The Good Brigade

Real estate investing even on a very small scale, remains a tried-and-true means of building an individual’s cash flow and wealth. – Robert Kiyosaki

ETF Profile

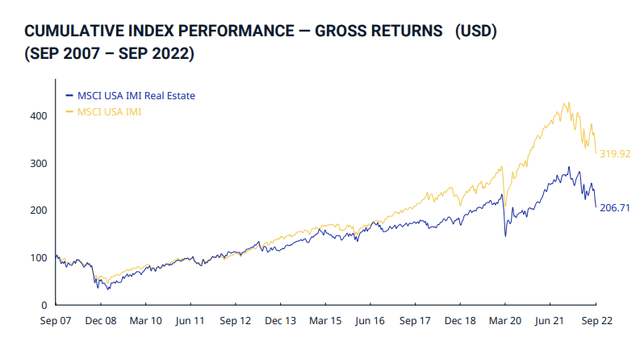

The Fidelity MSCI Real Estate ETF (NYSEARCA:FREL) is one of the cheapest (expense ratio of just 0.08%) ways to gain exposure to real estate stocks from the US. FREL tracks an index (the MSCI USA IMI Real Estate) that offers exposure to large, mid, and small-cap real estate stocks from the broad US equity universe. Since late 2013, US real estate has proven to be a very lucrative avenue for generating alpha with the index outperforming the diversified MSCI USA IMI by quite a wide margin.

FREL

If you’re thinking of pursuing this long-term wealth compounder here are a few things to note.

Factors To Note

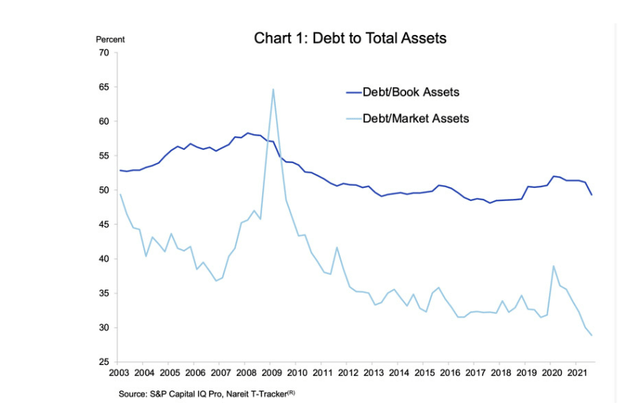

There’s no doubt that a higher interest rate regime could make things more challenging for REITs on account of higher borrowing costs and potentially lower value of properties, but I do wonder if some of those risks have been overstated when you consider that the financial picture looks a lot healthier than it did during the GFC.

Firstly, consider that these REITs don’t look as highly levered as they did back then; for instance, the debt-to-book assets ratio which stood at 60% in 2008/2009 has been less than 50% in recent periods. It is quite possible if these ratios were marked to market, some of the commercial properties may see a decline in value (thus boosting the debt/market assets ratio), but even then, I believe it won’t be anything close to what it was 13 years back.

NAREIT

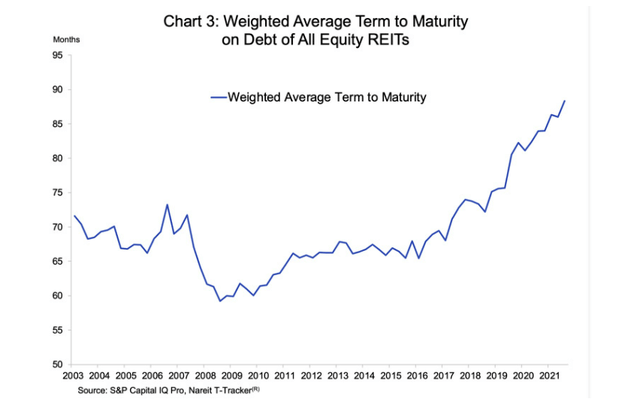

Crucially, compared to what we’ve seen back then – when the debt maturity profile was extremely short, of less than 5 years (in 2008) – a lot of these large REITs had locked in a lower fixed rate debt for a longer period (on a weighted average basis this works out to 88 months or over 7 years).

NAREIT

FREL is also dominated by large-caps (~73% of total holdings), and I think there are quite a few well-capitalized names, that are not hampered by excessive leverage, who could look upon the current environment to pick up assets on the cheap. I think the rising interest rate regime would likely have priced out a lot of smaller competitors who resort to M&A by taking on high leverage.

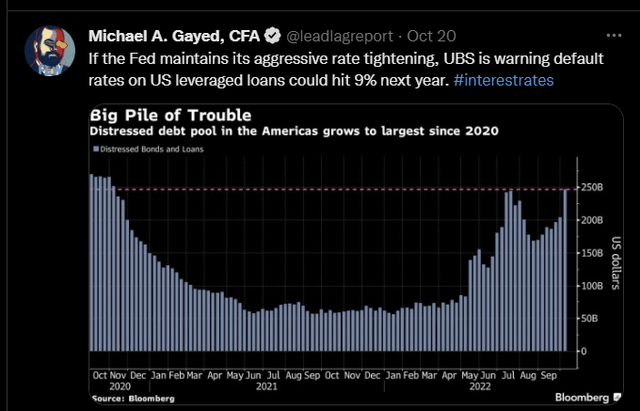

There is a competitive cohort that uses a high chunk of leveraged loans to finance their inorganic growth ambitions, but as noted in The Lead-Lag Report, default rates here look set to high double digits if the Fed keeps up its pace of tightening.

