By Matthew Piepenburg

As soon as once more, the US is dealing with a recession which Essential Road feels, Wall Road whistles previous, and DC merely denies.

Beneath, we have a look at these recessionary forces and delusional coverage makers within the context of blunt-speak relatively than Fed-speak in order that we are able to finest put together for what’s already felt however hardly ever spoken from on excessive.

De-Coding the Newest Fed-Converse: Hawks, Doves or Each?

As anticipated, and as already priced-in by the markets, the Fed raised the Fed Funds Charge (FFR) final week by 75 bps in what superficially seemed to be a hawkish assault on inflation however what in actuality was nothing greater than one other financial bluff.

Alas, there’s way more hidden dove than public hawk emanating from Wednesday’s newest Fed “steering.”

As I’ve constantly argued, the Fed has needed to take advantage of (relatively than defeat) inflation as a basic technique of secretly “inflating away” chunks of its embarrassing debt pile whereas publicly pretending to “fight” inflation with anemic (6.75% y/y) price hikes (and a 2.50% FFR) which can by no means meet up with (and due to this fact by no means defeat) present inflation charges above the 9% degree.

Everybody, together with Powell, is aware of that Uncle Sam can’t afford rising charges or a perpetually sturdy USD.

So why the general public ruse to “battle” 9% inflation” with 2.5% FFR?

Easy: The Fed sees a recession coming and desires to boost charges right this moment in order that they’ll have one thing—something—to chop tomorrow.

Dovish Pivot Translated

Thus, and as constantly argued, the Fed’s hawkish July chest-puffing will ultimately (i.e., when the recession turns into official) result in some dovish two-stepping as Powell has successfully telegraphed a future price hike pause by utilizing the magic phrases “relying on the info.”

In brief, I consider the Fed is in search of an excuse to print extra {dollars} and cap extra yields/charges with extra inflationary mouse-click magic cash and therefore extra Essential Road ache—all very unhealthy for a debased but comparatively sturdy USD and all superb for actual financial metals like gold.

Acknowledged merely, I really feel final Wednesday was the primary signal/trace of an inevitable Fed pivot from rising charges to pausing charges, after which ultimately, falling (YCC) charges and a falling greenback over the approaching months and quarters.

We’ll know extra on the finish of August when Powell scoots off to Jackson Gap as the remainder of the US sinks deeper right into a recessionary gap.

Recession Translated

And what’s the brand new excuse for the inevitable pivot to extra synthetic “lodging” (i.e., QE) relatively than the present and faux “inflation preventing” QT?

Powell described it in Fed-speak as “waiting for a slowdown in financial exercise.”

Translated into honest-speak, this simply signifies that Powell’s narrative will probably be shifting from inflation semantics to recession realities, regardless of each present effort constructed from DC to disclaim a recession.

I’m at all times impressed by the Fed’s means to pervert English, math and honesty within the title of fantasy, calm and coverage.

As we’ve proven elsewhere with blunt math relatively than sensational drama, the Fed, and its minions on the BLS, have actually invented a magical calculator which makes 2+2=1 on the whole lot from CPI Inflation, and the M3 Cash Provideto the present metrics used to show privately sought unfavorable actual charges into publicly constructive actual charges.

With a lot dishonesty from (and therefore mistrust of) the coverage makers, it thus comes as no shock that even the definition of a recession is now being perverted to supplant actuality with fantasy and thus hold the lots comfortably numb from the implications of the Fed’s more and more failed financial insurance policies—particularly a Fed-engineered recession to deflate Fed-made inflation.

However can any of us keep in mind the final time a central banker stood up and confessed: “Boy, we actually screwed that up, received that fallacious, and are actually dealing with years of self-inflicted distress; sorry about that”?

Or can any of us think about a central banker saying: “OK, we’ve been mendacity to you for years about true inflation ranges, which we truly must pay down the money owed we’ve helped create and which we’ll now use a recession to quell. Sorry about that.”

A Lesson in Recessionary Realism

Fortunately, we’re not within the Faustian discount required to work in DC, so we are able to all get pleasure from some sincere math and chilly information relating to confessing recessions.

As most already know, two consecutive quarters of declining actual GDP is how recessions are outlined and have been outlined for years.

Powell, Yellen and Biden’s press secretary, nonetheless, will nonetheless assert that the true definition of a recession is all of a sudden not so simple as that.

Hmmm.

Okay. So how about if we add the next details (and main indicators) to assist our monetary management in DC confess {that a} recession is exactly the place we’re headed and admittedly already standing.

Towards this finish, let’s share just a few information factors they may have ignored when backpedaling on the “recession” query, particularly

1. U.S. New Dwelling Inventories are on the highest ranges since 2018 and pending properties gross sales (reeling underneath the burden of rising mortgage charges) fell y/y by 20% in June.

2. Housing information is straight linked to tax receipt information. That’s, each fall collectively, and as tax receipt revenue falls, this too is a recessionary indicator, as falling US tax receipts are equally correlated to falling US inventory costs.

3. Promoting budgets/spending insurance policies are falling at locations like Amazon, whereas inventories at locations like Walmart are rising as their income are falling, together with names like Goal whose inventory worth tanked by 24% on Q1 earnings misfires; and…

4. Hawkish price hikes and a strengthening USD are a poison to the earnings flows of such enterprises already in debt as much as their ears after years of “free debt” growth within the backdrop of repressed charges and post-08 limitless cash printing.

