When household and mates put him down for dreaming, Jack Kellogg stored learning.

He knew what was potential and was decided to keep it up.

He knew faculty wasn’t for him. However, he managed to save lots of $10K from his valet job. And he knew he wished to take a position that cash.

So proper out of highschool, he joined my buying and selling problem in 2017.

Early on, he nearly gave up after shedding one-third of his account in two days. However he discovered consistency by September.

Then, Jack pushed it tougher than any dealer I do know…

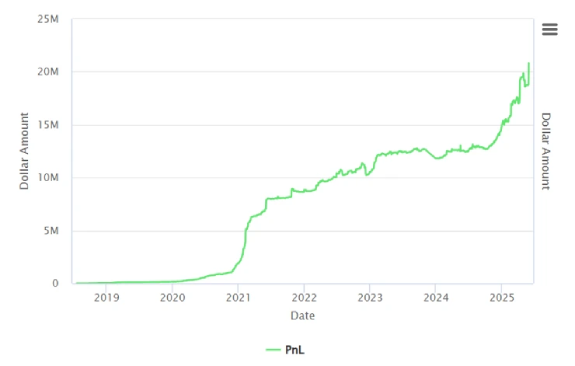

• 2020: Jack passes the $1 million milestone and closes the yr with $1.9 million in profession earnings.

• 2021: Jack has a $624K day, a $1.3 million week, and hits $8.6 million in profession earnings.

• 2022: Whereas the general market was down, Jack added $1.7 million to his total tally.

This yr, Jack crossed $20 million in buying and selling earnings (together with losses).

You may see Jack’s revenue chart beneath:

I’m not telling you this to brag. I’m exhibiting you that it’s potential. You probably have the suitable instruments…

Jack Kellogg is a dealer who epitomizes what dedication, self-discipline, and a well-developed buying and selling technique can obtain within the inventory market.

Discovering The Proper Shares

Jack and I aren’t geniuses.

We simply know which shares to commerce and the right way to commerce them.

For instance, right here’s why we determined to commerce a inventory named Cardio Diagnostics Holdings Inc. (CDIO).

The inventory was already on a multi-day run and it match our framework of what a scorching inventory ought to seem like:

• Low float: A low provide of shares helps the value spike larger when demand will increase. CDIO had 16 million shares within the float. That’s decently near our objective of 10 million shares or fewer.

• Sizzling sector: CDIO is a biotech inventory. And biotechs are scorching proper now.

• With information: The inventory acquired a notification that detailed it was vulnerable to delisting from the Nasdaq as a result of it was buying and selling underneath the minimal share-price requirement of $1. It was spiking to attempt to save itself from delisting.

My AI buying and selling bot — XGPT — is aware of precisely which shares to observe. And the right way to commerce them! (For extra particulars about how XGPT works, see right here.)

Check out the alert we acquired for CDIO:

CDIO chart multi-day, 1-minute candles.

There are plenty of shares that spike like this. We see new runners each week.

Our commerce patterns imply nothing if we’re watching the unsuitable shares.

Step one is to search out the inventory. Then …

The Patterns We Use

All of my millionaire college students use these patterns …

Risky shares prefer to comply with a selected framework as a result of persons are predictable throughout occasions of excessive stress.

Folks have all the time behaved equally once they’re pressured. And that most likely received’t change … ever.

It’s not rocket science. You simply want to realize sufficient expertise and put within the work to acknowledge these patterns in actual time.

And including an AI factor is a good way to up your buying and selling recreation.

As an alternative of ready for analyst upgrades, media noise, or lagging indicators…

It helps merchants such as you:

• Spot breakouts and development reversals early.

• Observe stream from big-money gamers.

• Simplify buying and selling with AI-enhanced scans and alerts.

Discover the suitable shares. Commerce the suitable patterns.

It’s an ideal one-two punch!

What do you consider Jack’s journey? Let me know at [email protected] and provides Jack the props he deserves!

Have a fantastic vacation!

Cheers,

Tim Sykes

Editor, Tim Sykes Each day