imaginima

iShares MSCI Global Energy Producers ETF (NYSEARCA:FILL) is an exchange-traded fund that provides investors with exposure to companies that engage in the exploration and production of oil and gas, or the production and mining of coal and other fuels. The expense ratio is reported as being 0.39%, which is not inexpensive but in line with most other sector-specific funds by iShares.

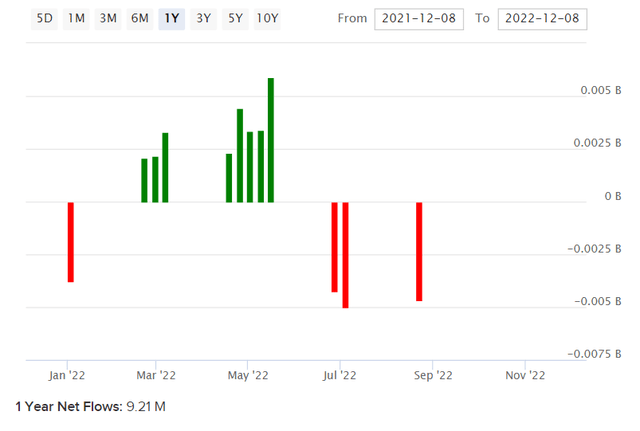

FILL’s net assets under management totaled $124 million as of December 9, 2022, making FILL relatively unpopular. Net fund flows over the past year have been stable for FILL, at circa $9.21 million positive.

ETFDB.com

Given the fund’s large exposure to some of the largest energy producers in the world, and considering the political and social headwinds that these largely traditional energy producers face, FILL shares appear to be very cheap. The fund’s benchmark index, whose performance it seeks to replicate, is the MSCI ACWI Select Energy Producers IMI Index.

The most recent factsheet for FILL’s benchmark index reveals trailing and forward price/earnings ratios of 7.29x and 7.15x, respectively, with a price/book ratio of 1.82x (as of November 30, 2022). That implies a forward return on equity of over 25%, indicating high corporate efficiency, and a dividend distribution rate of circa 29% of earnings based on a trailing indicative dividend yield of ~4%. Even if we factor in dividends, share buybacks, and assume a falling return on equity, our assumption would be positive longer-term earnings growth for the foreseeable future. Also, Morningstar’s consensus three- to five-year earnings growth rate for FILL’s portfolio is presently as high as 18.87%.

I think that consensus estimate is probably too ambitious. Nevertheless, given FILL’s very low price/earnings ratio, the forward earnings yield is about 14%. That is very high. The fund’s long-term beta is presently 1.32x. So, if we took a base equity risk premium of 5.5% and scaled this by 1.32x, and then added in the current U.S. 10-year yield of 3.586% as a risk-free rate proxy (FILL’s exposures are international, but over half the fund is exposed to the U.S., and other key exposures include mostly low-rate countries), we would arrive at a cost of equity estimate of 10.85%. If we assumed a long-term decline in earnings of 2% per year, that would take our growth-adjusted cost of equity to 12.85%, implying a forward price/earnings ratio of 7.78x.

7.78x is quite close to the prevailing ratio of 7.15x, and so clearly the market is pricing in long-term earnings declines for FILL’s portfolio of stocks whose businesses are counter to the supposed greener energy transition (to other sources/renewables), etc. And yet energy producer earnings have been fairly robust, while analysts now expect multi-year double-digit earnings growth rates (that is, over the next five years). The long-term negative view is therefore juxtaposed with a fairly healthy looking nearer-term picture, which would ultimately imply that the decline (once it actually begins) will be sharp.

Even if that is the case, it is unlikely that energy producers involved in fossil fuels will collapse overnight. The world’s industrial complex and infrastructure are underpinned by oil and gas (albeit not so much coal), and there are hundreds of thousands of jobs in traditional energy. It would not generally be wise for politicians to kill (or support the destruction of) the energy complex overnight (sometime in the 2030s). The process of weaning the world off traditional energy is likely to be a slow, multi-decade process.

Nevertheless, imagine a scenario where FILL’s portfolio generates average earnings growth of 8-10% per year (firmly under the Morningstar estimate), and then lands a forward price/earnings multiple of just 3x in year five (a massive forward earnings yield of 33.3%, which would almost certainly imply large structural upheaval by then in 2027/8, with sharp earnings declines thereafter into the 2030s). In this scenario, by my calculations the IRR for FILL would still exceed 15%, or 12-13% if adjusted for the fund’s beta.

The Russo-Ukrainian War and supply shocks have enabled energy prices to spike above previous expectations. This war appears likely to be protracted, while other political pressures will help to contain any renewed capital investment in traditional energies. While energy prices may not continue to spike out of control, they are likely to remain firm/elevated on a multi-year basis; unlikely to fall sustainably until demand pulls back significantly, which as noted is likely to take several decades. FILL’s portfolio’s earnings are therefore likely to remain robust. Even a collapse in the fund’s forward price/earnings ratio in the future seems priced in already, and in my opinion probably exaggerates the speed of the global industry’s future decline.

Timing the decline of traditional energy industry will be difficult, but I think an important point is that the market’s current pricing of FILL places the market’s estimates of timing easily in the pessimistic category. FILL’s portfolio is out of favor, at least relative to its present underlying earnings power (but also after taking into account the real risk of terminal decline). This opens up the potential for a strong forward IRR over the next five years, even if this decline does eventually occur. That is, given strong/robust earnings potential in the medium term.