A girl fills a glass with faucet water. Kemal Yildirim/E+ by way of Getty Photographs

In dividend progress investing, it’s typically mentioned that the most secure dividend is the one simply raised. I typically agree with this maxim.

That is most very true when a payout hike is completely supported by an organization’s fundamentals. Put one other manner, dividend boosts are sustainable when the next situations are met:

- The stability sheet is powerful and secure.

- Earnings constantly transfer larger and the expansion outlook stays promising.

- The dividend is comfortably backed up by earnings energy.

Now, an organization can shift its capital allocation technique seemingly at a second’s discover. This might put a dividend minimize or suspension on the desk. In my expertise, that hasn’t occurred too incessantly, although.

One of many more moderen dividend raises in my portfolio got here from the water and gasoline utility, Important Utilities (NYSE:WTRG). In July, the utility upped its quarterly dividend per share by 6% to $0.3255.

After I final coated Important Utilities with a purchase ranking in Could, I believed its deliberate capital spending would translate into strong long-term progress prospects. The corporate’s distinctive monetary well being was a plus as nicely. The discounted valuation is what sealed the deal for my purchase ranking.

I went on to up my place in Important Utilities by 110% in July (for disclosure functions, it is nonetheless one among my smaller holdings at a 0.6% weight).

At present, I will be sustaining my purchase ranking. Important Utilities’ second quarter outcomes shared on Aug. fifth have been respectable for the circumstances. The corporate has main fee instances that ought to quickly be taking part in out in its favor. Important Utilities nonetheless possesses an A- credit standing from S&P. Lastly, shares stay an ideal deal on the present valuation.

Constructive Fee Case Outcomes On The Horizon

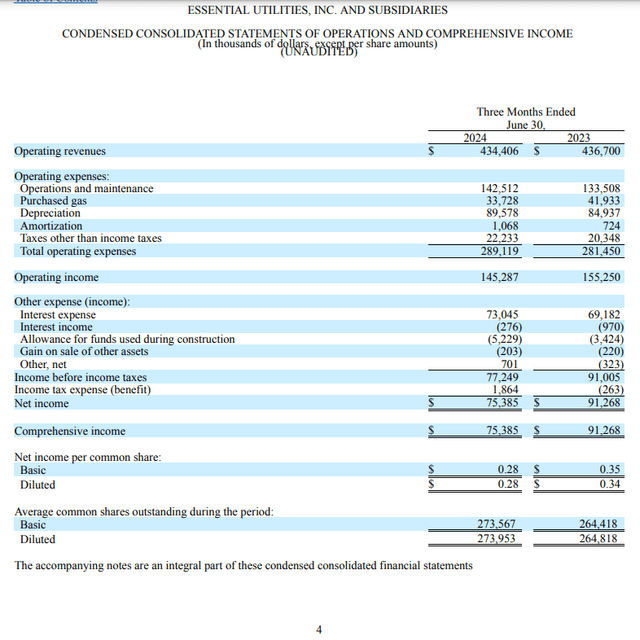

Important Utilities’ Q2 2024 10-Q Submitting

Final month, Important Utilities shared what, I believed, have been acceptable second-quarter outcomes. The corporate’s working income decreased by 0.5% over the year-ago interval to $434.4 million in the course of the quarter. This was $10.3 million lower than the In search of Alpha analyst consensus for the interval.

Initially, this does not seem to be a optimistic. Contemplating the headwinds that Important Utilities needed to navigate, although, I used to be pretty happy.

The utility’s Regulated Water phase working income elevated by 3% year-over-year to $302.5 million within the second quarter. Increased charges offset the decline in water utilization in the course of the quarter. This diminished water utilization could be defined by larger than regular water volumes within the year-ago interval.

Important Utilities Regulated Pure Gasoline phase working income declined by 7.8% year-over-year to $128.2 million for the second quarter. This was as a result of abnormally heat climate in Pittsburgh.

In accordance with CFO Daniel Schuller’s opening remarks in the course of the Q2 2024 Earnings Name, town was 44% hotter than regular within the quarter. This resulted in much less pure gasoline utilization, which led to decrease working income for the phase.

Important Utilities’ diluted EPS decreased by 17.6% over the year-ago interval to $0.28 in the course of the second quarter. That missed the In search of Alpha analyst consensus by $0.07.

