Parradee Kietsirikul/iStock through Getty Photographs

What has occurred out there in the previous couple of days is a stark reminder of the potential volatility typically uncared for by the typical investor. On this context, the Constancy Low Volatility Issue ETF (NYSEARCA:FDLO) is likely one of the funds that handle this query, providing entry to a portfolio that seeks to mitigate general volatility whereas nonetheless delivering aggressive returns in comparison with broader inventory indexes.

This fund adopts a barely completely different strategy from different low-volatility ETFs, holding a sector allocation much like its benchmark, the Russell 1000 index, somewhat than overweighting defensive sectors like utilities. This strategy has benefited FDLO, because it has taken benefit of its almost 30% allocation to the expertise sector, which has helped this fund outperform its low-volatility friends over the previous years, whereas sustaining volatility ranges on par with this peer group and considerably decrease than inventory market indexes.

Thus, regardless of potential dangers related to its publicity to extra delicate sectors, comparable to expertise, I view FDLO as a fund that may add worth for buyers and is value contemplating for a diversified portfolio.

ETF Description & Highlights

FDLO is an exchange-traded fund that gives publicity to giant and mid-capitalization corporations within the U.S. market with decrease volatility in comparison with the general market, monitoring the Constancy U.S. Low Volatility Issue Index.

This index seeks to attain returns typically consistent with the U.S. inventory market, however with decreased volatility. The index building course of selects shares that meet a low volatility standards primarily based on their historic costs, earnings stability, and beta, which measures a inventory’s volatility relative to the benchmark.

A quantitative strategy additionally assesses correlations amongst shares and applies optimization routines to attenuate general volatility. Shares are ranked in accordance with a composite rating, and people anticipated to contribute to a low-risk portfolio are chosen for inclusion within the index, with rebalancing occurring semi-annually.

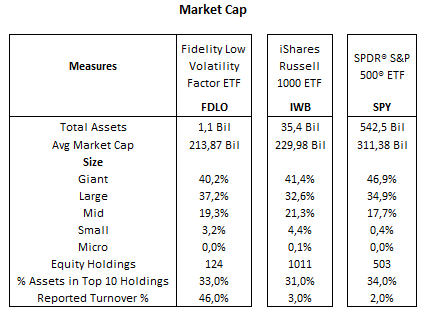

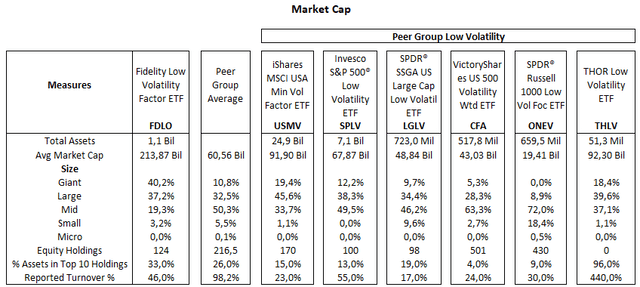

As of July 30, 2024, FDLO manages $1.1 billion in belongings invested in 124 corporations, with a mean market cap of $213.9 billion. Of those, almost 40.2% is allotted to mega caps, 37.2% to giant caps, 19.3% to mid-caps, and three.2% to small caps, in a distribution throughout market cap classes that’s much like its benchmark, the Russell 1000 index, represented by the iShares Russell 1000 ETF (IWB).

FDLO’s prime ten holdings (Apple, Microsoft, Alphabet, Amazon, Eli Lilly, UnitedHealth, Texas Devices, Oracle, Visa, and Mastercard) embrace some mega caps that additionally constituted the Russell 1000 index. Notably absent are semiconductors NVIDIA and Broadcom, in addition to Meta Platform, that are comparatively larger risky shares in comparison with different prime holdings.

Morningstar, consolidated by the writer

Under is a desk evaluating FDLO with a peer group of ETFs emphasizing lower-volatility shares. The primary two ETFs, USMV and SPLV, are the biggest gamers within the phase. The opposite 4 ETFs are a lot smaller when it comes to AUM, and though all of them goal low-volatility portfolios, their approaches have slight variations. As an illustration, CFA has a extra diversified allocation technique with almost 500 holdings, whereas ONEV consists of different measures apart from low volatility, comparable to worth and high quality. In the meantime, the final fund on the checklist, THLV, is a comparatively new ETF that invests in sector ETFs somewhat than widespread shares and is rebalanced weekly.

