Spencer Platt

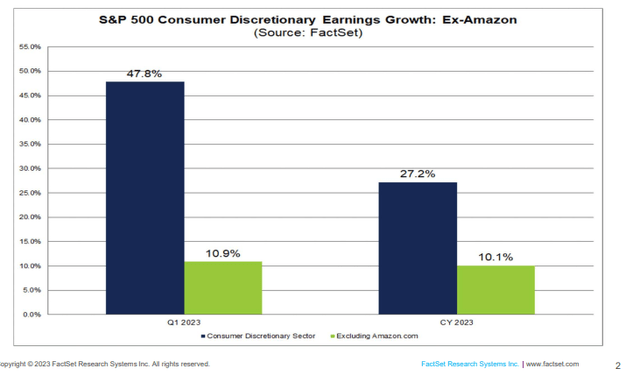

Earnings season has been solid so far. A 79% S&P 500 EPS beat rate is comfortably above the 5-year average while the Consumer Discretionary sector boasts impressive earnings growth even if you back out Amazon.

On Wednesday evening, Etsy (NASDAQ:ETSY) reports its Q1 results. I am a buy on the stock today after the steep recent decline but recognize ongoing technical risks with the chart.

Discretionary EPS Growth Robust

FactSet

According to Bank of America Global Research, ETSY is a US-based e-commerce company that operates online marketplaces connecting nearly 100mn buyers and 9mn sellers globally. It specializes in handmade and/or vintage items, art, and craft supplies. As of 2021, Etsy generated $13.5bn in gross merchandise sales and $2.3bn in total revenues. Revenue is primarily generated from listing and transaction fees, seller services such as advertising, and shipping labels.

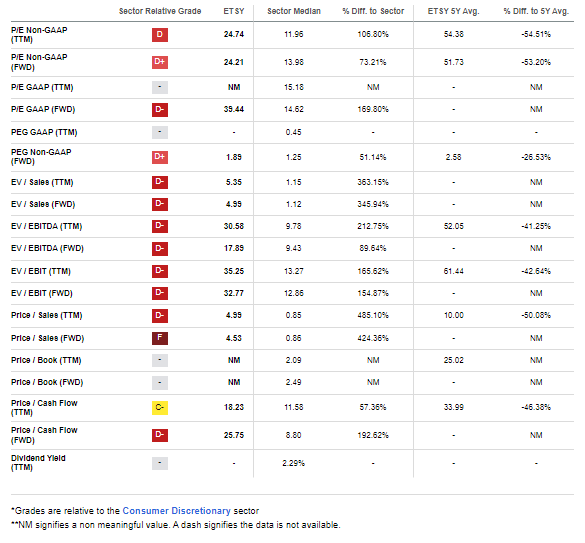

The New York-based $12.5 billion market cap Broadline Retail industry company within the Consumer Discretionary sector has negative trailing 12-month GAAP earnings but sells at a 24.2 forward operating P/E. The firm does not pay a dividend, according to The Wall Street Journal. Ahead of earnings on Wednesday night, ETSY has an elevated 13.3% short interest.

ETSY benefited during the pandemic with high app downloads and strong website traffic. Recently, growth has slowed as consumers shift spending preferences from goods to experiences and services. Nevertheless, demographic trends favor the online retailer and there remain plenty of untapped geographic areas for the company. Key risks include a downturn in the macroeconomic picture and potential job losses in the U.S. economy that could result in less discretionary spending.

But the latest data is positive – March app downloads were seen as having jumped 23% year-on-year (up from +19% in February) while daily active users rose 8% annually (up two percentage points sequentially) (as reported by BofA). But Truist notes that channel checks suggest softening ETSY sales using their card data analysis. Still, Piper Sandler recently upgraded the stock on valuation, and I am in that camp which I’ll assert later.

Shares traded higher last time ETSY reported care of a 13% annual revenue increase. The balance sheet is also in decent shape with $1.2 billion of cash and cash equivalents on hand. Finally, the company bought back $150 of stock in Q4.

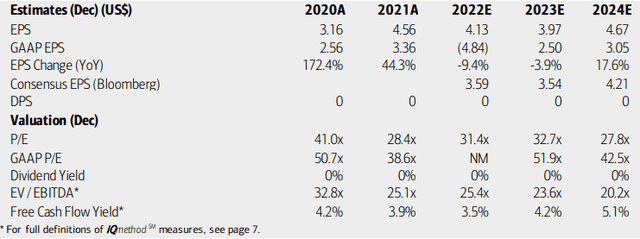

On valuation, analysts at BofA see earnings falling 4% this year after 2022’s more than 9% decline. Per-share profits are seen bouncing back big in 2024, however. The Bloomberg consensus forecast is less sanguine compared to BofA’s outlook. No dividends are expected on this growth stock, but ETSY is free cash flow positive throughout this tough earnings period. Bears can point to high earnings multiples on the stock, but relative to ETSY’s history, the current 24.2 forward operating P/E is less than half of its 5-year average of 51.7. Likewise, its TTM price-to-sales ratio is 5.0 – under the 5-year average of 10.0.

