Jetlinerimages

I’m at present increasing my airport protection. Beforehand, my protection primarily included Mexican airports, and I’m at present increasing that with airports positioned in different elements of the world comparable to Europe. On this report, I shall be discussing the funding angle for Flughafen Zürich (OTCPK:FLGZY, OTCPK:UZAPF). Since that is the primary time I cowl Flughafen Zürich, I may even be offering an outline of the corporate.

Flughafen Zürich Is Attractively Diversified

Flughafen Zürich

The next texts present a compact description of the actions of Flughafen Zürich sources from my inventory screener:

Flughafen Zurich AG is a Switzerland-based firm that’s engaged within the operation of Zurich Airport in Switzerland on behalf of the federal authorities. The Firm provides entry to worldwide, nationwide and regional transport networks. The Firm operates in 4 segments: the Aviation flight operations section encompasses the development, operation and upkeep of the airport working infrastructure; the Aviation safety section covers the set up, operation and upkeep of safety infrastructure and all processes of direct relevance to safety, which incorporates all methods and their operation and upkeep designed to stop actions of any type that have an effect on the safety of business civil aviation; the Non-aviation section encompasses all actions regarding the event, advertising and marketing and operation of the business infrastructure at Zurich Airport, and the Aviation plane noise section.

Flughafen Zürich

Essential to notice is that that Zurich Airport, which dealt with 28.9 million passengers in 2023, shouldn’t be the one airport that’s a part of the corporate’s portfolio. The corporate additionally operates the airports of Florianópolis, Vitória and Macaé in Brazil with a mixed passenger move of seven.5 million passengers and the airports of Antofagasta and Iquique in Chile with 4.2 million passengers. Moreover, the corporate added the airport of Natal in Brazil to its portfolio earlier this yr and Noida Worldwide Airport, which can have a totally operational capability of 70 million passengers will really grow to be the principle gem of the group and can begin operations in April 2025. Moreover, the corporate holds minority stakes within the airports of Bela Horizonte and Bogotá (via a service settlement). So Flughafen Zurich AG, is greater than the airport of Zürich.

Flughafen Zürich Is Nonetheless In Restoration Mode

Flughafen Zürich

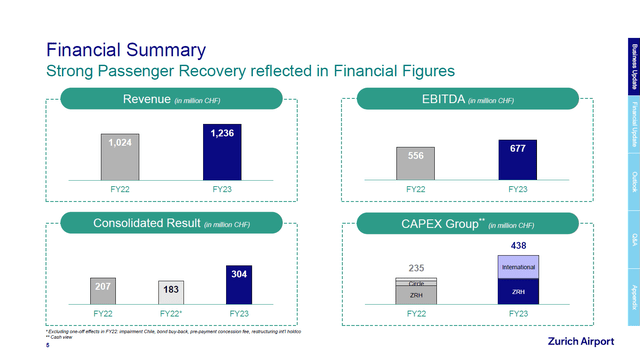

The corporate solely studies H1 and full-year earnings, so the newest earnings accessible are the FY2023 earnings. Revenues grew 20.7% to 1.2 billion CHF whereas EBITDA grew 21.7% to 677 million CHF. Passenger numbers at Zürich elevated 28% and have been 92% recovered in comparison with pre-pandemic. In Brazil, passenger numbers grew 13%, however total passenger numbers are nonetheless down in comparison with pre-pandemic with 4% decrease home passenger numbers and 10% decrease worldwide visitors. In Chile, passenger numbers grew 14% consisting of 14% home progress and 40% worldwide progress. Home visitors for the airports in Chile now exceed prep-pandemic ranges by 2%, however worldwide visitors stays 12% under pre-pandemic volumes. General, passenger visitors progress was increased than income progress and the visitors progress from and to Zürich was additionally decrease than the worldwide market progress. So, you can say that there’s a little bit of strain on charges to Zürich Airport engaging. Nevertheless, we even have to notice that there was a 28% enhance in passenger numbers and a 14% enhance in plane actions. A part of the revenues are a perform of plane actions and progress in that space was not in keeping with passenger progress as load components have been increased. On a constructive notice, EBITDA exceeded pre-pandemic figures by 5.4% on 2.1% increased revenues.

