LumerB

First Citizens BancShares, Inc. (NASDAQ:FCNCA) has decided to acquire SVB Financial Group’s (SIVB) debt portfolio in an attempt to bolster its high-yield asset base. Based on the initial market reaction, the deal seems compelling; however, in today’s analysis, we argue that the temporary spike was overblown and has placed First Citizens’ stock in an “overhyped” category.

Let us discuss a few of the salient features relating to First Citizens and its latest acquisition of SVB’s debt portfolio.

Deal Structure

First Citizens has agreed to acquire SVB’s loans and deposits for $72 billion at a discount worth 23% from the Federal Deposits Insurance Corporation. As part of the deal, the FDIC will receive $500 million in First Citizens’ stock appreciation rights. The latter is a performance-based compensation method, which is commonly used by a firm’s internal management (think of it as cash-based stock options). In addition, the FDIC has entered into a loss-share agreement with First Citizens, protecting the bank against tail risk pertaining to its commercial credit portfolio.

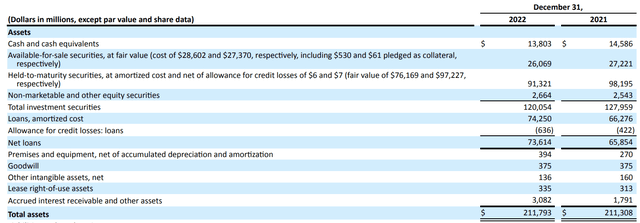

At face value, this deal looks good. The first factor that catches the eye is that approximately 75% of SVB’s assets are/were classified as held-to-maturity, meaning they are valued at amortized cost. Therefore, a discount on assets with nearly negligible price risk seems lucrative.

Furthermore, nearly 22% of SVB’s assets are/were classified as held-for-sale, meaning they are valued at lower of cost or carrying value. These assets lost value during the past year; however, unlike many long-life assets, HFS securities can be marked up once a debt market recovery has materialized.

SVB Asset Base (SVB 10-K)

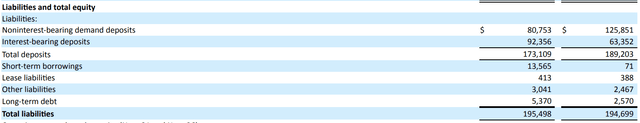

As briefly discussed in our most recent analysis of The Goldman Sachs Group, Inc. (GS), SVB’s collapse derived from a severe drawdown in deposits. Much of the drag on SVB’s deposits was due to depositors’ concerns about the waning economy and the potential effect on SVB’s business model, which was to raise capital from and fund high-risk businesses.

Although First Citizens will inherit a nearly identical balance sheet, the acquisition is synergetic, meaning that the integration of First Citizens’ liquidity and the FDIC’s credit protection commitment will likely enhance the risk-adjusted return prospects of the inherited balance sheet.

SVB Liabilities (SVB 10-K)

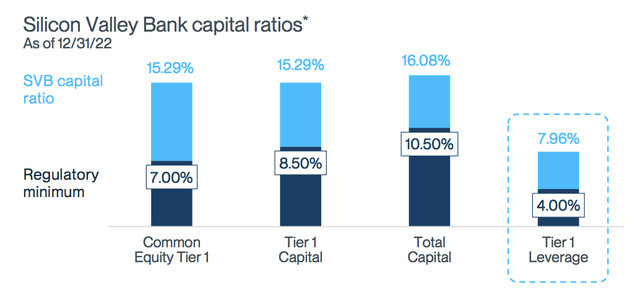

Two final factors to mention are the volatility of the balance sheet’s risk-weighted capital ratios and the absence of non-debt securities. The latter refers to the fact that a portion of the asset base needs to be adjusted to remove non-debt securities. In contrast, the prior refers to the implications that SVB’s Venture Capital Debt business model provides to capital adequacy ratios.

