Este artículo también está disponible en español.

Ethereum (ETH) seems to be lastly waking from its slumber, surging practically 37% up to now week following Bitcoin’s (BTC) all-time-high (ATH) rally.

Spot Ethereum ETFs Report Each day Inflows

Ethereum, the second-largest cryptocurrency with a market cap of roughly $404 billion, is now gaining floor on BTC, with the platform’s ETH token leaping greater than 35% over the previous week.

Associated Studying

Whereas the broader digital property market has been buoyed by Donald Trump’s victory within the 2024 US presidential election, extra elements may be driving the latest trade growth, particularly for ETH.

A key information level is the substantial influx of funds into spot ETH ETFs. On November 11, US-based spot ETH ETFs attracted a document $295 million in each day inflows, the best quantity to this point.

Compared, the earlier peak for each day inflows into spot ETH ETFs was $106 million, recorded on the primary day these ETFs launched in July 2024.

Based on information from SoSoValue, the document inflows had been led by Constancy’s FETH ETF, which drew in $115.48 million.

BlackRock’s ETHA adopted with $101.11 million, Grayscale’s ETH with $63.32 million, and Bitwise’s ETHW with $15.57 million.

On the time of writing, the whole worth of internet property held throughout numerous spot ETH ETFs stands at $9.72 billion, representing simply over 2.41% of Ethereum’s complete market cap. In the meantime, cumulative internet outflows from all spot ETH ETFs quantity to $41.30 million.

ETH Worth Motion And Resurgence In DeFi

Renewed curiosity from institutional traders in Ethereum ETFs amid document each day inflows seems to be contributing positively to ETH’s worth motion.

Associated Studying

All through a lot of 2024, ETH lagged in worth efficiency amongst main cryptocurrencies comparable to BTC and Solana (SOL). Nonetheless, This fall 2024 holds potential for a dramatic turnaround in ETH’s momentum.

Evaluation shared by Leon Waidmann, Head of Analysis at Onchain Basis signifies that ETH staking ranges are at an ATH, whereas the token’s reserves on crypto exchanges is heading towards document lows.

This mix of record-high staking ranges and lowered provide on exchanges suggests a possible provide squeeze, which might set off a parabolic rally for ETH.

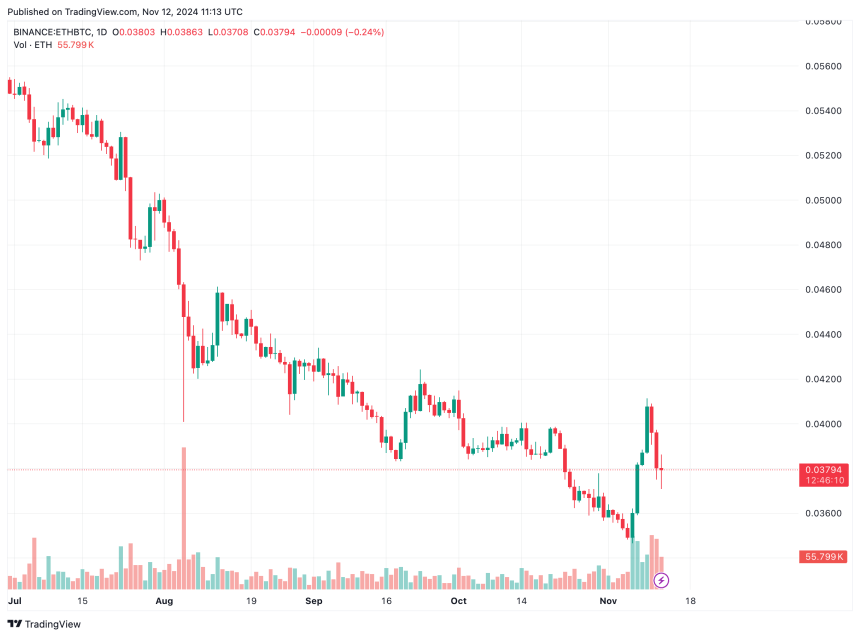

Moreover, the ETH/BTC ratio appears to be recovering after extended losses, with the buying and selling pair rising from 0.034 to 0.040 earlier than dipping to 0.037 on the time of writing.

The subsequent main resistance for this pair lies round 0.040, and a profitable breakout from this stage might result in extra good points for ETH over BTC. At press time, ETH sits about 32% under its ATH worth of $4,878 recorded in November 2021.