The diminished working income base from climate headwinds accounted for $0.02 of the drop in diluted EPS. Increased operations and upkeep bills additionally weighed on profitability. That is what pushed the corporate’s web revenue margin 350 foundation factors decrease to 17.4% for the second quarter. That is why diluted EPS fell at a sooner fee than working income within the quarter.

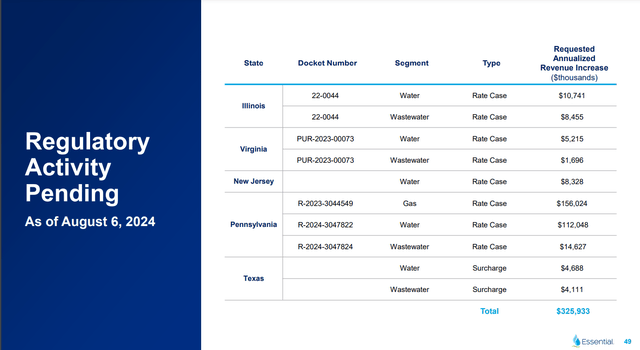

Important Utilities’ August 2024 Investor Presentation

Firm steerage for 2024 stays encouraging. Important Utilities is guiding for $1.98 in midpoint adjusted diluted EPS ($1.96 to $2). From the 2023 base of $1.86, this can be a 6.5% progress fee. The FAST Graphs analyst consensus is just under this steerage at $1.95 – – a 4.6% progress fee.

Wanting past this yr, Important Utilities anticipates that adjusted diluted EPS can compound at between 5% and seven% yearly. The corporate believes that its five-year capital spending plan can ship 8% annual fee base progress for the regulated water phase and 10% annual fee base progress for the regulated pure gasoline phase. This supplies a sensible path to such an adjusted diluted EPS progress goal.

The FAST Graphs analyst consensus is that adjusted diluted EPS will surge 9.3% in 2025 to $2.13. One other 5.9% progress in adjusted diluted EPS to $2.25 is anticipated in 2026.

The uptick in progress past this yr is predicated on the Peoples Gasoline fee case in Pennsylvania that is requesting $156 million in extra annual working income. The corporate reached a non-unanimous settlement for the case.

The Administrative Legislation Decide assigned to the case beneficial a choice according to the settlement, per CEO Christopher Franklin’s opening remarks in the course of the Q2 2024 Earnings Name. That included a climate normalization provision, which might present extra secure efficiency for the enterprise regardless of climate patterns. A choice for this case ought to be forward within the coming weeks and be set for an efficient date of Sept. 27.

Moreover, Important Utilities’ Pennsylvania water fee case is shifting alongside and is now within the discovery part. This may very well be a $126.7 million enhance to annual working income, and a fee order is anticipated in February.

Important Utilities can also be a financially vigorous enterprise. The corporate targets a debt-to-capital ratio of between 50% and 55%. That is higher than the 60% ratio that ranking companies want from the business, per The Dividend Kings’ Zen Analysis Terminal.

Important Utilities’ curiosity protection ratio was additionally robust, clocking in at 3.3. This explains the A- credit standing from S&P on a secure outlook (except in any other case sourced or hyperlinked, all particulars on this subhead have been in response to Important Utilities’ Q2 2024 Earnings Press Launch, Important Utilities’ August 2024 Investor Presentation, and Important Utilities’ Q2 2024 10-Q Submitting).

40%+ Upside Via 2026

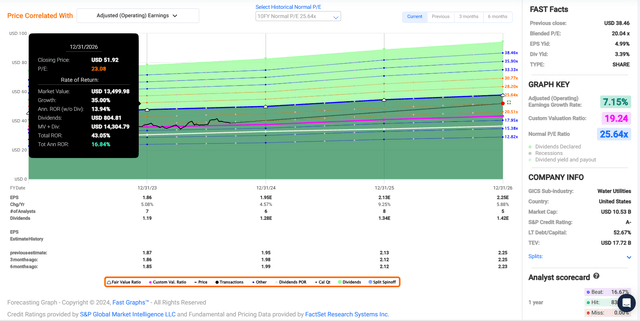

FAST Graphs, FactSet

Since my earlier article, shares of Important Utilities have generated 2% whole returns, versus the S&P 500 index’s (SP500) 5% whole returns. For my part, the utility is a slightly higher worth now than it was just a few months in the past.

