by confoundedinterest17

The Fed has signaled the terminal rate will likely be around 5% — we think an upper bound of 5% — reached in early 2023. To get there, the central bank will likely raise rates by 50 basis points at its December 2022 meeting, followed by two more 25-bp hikes in 2023. We then see it holding at 5% throughout the year. Markets have priced in a similar amount of tightening.

Controlling inflation comes at a cost to growth. Yield curves have inverted. A Bloomberg Economics model shows a 100% probability of recession starting by August 2023. Take that — like all model forecasts — with a grain of salt. But the basic view that aggressive Fed tightening will very likely tip the economy into a downturn is correct.

While various measures of impending US recession show a good chance of a 2023 recession, Powell’s preferred measure of the yield curve shows only a 30% chance.

What Might the Recession Look Like?

We project a 0.9% GDP contraction in 2H 2023, driven by an investment downturn as firms pare inventories amid a downshift in consumption. Residential investment will also contract with real interest rates likely to rise steadily throughout 2023 as nominal rates stay high and inflation moderates.

An Inventory-Led Downturn

Resilient consumption should help put a floor under demand.

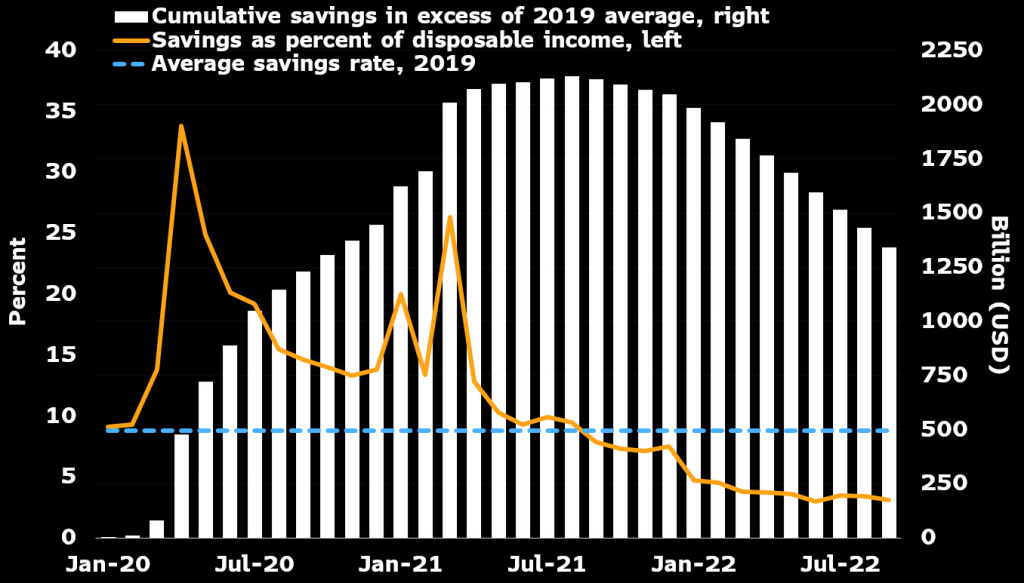

Households have enough of a cash buffer — extra savings built up over the course of the pandemic, rising COLAs for Social Security recipients, ongoing state and local government stimulus and solid 2022 wage income growth — to sustain consumption during the recession. Our base case is for real spending to grow at a quarterly annualized pace of about 0.5% in 2023, with strength concentrated in services.

By one measure, households may still have $1.3 trillion in the coffers, based on flows within the personal income report through September. At the current rate of drawdown, that’s enough to last around 15 months, or through the end of 2023. Funds may dry up faster as job losses mount and the unemployed fall back on their savings.

$1.3 Trillion Extra Savings to Keep Spending Positive

The labor market remained exceptionally tight into the end of 2022. We expect it to soften significantly next year, with the unemployment rate rising to 4.5% by the end of 2023. The pace of hiring will slow markedly as support from catch-up hiring dissipates and the effects of restrictive monetary policy settle in. We estimate only 20%-30% of total employment is still in sectors experiencing labor shortages, implying demand for labor is falling fast.

