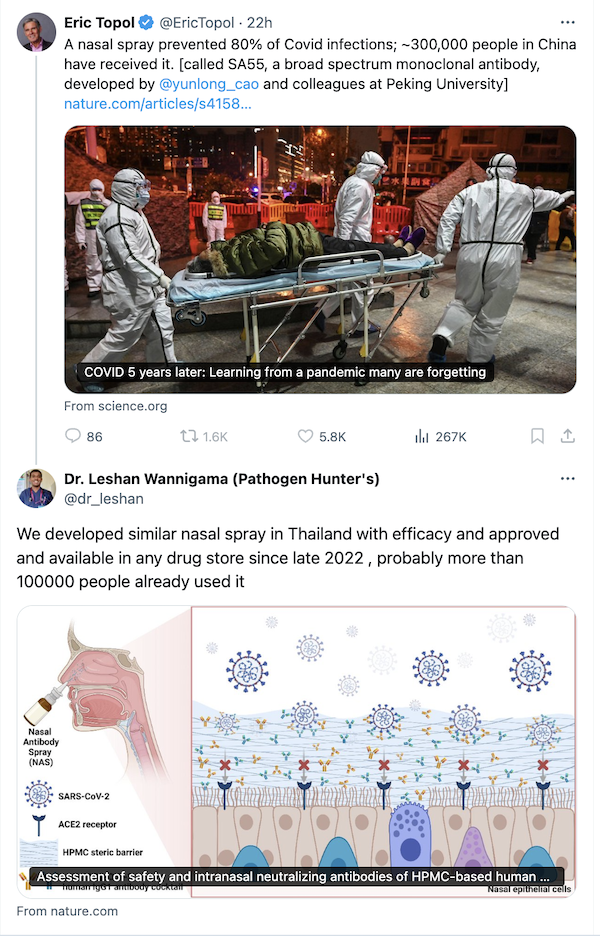

Federal Reserve Board Chairman Jerome Powell holds a press convention following a two-day assembly of the Federal Open Market Committee on rate of interest coverage in Washington, U.S., September 18, 2024. REUTERS/Tom Brenner

Tom Brenner | Reuters

The Federal Reserve probably will stick with the enterprise at hand when it wraps up its assembly Thursday with one other rate of interest reduce, however may have its eye on the long run towards a backdrop that immediately has gotten much more difficult.

Monetary markets are pricing in a near-certainty that the central financial institution’s Federal Open Market Committee will decrease its benchmark borrowing value by 1 / 4 proportion level because it seeks to “recalibrate” coverage for an economic system that’s seeing the inflation charge average and the labor market soften.

The main target, although, will flip to what’s forward for Chair Jerome Powell and his Fed colleagues as they navigate a shifting economic system — and the political earthquake of Donald Trump’s gorgeous victory within the presidential race.

“We expect Powell will refuse to present any early judgment on the implications of the election for the economic system and charges, and can search to be a supply of stability and calm,” Krishna Guha, head of worldwide coverage and central financial institution technique at Evercore ISI, stated in a be aware issued earlier than the election’s consequence was recognized.

In line with policymakers’ historic need to remain above the political fray, Powell “will say the Fed will take the time it wants to check the brand new administration’s plans” then will “refine this evaluation as precise insurance policies are developed and enacted,” Guha added.

So whereas the instant motion can be to remain the course and enact the reduce, which equals 25 foundation factors, the market’s consideration probably will flip to what the committee and Powell should say in regards to the future. The fed funds charge, which units what banks cost one another for in a single day lending however typically influences client debt as nicely, is presently focused in a spread between 4.75%-5.0%.

Market pricing presently favors one other quarter-point reduce in December, adopted by a January pause then a number of reductions by means of 2025.

Getting ready for Trump

But when Trump’s agenda — tax cuts, larger spending and aggressive tariffs — involves fruition, it might have a significant affect on a Fed attempting to right-size coverage after the mammoth charge hikes aimed toward controlling inflation. Many economists consider one other spherical of isolationist financial strikes by Trump might reignite inflation, which held beneath 3% throughout Trump’s whole first time period regardless of the same recipe.

Trump was a frequent critic of Powell and the Fed throughout his first time period, which ran from 2017-21, and is in favor of low rates of interest.

“Everyone seems to be looking out for future charge cuts and whether or not something is telegraphed,” stated Quincy Krosby, chief world strategist at LPL Monetary. “Additionally, nonetheless, there’s the query of whether or not or not they will declare victory on inflation.”

Any solutions to these questions can be largely left to Powell’s post-meeting information convention.

Although the committee will launch its joint resolution on charges, it is not going to present an replace on its Abstract of Financial Projections, a doc issued quarterly that features consensus updates on inflation, GDP development and unemployment, in addition to the nameless “dot plot” of particular person officers’ rate of interest expectations.

Past the January pause, there’s appreciable market uncertainty about the place the Fed is heading. The SEP can be up to date subsequent in December.

“What we’ll hear increasingly more of is the terminal charge,” Krosby stated. “That is going to come back again into the lexicon if yields proceed to climb larger, and it isn’t utterly related to development.”

So the place’s the top?

Merchants within the fed funds futures market are betting on an aggressive tempo of cuts that by the shut of 2025 would take the benchmark charge to a goal vary of three.75%-4.0%, or a full proportion level beneath the present degree following September’s half proportion level reduce. The Secured In a single day Financing Fee for banks is a little more cautious, indicating a short-term charge round 4.2% on the finish of subsequent 12 months.

“A key query right here is, what is the finish level of this charge reduce cycle?” stated Invoice English, the Fed’s former head of financial affairs and now a finance professor on the Yale Faculty of Administration. “Pretty quickly, they have to consider, the place do we expect this charge reduce interval modifications with the economic system wanting fairly robust. They might need to take a pause pretty quickly and see how issues develop.”

Powell additionally could also be known as on to deal with the Fed’s present strikes to cut back the bond holdings on its steadiness sheet.

Since commencing the hassle in June 2022, the Fed has shaved almost $2 trillion off its holdings in Treasurys and mortgage-backed securities. Fed officers have stated that the steadiness sheet discount can proceed even whereas they reduce charges, although Wall Avenue expectations are for the run-off to finish as quickly as early 2025.

“They have been blissful to only type of depart that percolating within the background they usually in all probability proceed to try this,” English stated. “However there’s going to be lots of curiosity over the following few conferences. At what level do they make an additional adjustment to the tempo of runoffs?”