Sundry Photography

Turnaround situations have a reputation for delivering spectacular returns, if and when the company can actually turn things around. Even with new management in place, it is unlikely that a company will regain market share or turn profitable after it has lost its way.

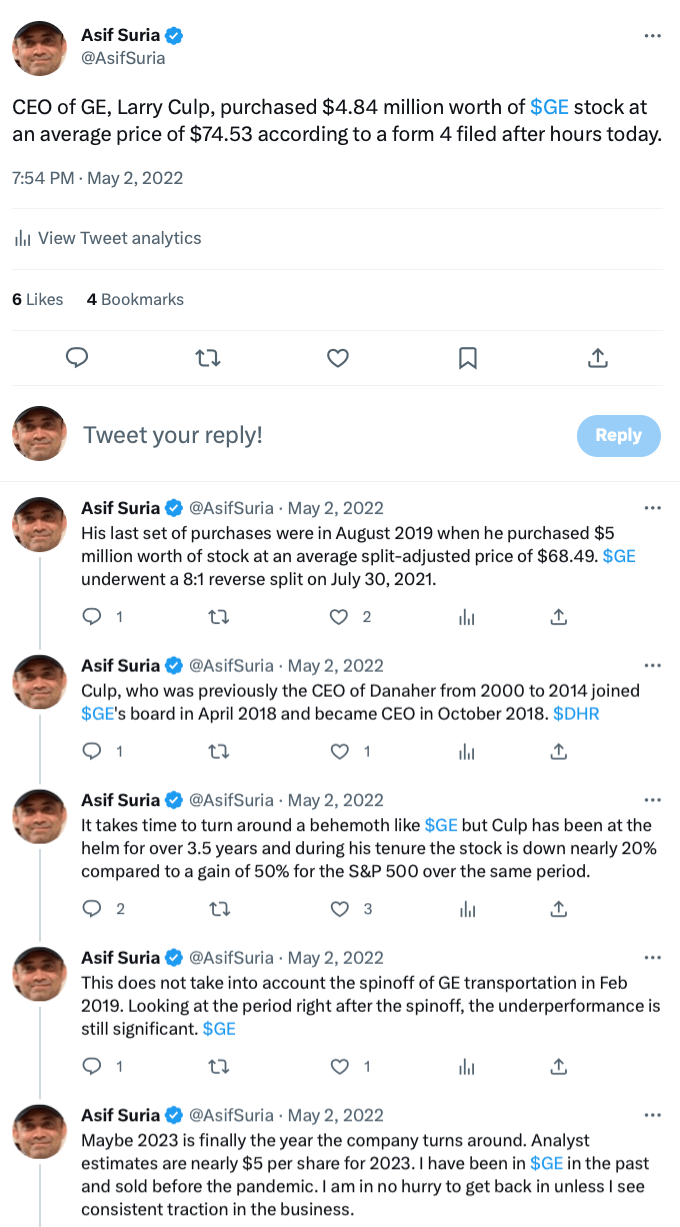

I discussed this briefly in a Twitter thread after an insider purchase at General Electric Company (NYSE:GE) by Larry Culp in May 2022.

GE Insider Purchases By Culp (Twitter)

Mr. Culp’s timing in buying GE’s stock was impeccable. The stock is up 74% over the last year as the company beat earnings estimates in three out of the last four quarters, increased its full year 2023 earnings estimates, and guided towards high single-digit revenue growth.

