Naeblys/iStock via Getty Images

Introduction

Following the energy sector fallout of the Russia-Ukraine war by the middle of 2022, it seemed that higher distributions may have only been less than a month away for GasLog Partners (NYSE:GLOP), as my previous article hoped. Whilst management instead opted to stay on a conservative path, as 2022 draws to a close, it sees a big year ahead in 2023 as charter rates for LNG vessels surge and fill their coffers, thereby making it very likely to see higher distributions.

Coverage Summary & Ratings

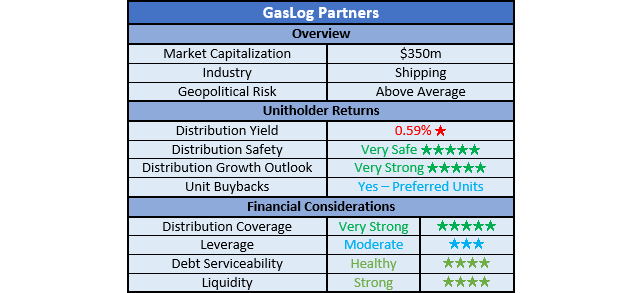

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

Author

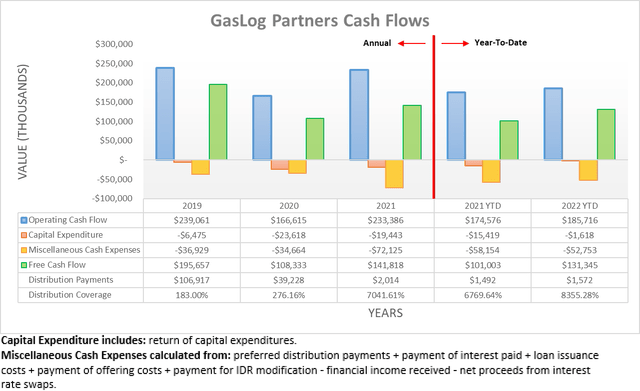

Despite merely seeing a fairly business-as-usual start to the year during the first quarter, thankfully 2022 continued improving as quarters progressed, especially concerning free cash flow. Even though their operating cash flow of $185.7m during the first nine months is still only a decent circa 6% higher-on-year versus their previous result of $174.6m during the first nine months of 2021, they still managed to generate $131.3m of free cash flow thanks to their bare bones capital expenditure. Due to this being coupled with bare bones distribution payments of only $1.6m, it left $129.7m of excess free cash flow for deleveraging or preferred unit buybacks, as subsequently discussed. Whilst this is already positive, they have only just begun seeing the benefits of surging demand for LNG vessels following the Russia-Ukraine war, which was highlighted as a catalyst when conducting the previous analysis.

Author

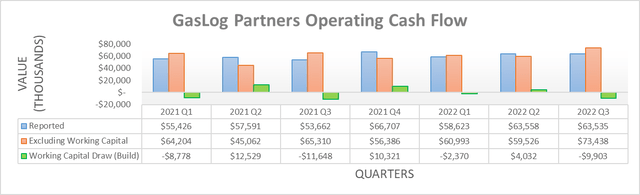

When viewed at the quarterly level, the improvement during the third quarter of 2022 is more easily visible. Whilst their reported result of $63.5m was only roughly in line with previous quarters, this was simply due to a working capital build of $9.9m that weighed down their cash generation. If excluded, their underlying result was $73.4m and thus by far their strongest result since at least the beginning of 2021. This stronger financial performance is already positive, although charter rates for LNG vessels only began surging towards the end of the third quarter and into the start of the fourth quarter.

GasLog Partners Third Quarter Of 2022 Results Presentation

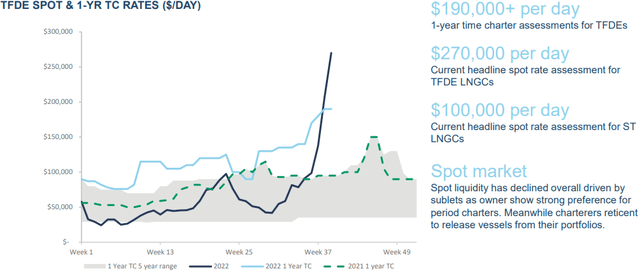

Even though it took a bit longer than expected, Europe scrambling to secure their natural gas supply as they lose most of their critical Russian supply sent LNG vessel demand surging along with spot charter rates. Whilst rates may ease from these record-setting levels in 2023, the natural gas shortage in Europe is almost certainly going to persist for many years and thereby creating a very strong outlook for LNG vessel demand that in turn, stands to support their charter rates at higher levels than normally observed during previous results.

