thitivong/iStock by way of Getty Pictures

Funding Method

- Constancy® Choose Industrials Portfolio is a sector-based equity-focused technique that seeks to outperform its benchmark by energetic administration.

- We imagine that uncertainty offers funding alternative. Inventory costs can change into disengaged from an organization’s intrinsic (truthful) worth at cyclical extremes due to investor overreaction.

- Cyclical shares exhibit repeatable patterns. We imagine this may current alternatives for a disciplined investor whose time horizon spans the subsequent cycle.

- We try to capitalize on these alternatives by intensive, academic-style analysis on cyclical drivers and company-specific fundamentals, together with disciplined portfolio building. The fund’s success relies on discovering the correct mix of undervalued cyclicals and extra constant earnings growers all through the cycle.

- Sector methods could possibly be utilized by buyers as options to particular person shares for both tactical- or strategic-allocation functions.

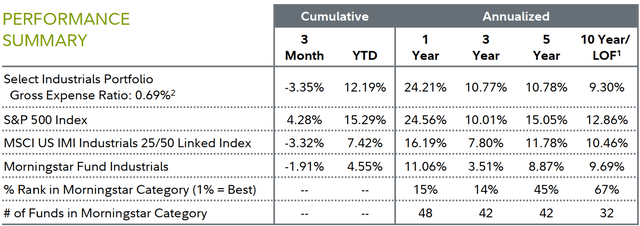

1 Lifetime of Fund (LOF) if efficiency is lower than 10 years. Fund inception date: 03/03/1997. 2 This expense ratio is from the newest prospectus and usually relies on quantities incurred throughout the newest fiscal yr, or estimated quantities for the present fiscal yr within the case of a newly launched fund. It doesn’t embody any charge waivers or reimbursements, which might be mirrored within the fund’s internet expense ratio. Previous efficiency isn’t any assure of future outcomes. Funding return and principal worth of an funding will fluctuate; due to this fact, you might have a acquire or loss whenever you promote your shares. Present efficiency could also be larger or decrease than the efficiency acknowledged. Efficiency proven is that of the fund’s Retail Class shares (if multiclass). You might personal one other share class of the fund with a unique expense construction and, thus, have totally different returns. To study extra or to acquire the newest month-end or different share-class efficiency, go to Constancy Funds | Mutual Funds from Constancy Investments, Monetary Professionals | Constancy Institutional, or Constancy NetBenefits | Worker Advantages. Complete returns are historic and embody change in share worth and reinvestment of dividends and capital good points, if any. Cumulative complete returns are reported as of the interval indicated. For definitions and different essential data, please see the Definitions and Necessary Data part of this Fund Evaluation. |

Market Evaluation

For the three months ending June 30, 2024, the industrials sector, as measured by the MSCI U.S. IMI Industrials 25/50 Index, returned -3.32%, whereas the broad-based S&P 500® index completed with a 4.28% acquire. After shaking off a tough April, the broader market rose in Could and June, however the rally was primarily confined to sure shares within the data know-how and communication providers sectors.

Resilient company income, a frenzy over generative synthetic intelligence and the Federal Reserve’s seemingly pivot to slicing rates of interest later this yr had been components driving the slender advance. Solely three of 11 sectors topped the broader market in Q2, and industrials was certainly one of six sectors that misplaced floor whereas the S&P 500® was hitting a sequence of recent all-time highs.

Traders’ emphasis on a slender group of development shares over cyclical and worth shares resulted in most business teams within the MSCI sector index producing lagging returns for the quarter. For instance, aerospace & protection – the section with the most important weighting within the MSCI index – superior 3%. Inside that group, Boeing (BA) completed with a -6% consequence, whereas TransDigm Group (TDG) and Raytheon Applied sciences (RTX) had been every up about 4%. The long-term basic outlook for business aerospace corporations is supported by the anticipated development within the world business jet fleet from 26,750 plane in 2023 to 50,170 in 2043. Nonetheless, jet producer Boeing has struggled to enhance provide chain reliability within the wake of pandemic-related labor turnover. In the meantime, uncertainty over the seemingly course of U.S. protection spending in a presidential election yr resulted in combined outcomes for Lockheed Martin (LMT) (+4%), Northrop Grumman (NOC) (-9%) and Basic Dynamics (GD) (+3%).

Industrial equipment & provides & parts, one other sizable section of the MSCI sector index, returned -8% the previous three months. Notable index parts on this group included Illinois Instrument Works (ITW) (-11%), Parker Hannifin (PH) (-9%) and Fortive (FTV) (-14%). An general weak U.S. manufacturing section, as evidenced by constantly gentle readings within the ISM Manufacturing PMI, has hampered corporations on this group.

Turning to a short-cycle group, cargo floor transportation (previously trucking), with a return of -14%, was the weakest-performing business within the MSCI index. The group continued to be challenged by a subpar freight market. Thus, even bellwether Previous Dominion Freight Line (ODFL) posted a weak -19% consequence, and Saia (SAIA) checked in with the identical return. XPO (XPO) (-13%) and Knight-Swift Transportation (KNX) (-9%) each did considerably higher.

Efficiency Evaluation

For the second quarter, the fund returned -3.35%, about consistent with the fund’s sector benchmark, the MSCI U.S. IMI Industrials 25/50 Index, however trailing the S&P 500®.