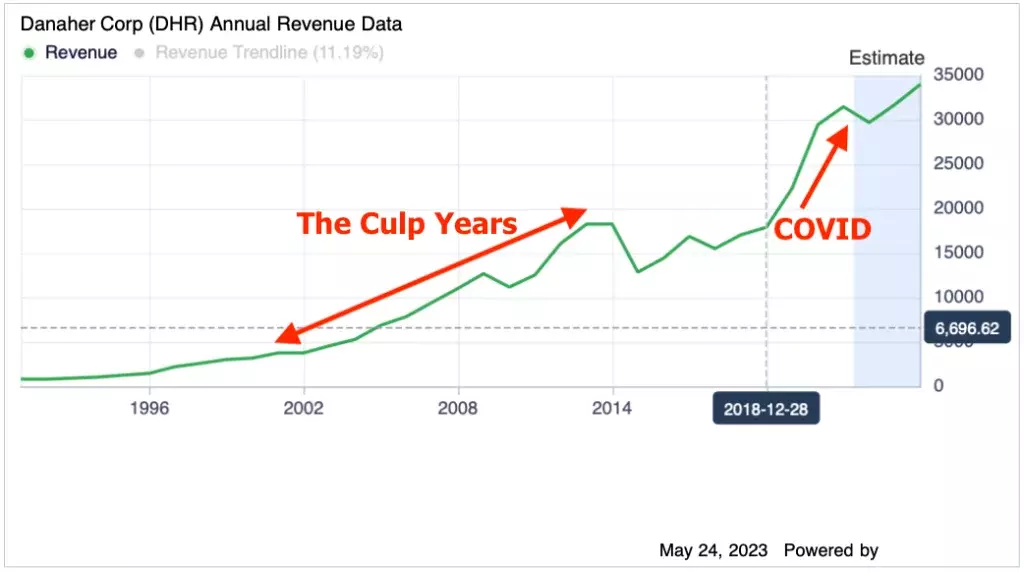

The revenue chart below puts Mr. Culp’s impact on Danaher Corporation (DHR) into perspective. Earnings per share followed a similar trajectory.

Danaher Revenue Culp Years (GuruFocus)

Carolina Dybeck Happe joined GE in March 2020 at a time when revenue had been declining sharply for years and the balance sheet was highly leveraged. During Ms. Dybeck Happe’s tenure, she played an integral part in improving operational performance and deleveraging the balance sheet.

Revenue rose from $72.97 billion in 2020 to $75.39 billion in the trailing twelve months (TTM), operating income increased from a loss of $632 million to a profit of $5.93 billion, and net debt dropped from $31 billion to essentially nothing during the same period. Part of the reduction in debt came from GE cutting its stakes in oil field services company Baker Hughes Company (BKR) and aircraft-leasing firm AerCap Holdings N.V. (AER). When looking at the debt situation, I am not taking into account drawdowns in long-term assets, decline in non-current liabilities of the finance division, asset sales, spinoffs, etc.

On May 18, 2023, General Electric Company announced that Rahul Ghai will become Senior Vice President and Chief Financial Officer of GE effective September 1, 2023, succeeding Carolina Dybeck Happe. Mr. Ghai will assume this role in addition to his current responsibilities as Chief Financial Officer of GE Aerospace, which he has held since August 2022.

Mr. Ghai served as Otis Elevators’ CFO since July 2019 before joining GE Aerospace. Rahul supported the development of all the financial operations during this time and was a significant player in helping Otis separate from United Technologies Corporation.

Mr. Culp said:

“Since Rahul joined GE Aerospace, we have benefited greatly from his leadership, including his wealth of experience as a public company CFO and with the spin-off process. This is the right time to make this change as GE progresses toward launching GE Vernova and GE Aerospace as standalone businesses, and I look forward to partnering with Rahul in this additional capacity.”

On May 18, 2023, General Electric Company announced that Carolina Dybeck Happe CFO will be stepping down effective September 1, 2023. I see this move as the company goes from a turnaround CFO to a growth-focused CFO.

Ms. Dybeck Happe will stay on as a Senior Vice President at GE to help with the transition and ongoing efforts to make sure the company is ready for the GE Vernova spin-off.

Ms. Dybeck Happe left Maersk, where she served as CFO, to join GE. She worked for Assa Abloy for 16 years, including 7 of those as the CFO, before moving on to Maersk.

GE Chairman and CEO H. Lawrence Culp said:

“Carolina has played a crucial role over the last few years, helping to significantly reduce GE’s debt, improve our financial and operating performance, and build the strategy and execution of our spin-offs plan against a market backdrop unlike any other that I’ve experienced. Importantly, under Carolina’s leadership, GE’s finance teams have become stronger operational partners to our businesses, creating insights to drive performance while deepening our focus on free cash flow. I am grateful for her many contributions that have helped GE regain its strength, and I look forward to working with her in the coming months as we complete the important work of transforming GE.”

GE and Ms. Dybeck Happe agreed that she will remain

“eligible for the severance benefits under her existing employment agreement and applicable equity award agreements if she resigns for ‘good reason’ on or before February 14, 2024, as a result of the CFO transition,”

according to the company’s SEC filing.

Turnaround

The finance division of GE was on the verge of failing in 2008 before Warren Buffett invested $3 billion, saving it from a massive meltdown. Again in 2020, GE, like all other businesses worldwide, was hit by the Covid-19 pandemic, and its many areas, particularly aviation, suffered a significant setback.

Management focused on both disposing assets and on cutting costs during this difficult period. In addition, Mr. Culp has been in the role of transforming GE’s portfolio, overseeing the sales of GE Capital Aviation Services (GECAS), Lighting, BioPharma, and GE Transportation, which was successfully spun off and then merged with Wabtec.

