Printed on October twenty second, 2025 by Felix Martinez

Extreme-yield shares pay out dividends which could be significantly better than the market widespread. As an example, the S&P 500’s current yield is solely ~1.2%.

Extreme-yield shares shall be notably helpful in supplementing retirement income. A $120,000 funding in shares with a median dividend yield of 5% creates a median of $500 a month in dividends.

Blue Owl Capital Firm (OBDC) is part of our ‘Extreme Dividend 50’ sequence, which covers the 50 highest-yielding shares throughout the Sure Analysis Evaluation Database.

We’ve created a spreadsheet of shares (and intently related REITs, MLPs, and so forth.) with dividend yields of 5% or further.

You’ll be capable to acquire your free full file of all securities with 5%+ yields (along with crucial financial metrics harking back to dividend yield and payout ratio) by clicking on the hyperlink beneath:

Subsequent on our file of high-dividend shares to guage is Blue Owl Capital Firm (OBDC).

Enterprise Overview

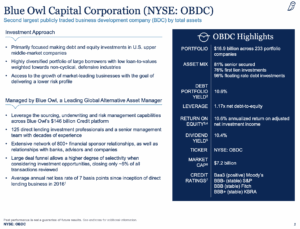

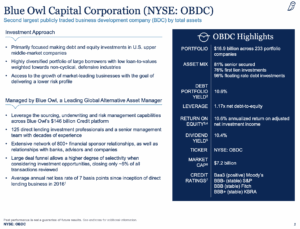

Blue Owl Capital Firm is a publicly traded enterprise enchancment agency (BDC) headquartered in New York, New York. Primarily based in October 2015, the company completed its preliminary public offering in July 2019. Blue Owl primarily invests in and gives financing to U.S. middle-market companies, specializing in these with annual EBITDA between $10 million and $250 million or revenues ranging from $50 million to $2.5 billion on the time of funding.

The company generates roughly $1.6 billion in annual gross funding income and holds a market capitalization of $6.6 billion, making it the third-largest publicly traded BDC. Blue Owl focuses on supporting growth-oriented companies by the use of strategic investments and lending choices.

On July 6, 2023, the company rebranded from Owl Rock Capital Firm to Blue Owl Capital Firm, updating its Nasdaq ticker from ORCC to OBDC to duplicate its new identification.

Blue Owl Capital Firm (OBDC) reported sturdy financial outcomes for the second quarter ended June 30, 2025. GAAP internet funding income (NII) per share was $0.42, exceeding expectations by $0.03, whereas earnings elevated 22.5% year-over-year to $485.8 million. Adjusted NII per share rose barely to $0.40 from $0.39 in Q1 2025. The Board of Directors declared an entire dividend of $0.39 per share for the quarter, along with a $0.02 supplemental dividend, reflecting an annualized yield of 10.4%. Net asset value per share was $15.03, modestly down from $15.14 throughout the prior quarter on account of select write-downs, partially offset by earnings exceeding dividends.

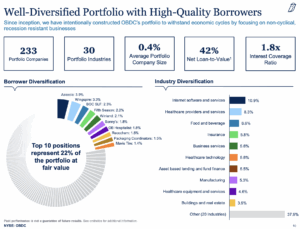

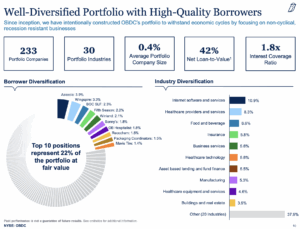

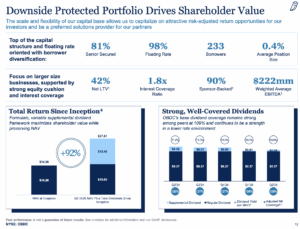

All through the quarter, Blue Owl devoted $1.1 billion to new investments whereas receiving $1.9 billion in repayments and product sales, resulting in an internet low cost of invested capital. The company’s portfolio consisted of 233 companies all through 30 industries, with complete investments valued at $16.9 billion. First-lien senior secured debt represented 75.8% of the portfolio, and solely 0.7% of the investments have been on non-accrual standing, demonstrating sturdy credit score rating prime quality and portfolio stability. Weighted widespread yields on debt investments remained partaking at roughly 10.6% at truthful value.

