As we mark 5 years because the onset of the COVID-19 pandemic, many headlines trumpet the resilience of the US financial system: unemployment is low, GDP has returned to development, and markets have rebounded. However beneath the surface-level indicators lies a extra difficult and sobering image.

An in depth examination of key financial metrics reveals that in a number of vital areas, the US financial system has not absolutely recovered from the results of each the virus and the extraordinary authorities interventions it prompted. Regardless of warnings from economists and coverage consultants in 2020, the nation carried out sweeping lockdowns, enterprise closures, and financial and monetary expansions at a scale by no means seen earlier than. These efforts have been typically framed as a essential tradeoff between public well being and financial output — a false dichotomy that ignored the long-run consequence of suppressing financial exercise at such an enormous scale.

At the moment, the prices of these tradeoffs are nonetheless being paid, and the total worth will not be identified for years to return.

(All photos sourced from Bloomberg Finance, LP)

1. US Producers New Orders for Nondefense Capital Items Excluding Plane (Convention Board)

One key indicator is the Convention Board’s New Orders for Nondefense Capital Items Excluding Plane, which serves as a proxy for enterprise funding in gear and sturdy inputs. From 2015 by means of early 2020, the metric confirmed regular development, signaling sturdy confidence and ongoing capital formation. However within the wake of pandemic disruptions, new orders plummeted. Though restoration started in 2021 and was supported by traditionally low rates of interest, the metric stays beneath its pre-pandemic trajectory. As of March 2025, a slight month-over-month decline (-0.1 % ) means that corporations stay cautious about long-term funding. The uneven rebound indicators lingering uncertainty within the enterprise atmosphere and will level to structural issues like reshoring, labor shortages, or geopolitical threat.

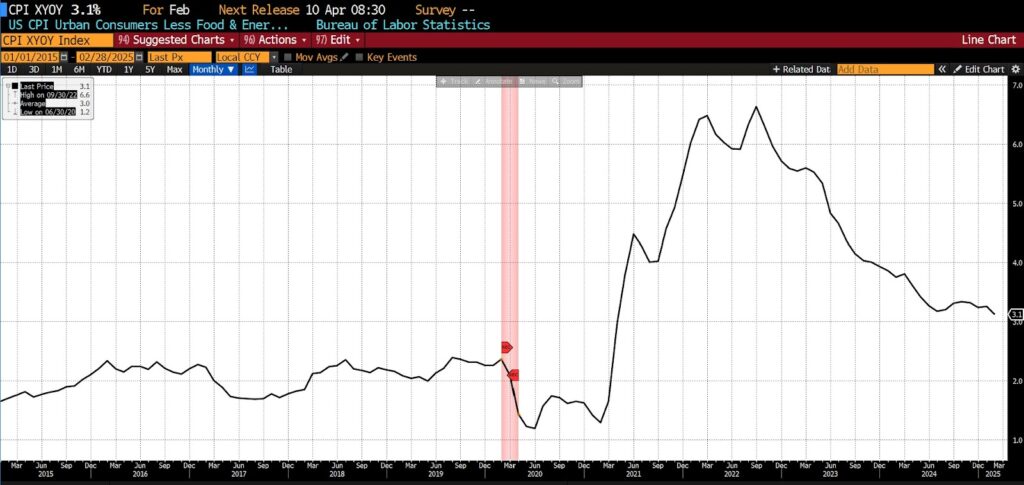

2. US CPI Ex Meals & Vitality, 12 months-Over-12 months (US Bureau of Labor Statistics)

Core CPI, which strips out unstable meals and power costs to supply a clearer image of underlying inflation, remained steady at round 2 % from 2015 to early 2020. However pandemic-era insurance policies — together with trillions in federal stimulus and extended provide chain disruptions — led to a surge in worth development. Core inflation peaked in 2022 and has cooled since, however as of early 2025, it stays elevated at roughly 3.1 % year-over-year. This persistent inflation has eroded shopper buying energy, significantly for middle- and lower-income households. It additionally complicates the Federal Reserve’s means to ease financial coverage, probably dampening future development.

