Electrical energy costs have moved from the background of every day life to the entrance strains of politics. What was as soon as a quiet family expense is now a visual burden and a potent image of coverage failure. Costs are rising not due to company greed or runaway markets, however as a result of regulation, politically directed funding, and top-down vitality planning have collided with the explosive progress of synthetic intelligence. Inflation, provide constraints, and authorities mandates have turned the grid — as soon as a mannequin of regular reliability — into an enviornment the place economics, expertise, and politics now conflict.

People as soon as fixated on the value of eggs as the logo of inflation. Now, the brand new shock is available in electrical energy payments. Energy expenses have jumped roughly 4.5 p.c prior to now 12 months — almost double the broader Client Worth Index (CPI) — pushed by surging demand from AI information facilities and superior manufacturing towards a backdrop of restricted provide. “When you’ve got elevated demand and restricted provide, you’re going to pay extra,” stated Calvin Butler, CEO of Exelon Corp., which just lately put aside $50 million to assist low-income clients pay summer time payments. The influence is spreading throughout the biggest US grid, PJM Interconnection, the place watchdogs estimate data-center progress alone has added $9.3 billion in energy prices.

CPI Electrical energy SA, 2010 – current

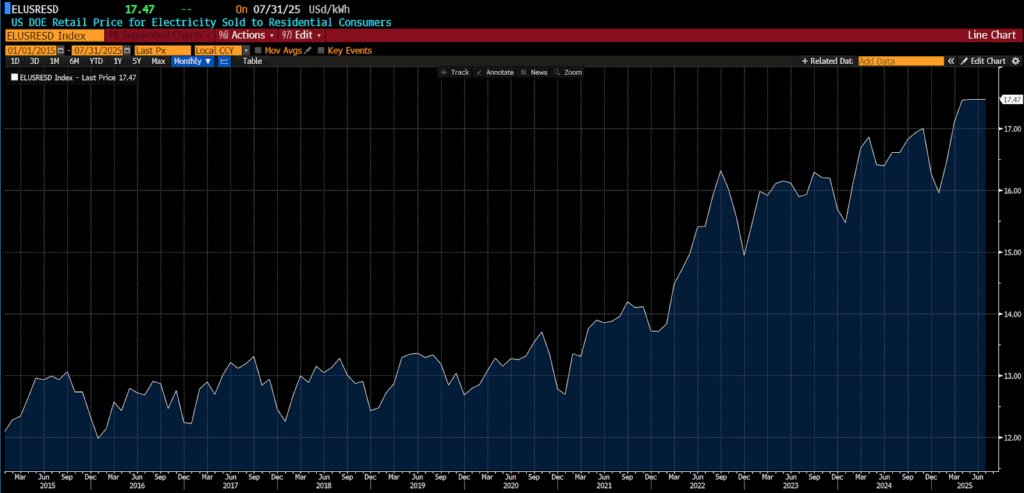

The numbers affirm the squeeze. The Power Data Administration stories that common US retail electrical energy costs in 2025 are about 13 p.c increased than in 2022, with the standard family invoice reaching $178 monthly. In Virginia — house to the world’s densest cluster of information facilities — residential energy and transmission prices are anticipated to rise as a lot as 26 p.c this decade and 41 p.c within the subsequent. Wholesale energy in areas with aggressive local weather targets, comparable to ISO-New England, has tripled since early 2024. The rules meant to stabilize the transition at the moment are amplifying volatility.

For twenty years, information facilities have been small, pretty nondescript, warehouse-like buildings on the panorama. The rise of generative AI has modified that. Coaching giant language fashions calls for huge computing energy, reworking modest warehouses into mega-complexes that draw as a lot electrical energy as medium-sized cities and eat thousands and thousands of gallons of water. Their footprint has turned electrical energy from a technical concern into an election situation.

In Virginia and New Jersey — this 12 months’s gubernatorial battlegrounds — the politics of AI infrastructure have grow to be a proxy for the nation’s vitality debate. Virginia Democrat Abigail Spanberger argues that tech corporations ought to pay a “justifiable share” for the grid upgrades their operations require. Her Republican opponent, Winsome Earle–Sears, blames clean-energy mandates for increased prices and reliability dangers. In New Jersey, some proposals have sought to make data-center builders fund grid modernization, whereas Republican Jack Ciattarelli requires extra amenities and new fuel crops to satisfy demand. Populist anger over rising payments has blurred social gathering strains: even native candidates from each events at the moment are calling for moratoriums on new information facilities.