OBDC ended the quarter with $360 million in cash, $9.3 billion in complete debt, and $3.7 billion in undrawn credit score rating functionality, sustaining compliance with all financial covenants. Working payments elevated barely to $266.8 million, primarily from curiosity, administration, and incentive expenses related to the present merger. CEO Craig Packer emphasised that the portfolio’s effectivity helps fixed earnings and fascinating risk-adjusted returns, positioning Blue Owl to capitalize on options throughout the middle-market lending sector whereas sustaining sturdy liquidity and capital flexibility.

Provide: Investor Relations

Progress Prospects

The company’s internet funding income (NII) per share may be very relying on the unfold between the yields on its investments and its private funding costs. On the end of Q2 2025, the weighted widespread complete yield on debt and income-producing securities was 10.6%, down 130 basis components year-over-year, whereas the widespread unfold declined 50 basis components to 5.8%.

Extreme charges of curiosity can revenue Blue Owl, nevertheless offered that the company maintains administration over its funding costs. Given the already elevated FY2025 NII per share, extra improvement is unlikely throughout the near time interval as market dynamics evolve.

Regarding distributions, Blue Owl presently pays a quarterly base dividend of $0.37 per share. Explicit dividends have been frequent in present intervals on account of additional options, nevertheless the bottom dividend is predicted to develop modestly at spherical 2% yearly, a tempo thought-about sustainable given the company’s earnings profile.

Provide: Investor Relations

Aggressive Advantages & Recession Effectivity

Blue Owl Capital has sturdy advantages on account of it focuses on lending to U.S. middle-market companies with regular cash flows. The company’s experience in structuring loans and investments, combined with its secure relationships with its portfolio companies, permits it to find out partaking options and make educated funding alternatives. Most of its loans are floating-rate, which can additionally assist earn further when charges of curiosity rise.

The company moreover performs properly in downturns. Its portfolio is mostly senior secured debt, which is safer, and only some investments are on non-accrual. This conservative technique and provides consideration to cash-generating corporations help Blue Owl maintain regular income and dividends, even all through recessions, whereas persevering with to supply common returns to patrons.

Provide: Investor Relations

Dividend Analysis

Blue Owl Capital’s annual dividend is $1.48 per share. At its present share worth, the stock has a extreme yield of 11.4%.

Given the company’s earnings outlook for 2025, NII/share is predicted to be $1.65. In consequence, the company is predicted to pay out 90% of its internet income per share to shareholders. This doesn’t embody some small explicit dividends which could be usually declared.

Closing Concepts

Blue Owl Capital is no doubt one of many largest BDCs, with a diversified portfolio all through completely totally different companies and industries. Although it has a relatively fast historic previous as a publicly traded agency, it has confirmed sturdy fundamentals.

We anticipate annualized returns of about 9.9% over the medium time interval, principally pushed by its dividend, and cost the stock as a keep.

Extreme-Yield Explicit individual Security Evaluation

Totally different Sure Dividend Sources

Thanks for finding out this textual content. Please ship any solutions, corrections, or inquiries to [email protected].

rn

rn

Source link ","writer":{"@sort":"Particular person","title":"Index Investing Information","url":"https://indexinvestingnews.com/writer/projects666/","sameAs":["https://indexinvestingnews.com"]},"articleSection":["Investing"],"picture":{"@sort":"ImageObject","url":"https://www.suredividend.com/wp-content/uploads/2022/10/Excessive-Dividend-Picture.jpg","width":0,"peak":0},"writer":{"@sort":"Group","title":"","url":"https://indexinvestingnews.com","emblem":{"@sort":"ImageObject","url":""},"sameAs":["https://www.facebook.com/Index-Investing-News-102075432474739","https://twitter.com/IndexInvesting_"]}}

Source link