Avoiding a Hard Landing Depends on Inflation, Fed

Extreme circumstances — the pandemic, Russia’s invasion of Ukraine — have made a recession more likely than not. Extreme circumstances can change, and so can policy makers’ response Whether the US can stick a soft landing depends substantially on how external conditions develop and how the Fed responds.

Not our base case, but we can envision a scenario in which the central bank opts to ease rates in 2023, boosting the chances of a soft landing.

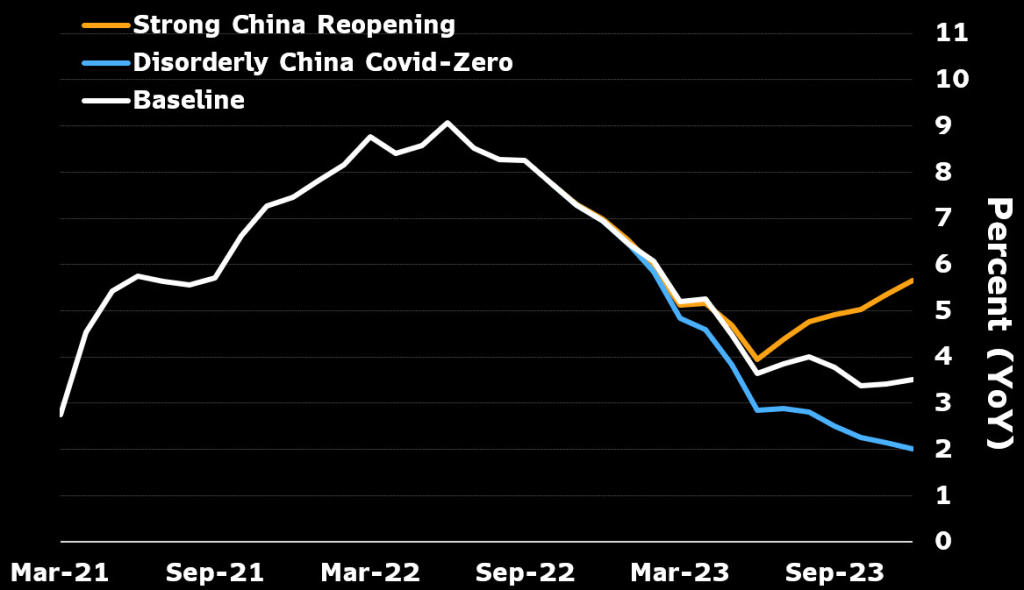

One way that could happen is inflation falling faster than expected. Currently, our baseline is for headline CPI to drop to 3.5% and the core to 3.8% by the end of 2023. The most important assumption there is that energy prices remain flat next year from 2022.

In an alternative scenario, inflation fall faster as China maintains Covid controls and growth stumbles. A Bloomberg Economics model attributes the recent fall in oil prices entirely to a drop in demand — mainly from China. If China’s growth falls off the cliff, perhaps amid a sharp rise in Covid cases and resumed lockdowns, commodity prices could tumble sharply.

A warm winter in Europe and the US could also keep energy prices in check. Lower demand from Europe for US liquefied natural gas would help stem the increase in domestic electricity prices.

In that scenario, US energy prices could fall 20% in 2023 and headline inflation may drop to 2% by the end of the year. Lower gasoline prices would work to soften inflation expectations, easing pressure on the Fed to hold rates at higher level. A rate cut could then come in 2H 2023, raising the possibility of a soft landing.

Scenarios of CPI Inflation in 2023

The risk cuts both ways. A quick and successful pivot to reopening in China could boost oil and other commodities prices. A colder winter in Europe and the US would generate upward pressure for electricity and utility prices. Assuming China is fully open by mid-2023 — the base case for our China team — energy prices could increase by 20% in the year. In that case, headline US CPI would hit a bottom of 3.9% in midyear before surging to 5.7% by year-end.

In that scenario, the terminal fed funds rate would most likely top 5%, possibly closing 2023 near the upper end of St. Louis President James Bullard’s estimated restrictive range of 5%-7%.

Bloomberg Economics US Forecast Table

Thanks to Yellen’s legacy of too low interest rates for too long, The Fed is playing catch-up by finally raising rates.

It is truly Fed Dead Redemption!