3. Convention Board Client Client Confidence Current Scenario (Convention Board)

Client confidence, as measured by the Convention Board’s Current Scenario Index, affords perception into how People understand present financial circumstances. Between 2015 and early 2020, shopper sentiment was buoyant, pushed by low unemployment and robust revenue development. The pandemic triggered a steep drop, and whereas confidence has partially rebounded, it has not returned to prior highs. In 2025, many households stay cautious amid ongoing issues over inflation, rates of interest, and job safety. This hesitancy is mirrored in cautious spending patterns and a reluctance to tackle new debt, each of which may suppress future financial dynamism.

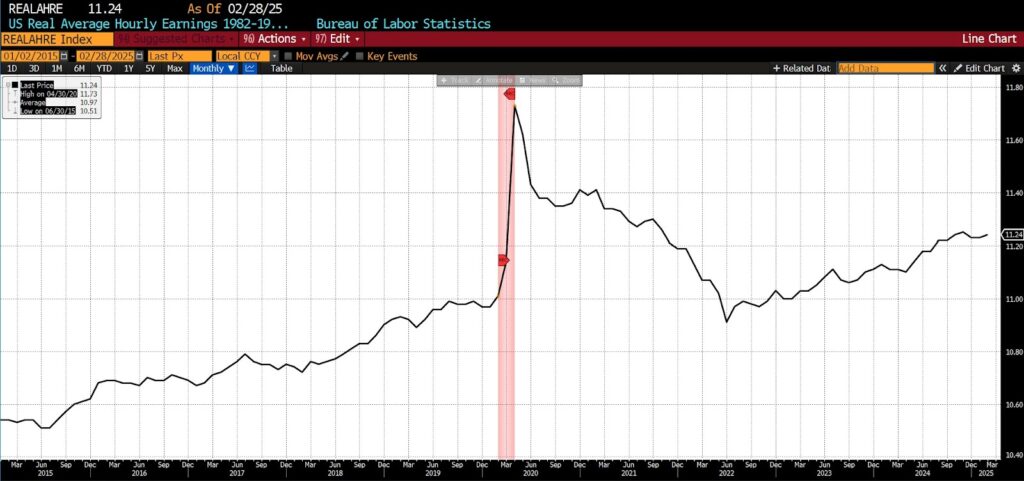

4. Actual Common Hourly Earnings (1982–1984 {Dollars}, Seasonally Adjusted) (US Bureau of Labor Statistics)

Actual common hourly earnings (adjusted to 1982-1984 {dollars}) current a combined image. From 2015 to 2020, actual wages rose modestly according to productiveness beneficial properties and low inflation. In 2020, as lower-wage employees have been disproportionately affected by job losses, common actual wages appeared to extend quickly. However subsequent inflation worn out these beneficial properties. By 2025, actual wages have solely barely improved relative to pre-pandemic ranges, indicating that nominal wage will increase haven’t saved tempo with the price of dwelling. This stagnation undermines family monetary resilience and locations better strain on public help packages.