Over the past five years, GE has paid down more than $100 billion in debt. The stock price reflects the fact that GE’s recovery has already made major gains. With the turnaround in progress, the next phase of the company is likely to be focused on growth.

GE Spinoffs

In November 2021 GE announced its plan to form three industry-leading, global public companies focused on aviation, healthcare, and energy. According to GE, the move was made to improve the performance of the different entities and increase their appeal to shareholders.

GE HealthCare Technologies Inc. (GEHC), which makes medical imaging equipment and tech products, was the company’s first spinoff. The company went public on January 4, 2023. GE Vernova, the power business spinoff which houses the energy portfolio, is scheduled for early 2024.

Following the split, GE will change its name to GE Aerospace, which will be solely focused on aviation. Mr. Ghai will continue to serve as the company’s CFO, while Culp will serve as its CEO.

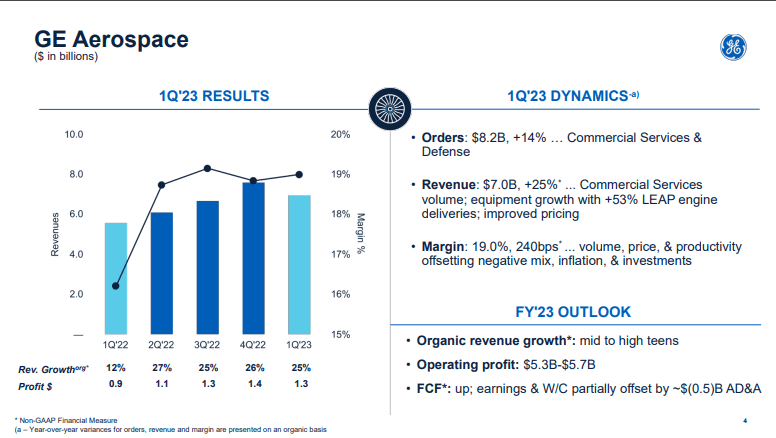

GE reported its first quarter 2023 earnings in April.

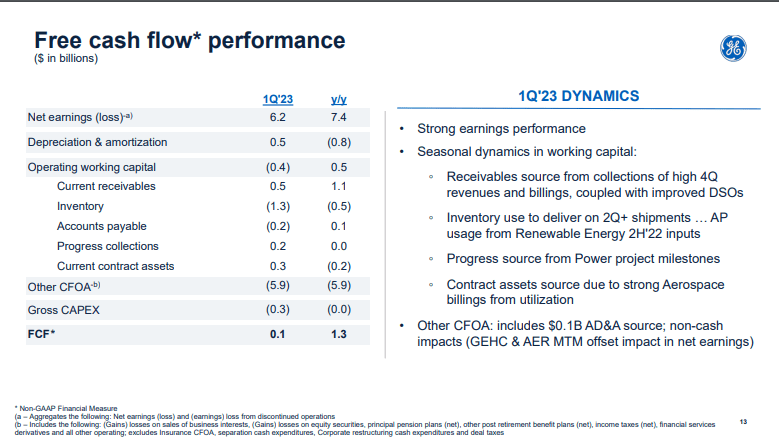

“We reported our first positive free cash flow in the first quarter in nearly a decade,” Culp said in the earnings statement.

- Revenue of $14.49 billion (+14.4% YoY) versus estimates of $13.36 billion.

- Net income of $6.2 billion; Free Cash Flow $0.1 billion.

- GE Aerospace, the strongest segment, saw revenue rise 25% from a year earlier to $6.98 billion.

GE Aerospace (Investor Presentation) Investor Presentation (GE website)

Welcome to edition 42 of C-Suite Transitions, a weekly series on InsideArbitrage that tracks appointments and departures at publicly traded companies during the prior week. We highlight five appointments and departures each week by picking the largest companies from the full list of management changes.

Sudden Departures

- SunPower (SPWR): On May 16, 2023, June Sauvaget informed SunPower that she was voluntarily resigning from her position as the Executive Vice President and Chief Marketing Officer of the company effective June 2, 2023.

- Replimune Group (REPL): On May 18, 2023, the Replimune Group announced that Jean Franchi resigns from her position as the company’s Chief Financial Officer, effective June 2, 2023.

- Grid Dynamics Holdings (GDYN): On May 15, 2023, Stan Klimoff Chief Strategy Officer informed Grid Dynamics of his intention to resign effective May 19, 2023, to explore opportunities outside the IT services industry.

