audioundwerbung

Note:

I have covered Fusion Fuel Green PLC (NASDAQ:HTOO, NASDAQ:HTOOW) previously, so investors should view this as an update to my earlier articles on the company.

In the midst of the ESG hype three years ago, I considered Fusion Fuel Green PLC or “Fusion Fuel” the “Next Hydrogen Hype In The Making” but with the green hydrogen revolution not progressing as quickly as anticipated, investor enthusiasm for hydrogen and fuel cell stocks has cooled down quite meaningfully over the past two years with leading U.S. exchange-listed players like Plug Power (PLUG), Ballard Power (BLDP), FuelCell Energy (FCEL), Bloom Energy (BE) and Advent Technologies (ADN) all trading near multi-year lows.

Europe-based solar-powered electrolysis start-up Fusion Fuel Green PLC is no exception. While the company successfully exploited the ESG-hype to obtain a backdoor listing in late 2020, results have fallen well short of the company’s original business plan thus causing the share price to languish.

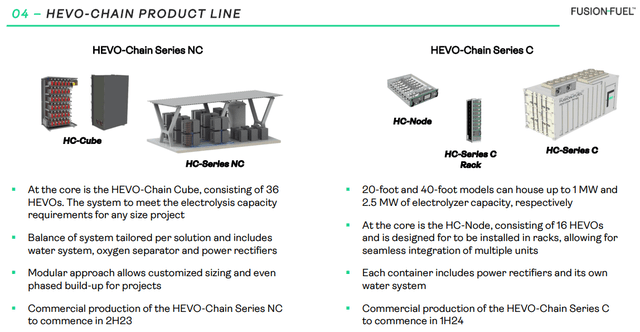

Company Presentation

Over the past two years, the company has spent all of the net proceeds from the de-SPAC transaction and related warrant exercises for covering operating losses and required investments in the business but until the end of 2022 failed to recognize any sales.

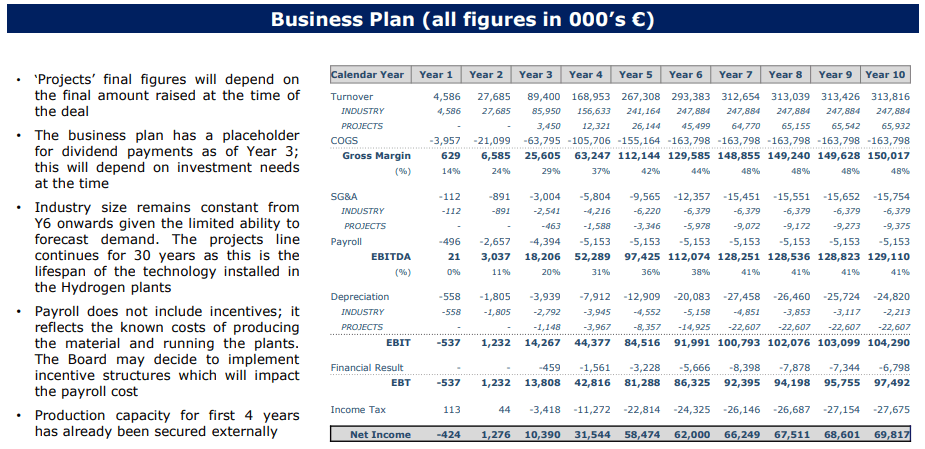

Keep in mind that Fusion Fuel’s original business plan forecasted revenues of €27.7 million and positive net income for 2022:

Company Presentation

With the company still mostly in development-stage mode and remaining liquidity depleting quickly, management had to resort to sales of newly issued common shares into the open market in order for Fusion Fuel to stay afloat.

Over the past year, the company has raised €6.1 million under its $30 million At the Market Issuance Sales Agreement (“ATM-Program”) with B. Riley Securities, Inc., Fearnley Securities Inc., and H.C. Wainwright & Co., LLC.

In addition, Fusion Fuel generated €7.5 million in net proceeds from the recent sale-and-leaseback of the company’s production facility in Benavente, Spain.