Morningstar, consolidated by the writer

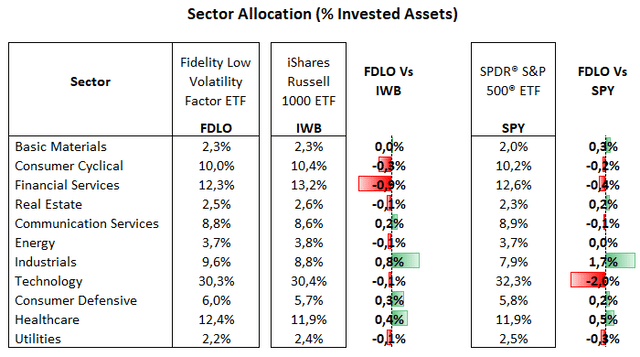

From a sector allocation perspective, FDLO’s largest allocation is to the expertise sector, with 30.3% of whole equities, adopted by monetary companies with 12.3%, healthcare with 12.4%, shopper cyclical with 10.0%, industrials with 9.6%, communication companies with 8.8%, shopper defensive with 6.0%, vitality with 3.7%, actual property with 2.5%, primary supplies with 2.3%, and utilities with 2.2%.

FDLO has a considerably comparable sector allocation in comparison with the Russell 1000 index. The principle variations are within the industrial sector, the place FDLO is chubby by 0.8%, and in monetary companies, with an underweight publicity of 0.9%.

Nonetheless, the primary divergences are present in particular person inventory holdings. FDLO has nearly no publicity to the semiconductor trade and main software program gamers comparable to Adobe and Salesforce. As a substitute, it has heavier allocations to names like Microsoft, Apple, Oracle, and IBM. Within the monetary sector, the fund has no holdings in banks, with its allocation targeting Visa, Mastercard, and insurers.

This selective strategy will be seen in different sectors as nicely. Within the industrial sector, Lockheed Martin, Union Pacific, and Honeywell are the primary holdings, whereas within the healthcare there are chubby allocations to the largest gamers comparable to Eli Lilly, UnitedHealth, and J&J, however restricted publicity to the medical gadgets trade.

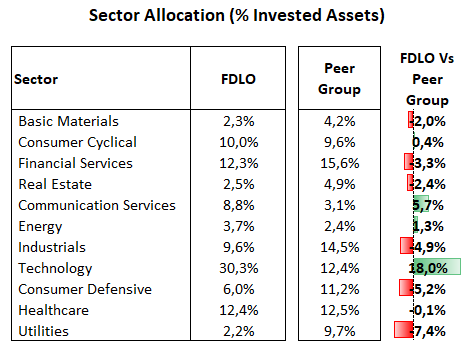

Morningstar, consolidated by the writer

In comparison with the peer group of low-volatility ETFs, FDLO is chubby in expertise (+18.0%) and communication companies (+5.7%), however underweight in utilities (-7.4%), shopper defensive (-5.2%), and industrials (-4.9%). This highlights a cautious stance amongst low-volatility funds on the expertise sector, favoring extra steady sectors comparable to utilities and shopper defensive. That is underscored by the historic elevated volatility within the expertise sector, which reveals a excessive beta of 1.24 over the previous three years, as measured by the Expertise Choose Sector SPDR Fund ETF (XLK), contrasting with decrease betas of 1.08 within the industrial sector and 1.02 within the monetary sector, two cyclical areas of the market as nicely.

Morningstar, consolidated by the writer

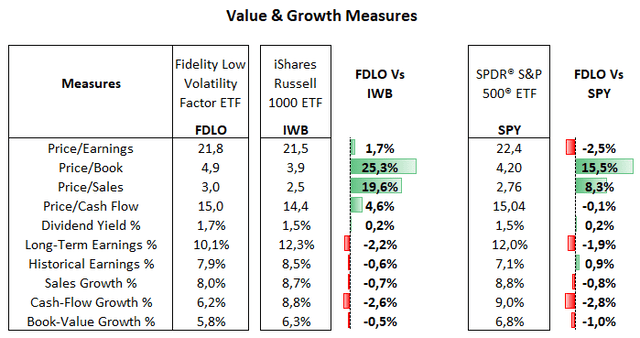

FDLO’s worth/earnings ratio of almost 21.8x is marginally larger than 21.5x for the Russell 1000 index. This might sound counterintuitive given FDLO’s minimal publicity to high-multiple industries like semiconductors and software program. Nonetheless, that is a minimum of partially offset by FDLO’s chubby allocation to giant corporations like Microsoft, Apple, and Eli Lilly that commerce at a premium relative to the broader market, and in addition attributable to FDLO’s no publicity to the financial institution trade, which generally trades beneath 15x and definitely lowers the Russell 1000 index valuations.