- Conformis (CFMS): On May 15, 2023, Robert S. Howe Chief Financial Officer and Treasurer notified Conformis, that he will be resigning effective June 9, 2023.

- Golden Minerals (AUMN): On May 18, 2023, John Galassini, Chief Operating Officer of Golden Minerals Company, notified the company of his resignation effective May 31, 2023.

- BlueLinx (BXC): On May 15, 2023, Kevin A. Henry Chief People Officer provided notice of his decision to resign from Bluelinx Holdings effective June 2, 2023.

- BJ’s Wholesale Club (BJ): On May 15, 2023, Scott Kessler notified BJ’s Wholesale Club Holdings of his decision to resign, effective as of May 26, 2023, as Executive Vice President, Chief Information Officer.

- Celularity (CELU): On May 16, 2023, Bradley Glover, Ph.D., Executive Vice President and Chief Operating Officer, notified Celularity of his decision to resign from his role effective as of May 31, 2023, to pursue another opportunity.

- ESS Tech (GWH): On May 17, 2023, Craig Evans, Co-Founder and President of ESS Tech tendered his resignation as President to be effective May 19, 2023.

- Tennant (TNC): On May 22, 2023, Tennant Company announced that Carol E. McKnight Senior Vice President, Chief Administrative Officer steps down effective May 26, 2023.

- Oncology Institute (TOI): On May 18, 2023, Oncology Institute notified Matthew Miller Chief Operating Officer of his termination from his position.

Appointments

1. Baker Hughes (BKR): $28.72

Rebecca Charlton (Baker Hughes)

On May 19, 2023, Baker Hughes Company announced that Rebecca Charlton has been appointed Senior Vice President, Controller, and Chief Accounting Officer effective June 1, 2023.

| MarketCap: $33.21B | Avg. Daily Volume (30 days): 6,767,969 | Revenue (TTM): $22.04B |

| Net Income Margin (TTM): -0.44% | ROE (TTM): -0.49% | Net Debt: $3.2B |

| P/E: -294.25 | Forward P/E: 18.02 | EV/EBIDTA (TTM): 10.38 |

| P/S (TTM): 1.39 | P/B (TTM): 2.08 | 52 Week Range: $20.16-$37.88 |

2. Foot Locker (FL): $26.16

Michael Baughn (Foot Locker)

On May 19, 2023, Foot Locker announced Michael Baughn has been appointed Executive Vice President and Chief Financial Officer of the company, effective June 12, 2023.

| MarketCap: $2.53B | Avg. Daily Volume (30 days): 5,115,693 | Revenue (TTM): $8.51B |

| Net Income Margin (TTM): 2.88% | ROE (TTM): 7.63% | Net Debt: $2.80B |

| P/E: 10.35 | Forward P/E: 8.56 | EV/EBIDTA (TTM): 7.49 |

| P/S (TTM): 0.33 | P/B (TTM): 0.86 | 52 Week Range: $22.95-$46.75 |

3. General Electric (GE): $100.98

Rahul Ghai (General Electric)

On May 18, 2023, General Electric Company announced that Rahul Ghai will become Senior Vice President and Chief Financial Officer of GE effective September 1, 2023, succeeding Carolina Dybeck Happe.

| MarketCap: $110.75B | Avg. Daily Volume (30 days): 5,354,507 | Revenue (TTM): $78.37B |

| Net Income Margin (TTM): 11.31% | ROE (TTM): 22.89% | Net Debt: $910M |

| P/E: 14.04 | Forward P/E: 49.75 | EV/EBIDTA (TTM): 13.17 |

| P/S (TTM): 1.38 | P/B (TTM): 3.41 | 52 Week Range: $47.02-$105.94 |

4. Texas Roadhouse (TXRH): $112.13

David Christopher Monroe (Texas Roadhouse)

On May 17, 2023, the Board of Directors of Texas Roadhouse appointed David Christopher Monroe as Chief Financial Officer of the company, effective as of June 28, 2023.

| MarketCap: $7.43B | Avg. Daily Volume (30 days): 1,170,902 | Revenue (TTM): $4.20B |

| Net Income Margin (TTM): 6.69% | ROE (TTM): 27.44% | Net Debt: $577.63M |

| P/E: 26.60 | Forward P/E: 23.04 | EV/EBIDTA (TTM): 16.92 |

| P/S (TTM): 1.83 | P/B (TTM): 7.17 | 52 Week Range: $68.25-$116.72 |

5. Radian Group (RDN): $25.27

Sumita Pandit (Radian Group)