Twitter

Then, if you follow The Lead-Lag Report Twitter account, you’d note that a few days back I’d got into a discussion with a few investment professionals who are well-versed with the dividend income space. We also touched upon how bearish investors have been conditioned to be this year, so much so that they’ve been missing out on some interesting high-yielding options; Opportunities such as this don’t come along too often, and I suspect at these levels, a lot of FREL’s names could start attracting buyer interest.

For instance, consider how attractive some of FREL’s largest holdings look from a yield angle; 7 out of the top 10 names are all trading at superior yields relative to their long-term averages, and on average, the top-10 names offer yields that are 30bps higher than the historical average.

Div yield-Current | Div yield- 5Yr Average | Difference | |

American Tower Corp | 2.91% | 1.86% | 1.05% |

Prologis Inc | 2.77% | 2.38% | 0.39% |

Crown Castle Inc | 4.65% | 3.26% | 1.39% |

Equinix Inc | 2.19% | 1.74% | 0.45% |

Public Storage | 2.67% | 3.34% | -0.67% |

Realty Income Corp | 4.88% | 4.41% | 0.47% |

SBA Communications Corp | 1.06% | 0.70% | 0.36% |

Simon Property Group Inc | 6.38% | 6.15% | 0.23% |

Welltower OP LLC | 4.04% | 4.45% | -0.41% |

VICI Properties Inc Ordinary Shares | 4.78% | 4.95% | -0.17% |

Average | 3.63% | 3.32% | 0.31% |

Source: YCharts

That isn’t to say that I’m super bullish on the REIT front. I believe there are some structural changes taking place in some commercial pockets and stakeholders are still readjusting to a new reality. My guest- Preston Pesek spoke about this at length in a conversation on the Lead-Lag Live platform. Previously loans to the sector were being underwritten when lease tenures were a lot longer, but it is questionable if lease tenures will be at the same level going forward considering a growing cohort of transient workers which in turn makes the revenue base a lot more unpredictable. Property cap rates will need to be re-adjusted to account for this new paradigm.

Twitter

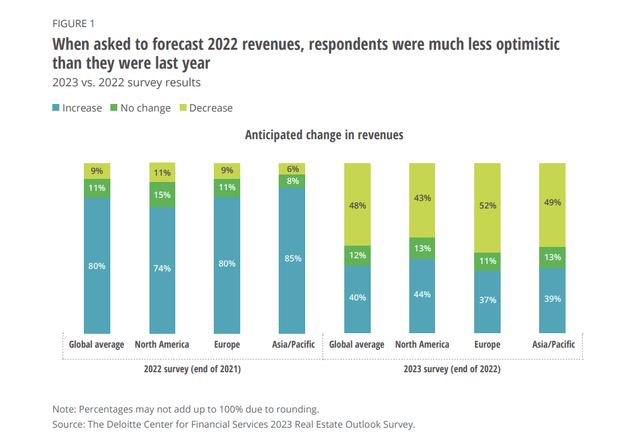

In keeping with what I’ve just said, I also found it quite interesting that global real estate stakeholders who took part in Deloitte’s 2023 survey didn’t sound too optimistic about their revenue prospects for 2023. At the end of last year, almost 80% of respondents across the globe were expecting an increase in revenues; now that figure is just down to 40%!

Deloitte

Conclusion

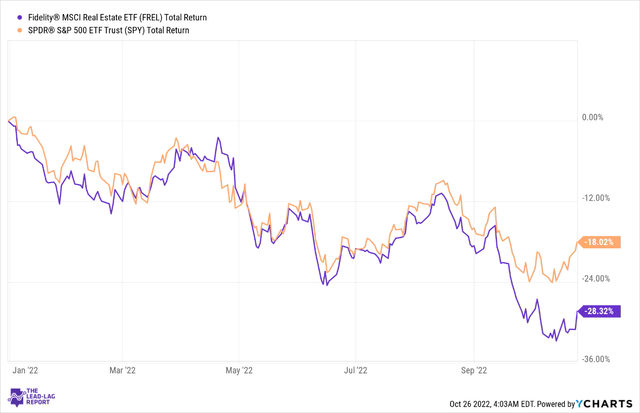

YCharts

This year, FREL has lagged the S&P500 by roughly ~1.6x, and as noted in the ‘Leaders-Laggers’ section of my paywalled research, a ratio measuring real estate stocks to the S&P500 has now almost dropped to the lows last seen in 2021. With earnings season back in business, we could see instances where a lot of these companies come out with numbers that exceed what are already low expectations.

Twitter

Besides, if you’ve been watching my tweets on the timeline of The Lead-Lag Report, you’d note that I’ve been suggesting that a melt-up scenario could take shape, and take some of the beaten-down names higher (for the uninitiated, the melt-up signals I follow typically hold for 4-6 weeks). Given the weakness seen this year, FREL may be one of the prime contenders to benefit from a concentrated surge.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.