imaginima

To date, Exxon Mobil (NYSE:XOM) has been one of the biggest beneficiaries of the ongoing energy crisis thanks to its dominant position in the oil and gas industry. In recent weeks, I have already covered how the upcoming global oil and natural gas disruptions are likely to continue to help the company generate record returns and enrich its shareholders. This article will focus on highlighting the upcoming global supply disruptions within the refining industry, which could potentially keep Exxon’s refining margins at record levels and at the same time minimize the downside of the ongoing demand destruction caused by the hawkish monetary policy of central banks around the world.

Supply Disruptions Are Not Over Yet

It’s been almost two weeks since the European embargo on Russian oil along with a price cap went into effect and we could assume that those measures have been successful so far. In the first 48 hours of the embargo, the Russian seaborne exports have halved, while the country is about to post a $55 billion budget deficit this month despite imposing a windfall tax on Gazprom (OTCPK:OGZPY) along with its peers last month and at the same time generating record profits at the beginning of 2022 due to high oil prices.

Add to this the fact that the IEA now expects the Russian oil output to decrease by 14% by the end of Q1’23 at a time when global consumption is forecasted to increase and we could come to a conclusion that the sanctions are working while the market is likely to remain tight for a while. That’s one of the main reasons why Exxon is likely going to be able to continue to generate record returns at Russia’s expense. However, that’s not the whole story.

In accordance with the sixth package of economic sanctions that was approved in early June, the European Union is expected to also implement an embargo and a price cap on Russian refined oil products such as diesel and gasoline on February 5. In 2021, countries of the EU combined imported 1.2 million barrels of refined products from Russia on a daily basis, which made them the biggest buyers of Russian diesel to date.

This is a big deal since when those measures are going to be implemented, Europe would be looking to other suppliers to satisfy its needs which would result in an additional tightening of an already tight refined products market. Considering that the oil embargo so far is working and drains Moscow’s coffers, there’s a decent chance that the ban on refined products would be working fairly well as well.

On top of that, several additional factors could worsen the ongoing refinery crisis even more. First of all, there’s always a possibility that the OPEC+ cartel would decrease its own refinery throughput in a retaliatory move in order to ensure that it continues to generate record returns, as was the case with its latest decision to decrease an oil output to keep the oil prices at relatively high levels.

Secondly, the destruction of the Russian refinery infrastructure within Russia proper could lead to the permanent loss of a global refinery throughput at a time when the demand for oil products continues to accelerate. Back in June, a drone attacked Russia’s oil refinery in the Rostov region, while a couple of days ago, another refinery was attacked deep in Siberia.

Thirdly, there’s always a possibility that the supplies of crude oil to Hungary and Slovakia through the Druzhba pipeline, which goes through Ukraine would be disrupted as well due to the ongoing Russo-Ukrainian war. This could take the Hungarian and Slovakian refineries out of the business for a while, deepening the refinery crisis even more.

Exxon’s Refining Business Continues To Deliver

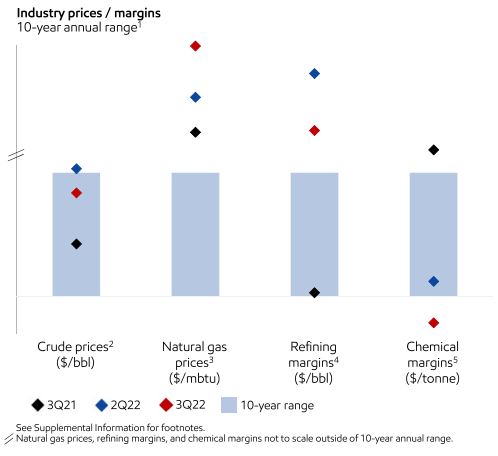

All of the developments discussed above would more than likely help Exxon to continue to generate record returns in the foreseeable future. Just as it’s the case with oil and natural gas, the disruption of supplies of refined products is more than likely to keep the company’s refining margins at relatively high levels. The company’s latest earnings report for Q3 shows that in the last two quarters the refining margins were already above the 10-year range. This could continue to be the case in an event of possible further global disruptions of supply.

Energy Industry Prices/Margin Ratio (Exxon Mobil)

Another important thing to mention is that as Russian oil products are about to leave the market, Exxon has a unique opportunity to continue to increase its own refinery throughput and not worry about a potential decrease in prices since even under such a scenario the market would remain tight.

Add to this the fact that there’s a risk for further strikes of workers of various European refineries in addition to the existing ones due to the rising inflation along with a higher cost of living and it becomes obvious that the supply disruptions within the refining industry are unlikely to be over yet.

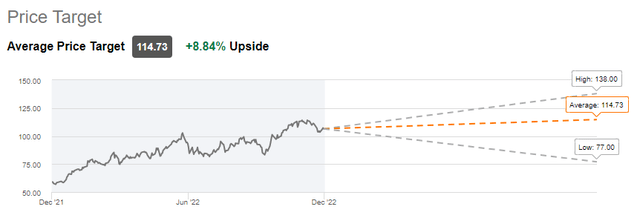

Considering all of those developments, it’s safe to say that Exxon is more than likely to continue to generate aggressive refining margins in the next couple of quarters at the very least. As a result, it’s safe to justify the ~9% upside that its stock offers at the current levels.

On top of that, as the company is expected to continue to show a decent growth of EPS and revenues in the next two quarters despite the hawkish monetary policy of central banks, while the EIA forecasts the price for Brent oil to average $92/b in 2023, the stock would likely perform well going forward.

Exxon’s Consensus Price Target (Seeking Alpha)

The Biggest Risk

There’s one major risk to the ongoing refinery story. Even though the supply disruptions would keep the market tight and ensure that companies continue to generate relatively high margins, there’s a possibility that the Biden administration decides to implement a fuel export ban.

Such an idea was already touted back in July, but the decision wasn’t made on whether to do so at that time. If such a decision would be made in the foreseeable future, then it would decrease the domestic gasoline prices, but at the same time, it would crush the margins for Exxon’s U.S. refineries. Such a decision would also create additional supply gaps in an already tight market, but the company wouldn’t be able to benefit from it due to the inability to supply a significant portion of its oil products to global customers.

Until that happens, Exxon would continue to greatly benefit from a tight market and more than likely be able to generate record returns in the next couple of quarters.