US Division of Power Retail Worth of Electrical energy Bought to Residential Customers, 2015 – current

States like New Jersey are seeing elevated and rising electrical energy costs after years of coverage decisions that prioritized offshore wind build-outs whereas permitting agency baseload and grid capability to stagnate—most notably the 2018 shutdown of the Oyster Creek nuclear plant—at the same time as demand accelerates. Now, the AI/data-center surge is colliding with these constraints: PJM tasks roughly 32 GW of latest peak load by 2030—~30 GW from information facilities—creating “upward pricing strain” and resource-adequacy issues, and up to date reporting exhibits shoppers throughout PJM choosing up billions in transmission prices tied to data-center progress. Offshore-wind obligations additionally carry above-market OREC prices that regulators and consultants observe will probably be handed by to ratepayers, reinforcing worth strain the place transmission upgrades lag. Briefly, locations that retired nuclear and moved slowly on wires whereas leaning exhausting into offshore wind entered the data-center period underprepared, and at the moment are struggling to maintain up or elevating charges to fund capability and grid upgrades.

Frustration is spreading. In Missouri, Senator Josh Hawley has denounced “huge electrical energy hogs,” accusing Silicon Valley of pushing expensive transmission tasks that residential ratepayers subsidize. Georgia’s Public Service Fee race has revolved round claims that data-center operators get pleasure from five-cent kilowatt-hour charges whereas households pay 4 instances extra. These fights mirror an financial fact: fixed-rate industrial contracts and tax abatements merely shift prices onto shoppers quite than decreasing them.

Demand progress just isn’t solely remarkably robust, however rising and tough to foretell. The Worldwide Power Company expects international data-center energy consumption to just about double by 2030. However in a genuinely aggressive market, such progress would appeal to personal funding in new technology and transmission. As an alternative, multi-year allowing processes, domestic-content mandates, and litigation have throttled provide. Investor-owned utilities plan greater than $1 trillion in capital tasks by 2029 — a lot of it pushed by regulation quite than market want — prices that inevitably circulate into charge bases and month-to-month payments.

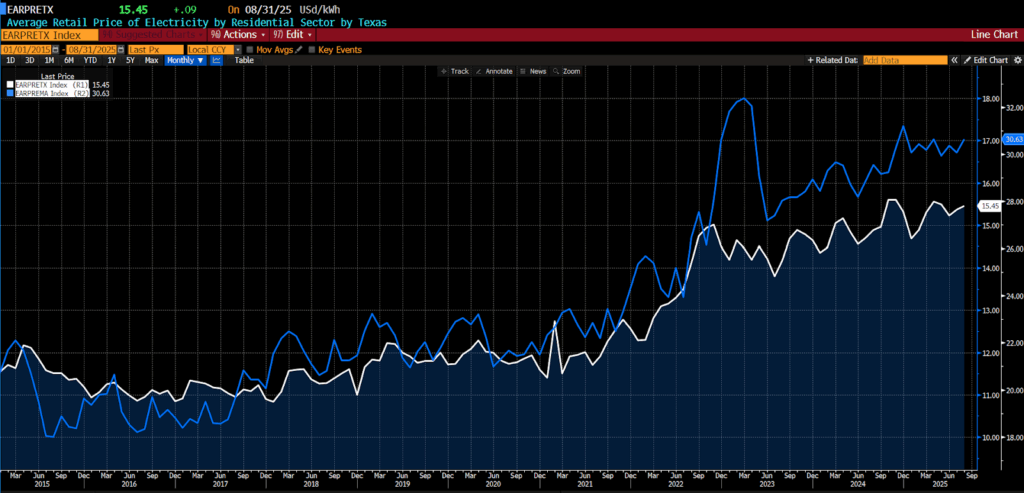

The political realignment round AI infrastructure reveals a deeper lesson: vitality can’t be centrally deliberate with out trade-offs. States like Texas, the place aggressive markets reply instantly to cost alerts, ship electrical energy at roughly half the value of Massachusetts and preserve stronger reliability regardless of speedy demand progress. In contrast, states that depend on administrative planning have locked in increased prices and slower innovation.

Common Retail Worth of Residential Electrical energy, Massachusetts (blue) vs. Texas (white), 2015 – current

Each events sense the stakes. The Trump administration’s AI Motion Plan seeks to speed up approvals and broaden grid capability to protect US dominance over China, even because it strikes to gradual the retirement of fossil-fuel crops and roll again tax incentives for wind and photo voltaic. Democrats selling the “abundance” agenda hail information facilities as foundations of a digital and decarbonized future. But the financial stress is identical: who pays for the electrons that energy the machines?

Electrical energy is not a impartial enter; it’s a commodity of each progress and grievance. The market might meet rising demand effectively if freed to take action. As an alternative, bureaucratic management, subsidy races, and political favoritism have produced shortages that politics then exploits. The remedy being supplied — extra mandates, extra subsidies, extra planning — is itself the illness.

A genuinely market-based strategy would let costs mirror shortage, open technology and retail provide to competitors, and finish cross-subsidies that disguise prices from voters. Decarbonization and innovation can coexist with affordability, however solely when capital is allowed to circulate the place returns justify the dangers taken. As People open their energy payments they’re discovering, and in some circumstances rediscovering, that electrical energy is in the end a market good, not a political entitlement, and that makes an attempt to manage away its prices solely defer and amplify them.