Capital adequacy ratios are measures of a bank’s assets relative to various tiers of financial assets. As displayed below, these ratios were extremely volatile under SVB due to its reliance on venture funding; therefore, the question becomes: will this group of assets deteriorate First Citizens’ future stress test results?

RWA (SVB )

First Citizens’ Adjusted Asset Base

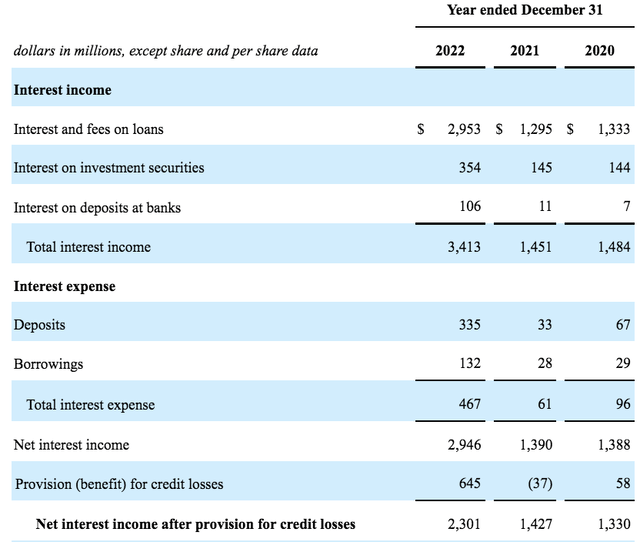

First Citizens BancShares’ income statement conveys its reliance on interest-based activities. As expected, rising interest rates in 2022 and early 2023 increased the bank’s net income.

However, credit must be given to idiosyncratic features such as the bank’s ability to keep its provisions for loan losses and costs of deposits low. What many analysts neglect is that rising interest rates are not always beneficial to banks because their cost of funding and loan default rates tend to exacerbate; therefore, managerial prowess is required to ensure positive net income.

Will SVB’s asset base enhance First Citizens’ income statement? In isolation, the base will likely increase gross interest income but add to provisions for loan losses; however, depositor rates are not likely to climb too much. Therefore, we believe the acquisition will add to the net income in the current interest rate environment, with First Citizens’ probable lower cost of financing (compared to SVB) being the catalyst.

First Citizens 10-K

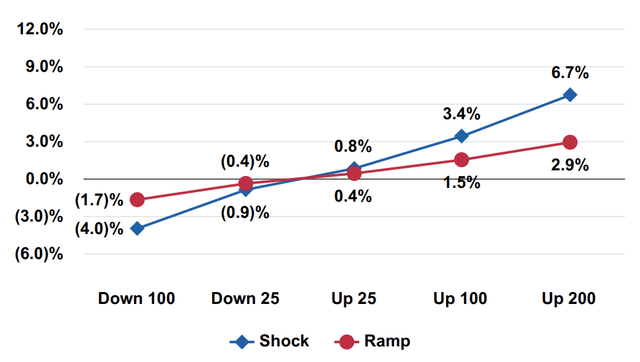

Despite our belief that SVB’s balance sheet will yield benefits to First Citizens, there are critical headwinds to consider. Firstly, many economists argue that an interest rate pivot might be near amid a pending recession. And, as displayed in the sensitivity analysis below, First Citizens typically experiences a downturn in profits whenever interest rates trend downward.

Interest Rate Sensitivity (First Citizens)