By the best way, such ad-spend cuts, falling earnings, tanking income, and new-hire slowdowns seen throughout the US at retailers like Walmart, Goal and Amazon are typical and main recessionary indicators which frequently precede/portend future labor layoffs.

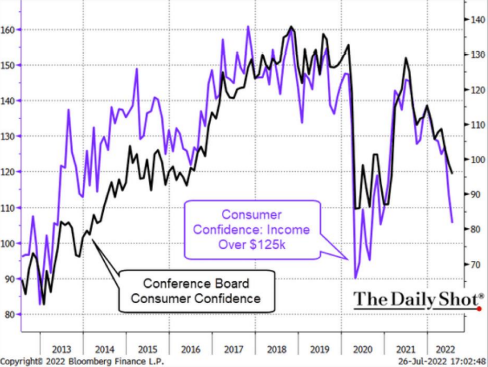

5. Shopper confidence amongst even the higher-income US inhabitants is sinking quick:

6. Rising charges and the sturdy USD coverage pursued by Yellen and Powell has made the price of US entitlements (i.e., well being, social safety and so forth.) painfully worse and finally unsustainable.

When Yellen was drunk-driving on the Fed, for instance, these entitlements had been 54% of US tax receipts in 2015; right this moment, as spending will increase and inflationary 10% “price of residing changes” (COLA) are truthfully utilized, annual US entitlement funds will very quickly attain 90% of US tax receipts.

In brief, the present and “hawkish” rising-rate-strong-USD coverage on the Eccles constructing will bankrupt the federal authorities except a pivot is made quickly to fill the spending gaps and deficits with extra pretend fiat cash—i.e., extra QE.

In any case, that wanted cash is definitely not coming from an anemic GDP, a topping and tanking market and therefore declining tax receipts.

7. As to Uncle Sam’s embarrassing bar tab, he’s dealing with $23T of excellent IOU’s, 30% of that are poised to re-price on the finish of this yr at the next (6.75%) relatively than decrease annual price, which boils all the way down to roughly $460B in further spending (12% of tax receipts) simply to cowl these rising curiosity bills.

Thus, except the Fed hits the “QE-Button” very quickly, Uncle Sam will probably be hiding from his collectors behind the Fed and its at the moment dim “completely satisfied hour” signal.

8. On the world degree, almost each main “developed economic system” is little greater than a glorified banana republicmathematically staring down the barrel of a sovereign debt disaster as governmental charges (i.e., the price of borrowing) are rising at the exact same time that financial progress and new export orders are sinking:

In the meantime the Pravda-Like Denial Continues

Regardless of every of the foregoing exhausting details, US Treasury Secretary, Janet Yellen, is main the official DC refrain in a now brazenly pathetic effort to disclaim actuality in methods paying homage to the Soviet period circa 1963.

In response to Yellen, and after back-to-back quarters of unfavorable GDP progress, “there’s no proof of a recession now.”

Such phrases as soon as once more verify how central bankers are nothing greater than word-smith politicians (propagandists?) wearing banker clothes and damaged (free-market) excessive heels.

Math and exhausting information are not the important thing focus of our central bankers. Like candor and ethics, they’ve changed honest numbers with political nouns and false narratives.

It appears right this moment that together with science, tradition, comedy, creativity and historical past, the very self-discipline of economics has itself been canceled.

What to Count on?

In such a distorted, determined and admittedly dishonest backdrop of kind over substance and false narratives over sincere math, what can the remainder of us count on from our central planners on excessive and our actual world expertise on the bottom?

As I not too long ago argued, the Fed is aware of it is not going to beat inflation (which it secretly wants) by way of rising charges.

As a substitute, Powell will centrally engineer a at the moment “deniable” recession (which is dis-inflationary) to publicly “fight” in any other case intentionally sought inflation.

Towards this finish, these fork-tongued bankers may even pull out their standard methods and magical calculators to persuade the world and markets that formally reported inflation ranges are sincere (regardless of being a minimum of 50% underneath-reported) whereas concurrently and intentionally pursuing a coverage of unfavorable actual charges (i.e., inflation charges above rates of interest) as they publicly and dishonesty report them as constructive.

So sure, a recession is right here, and an extended and deeper one is coming.

The Fed will use phrases and dishonest math to calm the cognitively dissonant from an abrupt market sell-off or a collective wising up.

As I see it, the Fed can postulate and chest puff a hawkish and rising price coverage for now and maybe even into the autumn.

However except the Fed specifically, and the key central banks usually, want to “defeat” inflation by catapulting the world into a world recession whose depth, period and ache will probably be excessive, they’ll haven’t any mathematical nor even political selection however to decrease charges, weaken their currencies and battle recessions inside their entrance yards.

As not too long ago argued, no nation, regime nor system in historical past has conquered a recession by jacking up charges and strengthening their foreign money.

Given the proof above, the US is heading straight right into a recession and as such will probably be pressured to confront that actuality (nonetheless downplayed or formally postponed) by cranking out the mouse-click cash in a approach which can cap yields, debase the greenback and thus be a tailwind for treasured metals throughout the board.

Except, in fact, you assume all that information above is pretend information and that the Fed has outlawed recessions, during which case all is ok and can at all times be nice, proper?

Assist Help Unbiased Media, Please Donate or Subscribe:

Trending:

Views:

38