Important Utilities’ current-year P/E ratio of 20 is considerably lower than the 10-year regular P/E ratio of 25.6 per FAST Graphs. I feel the case may very well be made that the utility is worthy of returning to a valuation a number of within the mid-20 vary.

Important Utilities’ annual ahead adjusted diluted EPS progress outlook of seven.2% is best than its 10-year common of 5.2%. This could assist the next valuation a number of than the current a number of.

As I’ve additionally mentioned in latest articles, the rate of interest surroundings by the tip of 2026 may very well be much like charges previously decade. That might justify a meaningfully larger valuation a number of for Important Utilities as buyers pour extra capital again into utilities.

Even so, I am going to err on the facet of warning. My truthful worth a number of will probably be one commonplace deviation lower than the 10-year common P/E ratio. That works out to a good worth P/E ratio of 23.1.

The present calendar yr is roughly 71% full. That leaves one other 29% of 2024 and 71% of 2025 nonetheless to come back within the subsequent 12 months. That is how I am weighing the FAST Graphs consensus estimates for 2024 and 2025 to get a ahead 12-month adjusted diluted EPS enter of $2.08.

Utilizing my truthful worth a number of of 23.1, I come out to a good worth of $48 a share. Relative to the present $39 share worth (as of September thirteenth, 2024), that is equal to a 19% low cost to truthful worth. If Important Utilities meets the expansion consensus and returns to truthful worth, it might generate a minimum of 43% cumulative whole returns by the tip of 2026.

A Secure And Reliably Rising Dividend

The Dividend Kings’ Zen Analysis Terminal

As is anticipated from a water utility, Important Utilities’ 3.3% ahead dividend yield registers under the utility sector median of three.6%. It’s because water utilities are typically valued at larger multiples than their utility counterparts and have decrease payout ratios. That explains the C grade for ahead dividend yield and C- grade for general dividend yield from In search of Alpha’s Quant System.

Important Utilities’ dividend is arguably fairly protected, too. The utility’s EPS payout ratio is positioned to be within the low to mid-60% vary in 2024. That is lower than the 75% EPS payout ratio that ranking companies choose from the business, per The Dividend Kings’ Zen Analysis Terminal.

For this reason the Quant System anticipates that Important Utilities can ship 6.6% annual ahead dividend progress to shareholders. That is reasonably above the sector median of 5.2%. This accounts for the Quant System’s B- grade for general dividend progress.

Meaning Important Utilities might prolong its 33-year dividend progress streak with strong dividend raises somewhat than token ones. For context, this streak is triple the sector median of 9.8 years. That’s the reason the Quant System awards an A+ grade to Important Utilities for general dividend consistency.

Dangers To Take into account

Important Utilities is a exceptional utility, but it surely nonetheless has dangers that warrant a dialogue. The corporate would not observe any new dangers in its most up-to-date 10-Q Submitting, so I will be highlighting key dangers from earlier articles.

One danger to Important Utilities is the considerably hotter climate as of late. This has some adverse influence on water consumption, but it surely particularly impacts the corporate’s pure gasoline operations.

Important Utilities is asking for a climate normalization adjustment in its Peoples fee case in Pennsylvania. It appears doubtless that the corporate will probably be granted this adjustment. But when it is not, that may imply its pure gasoline outcomes would nonetheless be fairly susceptible to unfavorable climate patterns.

One danger that I touched on in my earlier article stays, which is Important Utilities’ geographic focus. A supermajority of working income comes from Pennsylvania. Any pure disasters on this service space might end in harm to the corporate’s infrastructure. If this was past its commercially insured quantities, that would result in an impaired earnings base.

The fallout from such an occasion might embody a credit standing downgrade from the key ranking companies. This might inhibit Important Utilities from fulfilling its capital spending plans, which may be successful to its progress potential.

Abstract: A Excessive-High quality Dividend Inventory

The predictability of Important Utilities’ enterprise mannequin has allowed it to succeed in Dividend Champion standing. The corporate’s fundamentals look like intact, with respectable progress forecasts and a sound stability sheet. The payout ratio can also be conservative, which, I imagine, can allow additional dividend progress. Shares are additionally attractively valued right here.

So, Important Utilities appears to be set as much as generate 17% annual whole returns by the tip of 2026. That is why I am reiterating my purchase ranking.