On May 17, 2023, the Board of Directors of Radian Group appointed Sumita Pandit as Senior Executive Vice President and Chief Financial Officer, effective immediately.

| MarketCap: $4.01B | Avg. Daily Volume (30 days): 1,639,354 | Revenue (TTM): $1.21B |

| Net Income Margin (TTM): 59.55% | ROE (TTM): 17.44% | Net Debt: $1.13B |

| P/E: 5.92 | Forward P/E: 8.14 | EV/EBIDTA (TTM): 5.11 |

| P/S (TTM): 3.49 | P/B (TTM): 0.95 | 52 Week Range: $17.45-$26.06 |

Departures

1. Baker Hughes (BKR): $28.72

Kurt Camilleri (Baker Hughes)

On May 19, 2023, Baker Hughes Company announced that Kurt Camilleri transitions out of his current role of Senior Vice President, Controller, and Chief Accounting Officer effective June 1, 2023.

| MarketCap: $33.21B | Avg. Daily Volume (30 days): 6,767,969 | Revenue (TTM): $22.04B |

| Net Income Margin (TTM): -0.44% | ROE (TTM): -0.49% | Net Debt: $3.2B |

| P/E: -294.25 | Forward P/E: 18.02 | EV/EBIDTA (TTM): 10.38 |

| P/S (TTM): 1.39 | P/B (TTM): 2.08 | 52 Week Range: $20.16-$37.88 |

2. Centene (CNC): $64.64

James E. Murray (Centene)

On May 19, 2023, James E. Murray, Chief Operating Officer formally notified the company of his plans to retire in 2024.

| MarketCap: $35.69B | Avg. Daily Volume (30 days): 2,772,703 | Revenue (TTM): $137.02B |

| Net Income Margin (TTM): 1.08% | ROE (TTM): 5.63% | Net Debt: $3.65B |

| P/E: 25.10 | Forward P/E: 10.86 | EV/EBIDTA (TTM): 6.82 |

| P/S (TTM): 0.27 | P/B (TTM): 1.52 | 52 Week Range: $61.71-$98.53 |

3. Foot Locker (FL): $26.16

Robert Higginbotham (Foot Locker)

On May 19, 2023, Foot Locker announced Robert Higginbotham will cease to serve as interim Chief Financial Officer, effective on June 11, 2023, and will continue to serve as Senior Vice President, Investor Relations and Financial Planning & Analysis.

| MarketCap: $2.53B | Avg. Daily Volume (30 days): 5,115,693 | Revenue (TTM): $8.51B |

| Net Income Margin (TTM): 2.88% | ROE (TTM): 7.63% | Net Debt: $2.80B |

| P/E: 10.35 | Forward P/E: 8.56 | EV/EBIDTA (TTM): 7.49 |

| P/S (TTM): 0.33 | P/B (TTM): 0.86 | 52 Week Range: $22.95-$46.75 |

4. US Foods Holding (USFD): $39.40

Andrew E. Iacobucci (US Foods Holding)

On May 18, 2023, Andrew E. Iacobucci notified the company of his resignation as the company’s Senior Executive Vice President, Field Operations, and Chief Commercial Officer to pursue other business opportunities.

| MarketCap: $9.30B | Avg. Daily Volume (30 days): 2,270,338 | Revenue (TTM): $34.80B |

| Net Income Margin (TTM): 1.02% | ROE (TTM): 8.04% | Net Debt: $4.34B |

| P/E: 28.67 | Forward P/E: 16.00 | EV/EBIDTA (TTM): 12.26 |

| P/S (TTM): 0.27 | P/B (TTM): 2.39 | 52 Week Range: $25.49 – $41.76 |

5. Science Applications International (SAIC): $97.05

Nazzic S. Keene (Science Applications International)

On May 18, 2023, Science Applications International Corporation announced the retirement of Nazzic S. Keene as Chief Executive Officer of the company and also resigned from the Board of Directors effective as of October 2, 2023.

| MarketCap: $5.29B | Avg. Daily Volume (30 days): 281,271 | Revenue (TTM): $7.70B |

| Net Income Margin (TTM): 3.89% | ROE (TTM): 18.18% | Net Debt: $2.47B |

| P/E: 18.22 | Forward P/E: 13.48 | EV/EBIDTA (TTM): 11.46 |

| P/S (TTM): 0.72 | P/B (TTM): 3.15 | 52 Week Range: $81.69-$117.13 |

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.