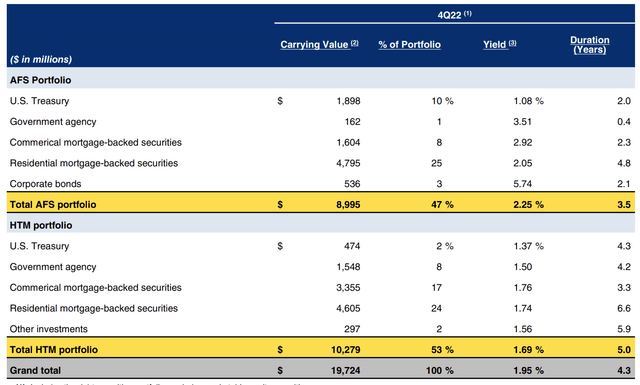

Furthermore, as visible in the diagram below, First Citizens has plenty of exposure to cyclical loans such as real estate mortgages. The possibility of a banking crisis has caused U.S. credit spreads to skyrocket, which might cause downward pressure on the bank’s AFS security prices. Additionally, the company’s treasury securities are subject to headwinds from an inverted U.S. yield curve, adding unwanted risk to the firm’s “risk-free” portfolio.

Debt By Type (First Citizens)

Return Prospects

Valuation

Banking stocks often oscillate around price-to-book values of 1.00 or around their historical price-to-book values. The reason is that their asset bases are liquid and easily measured.

First Citizens’ price-to-book was below one before the stock’s abrupt surge caused by the SVB announcement. At a price-to-book of 1.48, we believe First Citizens BancShares stock is overvalued.

Technical Analysis – Momentum

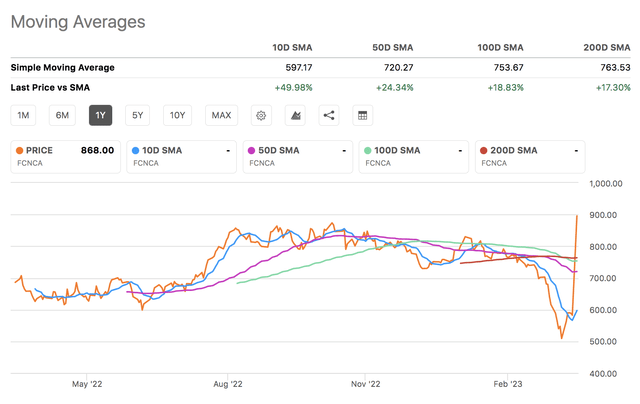

Measuring a stock’s momentum is nothing more than a statistical measure that tracks a simple moving average. Even when applying the most sophisticated statistical measures known to us, the SMA hosts a shortfall as the metric fails to accurately predict when a stock will revert to mean or when it will continue trading above its SMA (aka momentum). However, one can coalesce the metric with macroeconomic and company-specific variables to gather a better understanding of it.

As mentioned earlier, the market’s perception is that interest rate hikes are likely to hit a pause, which might cause banking stocks such as First Citizens to revert to or below their mean values. Moreover, we think First Citizens’ post-SVB announcement stock rise was a typical market overreaction, presenting an argument that the stock might soon revert to its SMA.

Momentum (Seeking Alpha)

Potential Counterargument

Although various positives were mentioned throughout the article, I wanted to highlight a few additional talking points.

Firstly, this analysis ignores First Citizens’ non-interest-bearing activities, which span 42% of the bank’s income mix. Although our outlook on the bank’s near-term debt operations is negative, non-interest activities must be considered to formulate a holistic conclusion.

Furthermore, the bank will likely benefit from the SVB acquisition in the long run. Although we think First Citizens might succumb to various systemic factors, namely an interest rate pause and rising credit spreads, the bank’s asset base is well-valued and set for long-term success.

First Citizens provides a dividend of merely 0.33%. However, this number could be ramped up in due course as the firm has a robust dividend coverage ratio of 35.07 and an existing cash dividend payout ratio of only 4.33%.

Final Word

Our analysis indicates that First Citizens BancShares, Inc. might benefit from its latest acquisition of SVB’s debt portfolio from both financial and synergetic points of view. However, unfortunately, the market’s reaction after the acquisition’s announcement likely makes the stock uninvestable, as it is overvalued on both a fundamental and technical level.

Furthermore, the bank is extremely sensitive to interest rates and credit spreads. With all else equal, we think the systemic environment will substantially impact First Citizens’ debt portfolio in the short-term.

To conclude, we assign a sell rating to First Citizens BancShares, Inc. stock until further notice.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.