What Are The Dangers For Flughafen Zürich?

The principle dangers I see for the corporate are any delay to the opening of Noida Airport, which is at present scheduled for April 2025. Any slip within the opening of that airport might imply extra value progress and delays to the earnings that the corporate would harvest from its actions in India. Moreover, it seems just like the market grew a bit sooner than passenger move for Zürich grew, so world competitors on connectivity may be a danger.

What Are The Development Drivers For Flughafen Zürich?

Whereas there are dangers, there are some progress drivers as effectively that make the corporate engaging. The airport in Noida is a phased growth that might attain 70 million passengers, however in its first section the capability is way smaller at 12 million passengers however on condition that the airport in Zurich processed 28.9 million passengers in 2023, including 12 million passengers by 2025 or perhaps a third of that’s important. Moreover, the operations in Natal are actually a part of the corporate’s operations and total we aren’t in progress mode in comparison with pre-pandemic. To me that is a sign the year-on-year progress needs to be fairly protected on condition that it’s nonetheless a part of the restoration. For 2024, increased earnings are anticipated on 95% restoration whereas full restoration is predicted by 2025 for the airport of Zurich and from 2026 onward it will likely be in progress mode with 2 to three % passenger progress anticipated.

Flughafen Zürich Presents Worth To Traders

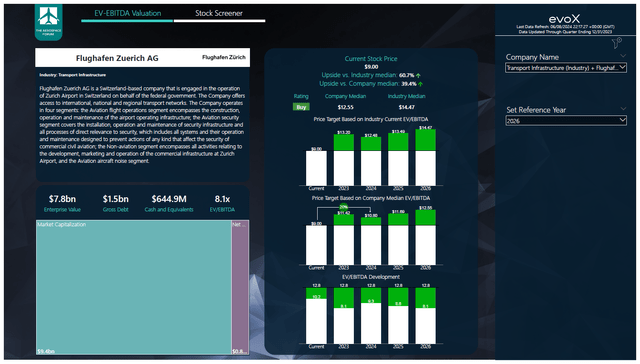

The Aerospace Discussion board

I consider that Flughafen Zürich provides potential to buyers. Towards the median EV/EBITDA for the corporate, we see 20% upside to $10.80 based mostly on implementing the newest steadiness sheet information and projections into our inventory screener. We additionally notice that the corporate trades at a reduction to friends. Whereas I do consider that the ought to commerce extra in keeping with its firm median than with friends, the truth that the inventory trades at a reduction to friends gives some extra shielding.

How To Make investments In Flughafen Zürich?

There are a number of methods to spend money on Flughafen Zürich. The primary one is through its FLGZY ticker. That ticker has ample quantity, however buyers must take into account that FLGZY represents 0.04 peculiar shares or in different phrases the ratio is 25 which means you could personal 25 FLGZY shares to signify one peculiar share. The second choice is UZAPF, which represents the peculiar share traded OTC. This ticker, nonetheless, has little to no quantity which means that purchasing and promoting and shopping for and promoting at desired costs is likely to be difficult. Due to this fact, my desired option to spend money on the corporate could be on its dwelling itemizing in Switzerland underneath the ticker FHZN.S which has ample quantity.

Conclusion: Flughafen Zürich Inventory Is Price Your Consideration

Flughafen Zürich isn’t just the airport of Zürich and I take into account {that a} good factor. You get the Zürich Airport because the gem of the corporate to spend money on plus some publicity to Latin America and the airport that may open in India in 2025 might be the following massive factor for Flughafen Zürich. Due to this fact, I’m initiating protection for Flughafen Zürich with a purchase score.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please pay attention to the dangers related to these shares.