With a more mature, high-margin business model today, high-single-digit EPS growth is likely over the next few years, making for a normalized PEG ratio of less than 3. With a decent quarter reported in February and a lower stock price, I am more bullish on valuation. If we assign a low 20s EV/EBITDA using ’24 estimates, then the stock should be near $140. The firm’s average EV/EBITDA historically has been in the high 20s, so that’s a discount to the long-term norm.

Etsy: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

ETSY: A Poor Valuation Grade, But P/E & P/S Are Down From Lofty Levels

Seeking Alpha

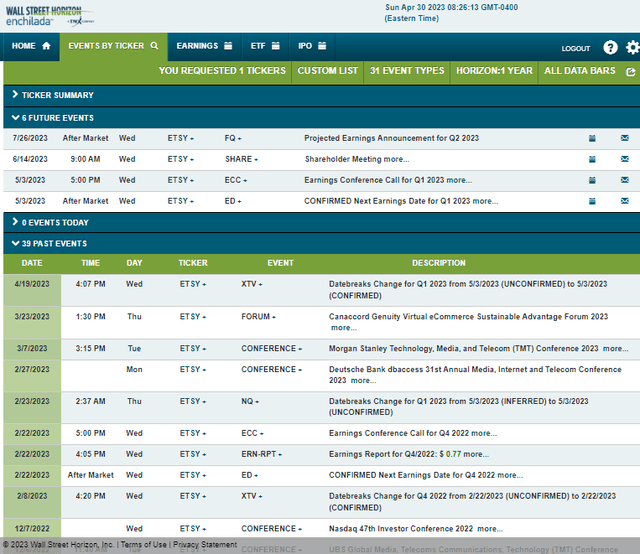

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q1 2023 earnings date of Wednesday, May 3 AMC with a conference call immediately after results cross the wires. You can listen live here. The company hosts its annual shareholder meeting on Wednesday, June 14.

Corporate Event Risk Calendar

Wall Street Horizon

The Options Angle

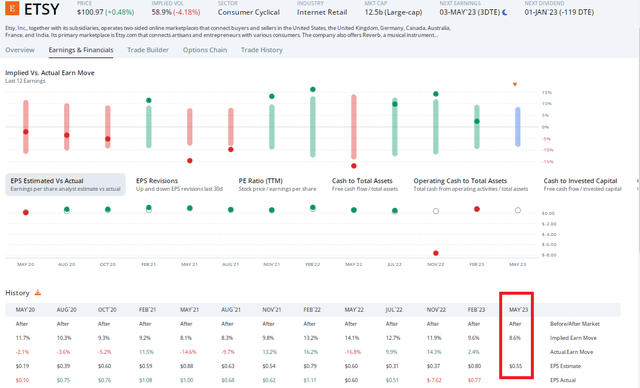

Digging into the upcoming earnings report, data from Option Research & Technology Services (ORATS) show a consensus EPS forecast of $0.55 which would be an 8% decline from $0.60 of per-share profits earned in the same quarter a year ago. The company had a strong bottom-line beat rate before missing in the last pair of instances, but the stock has traded higher post-earnings in the previous 3 reports (and 5 of the last 6). So, there is a positive trend here from an investor’s perspective.

This time around, options traders have priced in an 8.6% earnings-related stock price swing when analyzing the at-the-money straddle expiring soonest after the reporting date. That appears fair to me based on previous moves. And it could lean expensive given lower implied volatility on the stock now relative to past reporting dates.

ETSY: A YoY EPS Drop Seen

ORATS

The Technical Take

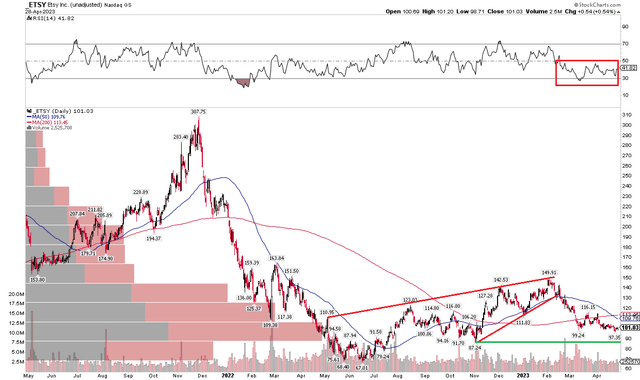

I issued a cautious technical note on ESTY back in February. While I felt the stock was near fair value around $140, the chart pointed to downside risks. Alas, the technicals bore out, and a bearish rising wedge pattern unfolded. Shares quickly dipped under $100. The stock has support near $87 but a bearish death cross between the falling 50-day moving average and flat 200-day moving average does not suggest an imminent reversal.

Moreover, the RSI momentum indicator at the top of the chart is mired in the bearish 20 to 60 range. I see resistance in the $112 to $116 range – so taking profits there on a bounce is wise. Once again, we have a bifurcated fundamental backdrop and technical view with ETSY.

ETSY: Few Signs of a Bullish Reversal

Stockcharts.com

The Bottom Line

I am a buy on ETSY heading into earnings despite the lackluster chart. Shares are back on the cheap side, and I see fair value near $145.