Andrii Dodonov

Introduction

It’s no secret that anticipated lower charges of curiosity are most likely to provide tailwinds for REITs going forward. Ahead of the FED meeting on September 18th, many predict a 25 basis elements cost reduce, which, I really feel, may be very most likely. In that case, REITs may even see a short surge, even with the newest rally they’ve been having enjoyable with given that July CPI report.

Moreover, lower charges of curiosity ahead will current good benefits to REITs like lower worth of capital and elevated share price appreciation. The revenue lower expenses current their share prices moreover permits the prospect for elevated improvement, as this permits them to problem shares above their NAVs along with see stronger funding train.

And this seems to be the case regarding Easterly Authorities Properties (NYSE:DEA), a REIT that leases to mission-critical authorities firms. Although I proceed to cost them a keep for causes listed on this text, their newest acquisitions and eight% dividend yield is perhaps a sexy funding various.

Earlier Keep Rating

I remaining coated Easterly Authorities Properties this earlier May in an article titled: Will Lower Curiosity Costs And A New CEO Help This REIT Get Once more To Growth? With their new CEO, Darrell Crate, coming onboard initially of the 12 months and anticipated lower charges of curiosity, the question remained whether or not or not DEA might develop to be a wonderful funding various.

Throughout the article, I moreover talked about that the potential for the company to resume improvement remained most likely due to potential lower charges of curiosity and elevated funding train. This resulted in administration rising steering and cash accessible for distribution or CAD (identical to AFFO) rising 5.7%. Nonetheless, the dividend payout ratio was nonetheless above 100% on the time.

Nonetheless their share price has rallied simply currently, up virtually 12% beating the S&P who’s up virtually 3% over the an identical interval.

Searching for Alpha

1H 2024 Effectivity

With the first half of the 12 months throughout the books for the REIT, points look like wanting up for Easterly Authorities Properties. Although FFO was flat from the prior quarter and year-over-year, earnings grew 6.8% year-over-year and 4.7% from the prior quarter.

Taking a deeper dive into the company’s financials, they actually observed some secure improvement from 2023. Administration mentioned they anticipated 2% to a few% improvement going forward, and thus far, they seem like delivering on that promise.

Let’s take a look into the company’s financials over the first six months of 2024 compared with the prior 12 months. Although this was flat at $0.29, core FFO actually grew 3.7% from $30,267 million to $31,373 million.

For comparability features, every pals Piedmont Office Realty Perception (PDM) and JBG SMITH Properties (JBGS) core FFO declined year-over-year. The earlier’s cash accessible for distribution moreover observed some improvement over the an identical interval. I’ll contact further on this later.

Q2’24 | Q2’23 | |

DEA | $0.29 | $0.29 |

PDM | $0.37 | $0.45 |

JBGS | $0.18 | $.036 |

For the first half, right here is how Easterly Authorities Properties managed to develop from 2023. Revenue, core FFO, CAD, and same-store NOI all observed secure improvement from the prior 12 months’s first six months, which is good to see.

1H ‘24 | 1H ‘23 | |

Revenue | $149,201 | $142,593 |

Core FFO | $62,129 | $59,767 |

CAD | $50,691 | $49,015 |

An identical-store NOI | $99,047 | $92,658 |

Tailwinds From Lower Curiosity Costs

Apart from the facility in Dallas, TX the company closed on throughout the prior quarter, they only currently observed an uptick in funding train, a revenue from anticipated lower charges of curiosity.

DEA closed on two additional acquisitions, one being the third-largest Veterans Affairs facility throughout the nation in Jacksonville, Florida. This was 100% leased and stood at virtually 100,000 sq. ft.

Moreover they only currently acquired a facility leased to BBB+ rated Northrop Grumman (NOC) earlier this month. This launched their complete property rely to 95 properties, up from 86 throughout the 12 months prior.

Although it isn’t recognized how these acquisitions will translate to the REIT’s bottom line improvement as of however, it’s most likely for them to spice up steering further down the street due to their strong acquisitions.