Admittedly, most of their fleet is currently contracted and therefore, not subject to these record-setting spot charter rates. Although thankfully, if looking ahead into 2023, more of their fleet is becoming available for spot charters, as per slides six and twenty-two of their third quarter of 2022 results presentation. This significantly increases their scope to capture this upside potential and drive their financial performance during 2023 well ahead of their results during 2022.

Author

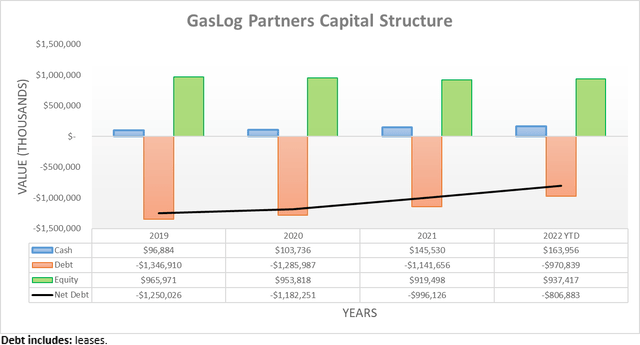

Following the analysis thus far, it should not catch anyone by surprise to see their net debt continuing its downward trajectory during the second and third quarters of 2022, thereby now landing at only $806.9m. This represents another impressive improvement of almost 17% versus its previous level of $969.8m following the first quarter. Admittedly, this was helped by $53.6m of divestitures, although to be fair, this occurred in conjunction with preferred unit buybacks of $38.7m, thereby netting out to a small inorganic benefit of a mere $14.9m.

Their net debt is certainly continuing its downward trajectory during the soon-to-end fourth quarter of 2022 given these booming operating conditions. Plus, the sale and leaseback of their vessel, the Methane Shirley Elisabeth that management expects to inject $17m of liquidity will further help drive their net debt that extra bit lower, as per slide four of their previously linked third quarter of 2022 results presentation. When wrapped together, it would not be surprising to see another $50m shaved off their net debt before the year ends, depending upon working capital movements and preferred unit buybacks.

When looking ahead into 2023, their net debt should plummet as their free cash flow reaps the rewards of booming LNG vessel demand. Whilst the inherent volatility of the shipping industry makes it impossible to ascertain the exact magnitude this far in advance, their performance during 2022 indicates that at least a $200m reduction is a realistic and frankly, conservative assumption given the prevailing booming operating conditions.

Author

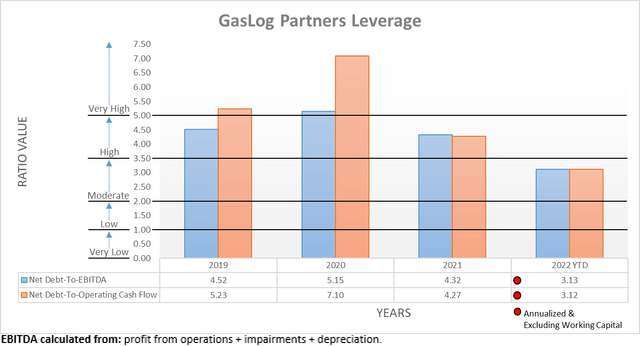

When lower net debt is combined with stronger financial performance, materially lower leverage is a given and on this front, the second and third quarters of 2022 did not disappoint with their net debt-to-EBITDA now down to 3.13 and their net debt-to-operating cash flow following along very closely at 3.12. Unlike their previous respective results of 3.99 and 3.98 following the first quarter, their results now sit within the moderate territory of between 2.01 and 3.50. Considering the analysis thus far, it is given their leverage will continue plummeting along with their net debt during the fourth quarter as well as into 2023. Even more importantly, they are now pushing their leverage below one of their targets, whilst making more progress on the second.

GasLog Partners Third Quarter Of 2022 Results Presentation

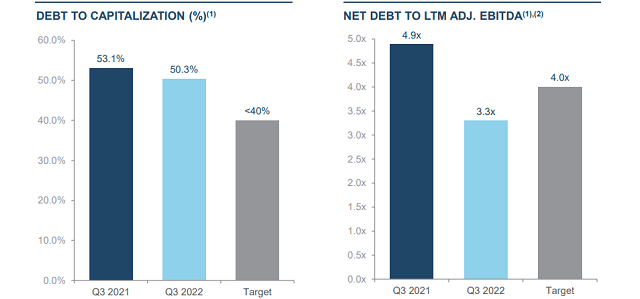

Thanks to their stellar performance during 2022, they are now noticeably beneath their leverage ratio target of sub-4.00 with a result of 3.30, which is obviously only heading lower. As a side note, the primary way that their leverage ratio differs from my net debt-to-EBITDA stems from their use of adjusted EBITDA from the last twelve months whereas my result annualizes their first nine months of 2022 results. When conducting the previous analysis, it was hoped that achieving their first leverage target would bring about higher unitholder returns, namely higher distributions. Alas, management instead opted to stay on a conservative path and keep their distributions at the bare bones to prioritize deleveraging, at least until they have also achieved their second leverage target, which my previous analysis highlighted as a possible hindrance.

