BalkansCat

Late in 2022 I urged a word of caution on Estee Lauder (NYSE:EL) calling the shares far from beautiful. While the company has proven to be an excellent long term steward of capital, the company saw some tough times, while the bolt-on deal for Tom Ford can be questioned. This made me cautious, even as shares have been lagging in 2022 already.

Beauty Place

Estee Lauder is a beauty product conglomerate which is active in a number of (price) categories, with operations across the globe and notable strength in make-up and skincare, making the company a competitor for the likes of L’Oréal and even names like LVMH. In the past, and still today, the company sold these products in old-fashioned department stores, specialty channels (think of Ulta Salon, for instance) and through online channels.

An $80 stock in the year 2016 had rallied to the $200 mark pre-pandemic and fully participated in the 2021 run, when shares peaked at $375 late in the year. This was followed by a significant pullback to $217 late in 2022, although shares were still up a factor of three since 2016.

In August 2022, the company posted a 9% increase in full year sales to $17.7 billion, mostly driven by a $10 billion skincare business, complemented by a $4.7 billion make-up business and a $2.5 billion fragrance segment, and a tiny $600 million hair care business. The key skincare business was responsible for about 80% of earnings, as make-up activities show insufficient profitability, while hair care was a lossmaking operation.

Adjusted earnings were reported at $7.24 per share, with operating margins having risen to 20%, for a $4.2 billion EBITDA number. Despite the lackluster share price performance in 2022, actually an outright disaster, the company still traded at 30 times earnings, which felt like a very high multiple, even amidst a strong track record and a very modest net debt load.

For the fiscal year 2023, the company guided for 3-5% sales growth, although this included a three-point headwind from the strong dollar and a two-point headwind from license deals ending (as well as exposure to Russia). So adjusted for these items, the outlook was quite decent.

After a disastrous first quarter, the company actually saw sales for 2023 down by about 7%, with adjusted earnings only seen at $5.25-$5.40 per share, a massive reset in the outlook.

Amidst the premium valuation, a roughly 40 times forward earnings multiple was very high. Moreover, the company saw net debt increase to $2.5 billion after the first quarter, to double this net debt load following a $2.8 billion deal for Tom Ford in November. Amidst all this, being a big disappointment in the 2022 share price performance and long term track record, I was very cautious on the shares here.

Coming Down

After voicing this cautious tone in December, shares actually rallied to $280 in December, but after a bombshell quarterly report in May, shares are now down to $180.

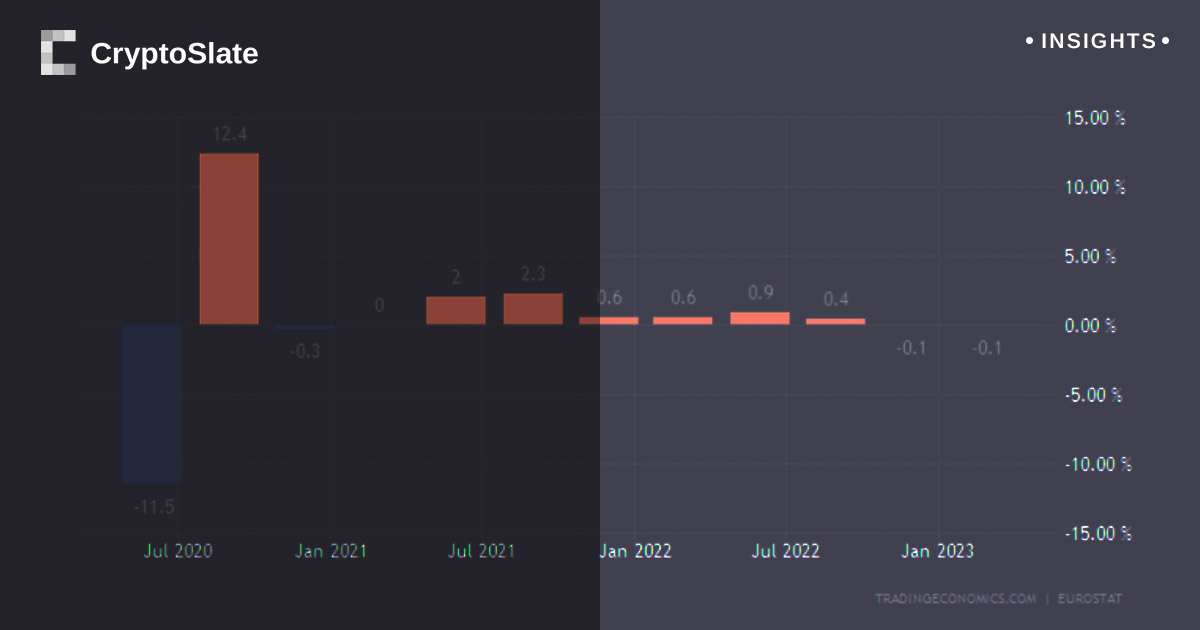

In February, Estee Lauder reported a 17% fall in second quarter sales to $4.62 billion, although the strong dollar cut sales by six percent. The deleveraging hurt margins in a huge way with operating margins of 12% (GAAP accounting) having been cut more than in half, with GAAP earnings down 63% to $1.09 per share. For the year the company saw earnings down about 6% and adjusted earnings seen down further to $4.87-$5.02 per share.

Third quarter sales, as reported in May, fell 12% to $3.75 billion. In this seasonally softer quarter, margins fell further to 8%, with reported GAAP earnings down 72% to $0.43 per share. The company lowered the guidance again, citing lower travel activity which actually does not rhyme with comments from many other businesses (although that is not really fair as Estee Lauder’s success is mostly tied to travel in Asia).

Full year sales were now seen down by about 11% for the year, adjusted earnings are only seen between $3.29 and $3.39 per share.

Still trading at $180, the 361 million shares value equity at $65 billion, a number which increases to $70 billion if we factor in pro forma net debt. With sales seen around $15-16 billion this year, sales multiples look reasonable, but margins are simply dismal by all means.

What Now?

With earnings power seen at a dismal $3 and change this year, there is little current earnings fundamental support here at $180. Even if we look at the +$7 earnings per share power in a very strong fiscal year 2022, the resulting 25 times earnings multiple (which is far from within reach here) is still quite lofty as shares are essentially back to the 2020 levels here.

This makes me very cautious even if shares are down in half, as the run higher was too aggressive and the current earnings pullback is severe and feels a bit more than just a cyclical pullback, with some structural headwinds here seen apparently as well. After all, the company is underperforming its peers in a major way. This makes me perfectly happy to not become involved with the business here, as no beauty is yet seen in the eye of this beholder.