hapabapa

Fortinet (NASDAQ:FTNT) is a TechStockPros favorite in the cybersecurity space. We’re bullish on Fortinet as we believe the company’s position in cybersecurity makes it relatively resilient to market downtrends. We expect to benefit from the rising demand for security and networking products. The cybersecurity market soared during the pandemic, and we believe it’s one of the few tech spaces that continues to grow in the post-pandemic environment. Cybersecurity spending is still at the forefront of IT spending priorities, even during macroeconomic headwinds, with the cybersecurity industry forecasted to grow at a CAGR of 10.92% between 2022-2027.

We already know Fortinet is taking advantage of the demand tailwinds in the cybersecurity space, with the stock growing 210% since the pandemic began in March 2020. We believe Fortinet has retained its pandemic catalyst of remote and hybrid work environments. We expect the pandemic-incited remote-hybrid work style and the company’s position in Unified Threat Management (UTM) to drive revenue growth going forward. We believe the stock is a safe haven for investors even during market volatility and recommend investors buy the stock at current levels.

Relatively recession-resilient

Fortinet operates within the fastest-growing segment of security services: cybersecurity. We expect to see more companies and enterprises increasing their IT spending on cybersecurity as the world becomes an increasingly digitalized place. The pandemic kick-started global digitalization of workforces, normalizing remote and hybrid work environments. Naturally, the rate of global cyber-attacks has increased alongside global digitalization. Gartner reported that global cyber attacks increased by 28% in 3Q22 compared to the same period in 2021. Today, data is currency; hence, cyber security is increasingly becoming a spending priority, even during market downtrends. We’re already seeing the demand tailwinds of the post-pandemic environment in Fortinet’s earnings, with the most recent 3Q22 quarter reporting revenue growth of 32.6% Y/Y.

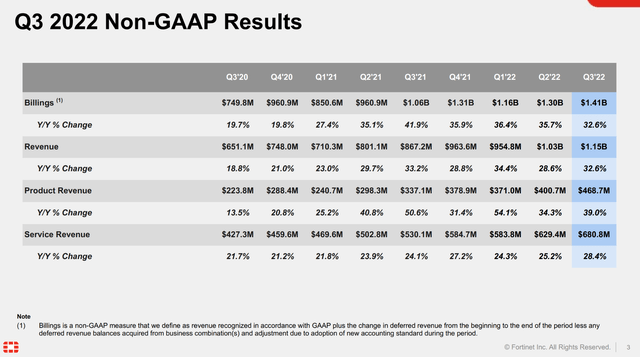

The following table outlines Fortinet’s 3Q22 earning results.

FTNT

We expect Fortinet to benefit from more and more organizations focusing on cybersecurity spending. According to an Enterprise Strategy Group study, 69% of organizations prioritize cybersecurity spending in 2022 over the cloud, artificial intelligence (AI), digital transformation, and application development. Our bullish sentiment on Fortinet is based on the company’s position within the larger global adoption of cybersecurity products and services. We recommend Fortinet as a buy for investors interested in a safe haven with major demand tailwinds during market downtrends.

Cybersecurity status quo won’t do

Cybersecurity can’t stay still – the industry’s nature requires constant updates. We believe Fortinet is up to the challenge. We expect Fortinet’s position in the security space and continued delivery of mission-critical solutions will enable it to retain and grow its position in the cybersecurity space.

We’re specifically constructive on the company’s Software-Defined Wide Area Network (SD-WAN) solutions that connect and extend enterprise networks over large geographical distances. We expect the SD-WAN is a signifier of Fortinet’s adoption to the post-pandemic environment and the increased nature of remote hiring. We expect SD-WAN to serve as a long-term growth driver for Fortinet. Futuriom, a research firm, expects SD-WAN tools to grow at a CAGR of 34% between 2021-2023. We’re also excited to see how the company’s newly launched managed cloud-native firewall service pans out. This service will simplify network security operations and be available on Amazon’s (AMZN) AWS. We believe Fortinet will continue expanding its customer base and adapting to the new cybersecurity requirements.

Risks to our buy-thesis

Fortinet is not without risks. Cybersecurity stocks have gone through some ups and downs over the past week after cybersecurity company, CrowdStrike (CRWD) reported a disappointing revenue forecast, blaming it on “increased macroeconomic headwinds.” CrowdStrike’s announcement sent cybersecurity peers lower in post-market trading, including Zscaler Inc. (ZS), SentinelOne Inc. (S), and Palo Alto Networks Inc. (PANW). We’re not too worried about CrowdStrike’s lower guidance because we expect the cybersecurity space is relatively resilient to market downtrends. We don’t believe Fortinet is not immune to macroeconomic headwinds but expect any negatives won’t be long-lived.