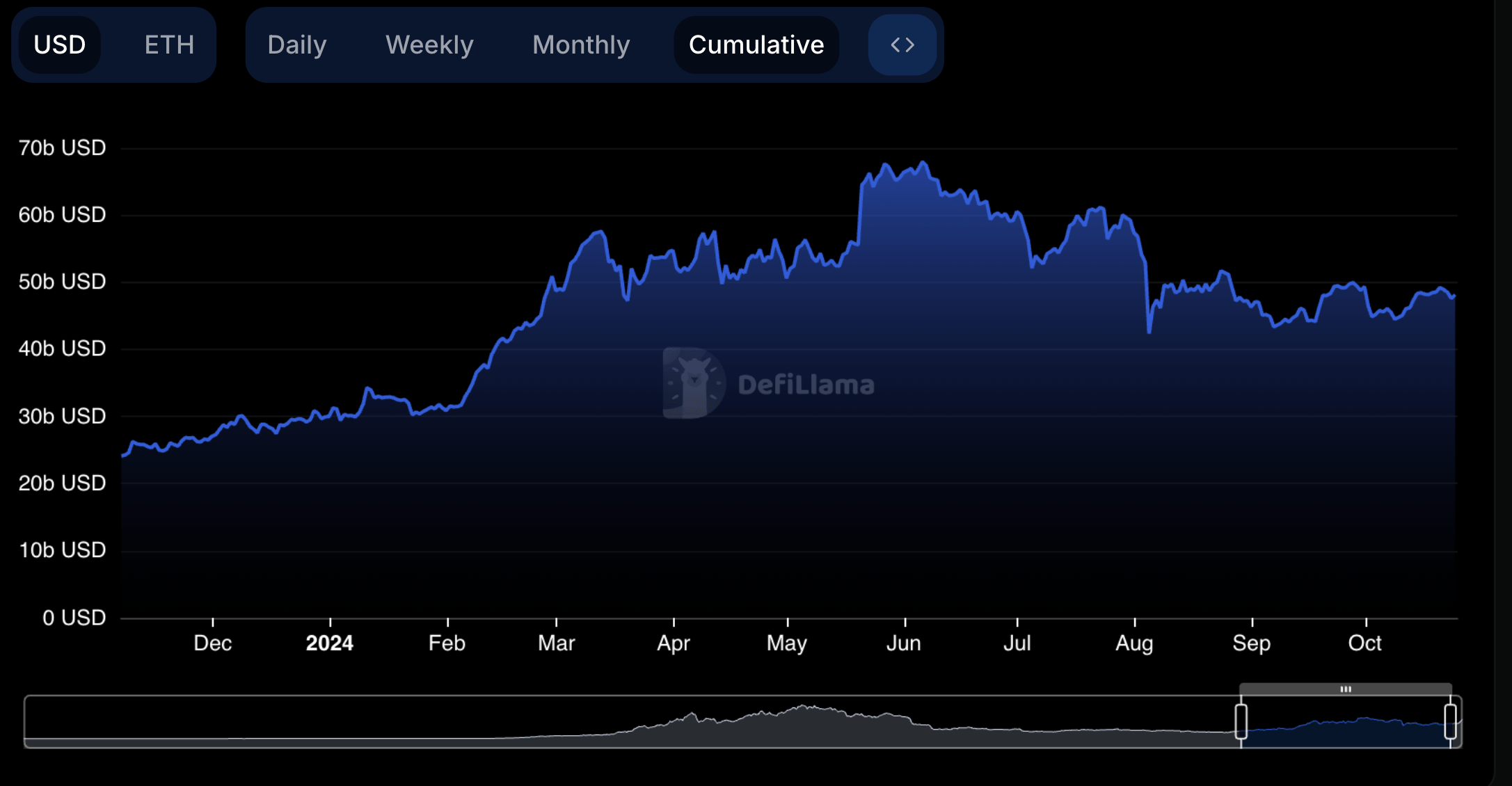

Additional, Ethereum’s decentralized finance (DeFi) exercise appears to be choosing steam. Knowledge from DefiLlama exhibits that the whole worth locked (TVL) throughout Ethereum-based DeFi protocols at present sits at $62.36 billion, up from about $24 billion in November 2023.

Over half of this TVL is tied to the ETH staking platform Lido, which holds near $33 billion. Lido is adopted by the DeFi lending protocol Aave with $15.21 billion and EigenLayer with $14.57 billion.

That mentioned, considerations stay concerning ETH’s “ultrasound cash” narrative because of the token’s excessive issuance price. At press time, ETH trades at $3,291, up 3.1% up to now 24 hours.

Featured picture from Unsplash, Charts from X.com, DefiLlama.com, and TradingView.com