Pan-European fund supervisor APS grew to become the primary institutional investor to straight purchase tokenized actual property belongings by means of MetaWealth’s blockchain-based funding platform, in keeping with an announcement shared with Cointelegraph.

APS, which manages over 12 billion euros ($13.7 billion) in belongings, bought 3 million euros ($3.4 million) in tokenized bonds tied to 2 Italian residential properties listed on MetaWealth: Fo.Ro Residing Rome and Porta Pamphili Rome. Every tranche was break up evenly at 1.5 million euros.

APS acquired the identical tokenized belongings which can be accessible to retail traders. The bonds had been transacted and recorded on the blockchain, which provides transparency and programmability to the method.

“Tokenisation represents a transformative shift in investing, providing elevated liquidity and streamlined transactions whereas sustaining compliance and safety,” stated Mihai Pop, a supervisor at APS.

Associated: Tokenized funds are scaling quick, hitting $5.7B — Moody’s

MetaWealth tokenizes Pan-European actual property

Based in 2023, MetaWealth tokenizes Pan-European actual property, enabling fractional possession and near-instant transfers of actual property tokens.

The platform has tokenized properties throughout Romania, Spain, Greece and Italy, facilitating over $50 million in tokenized transactions. Every token on MetaWealth represents fractional possession, permitting institutional and retail traders to commerce actual property stakes in seconds.

“The funding brings elevated belief to the house, an vital supply of liquidity to the ecosystem and elevated entry to real-world belongings for patrons and establishments alike,” MetaWealth CEO Amr Adawi stated.

MetaWealth stated it now ranks among the many prime 10 world real-world belongings (RWA) tokenization platforms, with customers from 23 nations.

Associated: VC Roundup: Twenty One traders inject $100M into BTC treasury, Bounce Crypto backs Securitize

Tokenization picks up velocity

There was a wave of curiosity in RWA tokenization, with main gamers from each conventional finance and crypto making headlines as of late.

On April 30, BlackRock filed to create a blockchain-based share class for its $150 billion Treasury Belief Fund, permitting a digital ledger to reflect investor possession. On the identical day, Libre revealed plans to tokenize $500 million in Telegram debt by way of its new Telegram Bond Fund.

On Could 1, MultiBank Group inked a $3 billion tokenization take care of UAE actual property agency MAG and blockchain supplier Mavryk.

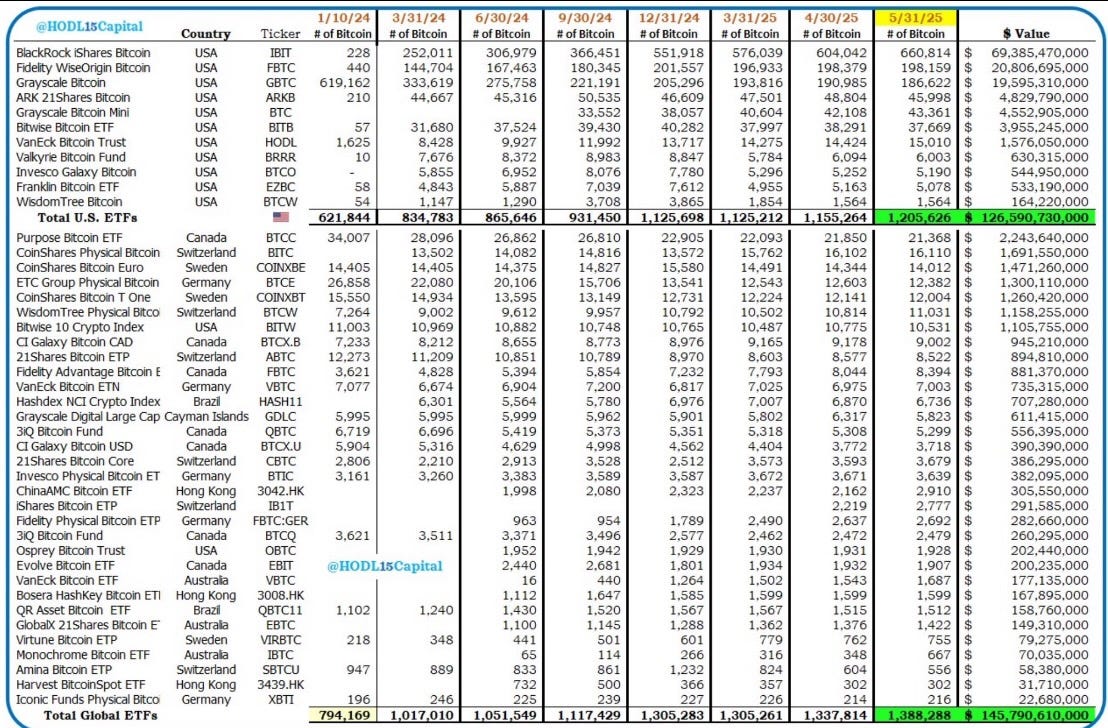

Journal: Child boomers price $79T are lastly getting on board with Bitcoin