Revealed on October twenty eighth, 2025 by Felix Martinez

Extreme-yield shares pay out dividends that are significantly bigger than the market widespread. For example, the S&P 500’s current yield is barely ~1.2%.

Extreme-yield shares will likely be considerably helpful in supplementing income after retirement. A $120,000 funding in shares with a median dividend yield of 5% creates a median of $500 a month in dividends.

Cross Timbers Royalty Perception (CRT) is part of our ‘Extreme Dividend 50’ sequence, which covers the 50 highest-yielding shares throughout the Sure Analysis Evaluation Database.

We now have now created a spreadsheet of shares (and intently related REITs, MLPs, and so forth.) with dividend yields of 5% or further.

It’s possible you’ll receive your free full guidelines of all securities with 5%+ yields (along with important financial metrics akin to dividend yield and payout ratio) by clicking on the hyperlink beneath:

Subsequent on our guidelines of high-dividend shares to analysis is Cross Timbers Royalty Perception (CRT).

Enterprise Overview

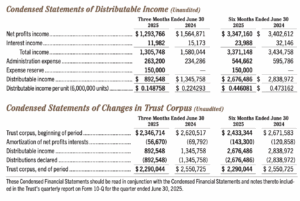

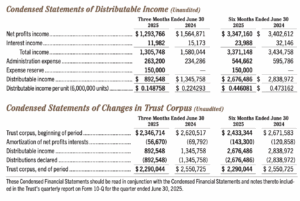

Cross Timbers Royalty Perception (CRT) is an oil and gasoline perception established in 1991 by XTO Energy, a subsidiary of ExxonMobil. The assumption generates income by way of a 90% web income curiosity in gas-producing properties in Texas, Oklahoma, and New Mexico, along with the San Juan Basin, and a 75% web income curiosity in working curiosity oil properties in Texas and Oklahoma. Whereas the 90% curiosity shouldn’t be matter to enchancment costs, the 75% curiosity requires CRT to share in manufacturing and enchancment payments, which means distributions are delayed if costs exceed earnings.

CRT’s earnings is carefully weighted in the direction of oil, which accounted for 72% of entire earnings in 2024, with pure gasoline making up the remaining 28%. Historically, the assumption has produced regular royalty income, producing $12.5 million in 2022 and $12.3 million in 2023. Month-to-month distributions are paid to unitholders by XTO Energy, and CRT has a market capitalization of roughly $52 million, offering consumers a royalty-based publicity to U.S. oil and gasoline manufacturing with predictable cash flows.

In mid‑August 2025, Cross Timbers Royalty Perception (CRT) reported its Q2 outcomes: oil volumes declined by ~18% 12 months‑over‑12 months, and pure gasoline volumes fell by ~35%. On the same time, the standard realized oil worth dropped by ~14%. Due to this, CRT’s distributable cash stream (DCF) per unit decreased by spherical 17%.

Distributions have dropped significantly over the earlier 5 months amid lower oil prices and the unwinding of OPEC manufacturing cuts. Primarily based totally on distributions over the first eight months of 2025, CRT is offering an annualized yield of roughly 12.1%.

Provide: Investor Relations

Progress Prospects

A key driver for Cross Timbers Royalty Perception is the price of oil and gasoline. Between 2014 and 2020, falling commodity prices restricted the assumption’s income, nevertheless the 2023 rally to 13-year highs allowed CRT to realize its highest distributable cash stream (DCF) per unit in eight years. Sturdy commodity prices instantly enhance distributable income and, in flip, the unit worth. Nonetheless, as OPEC manufacturing cuts unwind, CRT’s stock has pulled once more from near all-time highs.

As a royalty perception, CRT has minimal working payments, giving it vital leverage when revenues rise. Its distributable income and progress are subsequently nearly solely relying on commodity prices. Over the earlier decade, CRT has averaged $1.24 per unit in annual distributable and distributed cash stream, though this declined over loads of the ultimate eight years until 2022. Manufacturing from its properties naturally declines by 6%-8% per 12 months, which presents a headwind to future returns. Coupled with the worldwide shift in the direction of renewable vitality, we depend on distributable cash stream to say no by a median of 5% yearly over the next 5 years.

Aggressive Advantages & Recession Effectivity

Dividend Analysis

Cross Timbers Royalty Perception (CRT) classifies its distributions as royalty income, which is taxed as weird income on the recipient’s marginal tax payment. Distributions are declared 10 calendar days sooner than the doc date, typically the ultimate enterprise day of each month.

Payouts have historically been dangerous, reflecting swings in oil and gasoline prices. Between 2014 and 2020, distributions declined steadily ensuing from weak commodity prices, falling from $1.43 per unit in 2018 to $0.78 in 2020, sooner than rebounding in 2021 and 2022 as vitality markets recovered. CRT offered $1.92 per unit in 2023, yielding a median annual distribution of 10.9%, and an eight-year extreme of $1.96 per unit in 2022. Over the last 12 months, the current yield is roughly 12%.

Distributions are extraordinarily relying on commodity prices, as CRT distributes primarily all of its income and has no administration over manufacturing or pricing. Dividend progress is tied on to bigger distributable income, making payouts unpredictable and intensely cyclical.

Whereas elevated oil and gasoline prices can yield generous distributions, the long-term menace of worth declines—significantly amid the worldwide shift in the direction of renewable vitality—introduces vital volatility. Merchants must understand that CRT’s extreme yields embrace considerable variability, and the assumption’s payout pattern is best seen as a reflection of commodity market effectivity fairly than regular income.

Closing Concepts

Cross Timbers Royalty Perception (CRT) has fallen roughly 34% from its peak over the earlier 5 months, primarily ensuing from declining oil prices as OPEC restores manufacturing to common ranges. The stock’s extreme yield may appear engaging, nevertheless its effectivity stays intently tied to dangerous commodity markets.

Making an attempt ahead, CRT might ship a median annual return of about 6.8% over the next 5 years. This assumes a 12% starting distribution yield, 4% progress in distributable income, and a projected 5.5% valuation headwind. The assumption continues to face risks from the cyclicality of oil and gasoline prices, long-term manufacturing declines, and dealing costs, supporting a promote rating for the stock.

Extreme-Yield Explicit individual Security Evaluation

Totally different Sure Dividend Property

Thanks for learning this textual content. Please ship any recommendations, corrections, or inquiries to [email protected].

rn

rn

Source link ","writer":{"@sort":"Particular person","identify":"Index Investing Information","url":"https://indexinvestingnews.com/writer/projects666/","sameAs":["https://indexinvestingnews.com"]},"articleSection":["Investing"],"picture":{"@sort":"ImageObject","url":"https://www.suredividend.com/wp-content/uploads/2022/10/Excessive-Dividend-Picture.jpg","width":0,"top":0},"writer":{"@sort":"Group","identify":"","url":"https://indexinvestingnews.com","emblem":{"@sort":"ImageObject","url":""},"sameAs":["https://www.facebook.com/Index-Investing-News-102075432474739","https://twitter.com/IndexInvesting_"]}}

Source link