Morningstar, consolidated by the writer

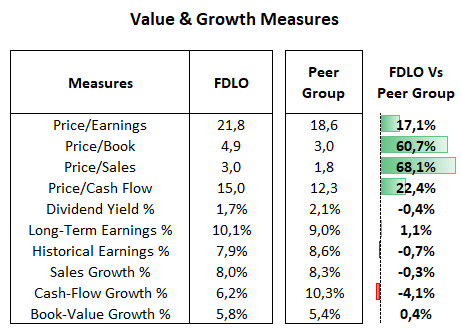

The peer group of low-volatility ETFs reveals decrease valuation multiples although, pushed by its chubby allocation to extra worth sectors, comparable to utilities and shopper defensive. That’s relevant even for its heavier publicity in industrials, as this sector additionally trades at a lot decrease multiples than the expertise sector.

Morningstar, consolidated by the writer

Delivering On A Decrease Volatility Portfolio

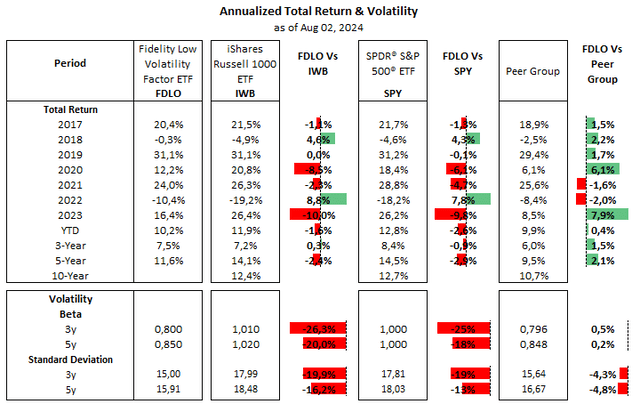

Though FDLO’s whole return has not been on par with benchmarks just like the Russell 1000 or the S&P 500 indexes, there isn’t a doubt it has delivered a reasonably good efficiency, outpacing its friends over time. That is in step with the FDLO’s sector publicity near the Russell 1000 index, not like the peer group, which leans towards worth sectors which have underperformed the broader market over the previous years.

As anticipated for a low-volatility fund, FDLO’s volatility measures, comparable to beta and normal deviation, have remained roughly 20% decrease than the broader market. This has been typically consistent with the peer group of low-volatility ETFs, with FDLO displaying a barely decrease normal deviation and primarily the identical beta within the 0.80 – 0.85 vary.

Morningstar, consolidated by the writer

In abstract, FDLO’s general efficiency displays an optimized portfolio with comparatively low volatility in comparison with the broader inventory market index. In the meantime, whole returns haven’t saved up with inventory indexes however have outperformed the peer group.

This outperformance is probably going attributable to FDLO’s sector allocation just about consistent with the Russell 1000 index, with important publicity to expertise and restricted allocation to defensive areas of the market which have lagged the market over the previous years.

In the meantime, FDLO has additionally prevented extra risky names like Tesla and semiconductor corporations, a selective strategy that may be seen in its lack of publicity to banks as nicely.

In my evaluation, FDLO is a fund value contemplating for the long term, because it balances publicity to higher-growth areas whereas limiting the danger related to extra risky names and industries. Nonetheless, buyers ought to needless to say even lower-volatility funds like FDLO are usually not proof against sharp market strikes. As we have now skilled in latest days, there’s seldom a protected place to cover throughout a market correction, and all sectors and industries will be affected to a sure extent.

That is maybe the largest danger for this fund at this second, as buyers appear to be unwinding bullish bets on market leaders, particularly in expertise, a sector wherein FDLO has important publicity. This reinforces the significance of defining clear funding objectives and holding a portfolio aligned with buyers’ danger tolerance.