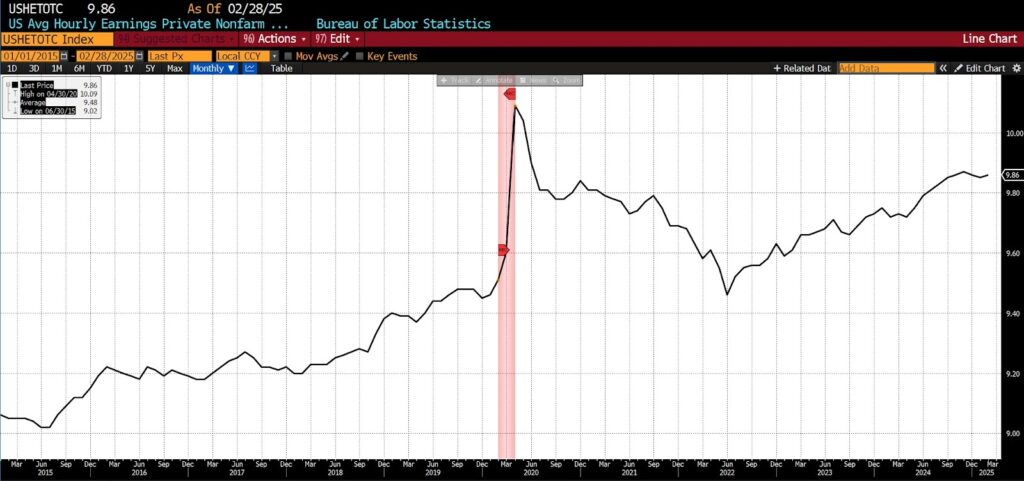

5. US Common Hourly Earnings Personal Nonfarm Payrolls (1982 {Dollars}) (US Bureau of Labor Statistics)

Equally, actual common hourly earnings within the non-public nonfarm sector have struggled to regain momentum. Previous to 2020, regular beneficial properties mirrored a aggressive labor market and wholesome financial fundamentals. Put up-pandemic, nonetheless, wage development has been neutralized by rising costs, leaving many employees with stagnant or declining actual incomes. Whereas some sectors — reminiscent of tech and logistics — have fared higher, a lot of the workforce stays in a holding sample. This weak earnings restoration impacts not simply consumption but additionally financial savings, funding, and general high quality of life.

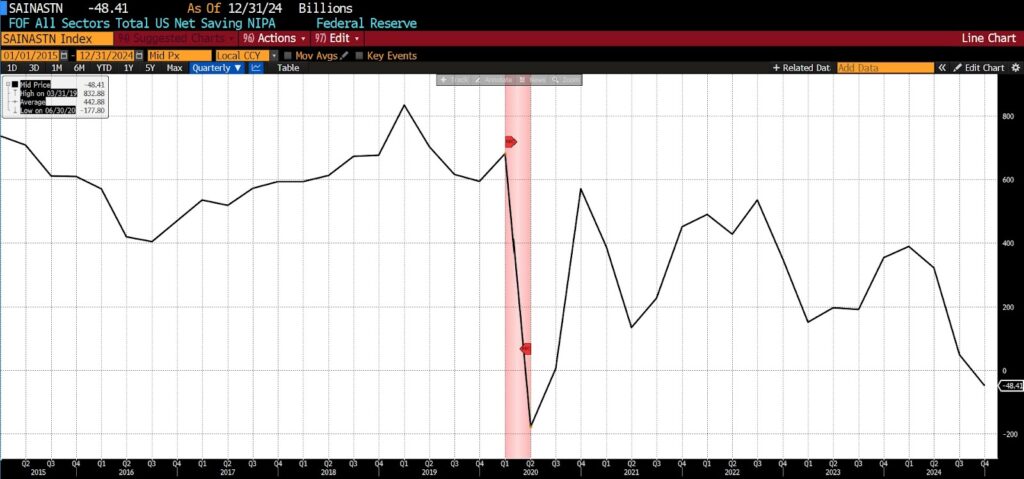

6. Whole Internet US Saving, All Sectors (Stream of Funds, NIPA) (US Bureau of Financial Evaluation)

Internet saving throughout all sectors, as measured by the Stream of Funds accounts, confirmed steadiness within the years main as much as the pandemic. In 2020, authorities transfers and decreased consumption pushed family financial savings to report highs. However that was a brief artifact. As of 2025, web saving has returned to development and even fallen beneath it, as households grapple with increased dwelling prices and diminished buying energy. This reversal undermines long-term capital accumulation and leaves households extra uncovered to financial shocks.

7. US Employment-Inhabitants Ratio, Whole Labor Pressure (Seasonally and Not Seasonally Adjusted) (US Bureau of Labor Statistics)

The employment-population ratio affords a broad view of labor market well being. From 2015 to 2020, it trended upward, reflecting sturdy employment beneficial properties throughout most demographics. The ratio collapsed in early 2020 as a consequence of mass layoffs and enterprise shutdowns and has not absolutely recovered even 5 years later. Persistent shortfalls may be attributed to early retirements, long-term sickness, childcare challenges, and shifting labor pressure preferences. A decrease employment-population ratio means fewer employees supporting rising pool of retirees, with implications for productiveness, tax revenues, social program solvency, and financial development as a complete.