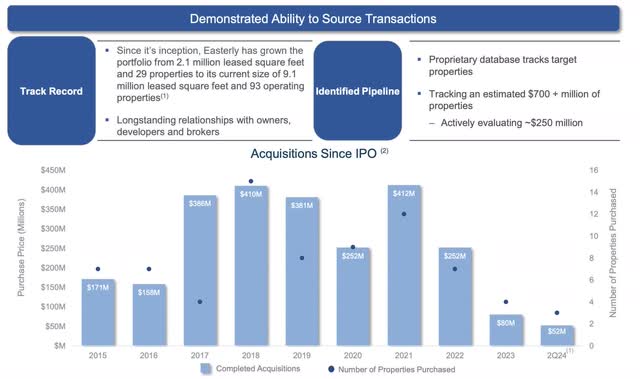

Administration reaffirmed their core FFO steering of $1.15 – $1.17 which they raised from $1.14 – $1.16 prior. Moreover they’ve a sturdy pipeline monitoring virtually $700 million in future acquisitions and two energetic duties in Atlanta and Flagstaff, AZ anticipated to be achieved in 2025 and 2026 respectively.

Moreover, with charges of curiosity extra prone to be quite a bit lower over the following 12 – 18 months, I depend on DEA to deal with further authorities adjoining properties with investment-rated expenses, identical to Northrop Grumman.

DEA investor presentation

Secure Stability Sheet

DEA’s steadiness sheet was moreover secure, with well-staggered debt maturities throughout the coming years. That that they had minimal debt maturing this 12 months and in 2025. That that they had $15.6 million in cash & equivalents and a web debt to adjusted EBITDA of 6.9x.

DEA investor presentation

This was in comparison with pals Piedmont Office Realty Perception and JBG SMITH Properties, whose web debt to EBITDAs had been 6.6x and a staggering 11.6x, respectively. Easterly’s debt totaled $1.4 billion, nonetheless most of it (97%) was fixed-rate with a weighted-average charge of curiosity of 4.39%. They might even most likely get to refinance their 2025 & 2026 debt at a lower cost, as this had charges of curiosity of 5.63% and 5.19%, respectively. Furthermore, most of their debt is well-laddered, maturing in 2027 and previous.

Elevated Payout Ratio

Although Easterly is a seeing improvement and stays a doubtlessly engaging funding due to its 8% dividend yield, their payout ratio nonetheless remained above 100%. This was in no matter CAD rising year-over-year. As a collector of dividends, that’s my important concern when analyzing shares.

Furthermore, an elevated payout ratio locations the dividend liable to being reduce. I’ve the pleasure of incessantly speaking with Easterly’s CEO and thru a contemporary video identify, he reassured administration’s plan to maintain the dividend. Moreover, with charges of curiosity providing tailwinds, I really feel chances are rising of sustaining the dividend, a minimal of for the near to medium time interval.

Using their shares glorious of 107,998,356 and 1H dividend price of $0.53, DEA would want roughly $57.3 million in cash accessible for distribution to cowl the dividend.

As beforehand talked about, CAD for the first half was $50.7 million, giving them a payout ratio of 113% at current. Nonetheless, I depend on CAD to proceed rising for the foreseeable future and for administration to maintain the current dividend.

Valuation

No matter their double-digit share price appreciation in the last few months, DEA’s valuation beneath its pals and sector median makes them a doubtlessly engaging funding various.

With a P/FFO various of 11.4x on the time of writing, they commerce successfully beneath the sector median’s 14.01x. That’s moreover most likely the rationale Quant assigns them a valuation grade of A-.

I do assume the REIT may even see further upside as charges of curiosity are lower, they often proceed to make acquisitions. In that case, I can see them commanding a minimal of a 13x various, giving consumers upside of roughly 12.9% from the current price of $13.29. Nonetheless as beforehand talked about, this all relies upon upon the place charges of curiosity are along with their funding train throughout the near to medium time interval.

Risks

Presently, Easterly Authorities Properties’ biggest hazard is their dividend. With an elevated payout ratio above 100%, this may most likely weigh negatively on their share price in comparison with office pals like Cousins Properties (CUZ) or Highwoods Properties (HIW).

Moreover, that’s the metric retaining me from upgrading the stock from a keep to a purchase order. That’s one factor I’ll most likely be retaining an in depth eye on going forward.

Bottom Line

Easterly Authorities Properties stays a doubtlessly good long-term funding due to their leasing to mission-critical tenants. Furthermore, anticipated lower charges of curiosity look like providing tailwinds, with funding train choosing up in 2024.

Going forward, I depend on DEA’s administration to deal with properties leased to government-adjacent tenants, identical to Northrop Grumman, throughout the coming months/years as funding train is extra prone to proceed choosing up.

Whereas they’re engaging due to the extreme dividend yield at current, their payout ratio above 100% retains Easterly Authorities Properties at a keep rating.