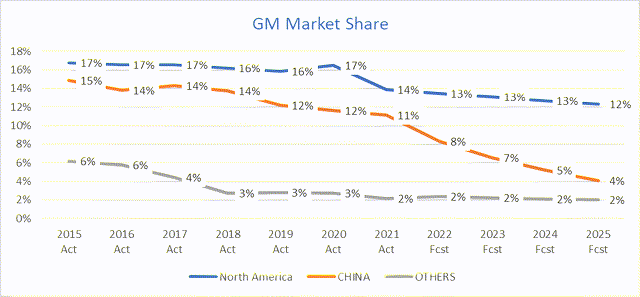

Some brands have not worked quite well globally for GM in the past. Thus, we prefer to be conservative moving ahead. Industry growth has also been moderate. Since 2015, the market share of GM has declined globally. Taking all these factors into consideration, we expect GM deliveries to contract from FY23. For 2022, we expect delivery numbers to be above the 2021 level due to strong growth in crossover vehicles, passenger cars, full-size pickup trucks, vans, mid-size pickup trucks, and full-size SUVs. GMNA will account for the majority of this delivery growth.

General Motors, author’s forecasts General Motors, author’s forecasts General Motors , author’s forecasts

We don’t foresee a large boost in revenue because the majority of EV vehicles are likely to be released next year or in early 2024. Furthermore, Europe is a large market for EVs. Its recent exit from the European market may have an impact on future delivery volumes. Exiting from unprofitable markets has helped GM keep its margins strong. We anticipate that sales costs will rise in 2022 owing to high raw materials, commodities, and logistic costs. However, GM has been able to keep its operating expenses under control and will continue to do so through 2025. (Refer chart above on GM profitability)

After factoring in all of the eventualities in our model and discounting them, we arrived at an intrinsic value of $53.3 for GM. We project the revenue to fall up to 2025, and start rising thereafter, as the company’s EV sales pick up. We’ve assumed a modest perpetual growth rate of 0.5% in our DCF model.

General Motors, author’s forecasts

Conclusion

General Motors is probably one of the underappreciated stocks, despite the company having a strong fanbase in the domestic market. The company’s revenue has been falling due to its exits from some markets, as well as losing some market share to EVs. However, GM been able to grow its margins. With its focus on EVs, the company could see incremental margin growth. GM stock has corrected nearly 40% in 2022. Even with a modest growth assumption, the stock offers a decent upside potential from here. Of course, the growth could be higher if GM’s EV plans get rolled out as it is hoping.