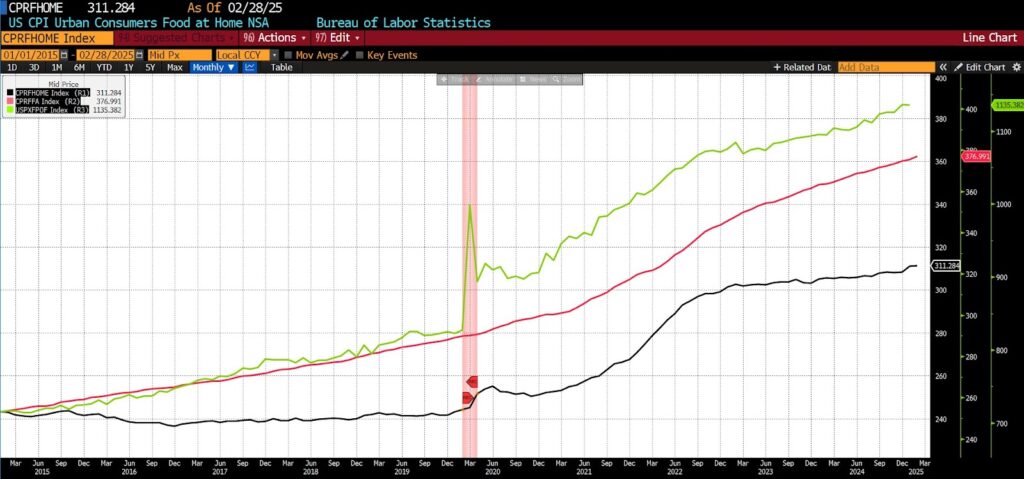

8. Meals Worth Indexes (Varied Measures, US Bureau of Labor Statistics / USDA)

Meals costs remained comparatively steady for many years, with annual will increase carefully monitoring common inflation. Nevertheless, the mix of extraordinary fiscal and financial growth, world provide chain breakdowns, and labor dislocations in the course of the pandemic triggered a pointy and sustained rise in meals prices. Starting in late 2020 and accelerating by means of 2022, meals costs adopted a basic “hockey stick” sample, with steeper will increase in staples reminiscent of meat, dairy, and grains. By 2025, though the speed of enhance has moderated, costs stay considerably above pre-pandemic ranges. For American households — significantly these with fastened or low incomes — this has created lasting strain on family budgets and elevated meals insecurity throughout communities.

9. Median Inflation Expectations (One-, Three-, and 5-12 months Horizons) (Federal Reserve Financial institution of New York)

Inflation expectations are vital to financial decision-making, influencing wage negotiations, shopper spending, and enterprise funding. Earlier than the pandemic, one-, three-, and five-year inflation expectations have been usually steady. Since 2020, nonetheless, these expectations haven’t solely risen however develop into considerably extra unstable. This shift displays the uncertainty launched by each the preliminary inflation spike and the coverage responses that adopted. Elevated and unstable inflation expectations enhance the chance premium on funding, discourage long-term contracting, and diminish actual wealth as households alter their conduct to hedge in opposition to future worth instability. For policymakers, regaining credibility round inflation concentrating on is now a central problem.

10. Housing Affordability Index, First-Time Consumers (Nationwide Affiliation of Realtors)

A mix of things, together with a flight from city facilities facilitated by traditionally low rates of interest and restricted stock drove residence costs to unprecedented ranges, particularly in suburban and rural areas. Because of this, first-time consumers — who typically lack important financial savings — have, because the pandemic, been priced out of the market at historic ranges. Massively expansionary Fed insurance policies additionally drove asset costs, which embody residence costs, up a lot sooner than wages. Fiscal stimulus packages supposed to mitigate financial harm inadvertently fueled demand for housing, intensifying rising worth will increase. These dynamics, coupled with ongoing provide chain points and delays in new housing building, have deepened the affordability hole to report lows (since 1986), inserting homeownership more and more out of attain of many aspiring consumers.

Taken collectively, the post-COVID developments in these financial phenomena clarify that whereas some headline figures paint a rosy image, the US financial system stays structurally altered by the occasions of 2020. Pandemic-era insurance policies, ostensibly aimed toward preserving lives and livelihoods, imposed immense prices on financial exercise, a few of which have been foreseeable and avoidable. By presenting the disaster as a binary alternative between public well being and financial output, policymakers created a story that uncared for the potential of extra balanced, focused interventions. And now, 5 years later, the financial system bears the load of these choices. The implications — misplaced earnings, decreased funding, lingering inflation, and decrease labor pressure engagement — are nonetheless unfolding. As we glance forward, it’s essential to know that the value of these tradeoffs is just not solely huge, however nonetheless rising and might be paid in methods each seen and hidden for a few years to return.