FG Trade Latin/E+ via Getty Images

Investment Thesis

Ferguson plc (NYSE:FERG) is a trading company that provides plumbing and heating products in the United States and Canada. The company recently posted decent Q1 FY23 results. In this thesis, I will analyze the quarterly results and its acquisitions. I think the management of FERG is very efficient, and they are dedicated to boosting the company’s revenue. I think it is a very promising company, but the revenue growth will be stagnant in FY23. So I assign a hold rating on FERG.

About FERG

FERG is a leading distributor of plumbing and heating products in North America to customers in residential and industrial end markets. It also supplies fittings, water and wastewater treatment products, and valves under the Wolseley brand. Under the Ferguson brand name, they provide expertise solutions and products, including plumbing, air condition products, fire, and fabrication. They also offer after-sales support, including credit, returns, maintenance, and operations support. FERG was founded in 1887 and is headquartered in Wokingham, United Kingdom.

Financial Analysis

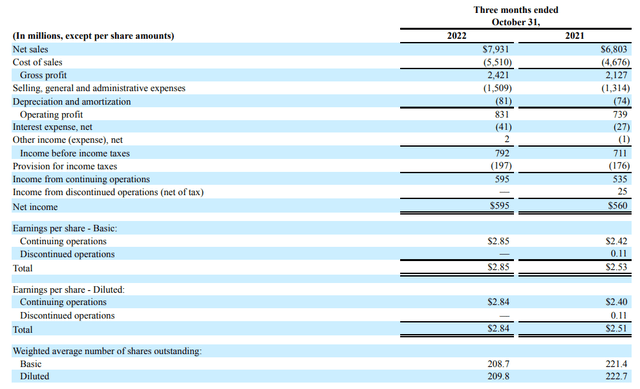

FERG recently announced its Q1 FY23 results. They beat the market revenue estimates by 2.5% and market EPS estimates by 5.8%. The reported revenue for the Q1 FY23 was $7.9 billion, an increase of 16.5% compared to the Q1 FY22. I believe the primary reason behind this increase was the outperformance by them in the U.S. markets and the acquisitions done by them in the United States. The reported net income for the Q1 FY23 was $595 million, an increase of 6.2% compared to the corresponding quarter of last year. I think the controlled operating expenses were the reason behind the increased net income. The reported diluted EPS for the Q1 FY23 was $2.84, an increase of 18.3% compared to the Q1 FY22.

Seeking Alpha

Their U.S. business saw a growth in revenues. The reported net sales in the U.S. for the Q1 FY23 was $7.5 billion, an increase of 17.3% compared to the corresponding quarter of last year. I believe the main reason behind the increase was their strategic acquisition; they acquired Monark Premium Appliance, which distributes high-end appliances serving builders and homeowners. This acquisition boosted its revenues in Q1 FY23. Talking about the Canadian market, they saw an increase of 3.6% in net sales in the Canadian market in Q1 FY23. In my opinion, outperformance in the U.S. and Canada was the primary reason behind the decent Q1 FY23 results.

Technical Analysis

Trading View

Currently, FERG is trading at the level of $125. Since the last year, the stock has corrected more than 31%, and since then, it has been forming lower highs and lower lows formation, which is considered a bearish pattern. But in December 2022, the stock broke the structure and formed a higher high, which can be a sign of trend reversal. Currently, the stock is taking support from its 200 ema, which is at $122. Now the stock has one major resistance level at $128; if it manages to break it in the daily time frame, we might see an upside rally up to $150. But if the stock fails to break the resistance level, we can see a downside up to $105. The next monthly candle will be very important because it will give us a clear picture of whether the stock will see a reversal or will continue to be bearish.

Should One Invest In FERG?

Seeking Alpha

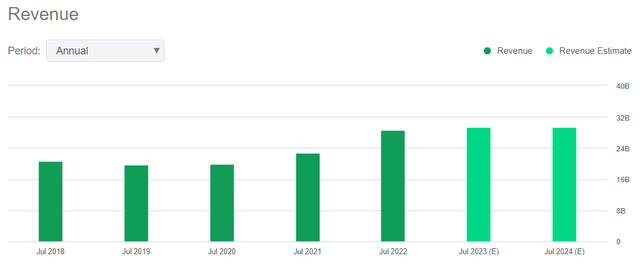

The company performed significantly well in FY22 in terms of revenue compared to FY21. Their revenues grew by 25.3% in FY22, but if we look at the FY23 revenue guidance, we can see that the management expects the revenue growth to be flat. They are expecting the FY23 revenues to be around $29.3 billion, which is just 2.5% higher than the FY22 revenue, which is a matter of concern because it can hamper the stock price of FERG. But the recent acquisitions in the U.S., like Airefco and Guarino distributing company, shows they are trying their best to increase their revenue. Airefco is a leading regional HVAC distributor company serving customers across 11 locations in Pacific Northwest, and Guarino distributing company is an HVAC distributor serving customers in Louisiana and Mississippi. In Q1 FY23, they also acquired Monark Premium Appliance, which I mentioned in the financial analysis segment. The management has estimated that these three acquisitions will generate annualized revenues of up to $270 million.

Seeking Alpha

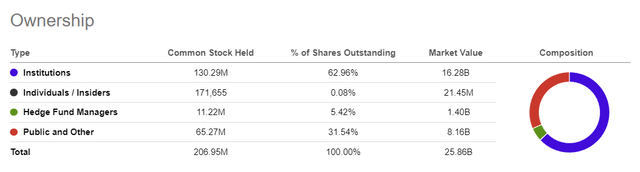

The shareholding pattern of FERG looks decent. Institutions own 63% of the stake in the company, which is a positive sign for investors. This might be the reason we don’t see many price fluctuations in the share price of FERG because, generally, when institutions own the majority of the stake in a company, we see less volatility in price fluctuations in the share price. Recently the company announced a share repurchase worth £110 million under the $2.5 billion share repurchase program. With this program, they are increasing their stake; it’s a positive sign and shows the management’s trust in the company.

Risk

Fluctuating Product prices

Some of their products contain a large amount of commodity-priced materials like copper and steel that are subject to price changes. Commodity prices can arise from global supply and demand changes, inflation, and geopolitical conflict. These price changes could affect the revenues of the company. Various other factors can affect their balance sheet, like a rise in the price of fuel that can increase transportation costs, shipping rates, and space availability can impact product costs. So in this highly competitive business, they should be able to adapt to price changes and should be able to implement better pricing policies. If they are unable to do so, their competitors might get an edge over them in the market.

Bottom Line

FERG has performed well in FY22, but the FY23 guidance shows that the revenue growth will be stagnant. It is undoubtedly a safe and promising company, taking several steps to boost its revenues, like strategic acquisitions. But in my view, the company might not be able to provide significant returns. So after analyzing all the parameters and the future growth potential, I assign a hold rating on FERG.