On this front, they are also making progress towards their debt-to-capitalization target, albeit to a slower extent because unlike before, this metric compares their total debt against their balance sheet equity. As a result, it does not receive as quick of a benefit from their stronger financial performance as their earnings-based leverage ratio. That said, when conducting the previous analysis following the first quarter of 2022, this stood at 53%, whereas it now stands modestly lower at 50% and thus getting closer to their target of sub-40%.

Whilst their debt-to-capitalization does not directly benefit from stronger financial performance, the prospects of repaying net debt faster will still expedite hitting their target of sub-40%, especially because reducing debt via free cash flow increases their balance sheet equity comparably, holding everything else constant. As it stands right now, their balance sheet equity sits at $937.4m, which could increase by $250m given their previously discussed combined deleveraging prospects during the fourth quarter of 2022 and 2023. Meanwhile, this could obviously see their total debt decrease by $250m in tandem, thereby seeing their debt-to-capitalization around 38% by the end of 2023, once again, holding everything else constant.

Since this scenario was constructed from a conservative basis for their deleveraging, their actual results could far surpass this estimation, although this is partly dependent upon their currently unknown future working capital movements, preferred unit buybacks as well as acquisitions and divestitures. Regardless, this would still see both of their leverage targets achieved by the end of 2023, if not earlier and thus make way for higher unitholder returns that would very likely encompass higher distributions, as they are an income-focused Master Limited Partnership.

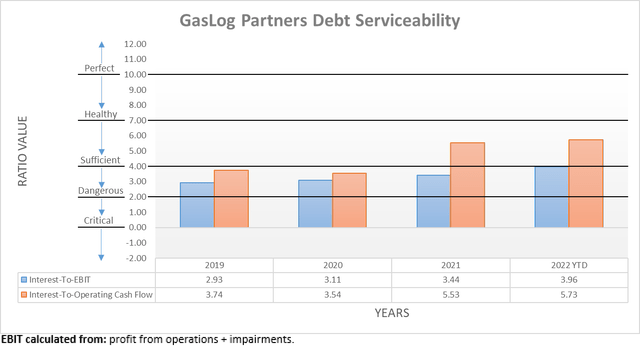

Author

Unsurprisingly, their debt serviceability also enjoyed material benefits alongside their leverage during the second and third quarters of 2022 with their interest coverage improving to 3.96 when compared against their EBIT, versus its previous result of 3.08 following the first quarter. This is right on the 4.00 threshold of what I consider healthy, which is obviously going to be crossed following the soon-to-end fourth quarter. Likewise, it is accompanied by interest coverage of 5.73 when compared against their operating cash flow and thus as a result, it means their debt serviceability is healthy across the board for the first time in many years.

Author

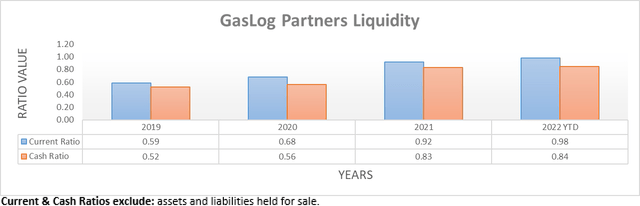

Finally, their already strong liquidity also enjoyed benefits during the second and third quarters of 2022 with their respective current and cash ratios climbing slightly to 0.98 and 0.84 versus their previous respective results of 0.91 and 0.80 following the first quarter. Unfortunately, they only provide breakdowns of their debt maturity profile following the fourth quarters of each year, although as it stands right now, their balance sheet sees $122.9m of current debt, meaning it comes due within the next twelve months from the end of the third quarter. Whilst certainly not immaterial, given the analysis thus far, it should be needless to explain they can easily repay these maturities as they come due, plus more if desired.

Conclusion

They did not move as quickly as previously hoped to lift their distributions higher, although they still continued making solid progress deleveraging. As 2022 now draws to a close and we look ahead into 2023, even conservative estimations see both of their leverage targets achieved before it ends, which makes higher distributions very likely. In light of this outlook, I now believe that upgrading to a strong buy rating is appropriate with their unit price still less than half its previous level back in 2019 before their distributions were first cut, despite their far more solid financial position and booming operating conditions.

Notes: Unless specified otherwise, all figures in this article were taken from GasLog Partners’ SEC Filings, all calculated figures were performed by the author.