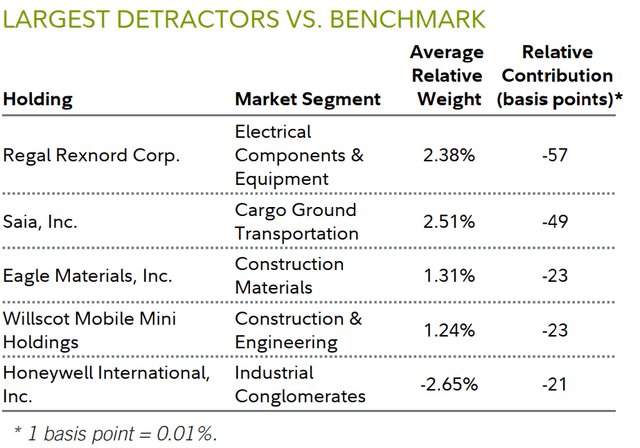

Turning to the fund’s efficiency, a large chubby in cargo floor transportation was one headwind throughout the quarter, together with inventory choice in electrical parts & tools.

Topping the fund’s checklist of particular person relative detractors was Regal Rexnord (RRX), a producer of business powertrain options, transmissions and electrical motors. The inventory returned about -25% the previous three months. On Could 6, the corporate reported lackluster quarterly income and earnings that had been largely consistent with or beneath many analysts’ expectations, as demand for the corporate’s merchandise was disappointing amid a difficult financial backdrop. We barely trimmed the place, nevertheless it remained a core chubby at quarter finish.

Additionally detracting was an out-of-index stake in Eagle Supplies (EXP), a producer of building supplies corresponding to cement and wallboard. Our place returned -20% for the three months. In Could, the corporate reported a roughly 17% decline in quarterly earnings, lagging analysts’ expectations, with administration citing a decrease revenue margin within the cement enterprise. We roughly halved the portfolio’s share rely right here.

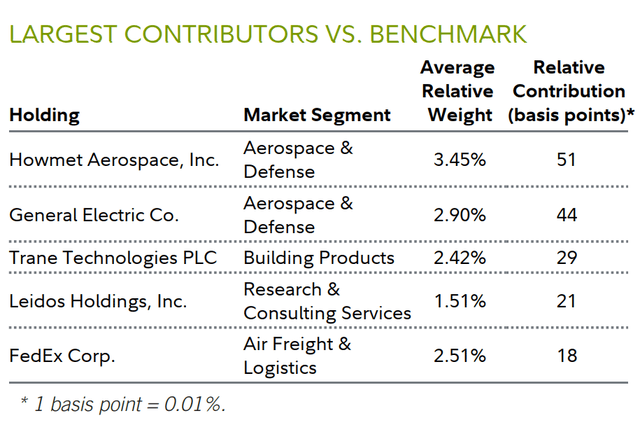

Conversely, inventory selecting and an chubby publicity to aerospace & protection supplied a lift to the fund’s relative consequence. Picks in buying and selling corporations & distributors helped as properly.

In stock-specific phrases, the fund’s prime relative contributor was Howmet Aerospace (HWM). Shares of the jet engine parts maker gained about 14% within the second quarter. In Could, administration reported Q1 monetary outcomes that exceeded expectations, together with all-time-high income pushed by a substantial improve in business aerospace gross sales, stemming from file aircraft-manufacturer backlogs. Consequently, administration favorably revised its expectations for each earnings and income for the total yr. Though we trimmed this place, Howmet Aerospace was the fund’s second-largest chubby at quarter finish.

Outlook and Positioning

Key indicators reflecting the well being of U.S. producers continued to mirror weak demand, with the June studying for the ISM Manufacturing PMI settling at 48.5. Most readings because the third quarter of 2022 have been beneath 50, historically thought-about the dividing line between increasing and contracting manufacturing exercise. After such a protracted interval of weak readings, we predict it is smart to search for areas of the industrials sector that could possibly be poised for enchancment.

Whereas we stay conscious of the macro uncertainty that exists as of mid-2024, we just like the fund’s publicity to longer-cycle subsectors and corporations tied to themes such because the bettering aerospace cycle, in addition to reshoring, upgrading the facility grid and addressing local weather change. The portfolio additionally holds some short-cycle performs geared to potential enchancment in U.S. financial exercise.

Industrial equipment & provides & parts was the fund’s largest subindustry chubby as of quarter finish, given our expectations for bettering demand there in a normalizing economic system. A number of shares on this group had been among the many portfolio’s largest particular person overweights as of June 30, together with Ingersoll Rand – our prime chubby general – ITT (ITT), Parker Hannifin, Dover (DOV) and Chart Industries.

Cargo floor transportation was one other group through which the fund carried a large chubby stake on the finish of June. Noteworthy holdings right here included Saia and Knight-Swift Transportation. These are short-cycle corporations that ought to be early beneficiaries of an bettering economic system.

Other than human useful resource & employment providers, which we averted fully in favor of different teams the place we noticed stronger development potential, noteworthy subindustry underweights included building equipment & heavy transportation tools. The fund’s solely holding on this group was Caterpillar. We’re reluctant to take a position extra closely right here till we see higher financial development in China, the place a lot incremental demand for this section comes from. The fund was additionally meaningfully underweight industrial conglomerates at quarter finish, though this was partly resulting from Basic Electrical’s departure from that group on account of its restructuring strikes.

The portfolio’s top-three particular person overweights as of June 30 had been Ingersoll Rand (IR), Howmet Aerospace and ITT. The three largest underweights at quarter finish had been Honeywell (HON), Raytheon Applied sciences and United Parcel Service (UPS).

As at all times, we thanks on your confidence in Constancy’s investment-management capabilities.