At the end of the first quarter, cash and cash equivalents amounted to just €5.8 million, down from €8.2 million at the end of 2022 despite an €2 million cash inflow from a short-term loan against the company’s outstanding VAT receivables which has been repaid subsequent to quarter end.

Please note that a meaningful part of the company’s remaining cash balance is restricted and can only be used for certain project-related expenditures.

Not surprisingly, the company’s recently filed annual report on form 20-F included a going concern warning:

As of December 31, 2022, the Group had €8.2 million of cash and cash equivalents, which included €2.9 million of restricted cash. This €2.9 million is deemed restricted as it can only be used on specific projects so is not readily available to be spent on selling, general and administrative expenses.

The Group expects to continue to incur net losses for the foreseeable future and is highly dependent on its ability to find additional sources of funding in the form of debt or equity financing to fund its planned operations.

The Group’s success depends on the profitable commercialization of its proprietary HEVO technology. There is no assurance that the Group will be successful in the profitable commercialization of its technology. These conditions raise significant doubt about the Group’s ability to continue as a going concern and therefore, to continue realizing their assets and discharging their liabilities in the normal course of business.

On Monday, Fusion Fuel reported disappointing first quarter results with immaterial revenues and sizeable cash burn.

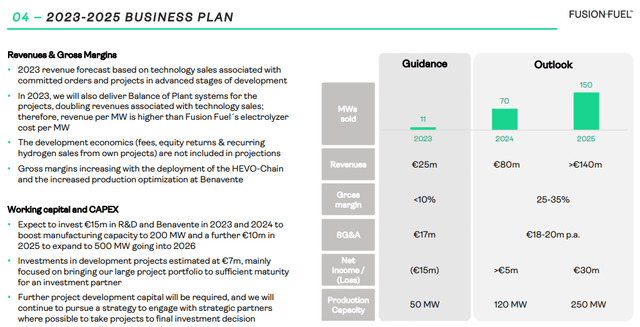

On the conference call, management affirmed the company’s recently issued outlook for both 2023 and 2024:

Company Presentation

Quite frankly, given Q1 sales of just €0.6 million, it’s difficult to envision Fusion Fuel achieving its ambitious full-year revenue target of €25 million, not to speak of the eye-catching €80 million projected for next year – particularly when considering the company’s history of overpromising and underdelivering.

Consequently, I would expect the company to also miss out on its stated goal of becoming “cash flow self-sufficient at some point in the second half of 2024“.

As stated on the conference call, Fusion Fuel is currently looking into ways to strengthen the company’s balance sheet but, unfortunately, management remained rather unspecific on this all-important issue:

(…) we’re currently looking into and investigating various capital areas where we can strengthen our balance sheet, multiple discussions with financial institutions based here in Europe and wider. As I mentioned as well, at the outset, we’ve invoiced three external clients so far in 2023. We want to continue that momentum as we push into the latter stages of Q2 and into Q3. And again, as I mentioned, we entered into a hydrogen purchase agreement as well with Dourogás and Hydrogen Ventures. So, we would look to use any inflows from those contracts to continue our CapEx, but it will be through a capital raising means as those discussions reach conclusion.

At least the company hasn’t utilized its ATM-Program so far in Q2 but I would expect any material funding agreement to be equity-linked which might result in some sort of toxic convertible debt transaction going forward.

Bottom Line

Like the vast majority of companies that managed to obtain a backdoor listing during the recent ESG hype, Fusion Fuel Green PLC has failed to execute upon its ambitious business plan.

Unfortunately, this has not stopped management from providing another set of highly aggressive short- and medium targets on the recent conference call which I would expect to be missed by a mile again.

With remaining liquidity depleting quickly and limited non-dilutive options to fund cash outflows from operations, I firmly expect any material funding agreement to be equity-linked.

Given the ugly combination of overly aggressive financial targets and high likelihood of additional near-term dilution, investors should avoid the shares or even consider selling existing positions.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.