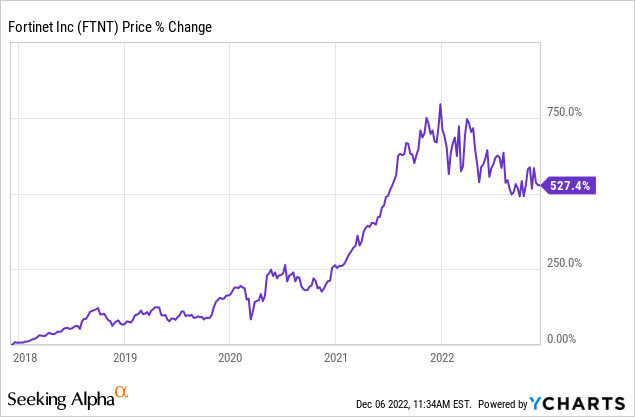

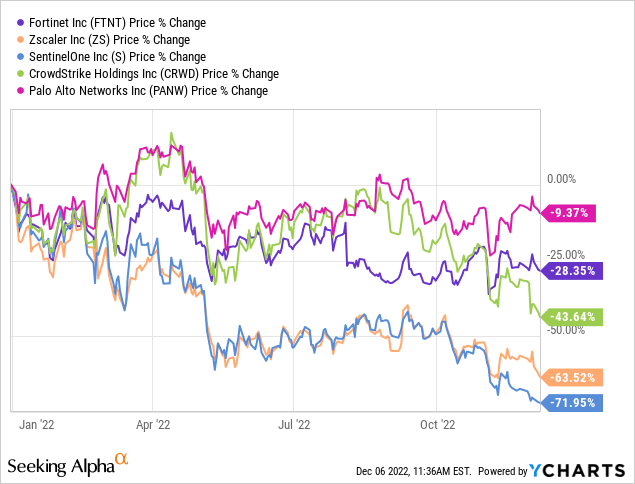

FTNT Stock performance

Fortinet stock is up an impressive 511% over the past five years. The stock soared since the pandemic’s beginning, growing over 200% since March 2020. YTD, the stock is down nearly 28% alongside the peer group due to macroeconomic headwinds. The competition also finds itself in the negatives YTD, with Palo Alto Networks dropping around 9%, Zscaler 64%, CrowdStrike around 44%, and SentinelOne Inc 72%. We believe the macroeconomic headwinds won’t be long-lived as cybersecurity remains recession-resilient and as Fortinet introduces new growth drivers to boost bottom and top-line growth.

The following graph outlines FTNT’s five-year and YTD performance along the cybersecurity peer group.

TechStockPros

TechStockPros

Valuation

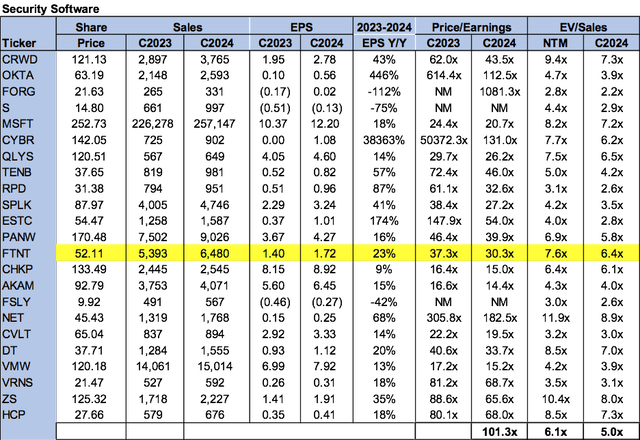

Fortinet is relatively cheap, trading at 30.3x C2024 EPS $1.72 on a P/E basis, compared to the peer group average of 101.3x. The stock is trading at 6.4x EV/C2024 Sales versus the peer group average of 5.0x. We expect revenue growth in 2023 from increased IT spending on cybersecurity. We recommend investors buy the stock before it rallies.

The following table outlines FTNT’s valuation compared to the peer group.

TechStockPros

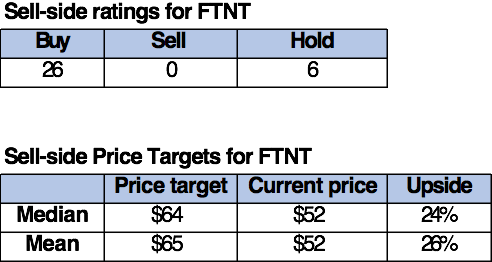

Word on Wall Street

Wall Street shares our bullish sentiment on the stock. Of the 32 analysts covering the stock, 26 are buy-rated, and the remaining are hold-rated. The stock is currently priced at $52. The median sell-side price target is $64, while the mean is $65, with a potential 24-26% upside.

The following table outlines FTNT’s sell-side ratings and price targets.

TechStockPros

What to do with the stock

We expect Fortinet to grow significantly as cybersecurity budgets increase. We believe the company will enjoy demand tailwinds as the world has become more accustomed to remote-hybrid work environments post-pandemic. We like Fortinet’s position in cybersecurity specifically as it introduces new growth drivers, namely the SD-WAN. We believe the stock is relatively cheap and recommend investors buy the stock at current levels.